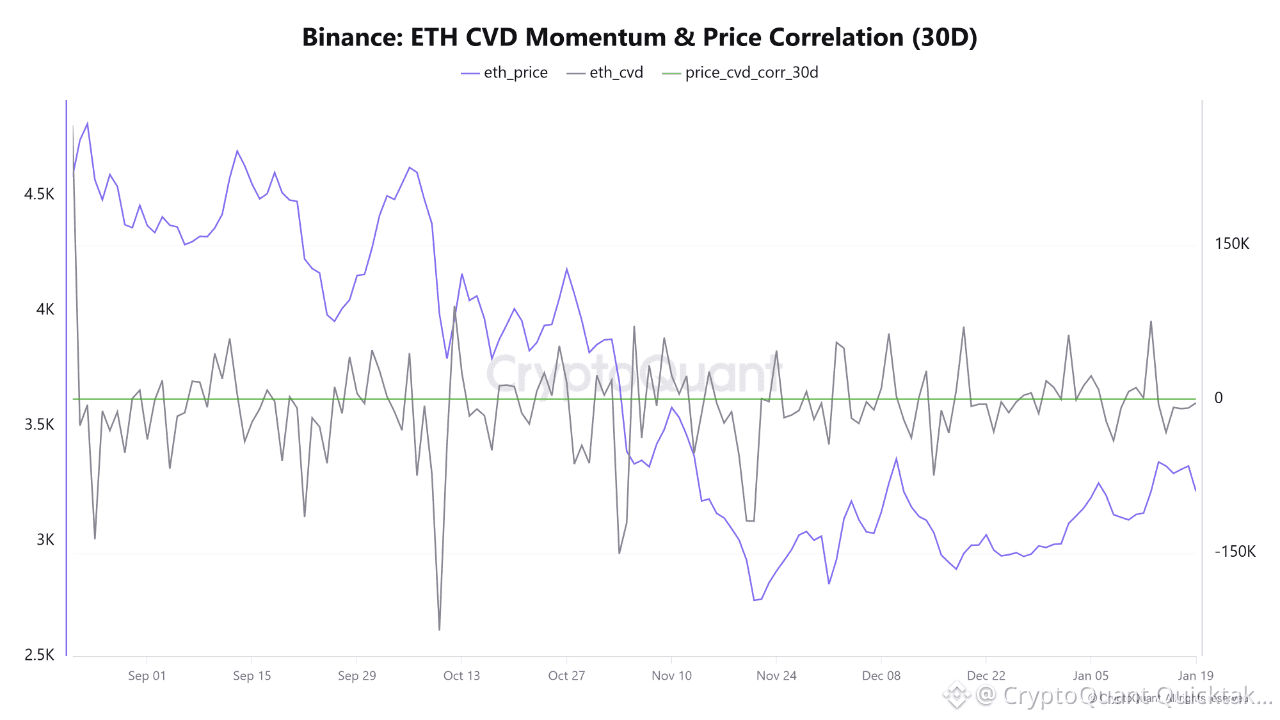

Data for Ethereum on the Binance platform indicates a sensitive phase in the market cycle at the beginning of 2026. The data shows that the price of ETH is currently trading near $3,200, while the Accumulated Order Flow (CVD) indicator is negative at around -3,676, suggesting that selling pressure continues to dominate short-term market movements.

Despite this selling pressure, the 30-day correlation coefficient between price and CVD is around 0.62, a relatively positive level that reflects a moderately strong relationship between price action and volume flows. This means that price movements are still partially supported by liquidity behavior, even though liquidity is currently more inclined to exit than to enter.

The gradual price decline to current levels indicates a clear correction phase following a strong upward surge. During such phases, short-term investors tend to take profits, while larger portfolios begin to reposition and gradually build positions, creating a sideways trend rather than a sharp directional move.

The continued negative CVD suggests that immediate demand has not yet reached a sufficient level to reverse the trend, but the relative price stability above $3,000 reflects the presence of institutional support that is preventing a sharp decline. This discrepancy between weak volume momentum and price stability often precedes periods of quiet consolidation, which form the basis for subsequent upward waves when positive liquidity returns.

Written by Arab Chain