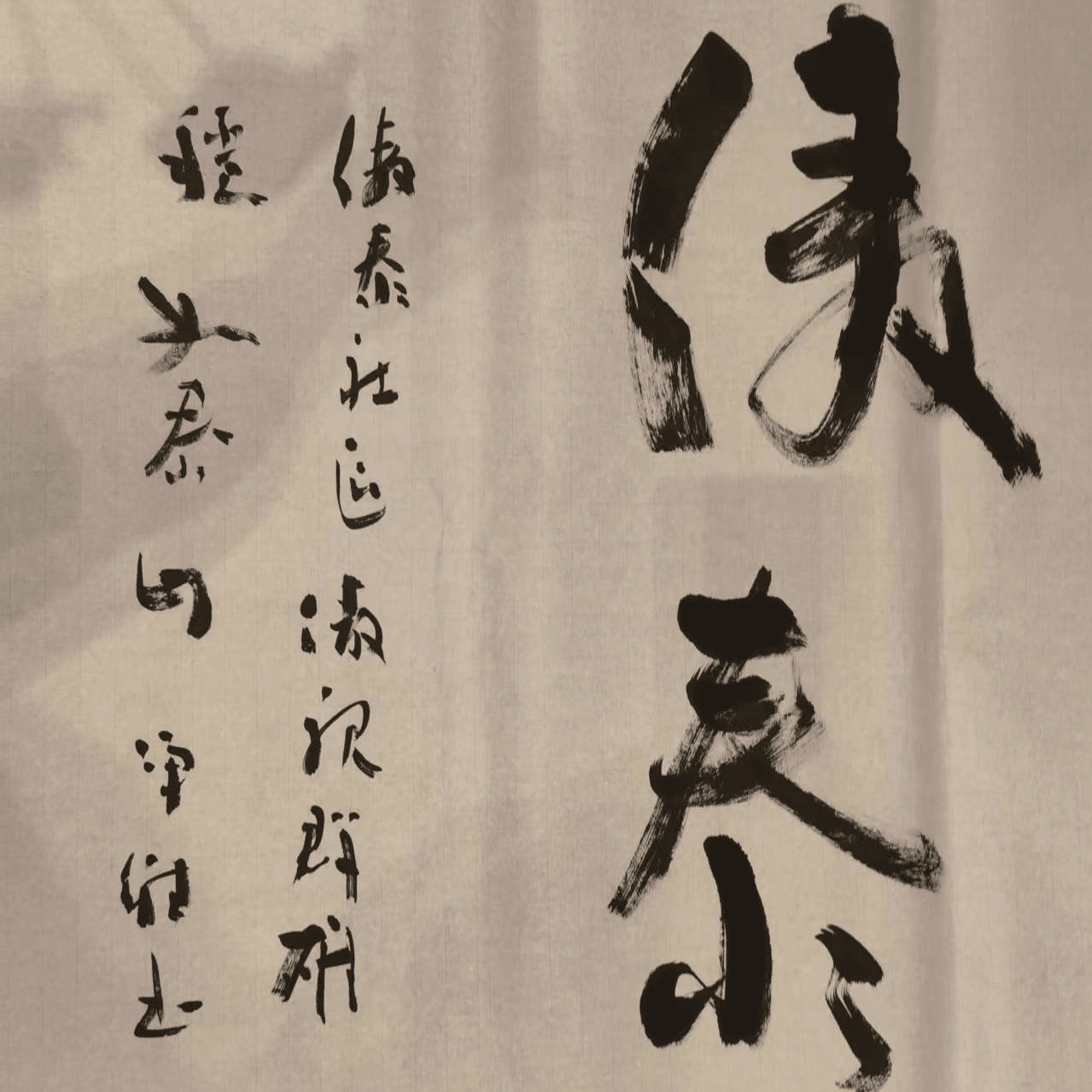

TaiShen傲泰资本

深耕区块链行业12年,傲泰资本创始人,BTC/ETH早期布道者,天使投资人,影视投资人,顶级模式策划者,二级投研专家,曾孵化打造年流水50亿平台,带领过上百人赚上千万。

208 Following

19.5K+ Followers

3.1K+ Liked

523 Shared

Posts

All

Quotes

Live

PINNED

Breaking the Game in 2026: CZ AMA Hardcore Insights Breakdown, Recognizing Sovereignty as the Core of Survival in the Cryptocurrency World

Aotai Capital was on-site at CZ's AMA at Binance Square last night. This time, it ranked in the top three and even shared the screen with the big boss. Although there was a slight regret of not having the opportunity to ask questions, the entire session was filled with valuable insights and every word was a gem, clarifying the core survival logic of the cryptocurrency industry in 2026 for industry practitioners. After shedding the identity of CEO, CZ spoke frankly from the perspective of an industry veteran. His insights into the industry are much more genuine and transparent than during his time in office, and they provide rational reflections for the currently fervent cryptocurrency market.

Start working

4 BTC$BTC 🧧🧧🧧🧧

{spot}(BTCUSDT)

{spot}(BTCUSDT)

Start working

🎁Day 9 of the 30k journey—daily 100u PEPE token rewards for my supportive followers!

🧧Day 1 of the 30k journey—daily 100u PEPE token rewards for my supportive followers!

$BTC $ETH

#美联储利率决议

#美股七巨头财报

🧧Day 1 of the 30k journey—daily 100u PEPE token rewards for my supportive followers!

$BTC $ETH

#美联储利率决议

#美股七巨头财报

Start working

$ZKP Good evening, babies 🤗

I have prepared 388U$BTC 🧧 to sprint to 27k

Follow me and get BTC 🎁

I have prepared 388U$BTC 🧧 to sprint to 27k

Follow me and get BTC 🎁

Start working

Breaking the Deadlock 2026: CZ AMA Hardcore Insights Analysis, Recognizing Sovereignty as the Core of Survival in the Crypto World

#CZ币安广场AMA

On January 31st at 12 AM, I waited for CZ's big brother's Binance Square AMA; the scene was once very lively. 🙋♀️ I raised my hand all night but didn't get a chance to speak, even though I had prepared my questions. 🙋 Congratulations to my brother from Aotai Capital for making it to the top three with big shots, sharing the screen and speaking together. Although I regret not having the chance to ask questions, I gained a wealth of valuable insights; every word is a wake-up call for the industry. As the poem says, 'Clearing the clouds to see the blue sky, one word awakens the dreamer.' A sharing session that reveals the truth of the industry, clarifying the new and old tracks, setting the clearest compass for the path forward in the crypto world of 2026.

On January 31st at 12 AM, I waited for CZ's big brother's Binance Square AMA; the scene was once very lively. 🙋♀️ I raised my hand all night but didn't get a chance to speak, even though I had prepared my questions. 🙋 Congratulations to my brother from Aotai Capital for making it to the top three with big shots, sharing the screen and speaking together. Although I regret not having the chance to ask questions, I gained a wealth of valuable insights; every word is a wake-up call for the industry. As the poem says, 'Clearing the clouds to see the blue sky, one word awakens the dreamer.' A sharing session that reveals the truth of the industry, clarifying the new and old tracks, setting the clearest compass for the path forward in the crypto world of 2026.

🎙️ 亏麻了吗?准备送快递还是跑滴滴?

End

05 h 06 m 00 s

22.9k

48

Start work

[Replay] 🎙️ 广交国际朋友,轻松畅聊在web3规划和未来,输出更有质量的信息,欢迎大家来嗨🌹💃🏻

03 h 00 m 51 s · You're sending too fast, please wait a moment and try again

Start Work

The Binance Square Web3 Peak Exchange Event Successfully Concluded | Exploring the New Landscape of the Industry Together, Heading Towards a New Journey

#金银为何暴跌

#贵金属巨震

At the forefront of the new trend, intelligence gathers in the cloud to initiate a new chapter. Last night, the Binance Square hosted the 【Xuhao Media】 Web3 crypto industry peak exchange event, which concluded successfully. This was a pioneering community event at Binance Square that sparked high-quality thought collisions and generated enthusiastic responses within the industry. As community tokens anchor the future direction of Web3, the BTC triangular pattern reconstructs a new order in the crypto market. We gathered in the cloud with numerous industry leaders and community partners to unlock the value code of community tokens, dissect market layout logic, and deeply explore investment opportunities in the primary market, allowing cutting-edge insights and practical knowledge to intertwine and burst forth in communication.

#贵金属巨震

At the forefront of the new trend, intelligence gathers in the cloud to initiate a new chapter. Last night, the Binance Square hosted the 【Xuhao Media】 Web3 crypto industry peak exchange event, which concluded successfully. This was a pioneering community event at Binance Square that sparked high-quality thought collisions and generated enthusiastic responses within the industry. As community tokens anchor the future direction of Web3, the BTC triangular pattern reconstructs a new order in the crypto market. We gathered in the cloud with numerous industry leaders and community partners to unlock the value code of community tokens, dissect market layout logic, and deeply explore investment opportunities in the primary market, allowing cutting-edge insights and practical knowledge to intertwine and burst forth in communication.

#一起瓜分BTC

#红包大派送

#红包大派送

Most people are impatient at present.

The current situation can also make people anxious.

It is important to cultivate a strong inner self and stable emotions at this time; one should not blindly follow trends. Calm down and work steadily, and the results will surely be good. First, introspect your own world, and then expand outward.

#红包大派送

#红包大派送

Most people are impatient at present.

The current situation can also make people anxious.

It is important to cultivate a strong inner self and stable emotions at this time; one should not blindly follow trends. Calm down and work steadily, and the results will surely be good. First, introspect your own world, and then expand outward.

Grayscale enters the BNB ETF, the crypto blue chip sector welcomes a new phase

On January 23, Grayscale, a major player in crypto asset management, officially submitted an S-1 registration application for a spot BNB ETF to the U.S. SEC, proposing to list under the trading code GBNB on Nasdaq, with Coinbase serving as the primary broker and custodian, utilizing a physical creation and redemption mechanism. This move marks a key milestone in the expansion of crypto ETFs from Bitcoin and Ethereum to diversified blue-chip assets.

As the leading platform token, BNB benefits from the deep empowerment of the Binance ecosystem, boasting a market cap exceeding 100 billion and stable trading liquidity. Its deflationary economic model and diverse application scenarios such as DeFi and NFTs make it a prime target for institutional investment. Grayscale's current positioning is not coincidental; it had previously completed BNB trust registration in Delaware. This action also replicates the mature compliance framework of Bitcoin and Ethereum ETFs and is a strategic move following VanEck's earlier application for a BNB ETF, highlighting institutional recognition of the value in the platform token sector.

The submission of this application also signals a new phase of institutionalization in the crypto market. Following the approval of BTC and ETH spot ETFs in 2025, the demand for traditional capital allocation in crypto assets continues to escalate. Grayscale is accelerating the construction of a comprehensive crypto ETF matrix, and the filing for the BNB ETF is an important step in meeting institutional diversification needs. If ultimately approved, it will bring a massive influx of traditional capital to BNB, further solidifying its position as the leading platform token and potentially opening the door for the ETF-ization of other mainstream crypto assets like SOL and DOT.

However, the road to approval still faces multiple uncertainties. The deep binding of BNB to the Binance ecosystem keeps its classification as a security under SEC scrutiny contentious, which is the core focus of the review. Furthermore, the SEC remains cautious regarding the review of non-BTC/ETH crypto ETFs, having previously postponed the approval of several crypto-related ETFs. Grayscale's current application is more of a probe into the regulatory stance, and actual implementation will still require time.

After the announcement, the price of BNB remained stable, reflecting the market's rational wait-and-see approach. However, it is undeniable that Grayscale's actions have injected new development momentum into the crypto market, and the process of compliance for crypto blue-chip assets is steadily advancing, while the dynamics surrounding the BNB ETF will become an important highlight in the institutionalization process of the crypto market in 2026.

On January 23, Grayscale, a major player in crypto asset management, officially submitted an S-1 registration application for a spot BNB ETF to the U.S. SEC, proposing to list under the trading code GBNB on Nasdaq, with Coinbase serving as the primary broker and custodian, utilizing a physical creation and redemption mechanism. This move marks a key milestone in the expansion of crypto ETFs from Bitcoin and Ethereum to diversified blue-chip assets.

As the leading platform token, BNB benefits from the deep empowerment of the Binance ecosystem, boasting a market cap exceeding 100 billion and stable trading liquidity. Its deflationary economic model and diverse application scenarios such as DeFi and NFTs make it a prime target for institutional investment. Grayscale's current positioning is not coincidental; it had previously completed BNB trust registration in Delaware. This action also replicates the mature compliance framework of Bitcoin and Ethereum ETFs and is a strategic move following VanEck's earlier application for a BNB ETF, highlighting institutional recognition of the value in the platform token sector.

The submission of this application also signals a new phase of institutionalization in the crypto market. Following the approval of BTC and ETH spot ETFs in 2025, the demand for traditional capital allocation in crypto assets continues to escalate. Grayscale is accelerating the construction of a comprehensive crypto ETF matrix, and the filing for the BNB ETF is an important step in meeting institutional diversification needs. If ultimately approved, it will bring a massive influx of traditional capital to BNB, further solidifying its position as the leading platform token and potentially opening the door for the ETF-ization of other mainstream crypto assets like SOL and DOT.

However, the road to approval still faces multiple uncertainties. The deep binding of BNB to the Binance ecosystem keeps its classification as a security under SEC scrutiny contentious, which is the core focus of the review. Furthermore, the SEC remains cautious regarding the review of non-BTC/ETH crypto ETFs, having previously postponed the approval of several crypto-related ETFs. Grayscale's current application is more of a probe into the regulatory stance, and actual implementation will still require time.

After the announcement, the price of BNB remained stable, reflecting the market's rational wait-and-see approach. However, it is undeniable that Grayscale's actions have injected new development momentum into the crypto market, and the process of compliance for crypto blue-chip assets is steadily advancing, while the dynamics surrounding the BNB ETF will become an important highlight in the institutionalization process of the crypto market in 2026.

💥Explosive重磅! CZ, the big brother of the CZ team, has arrived at Binance Square for a live Chinese AMA. The veteran rarely appears in public, and this time he shares priceless insights. Newcomers in the crypto world can avoid pitfalls, and entrepreneurs can seize opportunities—everything is perfectly handled!

① The veteran officially announces his permanent presence at Binance Square live, sharing hard-hitting knowledge up close. The autumn charm hidden in the mountains and fields, proximity brings golden opportunities.

② Binance Square will add entertainment buffs, fully upgrading the potential of the赛道. The wind starts from the tips of the grass—secure your position and win the early advantage.

③ Prediction is a long-term赛道. Only by staying committed and深耕 can one achieve lasting success. Distance reveals true strength; perseverance leads to far-reaching results.

④ The fast pace of Meme chain scientists versus the slow response of retail investors is a dialectical relationship. Know yourself and your opponent, then stay humble and avoid deep traps.

⑤ BTC's market hasn't reached its peak yet—reaching the 200k mark is just a matter of time. The tide is rising, and flowers will bloom soon.

⑥ The BNB ecosystem has a solid moat with tremendous inner potential—accumulation leads to sudden breakthroughs, and brilliance naturally shines.

⑦ The golden rule for newcomers: never touch futures contracts. Only small funds for trial and error—mistake one step, and the entire game is lost.

⑧ Content creation must strictly adhere to boundaries—no politics or explicit content. Compliance ensures steady progress; know what to do and what not to do.

⑨ Lessons from the U.S. experience: respect national laws and move with the times. Major rivers cannot be reversed—compliance ensures longevity.

⑩ Core principle for KOL success: choose a strong ally and build a solid community. Good birds choose fine trees—avoid three years of detours.

The vast mountains and fields can't hide autumn's affection, and deep cultivation in the crypto world builds unwavering confidence. Follow the veteran, align with industry rhythms, and even ordinary people can shine brightly at Binance Square!

① The veteran officially announces his permanent presence at Binance Square live, sharing hard-hitting knowledge up close. The autumn charm hidden in the mountains and fields, proximity brings golden opportunities.

② Binance Square will add entertainment buffs, fully upgrading the potential of the赛道. The wind starts from the tips of the grass—secure your position and win the early advantage.

③ Prediction is a long-term赛道. Only by staying committed and深耕 can one achieve lasting success. Distance reveals true strength; perseverance leads to far-reaching results.

④ The fast pace of Meme chain scientists versus the slow response of retail investors is a dialectical relationship. Know yourself and your opponent, then stay humble and avoid deep traps.

⑤ BTC's market hasn't reached its peak yet—reaching the 200k mark is just a matter of time. The tide is rising, and flowers will bloom soon.

⑥ The BNB ecosystem has a solid moat with tremendous inner potential—accumulation leads to sudden breakthroughs, and brilliance naturally shines.

⑦ The golden rule for newcomers: never touch futures contracts. Only small funds for trial and error—mistake one step, and the entire game is lost.

⑧ Content creation must strictly adhere to boundaries—no politics or explicit content. Compliance ensures steady progress; know what to do and what not to do.

⑨ Lessons from the U.S. experience: respect national laws and move with the times. Major rivers cannot be reversed—compliance ensures longevity.

⑩ Core principle for KOL success: choose a strong ally and build a solid community. Good birds choose fine trees—avoid three years of detours.

The vast mountains and fields can't hide autumn's affection, and deep cultivation in the crypto world builds unwavering confidence. Follow the veteran, align with industry rhythms, and even ordinary people can shine brightly at Binance Square!

Chinese meme reignites emotions

Various flights - take off instantly

After takeoff, sell decisively

Life's chart, profit at peak

Dark horse Eat the meat

Golden shovel Eat the meat

Small shareholder Eat the meat

Profit and sell quickly, secure gains! Take profit when you see a good opportunity!

Various flights - take off instantly

After takeoff, sell decisively

Life's chart, profit at peak

Dark horse Eat the meat

Golden shovel Eat the meat

Small shareholder Eat the meat

Profit and sell quickly, secure gains! Take profit when you see a good opportunity!

#红包大派送

#红包大派送

Understanding Venezuela, Understanding Bitcoin

The US is now most frustrated by gold. If gold were merely a safe-haven asset, it wouldn't be rising so decisively. Now, countries around the world are effectively betting on gold as a way to short the US dollar—this is the most direct way to price the decline of the dollar.

After the collapse of the Bretton Woods system, gold became the biggest rival to the US dollar. Since the dollar has continuously replaced gold's function as a medium of exchange, the two have always moved in opposite directions. When industrial resources like silver, copper, and lithium also start rising in line with gold's logic, it signals that the world no longer trusts America's 'credit contract,' and instead recognizes the real collateral of physical resources.

This is why the US must now 'fight with its back against the wall' and launch a sudden strike on Venezuela to seize its oil. The US realizes that if it cannot regain dominance over physical resources—those backing gold and its resource-based alliance—the dollar will be worthless, and the dollar's hegemony will vanish. With Middle Eastern oil powers refusing to cooperate and the petrodollar system breaking down, the US must find a compliant and large oil reserve within its 'backyard.' By controlling Venezuela, the US can establish a massive oil and mineral closed loop across the Western Hemisphere—long-term, this is about re-collateralizing the dollar with physical assets.

However, short-term impacts are equally critical. The 2026 midterm elections are vital for Trump—losing would mean the end of his political life. To win votes, he needs low oil prices, a booming stock market, and low interest rates. While Venezuela's oil production can't be significantly boosted in the short term, the strike sends a signal in financial markets about future oversupply. This is enough to suppress speculative capital, allowing voters to see falling gas prices at the pump.

At the beginning of 2026, the world will be more surreal than any movie. When rumors start circulating online about Venezuela retaining $60 billion in Bitcoin, the consensus around decentralized, borderless, non-inflationary assets will evolve into a belief. The US is willing to forcibly cut interest rates for elections and launch military strikes for oil—this is the era when fiat currencies are weaponized. Bitcoin becomes the only survival fortress. This is also why the US is racing to seize the initiative and gain control over Bitcoin's pricing. The shift from 'private speculation' to 'national strategic reserve' marks Bitcoin's official 'coming-of-age' moment!

#红包大派送

Understanding Venezuela, Understanding Bitcoin

The US is now most frustrated by gold. If gold were merely a safe-haven asset, it wouldn't be rising so decisively. Now, countries around the world are effectively betting on gold as a way to short the US dollar—this is the most direct way to price the decline of the dollar.

After the collapse of the Bretton Woods system, gold became the biggest rival to the US dollar. Since the dollar has continuously replaced gold's function as a medium of exchange, the two have always moved in opposite directions. When industrial resources like silver, copper, and lithium also start rising in line with gold's logic, it signals that the world no longer trusts America's 'credit contract,' and instead recognizes the real collateral of physical resources.

This is why the US must now 'fight with its back against the wall' and launch a sudden strike on Venezuela to seize its oil. The US realizes that if it cannot regain dominance over physical resources—those backing gold and its resource-based alliance—the dollar will be worthless, and the dollar's hegemony will vanish. With Middle Eastern oil powers refusing to cooperate and the petrodollar system breaking down, the US must find a compliant and large oil reserve within its 'backyard.' By controlling Venezuela, the US can establish a massive oil and mineral closed loop across the Western Hemisphere—long-term, this is about re-collateralizing the dollar with physical assets.

However, short-term impacts are equally critical. The 2026 midterm elections are vital for Trump—losing would mean the end of his political life. To win votes, he needs low oil prices, a booming stock market, and low interest rates. While Venezuela's oil production can't be significantly boosted in the short term, the strike sends a signal in financial markets about future oversupply. This is enough to suppress speculative capital, allowing voters to see falling gas prices at the pump.

At the beginning of 2026, the world will be more surreal than any movie. When rumors start circulating online about Venezuela retaining $60 billion in Bitcoin, the consensus around decentralized, borderless, non-inflationary assets will evolve into a belief. The US is willing to forcibly cut interest rates for elections and launch military strikes for oil—this is the era when fiat currencies are weaponized. Bitcoin becomes the only survival fortress. This is also why the US is racing to seize the initiative and gain control over Bitcoin's pricing. The shift from 'private speculation' to 'national strategic reserve' marks Bitcoin's official 'coming-of-age' moment!

Login to explore more contents