Summary

Global markets are entering 2026 with liquidity returning but with a clear “de-concentration” dynamic: capital is rotating out of crowded, high-valuation U.S. mega-cap tech into cheaper areas such as small caps and emerging markets, particularly China. This is less a broad risk-on chase and more a defensive diversification and mean-reversion trade as investors show reduced tolerance for expensive growth leadership.

In commodities, the rally is being led by industrial metals where “rigid” production demand dominates hedging narratives. Copper and nickel have surged on stockpiling/tariff expectations and supply concerns, while gold and silver are rising but lagging in magnitude—reflecting a market focused on re-industrialization and supply-chain defense rather than pure safe-haven positioning.

Crypto is trending upward but faces a short-term demand deficit and technical resistance, lacking the structural allocation bid seen in physical industrial chains. The medium-term story is institutional and potentially sovereign: Morgan Stanley’s filing for Bitcoin and Solana trusts signals a new phase of Wall Street competition in crypto products, while discussions around national strategic reserves (e.g., U.S. legislative conversations and emerging-market evaluations) could create a new source of inelastic demand in 2026.

Market Overview

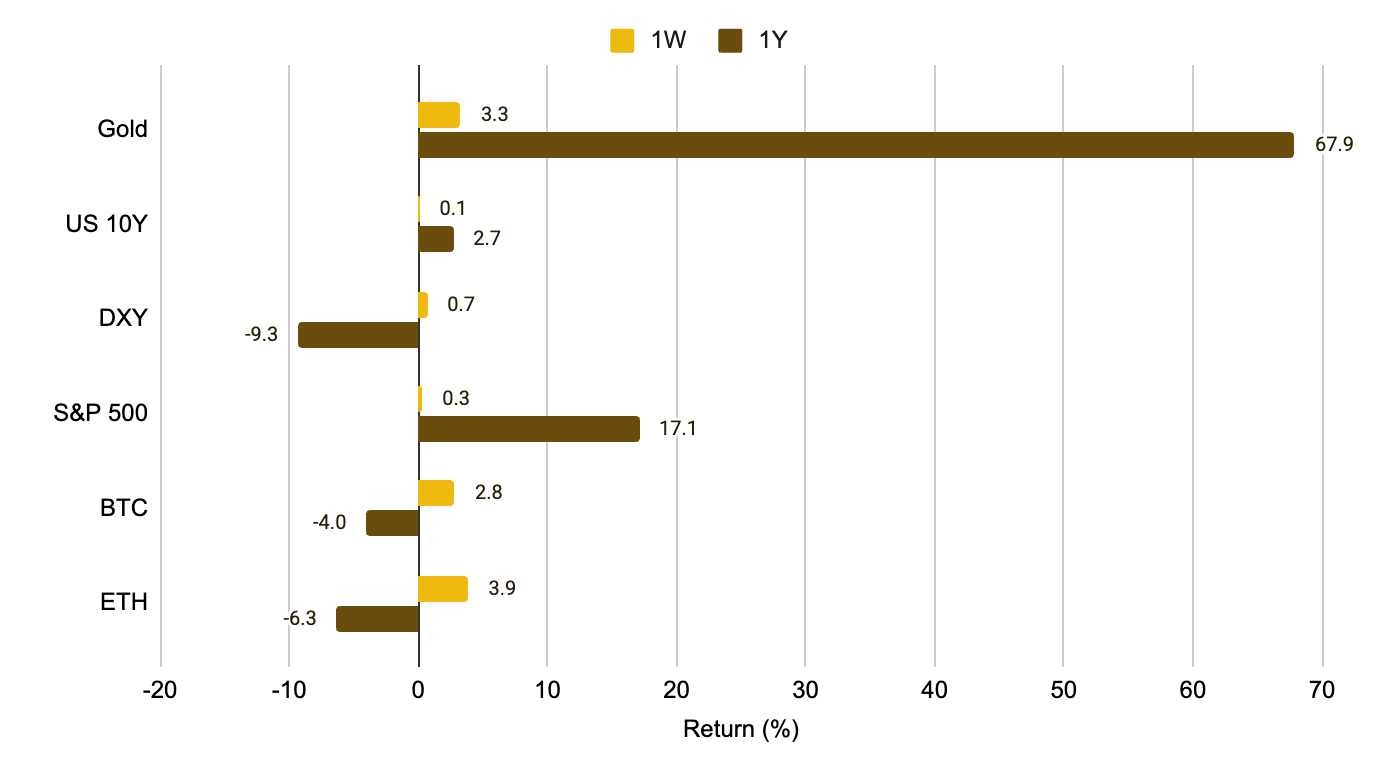

As we enter the new year, liquidity is returning to global markets, which are exhibiting complex characteristics of "de-concentration." Traders are calibrating the Federal Reserve's interest rate path while awaiting labor market data, yet simultaneously executing aggressive position adjustments. Capital is rotating out of the crowded US technology sector into more attractively valued small-caps and emerging markets (specifically China). While the broader equity rally has lifted cryptocurrencies, crypto assets have stalled at key resistance levels due to a lack of "structural demand" comparable to that seen in industrial metals.

Figure 1: Weekly and Yearly Performance – Crypto and Global Market Assets

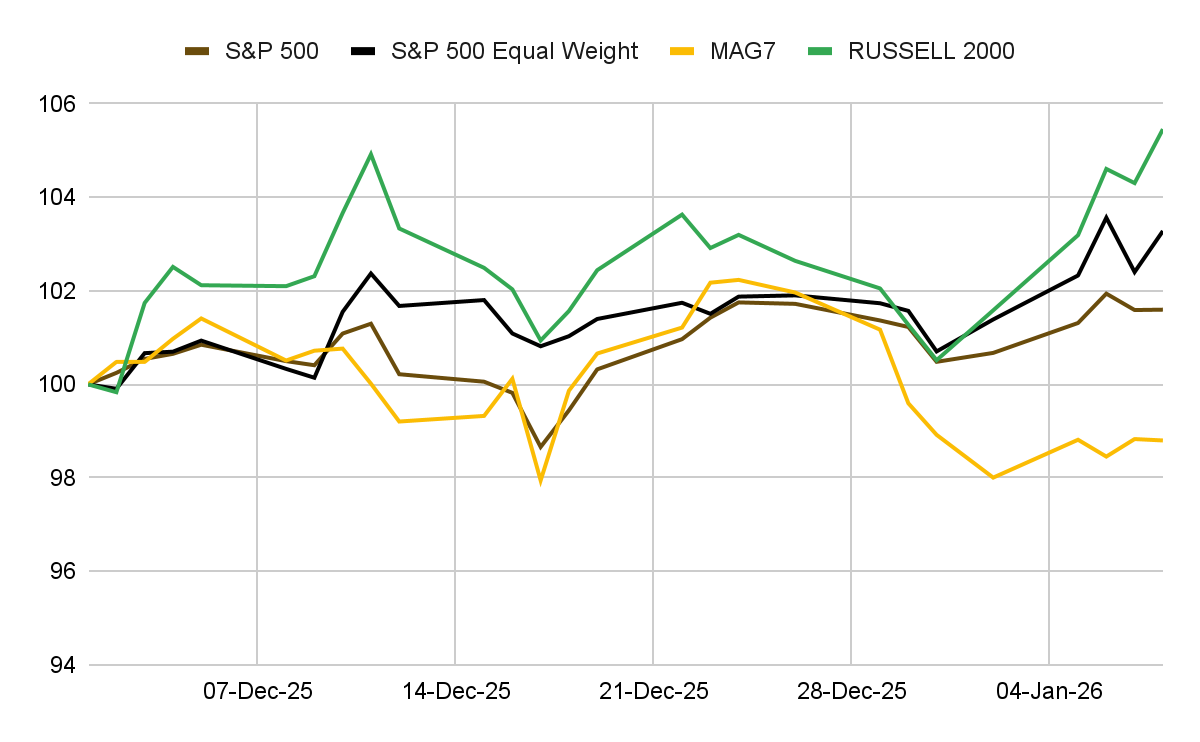

Macro Paradigm Shift: From "Mag7 Dominance" to "Breadth Restoration"

The dominant theme of 2025 was the unilateral bull market of the "Magnificent Seven" (Mag7), driving market concentration to historical extremes—the top ten companies alone contributed 53% of the S&P 500's total return for the year. However, the market landscape in early 2026 has undergone a dramatic reversal. Capital flows are not reflecting a broad "Risk-On" sentiment but rather a defensive diversification.

Performance Divergence: Year-to-date, the Mag7 has declined by 0.7%, while the small-cap Russell 2000 index has rallied 3.3%.

The Rotation Logic: This "expansion of breadth" is fundamentally built on liquidity withdrawing from overcrowded, high-valuation tech stocks.

Valuation Depressions: Capital is flowing into previously deeply undervalued pockets, most notably the Chinese equity market. The Shanghai Composite Index has risen for 13 consecutive trading sessions, marking its longest winning streak since the 1990s. This signals a reduced tolerance for high valuations and a flight to safety via mean reversion.

Figure 2: Market Shift to Low-Valued Since December

Commodities: Industrial Utility Outweighs Hedging Attributes

Beneath the surface of the current "Metals Mania," market asset selection is highly specific: the stronger the rigid production demand, the stronger the asset performance. Current capital flows are heavily skewed toward "hard assets with industrial utility" rather than pure "traditional safe havens."

Tier 1 (Industrial Rigid Demand):

Nickel: Surged over 10% in a single day this week, driven by short covering and supply concerns.

Copper: Propelled by a stockpiling frenzy triggered by tariff expectations, hitting a historic high exceeding $13,387/ton.

Tier 2 (Financial/Hedge):

While Gold and Silver are rising, their magnitude and explosiveness significantly lag behind industrial metals.

The Hierarchy: This "Copper > Silver > Gold" price hierarchy reflects a market trading on the logic of "Re-industrialization" and "Supply Chain Defense," rather than simple currency debasement fears.

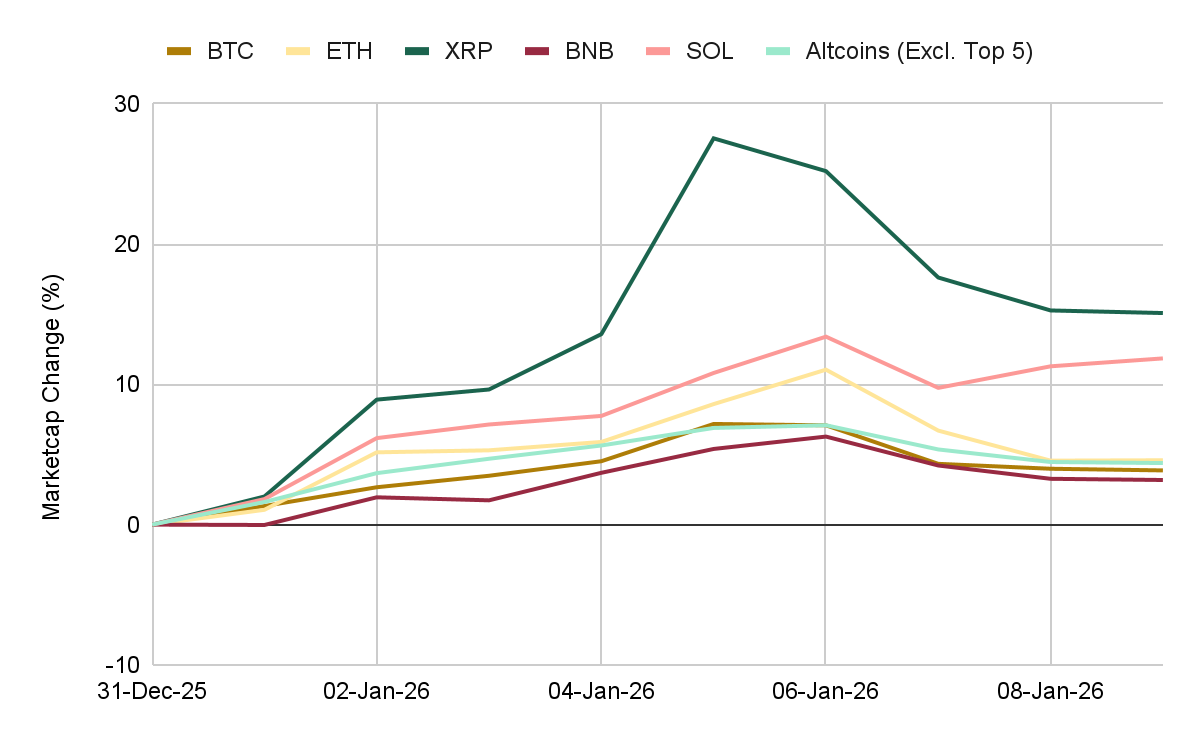

1. Digital Assets

Figure 3: YTD Indexed Performance – Major Digital Assets

Crypto Market: Short-Term Demand Deficit vs. Long-Term Institutional Deep Dive

This macro preference for "real assets" has profoundly impacted the crypto market. While maintaining an overall upward trend, Bitcoin—as "Digital Gold"—has performed relatively modestly compared to the capital-draining "real asset" sector. This is primarily because, at this stage, crypto assets temporarily lack the rigid allocation demand inherent to the physical industrial chains of copper or nickel.

However, a structural pivot is expected in 2026. The definition of "rigid demand" is expanding from "industrial utility" to "National Strategic Reserves." As more nations seek to diversify their sovereign balance sheets, we anticipate sovereign-level buying to become the new source of inelastic demand:

United States: Legislative discussions on establishing a Crypto Strategic Reserve are happening at both federal and state levels and may see substantive progress soon.

Emerging Markets: Nations such as Brazil are actively evaluating the inclusion of Bitcoin in national reserves.

Value Transition: Once this sovereign "accumulation wave" begins, the crypto market will complete its value transition from a "speculative tool" to a "strategic resource."

The Institutional Game: ETF Arms Second Round Race & Index Battles

While prices remain capped by technical resistance, this week's events mark Traditional Finance's (TradFi) entry into the "Second Round" of crypto adoption.

1. Morgan Stanley's "First-Mover" Signal

On January 6, Morgan Stanley officially filed S-1 registration documents with the SEC for the Morgan Stanley Bitcoin Trust and the Morgan Stanley Solana Trust.

This move breaks the reserve of top-tier investment banks acting solely as distribution channels. This "front-running" behavior is expected to force competitors like Goldman Sachs and JPMorgan to follow suit to avoid falling behind in this emerging asset management lane. This implies that 2026 will initiate a new "Crypto ETF Issuance Arms Race" among Wall Street giants, creating expectations for sustained passive buying pressure over time.

2. The MSTR & MSCI "Inclusion Tug-of-War"

The market previously held extreme fears that MicroStrategy (MSTR) would be excluded from the MSCI Index, which would have triggered nearly $10 billion in forced selling across the DATs. This week, MSCI decided to temporarily suspend exclusion. The removal of this "Sword of Damocles" directly drove a 6% after-hours rebound in MSTR.

While the worst-case scenario was avoided, MSCI's stance remains cautious—pausing weight increases and rejecting new members. This "frozen state" effectively locks MSTR out of gaining incremental capital via index expansion. This partially explains the crypto market's muted reaction: the market was pricing in "liquidity expansion" but only received "liquidity preservation."

2. Global Markets

Figure 4: Multi-Asset Performance – Equities, FX, Commodities, Bonds, Volatility

Equities: The market witnessed a distinct rotation. The S&P 500 eked out a modest gain of 0.33%, while the Tech-heavy Nasdaq 100 and NYFANG+ Index underperformed (down -1.45%), driven by profit-taking in AI names.

FX: The U.S. Dollar Index (DXY) advanced 0.73%, supported by data suggesting the labor market is not facing an imminent meltdown. Trade Balance Impact: The U.S. trade deficit narrowed significantly in October due to a drop in imports and a rise in exports, further supporting the greenback. Major currencies softened against the dollar; the EUR/USD pair fell -0.75%, while the USD/JPY pair saw a slight gain of 0.18%.

Commodities: Gold showed resilience, gaining 3.34% as a safe-haven asset, while Silver surged 6.56%, significantly outperforming the broader complex. Copper saw healthy gains of 2.19%, indicating continued demand despite mixed manufacturing signals globally.

Bonds: U.S. Treasury yields pushed higher, and prices remained under pressure following "hot" economic data. Oil recovered from mid-week losses to gain 1.34%, underpinned by geopolitical tensions after the U.S. signaled a hardline stance against Iran.

Volatility: Volatility indices expanded across asset classes ahead of the NFP report.

Macro Outlook

Macro Data: Robust Consumption vs. Cooling Labor

US economic data is exhibiting divergence, adding complexity to the Fed's policy calibration.

Strong Consumption (ISM PMI Beat): The December Services PMI rose to 54.4, with the New Orders Index surging to 57.9. This proves demand in the US economy remains hot with no signs of recession.

Figure 5: ISM Services New Orders Reach Highest Level in 14 Months

Cooling Labor (JOLTS/ADP Miss): Job openings (7.146 million) fell below the number of unemployed persons for the first time, characterizing a "low hiring, low firing" dynamic. This indicates that while corporations remain profitable (Strong Consumption), they have ceased expansion (Cooling Labor)—a classic late-cycle characteristic.

Geo-Macro: LATAM Uncertainty & The Inflation "Windfall"

Governance turmoil in Latin America is reshaping regional asset pricing and generating significant spillover effects. BTC as a "non-sovereign store of value" enjoys both hedge utility and more dovish central banks expectation.

Venezuela Return Expectations: The market is pricing in the possibility of Venezuela returning to the global energy supply chain, putting short-term pressure on international oil prices.

Inflation Model Projection: If oil prices can be suppressed within the $40-$45 range (a price slightly above the U.S. shale breakeven line, avoiding domestic industry collapse), it would deliver a perfect "disinflationary dividend" to the U.S. economy.

Impact: Estimates suggest this would reduce U.S. headline CPI by an additional 0.3%-0.5%, transmitting to a 0.1%-0.2% drop in Core Inflation. For risk assets hoping for a dovish Fed pivot, this is a prime macro tailwind.

The Week Ahead

Friday’s Nonfarm Payrolls (NFP) data will be a turning point for market sentiment, it should answer whether "labor market cracks" have widened into recession signals, with a low probability of missing expectations. This is because high-frequency weekly data shows the job market has improved since November—a trend that may reshape the market’s current dovish monetary policy outlook. The first round of price discovery in the 2026 market will kick off with the January 10th NFP release and be further reinforced by the Consumer Price Index (CPI) data on January 15th.

Figure 6: Key Macro and Crypto Events for the Week of January 09-16, 2025

Other macro and policy stress test over the next three weeks:

Jan 9: The Decisive Moment

Supreme Court Tariff Ruling (SCOTUS): A political event with high uncertainty that will directly impact global trade expectations and the inflation outlook.

Starting Jan 15: Earnings Season Test

The banking sector unveils results first, followed by the heavy-weight tech window, verifying if corporate earnings can support current valuations.

Jan 30: Fiscal Cliff

The U.S. government faces shutdown risks again, serving as another stress test for market risk appetite.

Jan TBA: New Fed Chair

President Trump is expected to announce his nominee for the next Federal Reserve chair in January 2026. While he has recently stated that he has made a decision on the pick, he has not yet publicly revealed the name.