hello my dear cryptopm binance square family, today in this article we will talk about Dusk.

In a market full of noise, shortcuts, and compliance theater, projects that can actually survive regulation, ship real infrastructure, and attract institutional partners are rare. Most collapse under one of those pressures. Dusk stands out because it was built with the assumption that pressure would come, not with the hope that it would not.

This is not a DeFi casino chain. It is a Layer 1 blockchain designed specifically for regulated financial infrastructure, and that single design decision already separates it from most of the market.

Architecture Built To Avoid False Choices

Most blockchains force trade-offs. Speed versus security. Privacy versus compliance. Performance versus decentralization. Dusk is designed to avoid these artificial choices.

By separating the settlement layer from the application layer, Dusk protects consensus and finality while allowing flexibility at the application level. The settlement layer focuses on correctness, auditability, and security. On top of it runs DuskEVM, an EVM compatible environment that allows developers to build using familiar tools without weakening compliance guarantees.

The DuskEVM mainnet launch is not about chasing the EVM trend. It is about meeting developers where they already are while keeping the protocol suitable for regulated use cases.

Hedger Privacy Is Built For Regulation, Not Marketing

Most privacy solutions in crypto are superficial. Hide balances, obscure addresses, move on. Dusk’s Hedger technology is different because it treats privacy as a regulatory requirement, not a cosmetic feature.

Hedger enables transactions that remain private to the public while still being auditable by regulators and authorized parties. This is the only privacy model that works for real financial markets. Institutions do not want secrecy. They want controlled visibility.

The release of Hedger Alpha marks the shift from theory to real-world testing. Fintech firms are already experimenting with it, which matters far more than online hype.

Partnerships That Come With Real Obligations

Partnerships only matter when they introduce accountability. Dusk’s collaboration with NPEX is not symbolic. NPEX is a licensed exchange operating under European regulation. Through this partnership, more than €300 million worth of tokenized securities are expected to flow into Dusk-based real world asset applications, including DuskTrade planned for 2026.

This gives Dusk something most projects cannot manufacture: real operational credibility under MiCA.

On the infrastructure side, Dusk’s integration with Chainlink strengthens price discovery, risk monitoring, and off-chain data reliability. These elements are non-negotiable for compliant RWA markets. Dusk did not attempt to reinvent this layer. It integrated proven infrastructure instead.

Why Institutions Are Paying Attention

Institutions do not chase hype. They chase systems that remain reliable under legal and operational constraints. Dusk offers privacy that regulators accept, architecture that scales without fragility, EVM compatibility without surrendering control, and real asset pipelines instead of whitepapers.

That combination is rare, and scarcity is what creates long-term value.

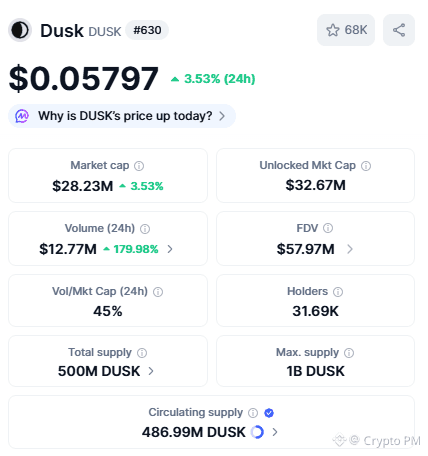

About The DUSK Token, Without Fantasy

Let’s be direct. The DUSK token only matters if the ecosystem is actually used. The difference here is that usage is real, not hypothetical. Transaction fees, staking, deployment, and governance all flow through the token. If compliant DeFi and RWA adoption grow on Dusk, the token captures value naturally. If they do not, it will not.

There is no artificial narrative protecting it. That is uncomfortable, but healthy.

Where Dusk Is Right Now

After nearly five years of building, regulatory alignment, and infrastructure development, Dusk is entering the hardest phase. Execution at scale. This is where most projects fail. It is also where serious infrastructure finally proves itself.

If compliant RWA and institutional DeFi become dominant themes, Dusk is structurally prepared. Not because it was loud, but because it was patient.

MY Take

Dusk is not exciting in the way crypto social media prefers. That is a strength, not a weakness. It is cautious where it must be, strict where it should be, and flexible where it matters.

If you are chasing fast narratives, this is not for you. If you are watching which blockchains might still matter once regulation becomes unavoidable, Dusk deserves attention, not blind belief, but serious and continuous observation.