Goshi khanzada

ALHAMDULLILAH FOR EVERYTHING

0 Following

18 Followers

33 Liked

0 Shared

🎁 Claim Free $BTC

Good Night 🌹

How to participate:

1️⃣ Repost

2️⃣ Like

3️⃣ Share

💬 Comment “Good Night”

#BinanceSquareFamily

#Write2Earn #BTC #BNB $BNB $SOL

$SOL : 131.83

📈 +0.17%

Good Night 🌹

How to participate:

1️⃣ Repost

2️⃣ Like

3️⃣ Share

💬 Comment “Good Night”

#BinanceSquareFamily

#Write2Earn #BTC #BNB $BNB $SOL

$SOL : 131.83

📈 +0.17%

🎁 #RedRaffle Alert! 🎁

#DUSK 🔥 Free $BNB B is up for grabs! 💰

⏳ Don’t miss this limited-time reward!

How to join 👇

✅ Follow

✅ Like

💬 Comment: Binance

⚡ Fast movers grab the rewards first!

Claim now & stay tuned for more surprises!

#RedPacket #BNBGiveaway #Binance #CryptoRewards #DuskNetwork

#DUSK 🔥 Free $BNB B is up for grabs! 💰

⏳ Don’t miss this limited-time reward!

How to join 👇

✅ Follow

✅ Like

💬 Comment: Binance

⚡ Fast movers grab the rewards first!

Claim now & stay tuned for more surprises!

#RedPacket #BNBGiveaway #Binance #CryptoRewards #DuskNetwork

$ETH $AB

## Stock market information for Bitcoin (BTC)

* Bitcoin is a crypto in the CRYPTO market.

* The price is 89618.0 USD currently with a change of 563.00 USD (0.01%) from the previous close.

* The intraday high is 90804.0 USD and the intraday low is 88509.0 USD.

Bitcoin (BTC) is trading around **~$89,600** and currently showing limited directional movement — a sign of **market consolidation** rather than fresh trend breakout.

---

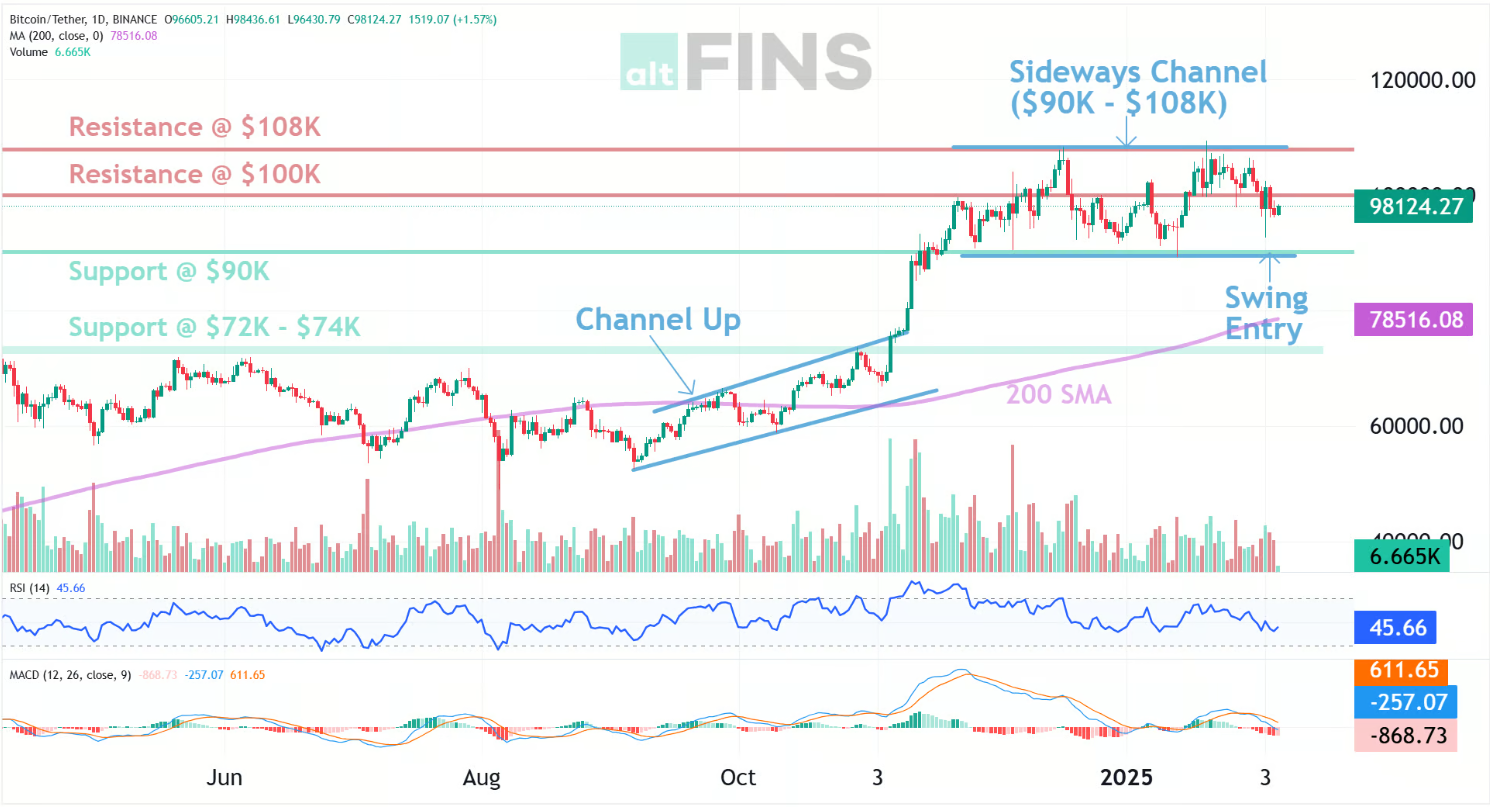

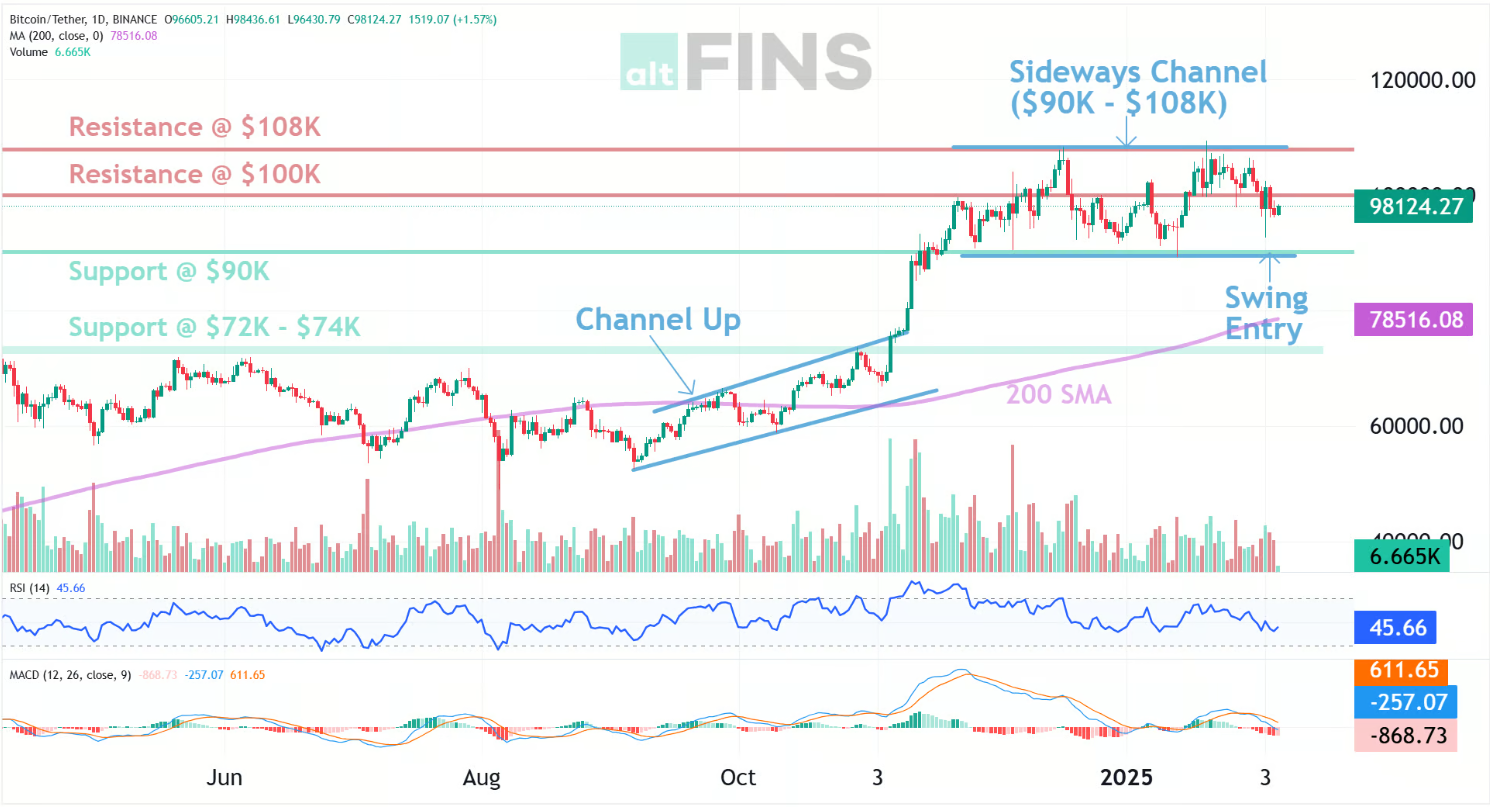

## 📈 **Market Structure: Consolidation, Not Trend**

Recent price action shows BTC sliding into a **tight range between roughly $80,800 support and $94,000 resistance**, with low trading volumes and indecision dominating markets. Analysts describe this as a **range-bound consolidation phase** after a deep drawdown from 2025 highs. ([Pintu][1])

➡️ *What this means:* The market is not trending strongly up or down — traders await new catalysts (macro data, ETF flows, regulatory news) before direction becomes clear.

---

## 🔍 **Technical Signals & Patterns**

* **Sideways trading** within a channel suggests lack of momentum and reduced volatility short-term. ([ZebPay][2])

* A break above **$94,000** could trigger a renewed rally; a breakdown below **$80,000** may signal deeper correction. ([Pintu][1])

* Indicators like shrinking volume and consolidation often precede **big moves**, but the direction isn’t yet confirmed.

#BTC90kChristmas #ETH #ab #StrategyBTCPurchase #BTCVSGOLD

## Stock market information for Bitcoin (BTC)

* Bitcoin is a crypto in the CRYPTO market.

* The price is 89618.0 USD currently with a change of 563.00 USD (0.01%) from the previous close.

* The intraday high is 90804.0 USD and the intraday low is 88509.0 USD.

Bitcoin (BTC) is trading around **~$89,600** and currently showing limited directional movement — a sign of **market consolidation** rather than fresh trend breakout.

---

## 📈 **Market Structure: Consolidation, Not Trend**

Recent price action shows BTC sliding into a **tight range between roughly $80,800 support and $94,000 resistance**, with low trading volumes and indecision dominating markets. Analysts describe this as a **range-bound consolidation phase** after a deep drawdown from 2025 highs. ([Pintu][1])

➡️ *What this means:* The market is not trending strongly up or down — traders await new catalysts (macro data, ETF flows, regulatory news) before direction becomes clear.

---

## 🔍 **Technical Signals & Patterns**

* **Sideways trading** within a channel suggests lack of momentum and reduced volatility short-term. ([ZebPay][2])

* A break above **$94,000** could trigger a renewed rally; a breakdown below **$80,000** may signal deeper correction. ([Pintu][1])

* Indicators like shrinking volume and consolidation often precede **big moves**, but the direction isn’t yet confirmed.

#BTC90kChristmas #ETH #ab #StrategyBTCPurchase #BTCVSGOLD

$XRP

---

## 🔍 **Bitcoin Market Snapshot — Early January 2026**

📊 **Current Price Action:**

Bitcoin has been **trading in a tight range** around key levels near ~$89,000–$90,000, reflecting persistent *consolidation rather than a directional breakout*. This reflects short-term indecision among traders and investors on risk assets. ([FXStreet][1])

📈 **Technical Structure:**

* BTC is resting **within a consolidation zone** with resistance near **$90k–$92k** and support around **$84k–$87k**. ([Blockchain News][2])

* Several momentum indicators (like MACD and RSI) show **mixed signals**, hinting that bulls and bears are evenly matched in the near term. ([CoinMarketCap][3])

* Traders are closely watching a **break above $90.5k** — this could trigger follow-through buying toward $95k–$100k targets. ([Blockchain News][2])

---

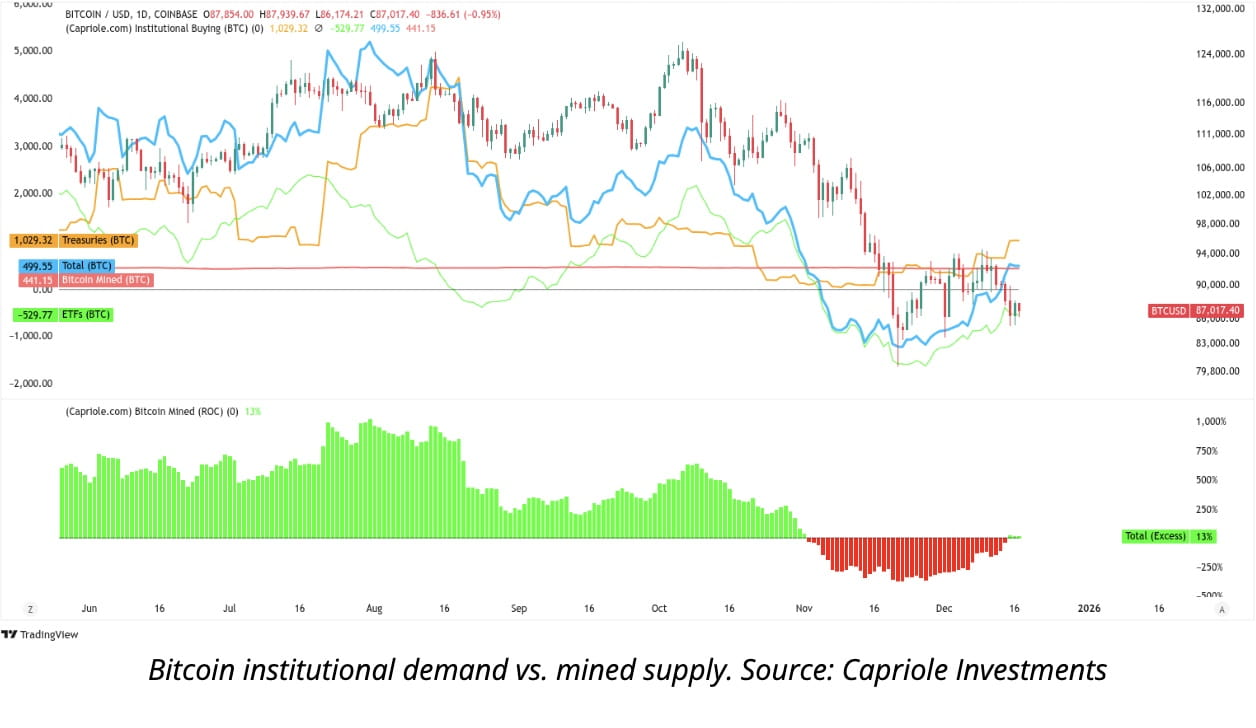

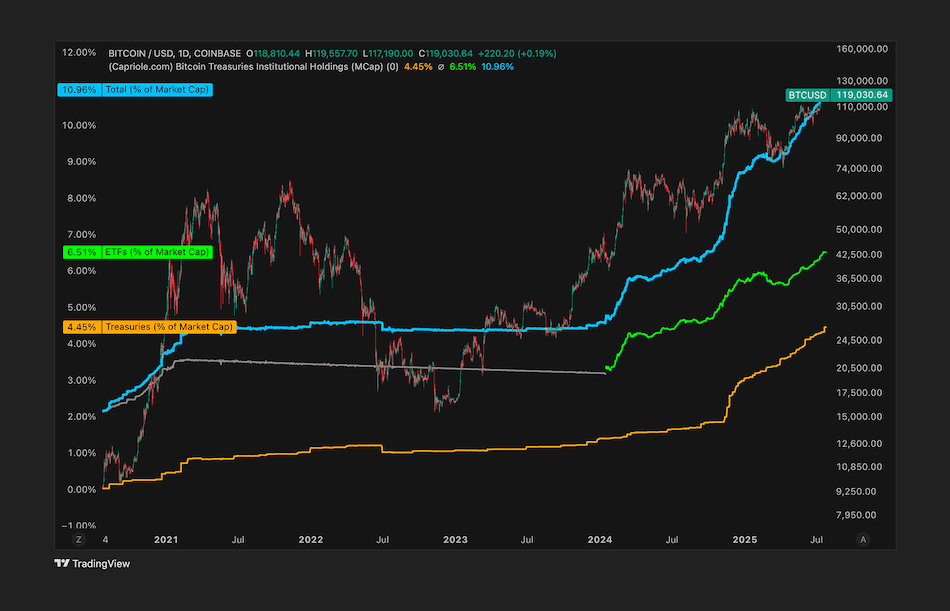

## 📊 **Short-Term Outlook: Consolidation With Bullish Edge**

**Bullish Scenario**

* A decisive move above **upper resistance (~$92k)** would open the path to **$95k+** and possibly **$100k** later this quarter.

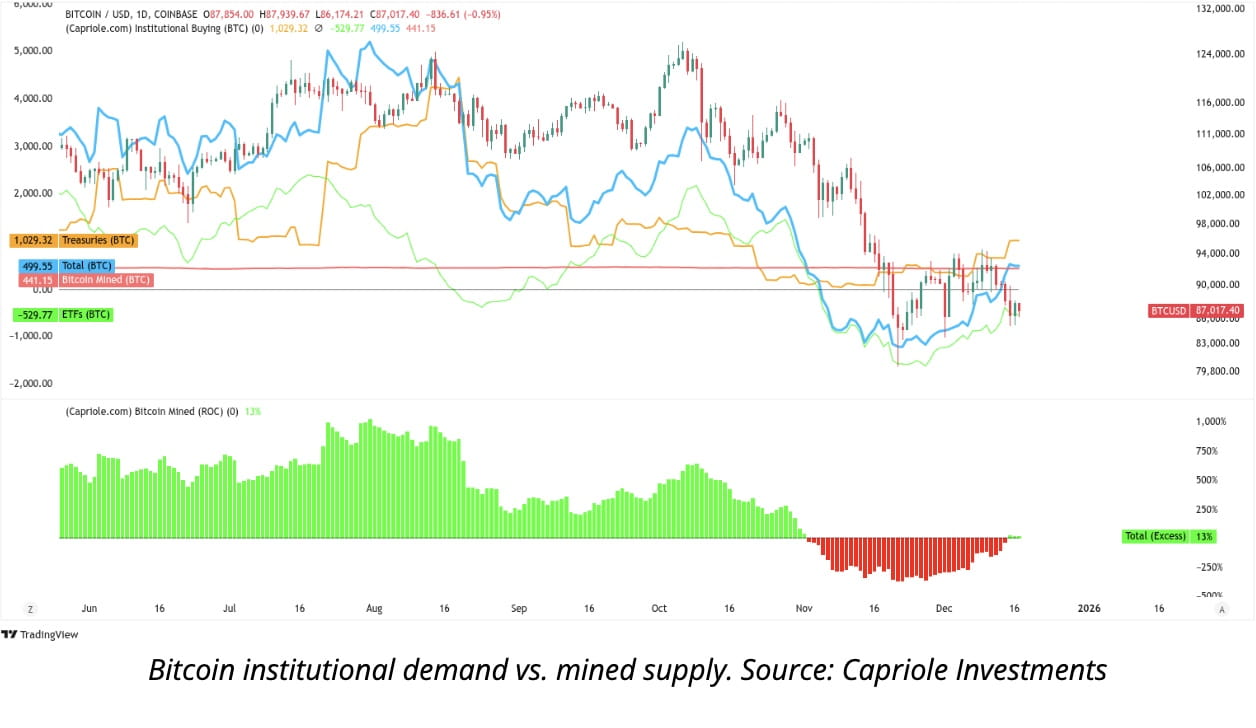

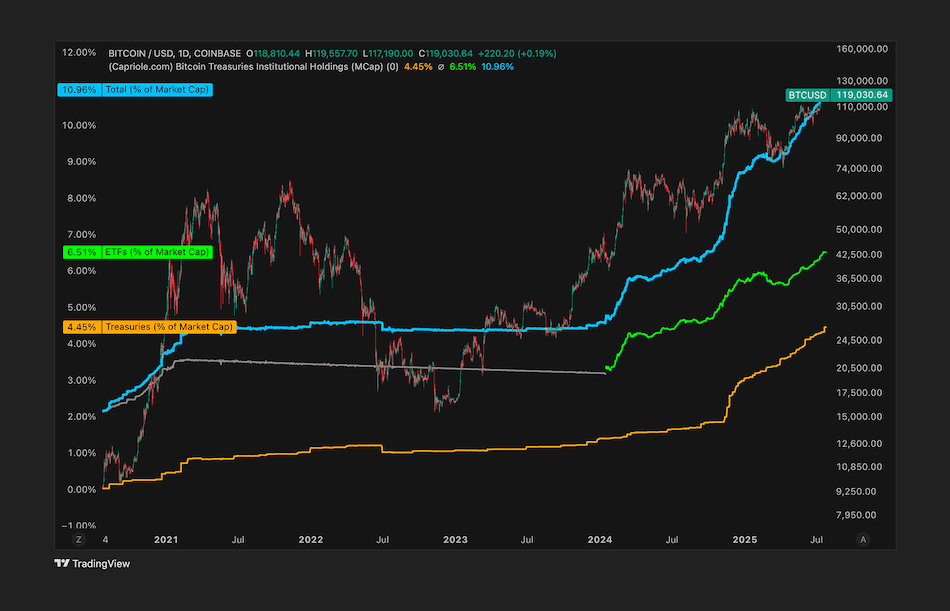

* Increasing institutional interest via ETFs and corporate treasuries could act as *fuel for upside continuation*. ([CoinMarketCap][3])

**Bearish Scenario**

* If BTC breaks below **$84k–$87k support areas**, deeper retracements toward **$80k or lower** cannot be ruled out.

* Macro risk factors — like broader risk-off sentiment or slower ETF flows — may pressure prices further. ([CoinMarketCap][3])

---

## 📌 **Fundamental Forces at Work**

### 🧠 **Institutional Accumulation**

#xrp #BTC90kChristmas #StrategyBTCPurchase #BTCVSGOLD #WriteToEarnUpgrade

---

## 🔍 **Bitcoin Market Snapshot — Early January 2026**

📊 **Current Price Action:**

Bitcoin has been **trading in a tight range** around key levels near ~$89,000–$90,000, reflecting persistent *consolidation rather than a directional breakout*. This reflects short-term indecision among traders and investors on risk assets. ([FXStreet][1])

📈 **Technical Structure:**

* BTC is resting **within a consolidation zone** with resistance near **$90k–$92k** and support around **$84k–$87k**. ([Blockchain News][2])

* Several momentum indicators (like MACD and RSI) show **mixed signals**, hinting that bulls and bears are evenly matched in the near term. ([CoinMarketCap][3])

* Traders are closely watching a **break above $90.5k** — this could trigger follow-through buying toward $95k–$100k targets. ([Blockchain News][2])

---

## 📊 **Short-Term Outlook: Consolidation With Bullish Edge**

**Bullish Scenario**

* A decisive move above **upper resistance (~$92k)** would open the path to **$95k+** and possibly **$100k** later this quarter.

* Increasing institutional interest via ETFs and corporate treasuries could act as *fuel for upside continuation*. ([CoinMarketCap][3])

**Bearish Scenario**

* If BTC breaks below **$84k–$87k support areas**, deeper retracements toward **$80k or lower** cannot be ruled out.

* Macro risk factors — like broader risk-off sentiment or slower ETF flows — may pressure prices further. ([CoinMarketCap][3])

---

## 📌 **Fundamental Forces at Work**

### 🧠 **Institutional Accumulation**

#xrp #BTC90kChristmas #StrategyBTCPurchase #BTCVSGOLD #WriteToEarnUpgrade

$BNB

### 📊 Trend Perspective

Bitcoin continues to respect its **long-term uptrend**, even after recent consolidation. On higher time frames, price action looks like a **pause within a broader bull cycle**, not a breakdown. This type of sideways movement often appears after strong rallies as the market absorbs profit-taking.

---

### 🧱 Key Technical Zones

* **Strong support:** Area where buyers previously stepped in aggressively

* **Major resistance:** Zone where selling pressure has repeatedly slowed advances

* Price is currently **compressing between these zones**, suggesting a larger move may be approaching once direction is confirmed.

---

### 😐 Market Sentiment

Sentiment has cooled from extreme optimism to a more **neutral / cautious stance**. Historically, this reduces downside risk and creates room for renewed upside if fresh demand enters the market.

---

## 🔮 Forward Scenarios

**Bullish case 🟢**

* Break above resistance with volume

* Renewed institutional interest

* Momentum continuation toward new highs later in the cycle

**Neutral case 🟡**

* Continued range-bound trading

* Volatility stays low while the market builds energy

**Bearish case 🔴**

* Loss of major support

* Macro pressure spills into risk assets

* Deeper correction before the next expansion phase

---

### ✍️ Bottom Line

Bitcoin appears to be **resting, not reversing**. As long as long-term support holds, the broader structure favors **continuation rather than collapse**. Traders are watching for **volatility expansion** as the next major signal.

#BTC90kChristmas #BTCVSGOLD #StrategyBTCPurchase #CryptoMarketAnalysis #StrategyBTCPurchase

### 📊 Trend Perspective

Bitcoin continues to respect its **long-term uptrend**, even after recent consolidation. On higher time frames, price action looks like a **pause within a broader bull cycle**, not a breakdown. This type of sideways movement often appears after strong rallies as the market absorbs profit-taking.

---

### 🧱 Key Technical Zones

* **Strong support:** Area where buyers previously stepped in aggressively

* **Major resistance:** Zone where selling pressure has repeatedly slowed advances

* Price is currently **compressing between these zones**, suggesting a larger move may be approaching once direction is confirmed.

---

### 😐 Market Sentiment

Sentiment has cooled from extreme optimism to a more **neutral / cautious stance**. Historically, this reduces downside risk and creates room for renewed upside if fresh demand enters the market.

---

## 🔮 Forward Scenarios

**Bullish case 🟢**

* Break above resistance with volume

* Renewed institutional interest

* Momentum continuation toward new highs later in the cycle

**Neutral case 🟡**

* Continued range-bound trading

* Volatility stays low while the market builds energy

**Bearish case 🔴**

* Loss of major support

* Macro pressure spills into risk assets

* Deeper correction before the next expansion phase

---

### ✍️ Bottom Line

Bitcoin appears to be **resting, not reversing**. As long as long-term support holds, the broader structure favors **continuation rather than collapse**. Traders are watching for **volatility expansion** as the next major signal.

#BTC90kChristmas #BTCVSGOLD #StrategyBTCPurchase #CryptoMarketAnalysis #StrategyBTCPurchase

$BTC Market Context:

Bitcoin is trading in a tight range near ~$88,000, showing sideways movement with low volatility. This suggests the market is consolidating after the late-2025 pullback from highs above $126,000. Consolidation in this zone reflects cautious sentiment among traders and institutions. The Economic Times+1

Technical Structure:

Range-bound: BTC is stuck between roughly $85,000 and $90,000, with repeated rejections near the upper boundary. MEXC

Key resistance: Immediate barrier around $90,000 – $92,000. A clean daily close above this level is widely viewed as a bullish trigger. Blockchain News

Support levels: Stronger technical floors lie near $84,000–$87,000; a break below these could invite deeper testing. MEXC

Momentum: Mixed technical indicators show consolidation without clear trend bias — buyers and sellers are currently balanced. CoinMarketCap

Sentiment & Outlook:

Market sentiment is neutral to cautiously optimistic, with low trading volume and reduced leverage suggesting traders are positioning ahead of a potential breakout. Analysts note that prolonged volatility compression often precedes significant directional moves, either up or down. MEXC

Potential Scenarios (Professional View):

✔️ Bullish continuation: Break and close above $90K–$92K with strong volume → could open the door to re-testing mid-six figures. Blockchain News

❌ Bearish risk: Close below $84K might extend the consolidation lower toward $80K or beyond before stabilizing. MEXC

Summary:

BTC is in a consolidation phase after the 2025 downturn. For now, traders watch $90K resistance and $84K support as critical decision points. A decisive breakout in either direction will likely define Bitcoin’s next trend. This is a market snapshot, not financial advice.

#StrategyBTCPurchase #BTCVSGOLD #USJobsData #BTC90kChristmas

Bitcoin is trading in a tight range near ~$88,000, showing sideways movement with low volatility. This suggests the market is consolidating after the late-2025 pullback from highs above $126,000. Consolidation in this zone reflects cautious sentiment among traders and institutions. The Economic Times+1

Technical Structure:

Range-bound: BTC is stuck between roughly $85,000 and $90,000, with repeated rejections near the upper boundary. MEXC

Key resistance: Immediate barrier around $90,000 – $92,000. A clean daily close above this level is widely viewed as a bullish trigger. Blockchain News

Support levels: Stronger technical floors lie near $84,000–$87,000; a break below these could invite deeper testing. MEXC

Momentum: Mixed technical indicators show consolidation without clear trend bias — buyers and sellers are currently balanced. CoinMarketCap

Sentiment & Outlook:

Market sentiment is neutral to cautiously optimistic, with low trading volume and reduced leverage suggesting traders are positioning ahead of a potential breakout. Analysts note that prolonged volatility compression often precedes significant directional moves, either up or down. MEXC

Potential Scenarios (Professional View):

✔️ Bullish continuation: Break and close above $90K–$92K with strong volume → could open the door to re-testing mid-six figures. Blockchain News

❌ Bearish risk: Close below $84K might extend the consolidation lower toward $80K or beyond before stabilizing. MEXC

Summary:

BTC is in a consolidation phase after the 2025 downturn. For now, traders watch $90K resistance and $84K support as critical decision points. A decisive breakout in either direction will likely define Bitcoin’s next trend. This is a market snapshot, not financial advice.

#StrategyBTCPurchase #BTCVSGOLD #USJobsData #BTC90kChristmas

Login to explore more contents