Disclaimer: This FAQ Page is for general information and educational purposes only. It does not constitute legal terms or any form of legal agreement between you and Binance. It should not be construed as financial, legal or other professional advice. The information on this page may be outdated. For legal terms applicable to Futures and Options Trading Services, please refer to the Terms of Use, the Exchange Rules (including the Exchange Procedures) and the Clearing Rules (including the Clearing Procedures) which come into effect on 5 January 2026. Additional terms and conditions will also be set out in the Contract Specifications applicable to the relevant Derivatives contract.

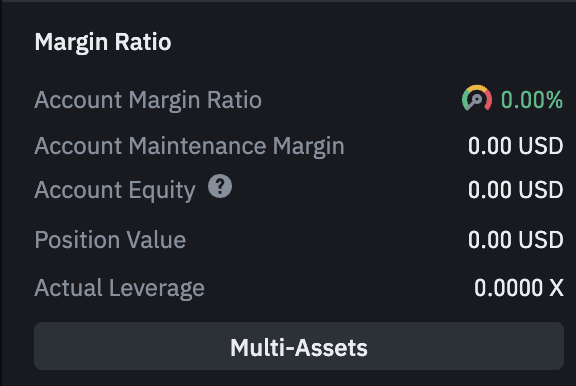

If you select the [Multi-Assets Mode], you'll see a [Multi-Assets] tag on the Margin Ratio widget.

Since your margin balance is shared across multiple positions in the Multi-Assets Mode, please monitor your margin ratio closely. Once the margin ratio reaches 100%, all positions will be liquidated.

You can use the following equation to calculate your margin ratio in the Multi-Assets Mode:

Account Margin Ratio = Account Maintenance Margin / Account Equity

Please note that the margin ratio is based on the prevailing market rate for USDTUSD and USDCUSD pairs.

Suppose the asset pairs and their respective floating conversion rates are as follows:

Asset Pair | Asset Index | Index Bid Buffer | Index Ask Buffer | Bid Rate | Ask Rate |

USDTUSD | 0.99 | 0.01 | 0.005 | 0.9801 | 0.99495 |

USDCUSD | 1 | 0 | 0 | 1 | 1

|

You want to trade two contracts, BTCUSDT perpetual and ETHUSDC with 100x and 50x leverage respectively. In this scenario, the Maintenance Margin Ratio will be 0.8% and 1% respectively. Depending on the margin mode you’re (Isolated or Cross), the account status and calculation changes of various parameters are as follows:

Symbol | BTCUSDT | ETHUSDC |

Margin Asset | USDT | USDC |

Asset Wallet Balance | 200 | 220 |

Asset Equity | 200 | 220 |

Maintenance Margin Ratio | 0.008 | 0.01 |

Initial Margin Ratio | 0.01 (100x) | 0.02 (50x) |

Unrealized PnL | 0 | 0 |

Under the Single-Asset Mode:

USDT available for order = 200 USDC available for order = 220

Under the Multi-Assets Mode:

Account Equity = ∑min(assetEquity*bidRate, assetEquity*askRate) = 200 * 0.9801 + 220 * 1 = 416.02

As there are no open positions,

Symbol | BTCUSDT | ETHUSDC |

Margin Asset | USDT | USDC |

Asset Wallet Balance | 200 | 220 |

Asset Equity | 200 | 220 |

Maintenance Margin Ratio | 0.008 | 0.01 |

Initial Margin Ratio | 0.01 (100x) | 0.02 (50x) |

Position Quantity | 0.5 | 20 |

Entry Price | 20,000 USDT | 600 USDC |

Mark Price | 20,000 USDT | 600 USDC |

Unrealized PnL | 0 | 0 |

Account Maintenance Margin = ∑assetMM*askRate = 0.5 * 20,000 * 0.008 * 0.99495 + 20 * 600 * 0.01 * 1 = 199.596

As there is no unrealized PnL,

Symbol | BTCUSDT | ETHUSDC |

Margin Asset | USDT | USDC |

Asset Wallet Balance | 200 | 220 |

Asset Equity | 200 - 500 = -300 | 220 + 400 = 620 |

Maintenance Margin Ratio | 0.008 | 0.01 |

Initial Margin Ratio | 0.01 (100x) | 0.02 (50x) |

Position Quantity | 0.5 | 20 |

Entry Price | 20,000 USDT | 600 USDC |

Mark Price | 19,000 USDT | 620 USDC |

Unrealized PnL | 0.5 * (19,000 - 20,000) = -500 | 20 * (620 - 600) = 400 |