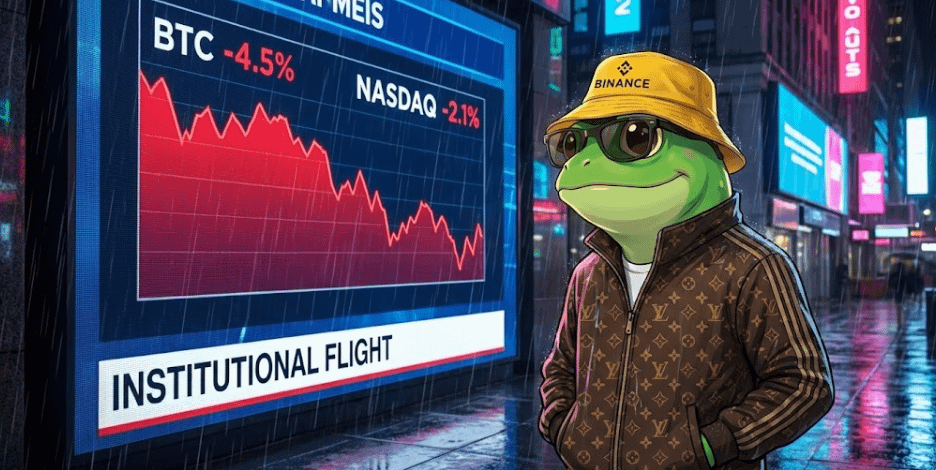

A single sentence hit the essence of this bear market. The previous narrative of BTC was "decentralization", "hedging against fiat", "digital gold". What about now? Its correlation with Nasdaq is much higher than with gold. Institutions have come, ETFs have arrived, Wall Street's money has come — and then Wall Street's money has also run away.

Since October, the cumulative outflow of the US spot BTC ETF has reached $8.5 billion. The CME Bitcoin futures open interest has plummeted by about two-thirds from its peak at the end of 2024, leaving around $8 billion. The price of BTC on Coinbase has consistently been lower than on Binance. The price difference is not large, but the direction is very clear — US funds are continuously net selling.

You think institutionalization can bring stability. The result of institutionalization is homogenization. BTC now rises and falls in sync with tech stocks, inversely fluctuates with the dollar index, and moves in tandem with risk appetite. It is no longer an alternative asset. It has become a Nasdaq with a higher beta.

BTC today is $66,941. It has slipped again from yesterday's $67,341.

The Fear and Greed Index reports 8. Eight. This is not "extreme fear"; this is fear itself having become numb. The last time this number appeared in single digits was during the FTX crash. That time had a clear black swan. This time, there is none. Just four and a half months of continuous decline, from $126,000 to $67,000, a drop of 47%.

ETH $1,930. It has dropped 33% this year and 60% from its peak. SOL $82. DOGE $0.10. XRP $1.47. Altcoins are all lying flat, lacking even the strength to rebound.

Today's macro situation has added more fuel to the fire.

The first point: the situation in the Middle East is escalating. The U.S. military has deployed more than 50 fighter jets to the Persian Gulf, including F-16s, F-22s, and F-35s. Two aircraft carrier strike groups—the Lincoln and the Ford—are already in place. Iran has blocked parts of the Strait of Hormuz for military exercises, and the supreme leader has stated, "We will respond decisively."

Oil prices are rising, the dollar is rising, gold is rising. Risk assets are falling. BTC is a risk asset.

The second point: the Federal Reserve's minutes released hawkish signals. Rate cut expectations continue to be pushed back. The market now gives a 90% probability of maintaining rates in March. A high-interest rate environment suppresses all non-yielding assets, with BTC being the first to suffer.

Arthur Hayes published a long article yesterday titled (This Is Fine).

His core argument is: the crash of BTC is not because of problems inherent in crypto itself, but because it is pricing in an impending AI-related credit crisis. He believes that the U.S. banking system has too much credit exposure to AI infrastructure, and once the AI bubble bursts, credit contraction will force the Federal Reserve to re-inject liquidity. And that moment will mark the beginning of BTC's new high.

This logic is very Hayes—always waiting for that moment when the "Federal Reserve is forced to print money." But he also said something very honest: BTC may drop below sixty thousand in the short term. Political division will delay the Federal Reserve's response speed.

Translated into operational language: the direction may be right, but the time window may be long. During this time, your position will be repeatedly tortured.

Tomorrow, February 20.

The U.S. Supreme Court's ruling on the legality of Trump's tariffs may be imminent. The last time tariff news triggered the market was in October, with a liquidation of $19 billion. If the ruling maintains the tariffs, it means inflation expectations will rise, rate cuts will be further away, and the dollar will be stronger. This is a triple blow for BTC.

The options market is already pricing in this risk. CoinDesk reports that $40,000 BTC put options have become the second-largest position in contracts expiring in February. Forty thousand. This strike price represents a 40% drop from the current price. Someone is betting real money on this level of collapse.

But speaking of which.

Tether's market cap now accounts for 8% of the total crypto market cap. Historically, when this ratio reaches 8%-10%, it often means that a large amount of money is "lying in" stablecoins, waiting. They haven't left the crypto ecosystem; they just haven't decided when to rush back in.

Ledn has just completed a bond issuance of $188 million, with underlying assets being 5,400 BTC mortgages—this is the first official ABS (asset-backed security) in the crypto industry. This indicates that traditional financial pipelines are widening, not shrinking. It's just that this pipeline is now draining water out, not pumping it in.

The last question:

Bloomberg says BTC has paid the price for embracing Wall Street. Hayes says the Federal Reserve will eventually print money to save everything. Harvard is selling BTC and buying ETH. Whales are moving bricks to Binance. The options market is betting on $40,000.

Among these people, who is right doesn't matter. What matters is—they are all moving, and what are you doing? #BTC