Introduction:

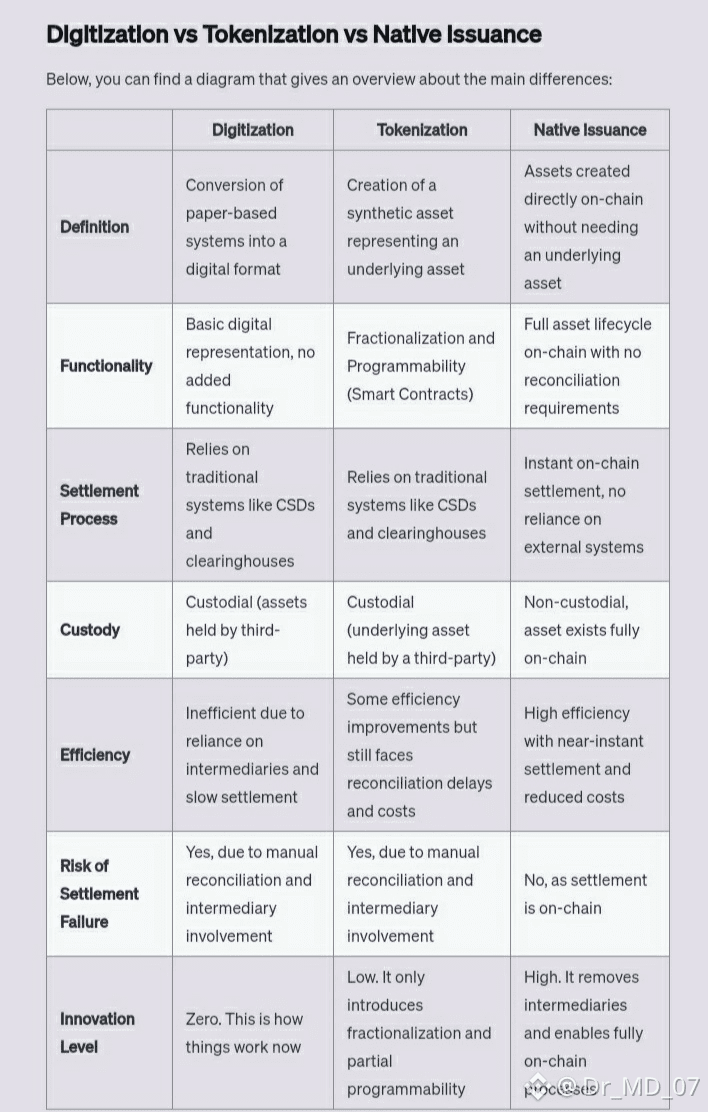

In recent years the crypto space has moved beyond simple payments. The focus today is on how real world assets can exist on blockchain networks in a legal and practical way. Concepts like digitization and tokenization are often mentioned together yet they are not the same.@Dusk takes a different approach called native issuance. This idea is gaining attention in 2025 as institutions and builders search for clarity trust and compliance. Understanding these concepts in simple terms helps explain why Dusk stands out in the current market.

Understanding Digitization in Simple Terms:

Digitization is the earliest step of bringing assets into the digital world. It usually means converting paper based records into digital files. For example a company may scan ownership documents and store them in a database. Nothing about the asset itself changes. The digital version is only a mirror of the real one. In blockchain discussions digitization is often misunderstood. Many assume that once data is digital it is blockchain ready. In reality digitization does not provide transparency shared access or automation. It still depends on central control and trust in the operator.

Tokenization and Its Limits:

Tokenization goes a step further. It represents an asset with a digital token on a blockchain. This token can be transferred or tracked more easily. In simple words tokenization puts a label on an asset and places that label on chain. While this improves accessibility it still relies on off chain agreements. The token is a promise not the asset itself. Ownership rules compliance checks and investor rights often remain outside the blockchain. This gap is becoming a concern as regulations tighten and investors demand stronger guarantees.

What Native Issuance Really Means:

Native issuance is where Dusk changes the conversation. Instead of converting existing assets into tokens Dusk allows assets to be created directly on chain. From day one the asset lives within the blockchain rules. Compliance privacy and ownership logic are built into its structure. This removes the need for external enforcement. In simple terms the blockchain becomes the place where the asset is born grows and is managed. This approach aligns better with legal clarity and operational efficiency.

How Dusk Applies Native Issuance:

Dusk is designed for regulated financial use cases. Its architecture focuses on privacy and compliance at the same time. When an asset is issued on Dusk it can include rules about who can hold it and how it can move. These rules are enforced automatically. For users this feels simple even though the system behind it is advanced. In 2024 and early 2025 Dusk has continued refining its infrastructure to support real world assets and institutional needs. This progress has increased interest from builders who want long term reliability.

Why This Matters in Today Market:

The crypto industry is maturing. Regulators are paying closer attention and institutions are entering with caution. They need systems that respect laws without sacrificing efficiency. Tokenization alone often falls short here. Native issuance answers a real demand. Dusk positions itself as a network where digital assets are not add ons but core elements. This makes the platform relevant in discussions about the future of digital finance and on chain securities.

A Human Perspective on the Shift:

From a personal viewpoint the shift from tokenization to native issuance feels natural. Early crypto experiments taught the industry many lessons. Simplicity without structure led to confusion. Dusk seems to learn from that history. It does not try to impress with complexity. Instead it focuses on building a system that works quietly and reliably. This human centered design is important for adoption. Users and institutions want clarity not constant adjustment.

Visualizing the Difference Without Comparison:

Imagine building a house. Digitization is like taking photos of an existing building. Tokenization is like placing a sign that says this house exists. Native issuance is building the house directly on solid ground with rules for ownership and access already included. Dusk focuses on this foundation. Everything grows from there in a controlled and transparent way.

Conclusion:

Digitization tokenization and native issuance represent different stages of blockchain evolution. While digitization and tokenization helped the industry grow they also revealed limits. Native issuance offers a cleaner and more secure path forward. Dusk embraces this model by making on chain asset creation compliant private and practical from the start. As trends in 2025 point toward regulation friendly infrastructure Dusk stands as a thoughtful response rather than a loud promise. For those watching the future of digital assets Dusk provides a clear example of how blockchain can mature responsibly.