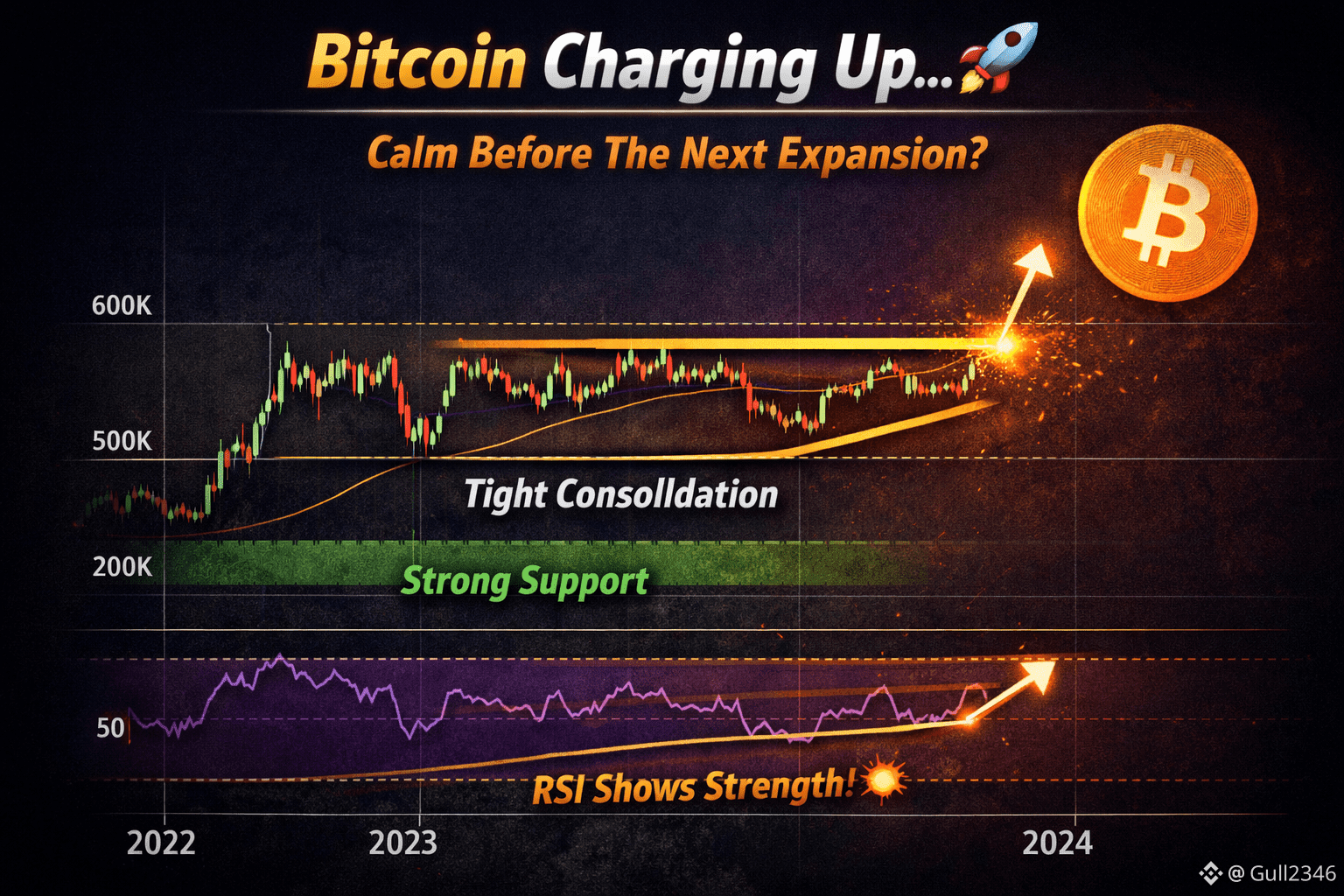

$BTC Bitcoin continues to show strength, and despite short-term noise, the bigger picture remains extremely bullish. When you zoom out on the higher timeframes, BTC is not showing weakness — instead, it’s consolidating like a coiled spring 👀🔥

📊 Healthy Consolidation, Not Distribution

After a strong impulsive move, Bitcoin has entered a tight consolidation range. This type of price action usually signals accumulation, not the end of a trend.

Strong hands are absorbing supply while weak hands get shaken out.

Price is holding above key structural support, and every dip is getting bought quickly — a clear sign that buyers are still in control.

📈 RSI & Momentum Tell the Real Story

While price moves sideways, RSI is holding above key levels, showing that momentum remains bullish.

There is no major bearish divergence, which means sellers lack real strength.

This is often the phase where Bitcoin builds energy before continuation — frustrating traders in the short term, but rewarding patience in the long term.

🧠 Market Psychology: Quiet Before Expansion

Bitcoin rarely gives easy entries before a big move.

This slow, boring price action is exactly how BTC behaves before expansion phases. Once volatility returns, moves tend to be fast and aggressive 🚀

If Bitcoin breaks above resistance:

Momentum could accelerate quickly

Liquidity will chase price

Altcoins may follow shortly after

🔥 Final Thoughts

As long as Bitcoin holds its current structure, the bullish trend remains intact.

This looks less like a top — and more like preparation for the next leg higher.

The market is calm… but calm phases don’t last forever 🌋

💥 Follow for free BTC & crypto analysis, VIP signals, and real-time market updates

⚠️ Content may soon become private for followers only.#BTC #USNonFarmPayrollReport #USTradeDeficitShrink #ZTCBinanceTGE #BinanceHODLerBREV