Yes, You read that right.

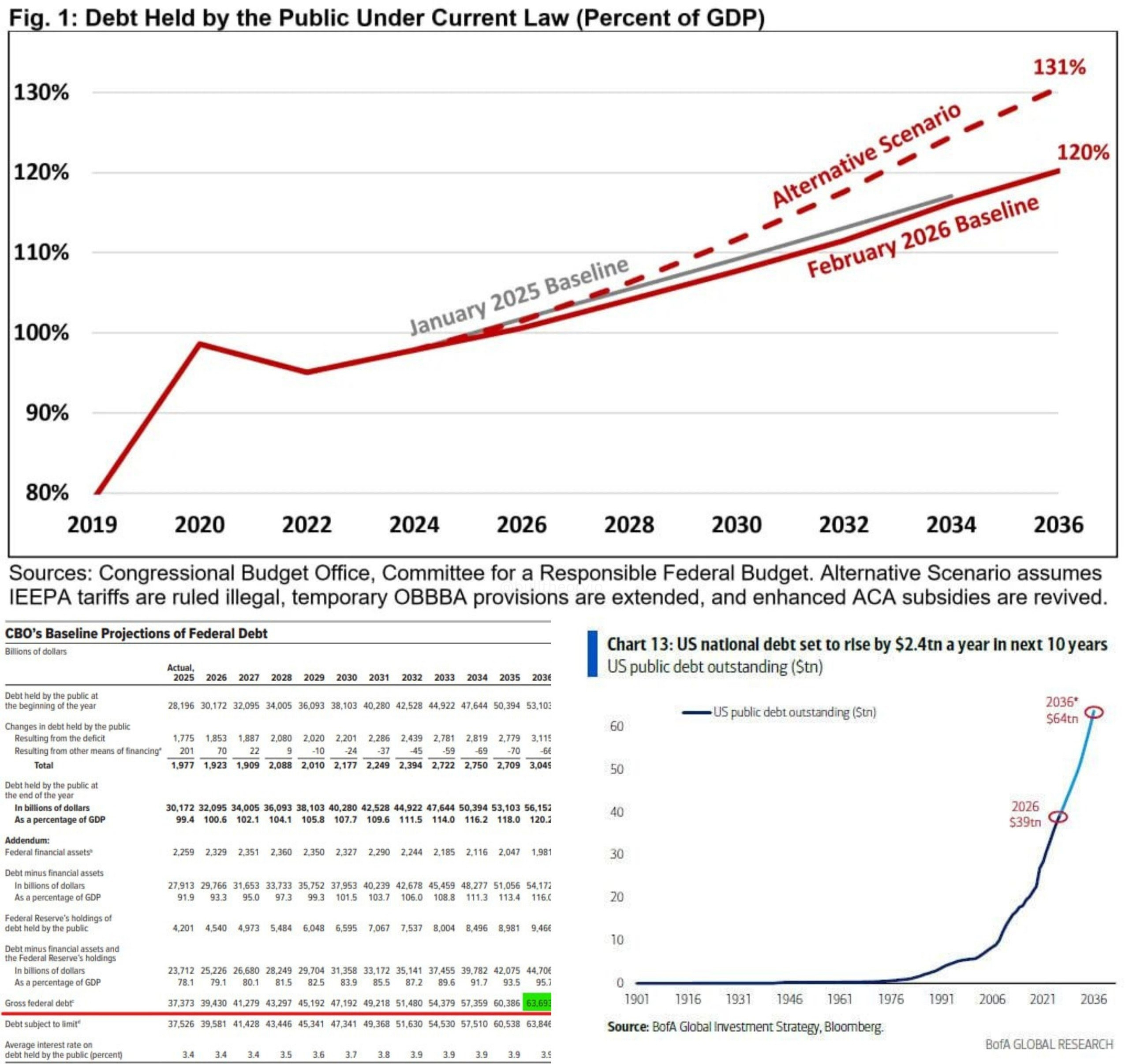

According to the CBO, U.S. national debt is expected to rise from $39T in 2026 to $64T by 2036.

That’s a $25 TRILLION increase in just one decade.

To understand how big that is:

The government will be adding around $2.4T–$2.5T of new debt every single year, even if there is no recession, no war, and no emergency spending.

But What's causing this ?

FIRST: ANNUAL DEFICITS KEEP WIDENING

Every year, the U.S. government is expected to spend far more than it earns. That annual shortfall is projected to rise from about $1.9 trillion in 2026 to roughly $3.1 trillion by 2036.

SECOND: INTEREST COSTS ARE BECOMING ONE OF THE BIGGEST THREATS

Because rates are higher now, servicing old debt is getting expensive fast. Interest payments are projected to cross $1T per year immediately...

And move toward $2T+ annually within a decade. At that point, a huge portion of tax revenue goes just to paying interest on past borrowing.

THIRD: MOST FEDERAL SPENDING IS AUTOMATIC AND RUNS ON PRE SET PROGRAMS, NOT YEARLY DECISIONS.

Social Security, Medicare, and healthcare costs are rising automatically as the population ages. These programs make up the majority of spending growth and they’re politically very hard to cut.

FOURTH: DEBT VS GDP IS BREAKING RECORDS

Debt held by the public is projected to rise from:

• 101% of GDP in 2026

• To 120% by 2036

That would exceed the previous record set after World War II. But unlike the 1940s, this is happening during peacetime economic expansion, not after a global war.

And here’s the actual risk:

The U.S. is heading toward a situation where interest costs are rising faster than economic growth. When debt costs grow faster than the economy itself, the system starts compounding debt automatically.

At that point, debt stops being a policy choice and starts becoming a structural cycle.

More borrowing is needed just to fund existing obligations. More interest has to be paid on past interest. And deficits widen even if spending does not increase.

This is why projections showing $64 trillion in debt are not just long term estimates.

They signal a fiscal path where debt keeps accelerating faster than the economy that supports it.