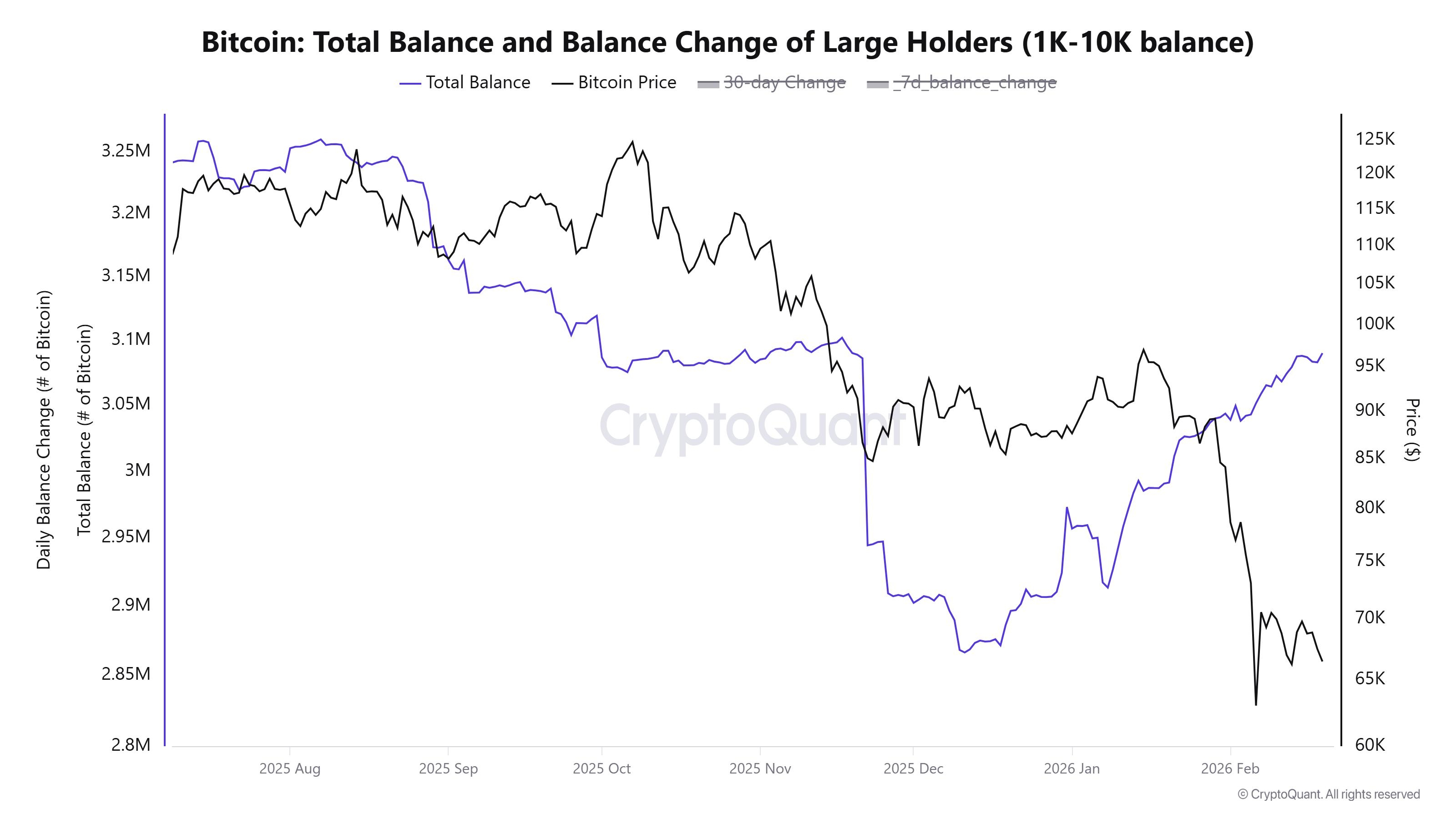

After dumping 230,000 BTC during the chaos, the biggest players in the game are back — and they’re buying aggressively.

In just three months, wallets holding 1,000–10,000 BTC rebuilt their reserves to pre-crash levels. In the last 30 days alone? Nearly 100,000 BTC scooped up.

That’s not random buying. That’s strategy.

They Sold the Top… Now They’re Reloading.

Back in August 2025, when Bitcoin hit $124,000, whales started distributing. The rally stalled. The market cooled.

Now? They’ve reversed the entire sell-off.

This is a classic V-shaped accumulation:

Sell strength. Absorb fear. Rebuild quietly.

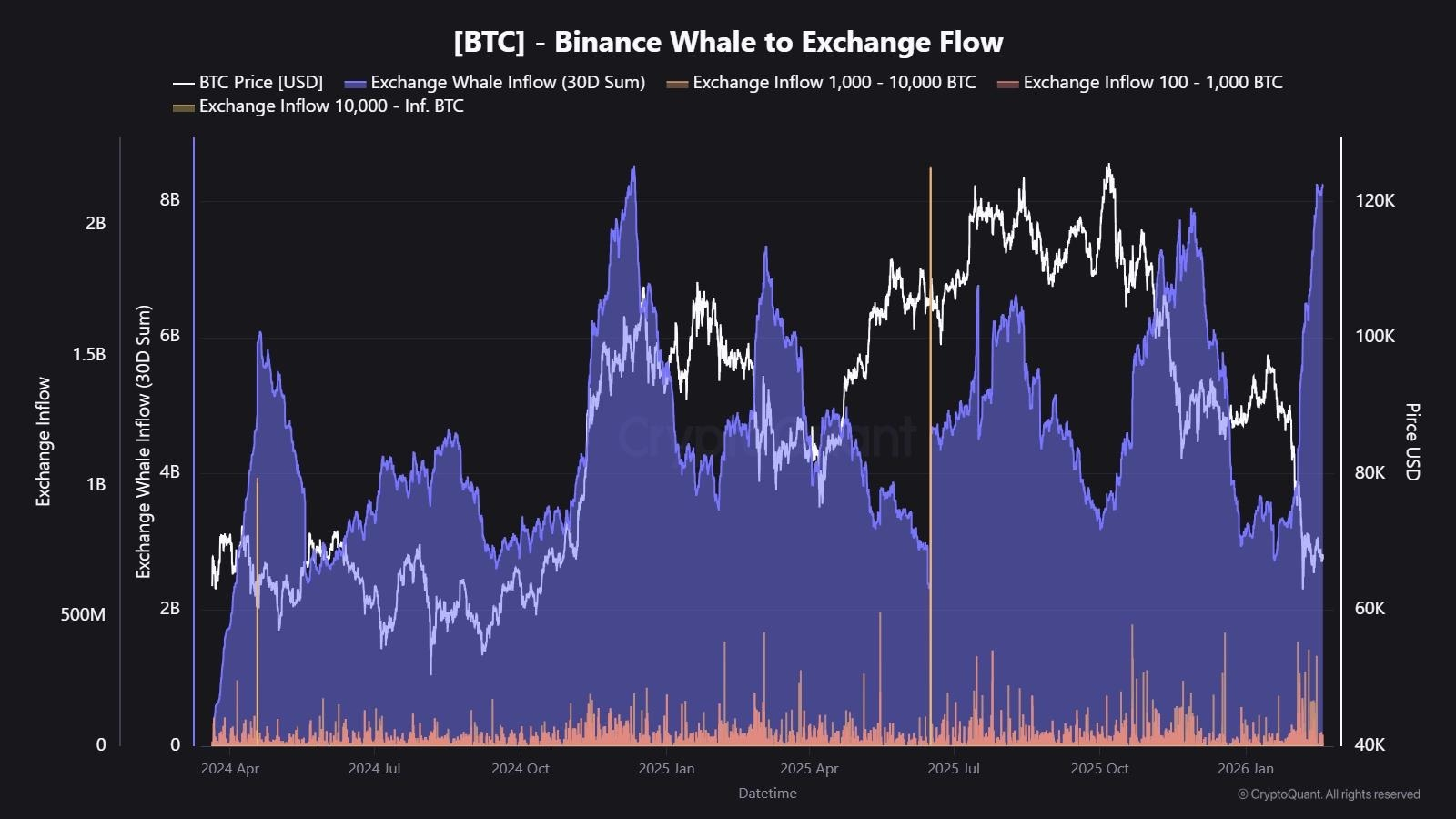

Big Money Is Moving. Hard.

$8.24 billion in whale BTC just flowed into Binance — the highest in 14 months.

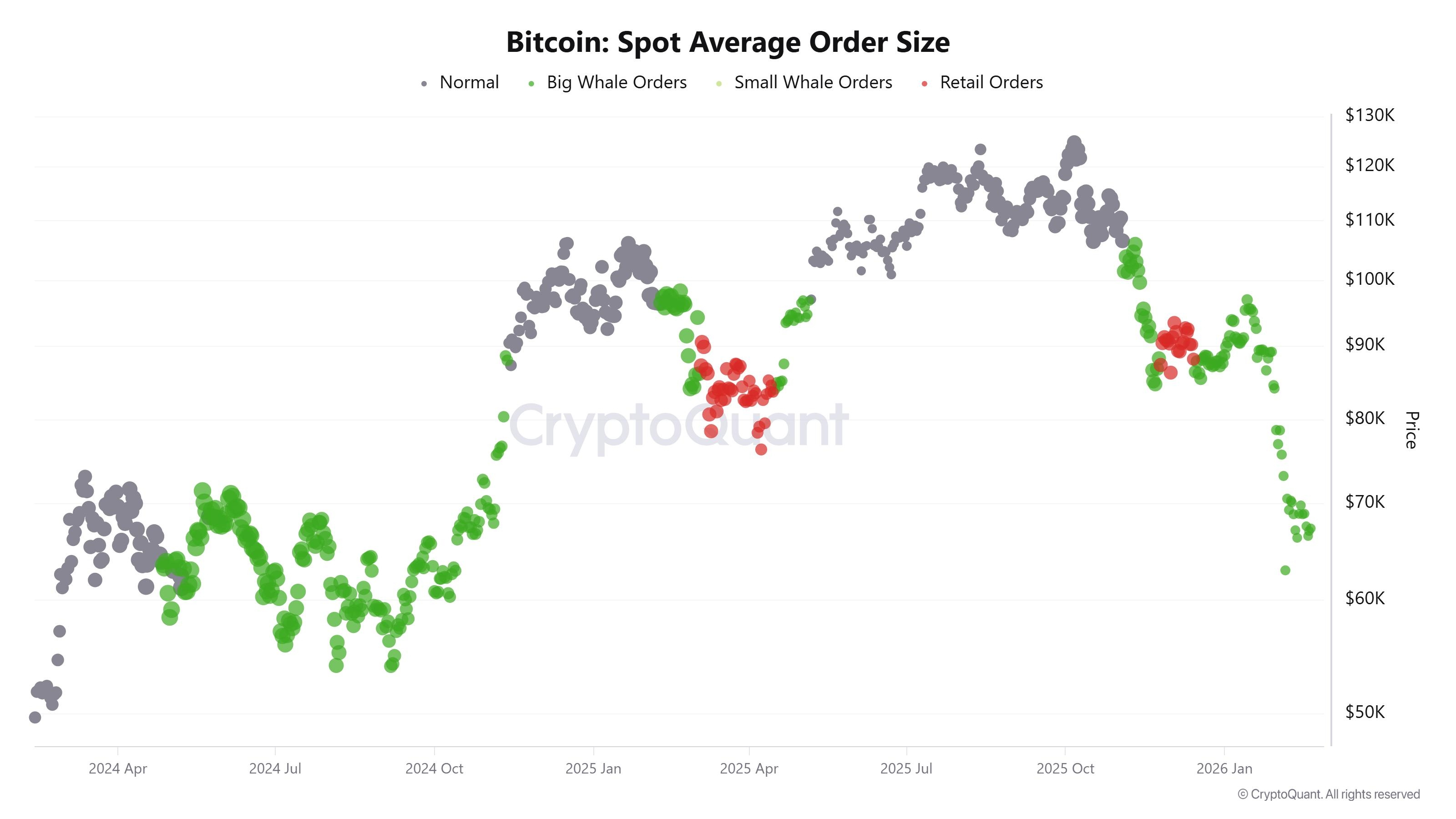

Retail flows are flattening.

Large trade sizes are dominating the spot market.

And here’s the twist:

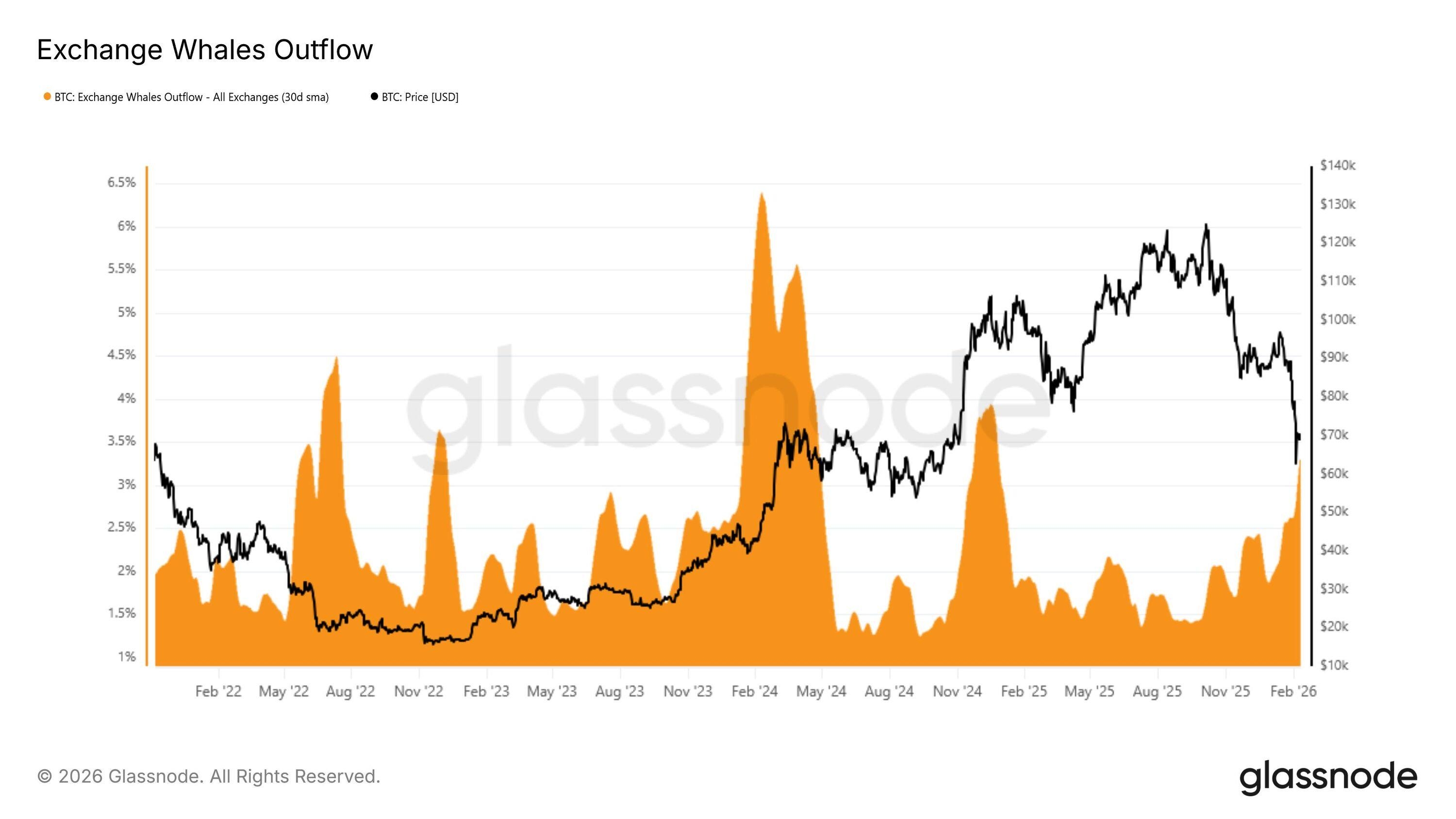

While billions are moving onto exchanges, whales are also pulling out 60,000–100,000 BTC at the same time.

In other words: massive movement… but no real increase in exchange supply.

That suggests positioning — not panic.

The strongest hands in the market have quietly rebuilt their positions.

When whales accumulate at scale, it’s rarely random.

They’re either preparing for volatility — or positioning before the next major move.

Either way, this isn’t small money activity.

This is smart money reshuffling the board.