Don't let the headlines scare you. While December saw a massive exit of funds from Bitcoin ETFs, analysts confirm this was a strategic tax move, not a loss of faith in the asset.

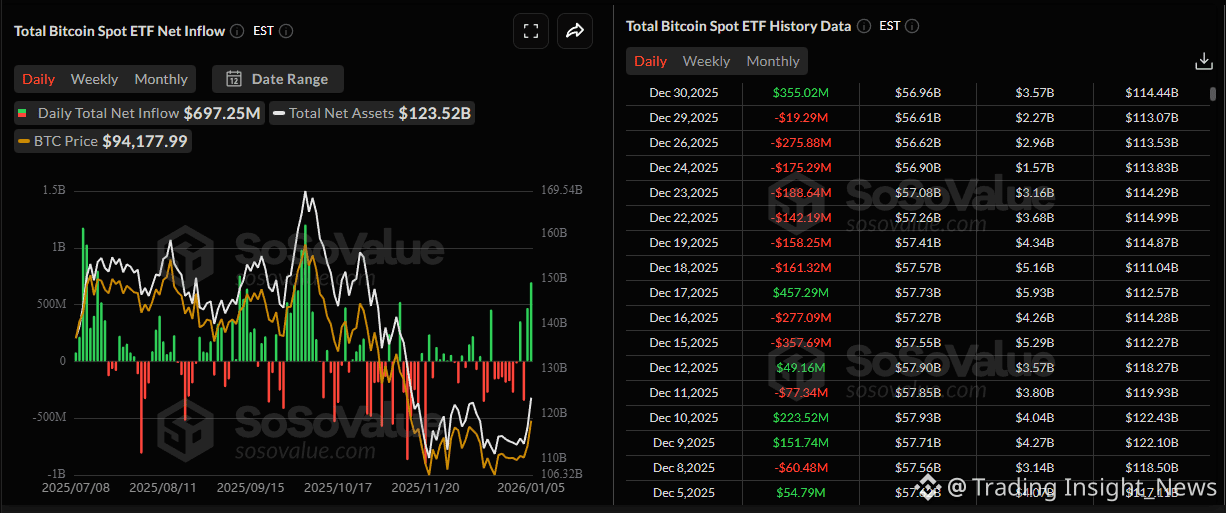

🔸 In December 2025, Bitcoin Spot ETFs recorded approximately $1 billion in net outflows.

🔸 This was primarily driven by tax loss harvesting a strategy where investors sell assets at a loss before year-end to lower their tax bills. It was not due to weakening demand.

🔸 Proof of this theory arrived immediately. On the first trading day of 2026, the trend reversed with nearly $500 million in net inflows.

🔸 Onchain data supports the bullish thesis, showing zero significant selling from OG Whales during this period.

Now that the tax selling pressure is over and funds are flowing back in, do you expect Q1 2026 to be a green quarter for BTC?

News is for reference, not investment advice. Please read carefully before making a decision.