Since the rapid rise from 15555, it seems that everyone is immersed in the joy of the arrival of the Mavericks, but I still want to express my own views. From being criticized for being bearish throughout February and being criticized for being bearish at 25200, I seem to have acquired a new skill, which is to automatically ignore the noise.

This post was originally updated on the 1st, but due to other things, it has been put in the draft. I have some free time today, so I won't waste any more time, and will get straight to the point.

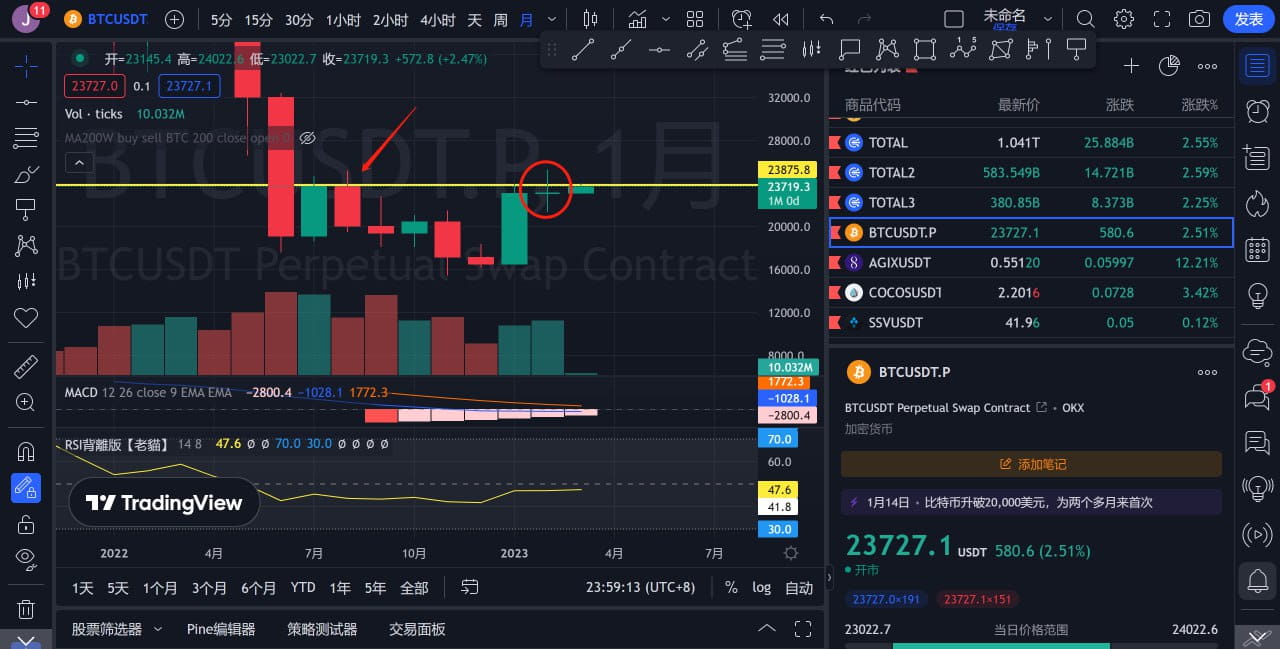

First, let’s look at the closing of the monthly line; the “Doji” Doji is the most characteristic K-line of the combined reversal pattern.

And we can see that Bitcoin's closing price in February was lower than the flat point in August last year.

Flat top: The key support/resistance of the combination of the K-line positive line closing price + the negative line closing price.

The closing price in August last year was 23293. The closing price in February is 23141. As shown below

Judging from the monthly closing line, this is a signal that the bulls are temporarily in a downturn in my opinion.

Next, let’s look at volume and price analysis from different exchanges.

I chose Binance, Coinbase, and OKX to see the Bitcoin trading situation on the three major platforms

Below are Figure 1: Binance, Figure 2: Coinbase, Figure 3: OKX

Judging from the volume distribution, the Bitcoin volume of Binance and OKX in February was relatively full and huge. However, as we can see in Figure 2, Coinbase is a spot exchange, and its volume distribution in February was not as optimistic as that of other exchanges. Therefore, my view is that the volume of Binance and OKX is more of the closing of short contracts and the trading volume of long contracts.

I also gave my short-term bearish view. In March, there is a possibility of a high hanging recovery trend. In addition, there are two key market data to be released in the middle of the month. Since it is a monthly line, we observe it in months.

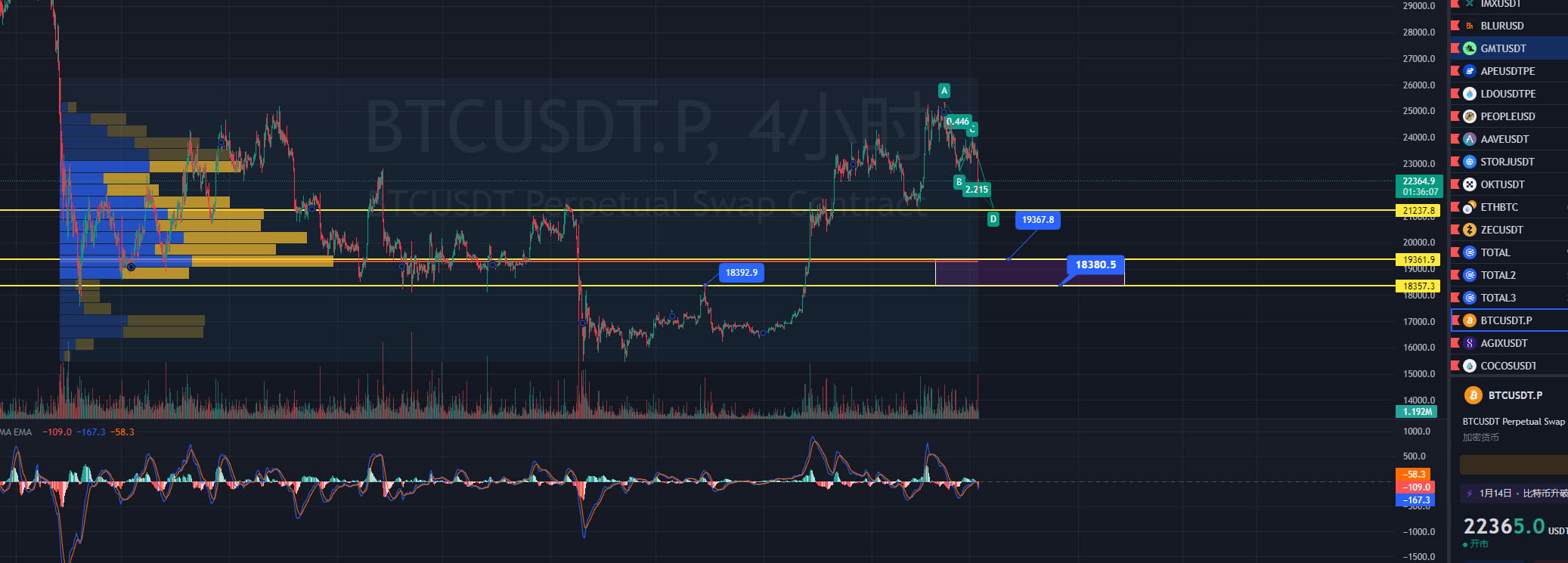

Judging from the short-term 4-hour trend, Bitcoin is still creating new highs, but it has not created a lower low. Therefore, the confirmation signal on the right has not been confirmed yet.

If Bitcoin reverses from AB=CD, it will be the bottom support before 21400. Let’s look at the following figure.

If Bitcoin does not get effective support and rebound here, and breaks down with large volume, I will pay attention to the two positions below. As shown in the figure below, I will give my own judgment logic

#BTC 18300 was the area where FTX was constantly consolidating before the crash, and it was also the support and resistance exchange position that was repeatedly tested after the crash. This round of breakthrough is determined. The second is 19300

19300 is the POC chip-intensive trading area of the entire round of box below 25200.

The above is my view on the closing price in February and the possible trend in March. If the decline is realized, then we can buy cheap high-quality chips at the bottom.

Analysis is not afraid of being slapped in the face, after all, being slapped in the face makes people progress. I always say this: there is no general who always wins in any market.

PS: People who are fully invested in spot commodities will speak ill of the bearish bloggers. In fact, it is understandable, just like a poisonous snake does not know it is poisonous.

Message: In 2024, not only will BTC be halved, but the Fed will also cut interest rates. With the blessing of these two benefits, even if there is no violent bull market, there will be a good small bull market. It should not be difficult for me to see BTC reach 40,000 or 50,000. Some mainstreams have a three-fold or five-fold increase, which is normal, and other popular tracks are even more than that. This year is to buy the track you are optimistic about as much as possible at a low point. The holding cycle is enlarged. This should be the simplest wealth code. Around L2, follow LSD. There are also ZK system and Binance ecology. If you want to play short-term, take a 10% position, practice, learn more indicators, draw more pictures, and simply find support pressure, etc. Improve your ability to survive in the market. It is such a blessing to be able to participate in the market in a bear market. How many people lose money in the bull market.

Follow Brother Chi for more trading technical analysis and content sharing.