As of January 11, 2026, Bitcoin ($BTC ) is navigating a period of high-stakes consolidation following a volatile 2025. After reaching a lifetime peak of $126,198 in October 2025, the market has cooled significantly, currently trading in the $90,000 to $91,000 range.

Here is a short analysis of the current market state:

1. Market Performance & Price Action

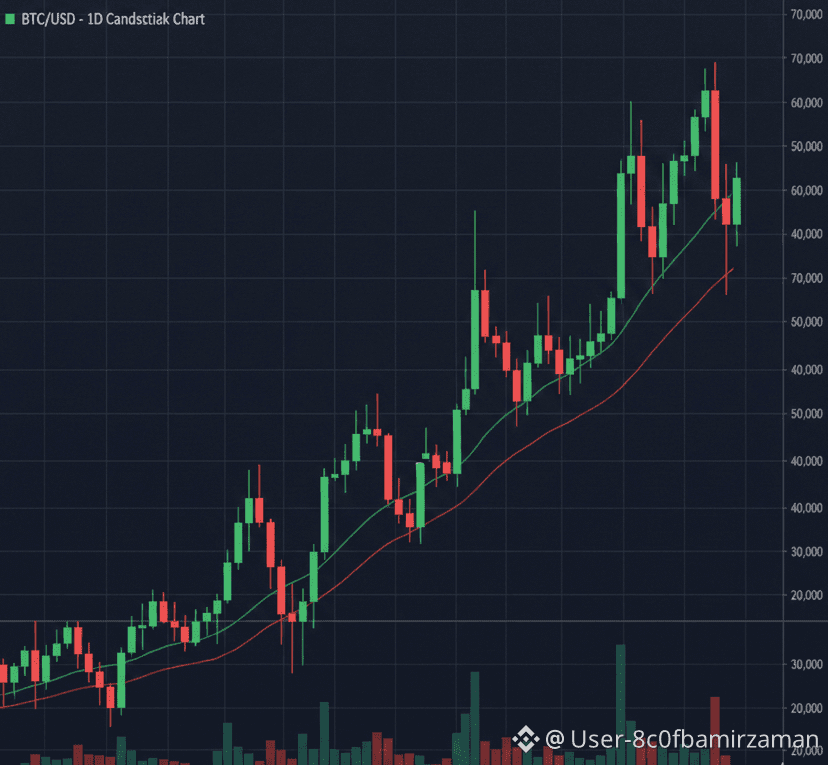

Bitcoin $BTC has entered 2026 with a "neutral-to-cautious" sentiment. While it managed a small relief rally in the first week of January, it remains roughly 28% below its all-time high.

Current Price: Approximately $90,600.

Short-term Trend: Sideways.$BTC is trapped in a consolidation channel between $85,000 (support) and $95,000 (resistance).

Technical Health: The 50-week Moving Average was recently broken for the first time since late 2023, signaling a potential shift in the long-term trend. Analysts are closely watching the $80,000 floor; a drop below this could trigger a deeper correction toward $68,000.

2. Institutional & Regulatory Drivers

The narrative for 2026 has shifted from "hype" to "operationalization."

Regulatory Clarity: The U.S. is moving toward a formalized crypto market structure bill (expected markup Jan 15, 2026). This is viewed as a long-term bullish catalyst that may reduce "fly-by-night" volatility while inviting steadier institutional capital.

ETF Inflows: Despite the price stagnation, spot Bitcoin ETFs saw over $1.1 billion in net inflows during the first two trading sessions of 2026, suggesting that institutional "buy-the-dip" interest remains active.

3. Macro Environment

Interest Rates: The Federal Reserve has lowered rates to the 3.50–3.75% range. While usually good for "risk-on" assets, a strong U.S. Dollar and stretched equity valuations are keeping a lid on a major Bitcoin breakout for now.

Network Fundamentals: Bitcoin’s hashrate remains near record highs, indicating that the underlying security and mining infrastructure are robust despite the price retracement from the $120k+ levels.

Summary Table

Metric Status Key Level

Sentiment Neutral / Consolidation N/A

Primary Support Holding $85,000

Psychological Resistance Strong $100,000

2026 YTD Performance Positive (+4.23%) High of $95,000

The Bottom Line: Bitcoin is in a "wait-and-see" phase. It needs to reclaim and hold $95,000 to flip the short-term bias back to bullish. Until then, expect choppy, range-bound trading.

#BTC #USNonFarmPayrollReport #CryptoMarketAnalysis #PrivacyCoinSurge #btc70k