Part 1: Introduction and Scope

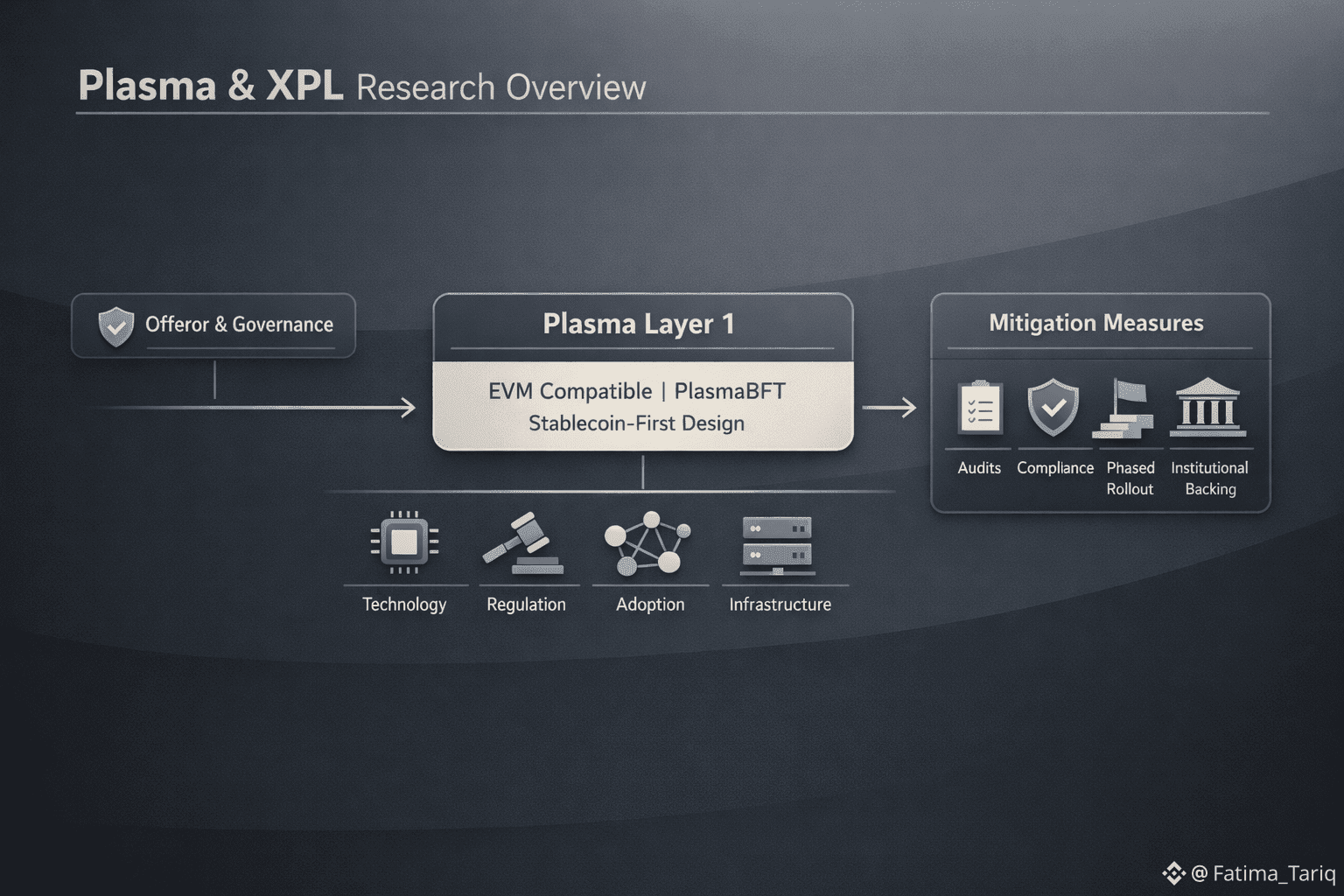

Overview of Plasma and XPL

Plasma is a blockchain network designed with a strong focus on stablecoin settlement and infrastructure efficiency. XPL is the native token that operates exclusively on the Plasma blockchain and is directly affected by the network’s performance, security, governance mechanisms, and adoption.

Because XPL tokens rely entirely on the Plasma blockchain, any technical or operational issue affecting the network may also affect token functionality. This tight dependency makes it especially important to understand implementation‑level risks, consensus design choices, validator dynamics, and external infrastructure dependencies such as bridges and third‑party service providers.

The following sections begin with risks related to project implementation and technical development, before expanding into regulatory, market, ecosystem, and infrastructure considerations.

Section 1: Project Implementation‑Related Risks

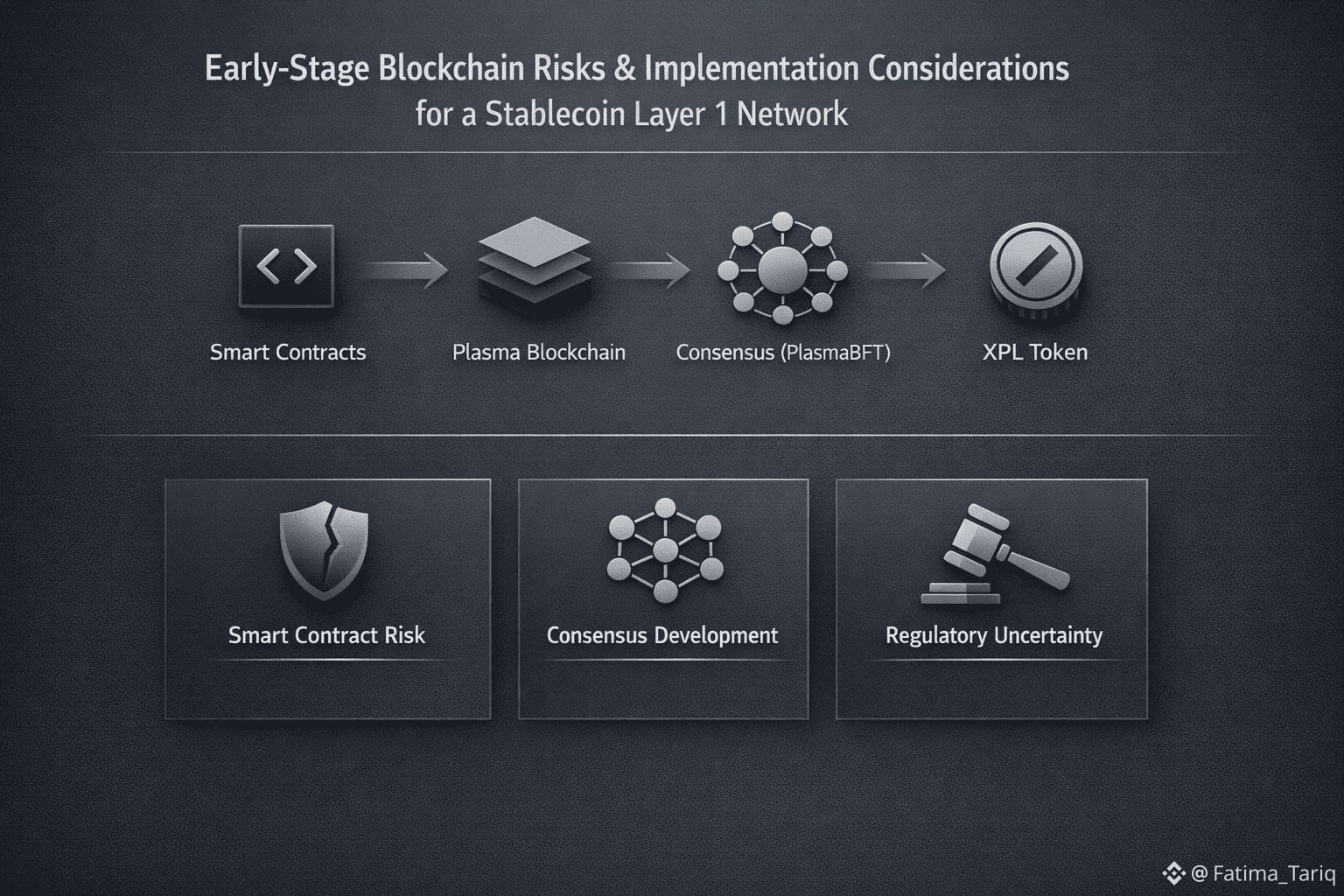

Project implementation risks refer to challenges that may arise during the design, development, testing, and deployment of the Plasma blockchain and its associated token systems. These risks are particularly relevant in early‑stage networks where components are still being refined and validated.

1.1 Technical Development Risks

Smart Contract Issues

Smart contracts play a central role in token distribution, staking mechanisms, and governance functions. Although robust security measures and planned audits are in place, it is not possible to guarantee that all vulnerabilities will be identified before deployment.

Unforeseen bugs or logical errors in smart contracts could lead to disruptions in token operations, unexpected behavior in staking systems, or governance failures. Because smart contracts often operate autonomously once deployed, even minor flaws can have outsized consequences if exploited or triggered under unexpected conditions.

This risk exists even in well‑audited systems and is a known characteristic of blockchain‑based applications.

Blockchain Dependency

XPL tokens operate exclusively on the Plasma blockchain. This creates a direct dependency between the token’s functionality and the underlying network’s performance.

If the Plasma blockchain experiences congestion, downtime, or security breaches, the implementation and usability of XPL tokens may be affected. Potential impacts include delayed transactions, limited access to token functions, or interruptions to staking and governance activities.

This dependency means that improvements or failures at the blockchain level directly influence the token ecosystem.

PlasmaBFT Consensus Risks

The Plasma blockchain uses a custom consensus mechanism known as PlasmaBFT. As this mechanism is still under development and testing, there may be unknown bugs or edge cases that have not yet been identified.

Consensus‑level issues could result in incorrect transaction processing, temporary network disruptions, or security vulnerabilities. Because consensus mechanisms are foundational to blockchain integrity, even rare or theoretical issues must be considered carefully.

Ongoing testing and phased deployment are intended to reduce these risks, but they cannot eliminate them entirely during early stages

Section 2: Regulatory and Compliance Risks

Regulatory and compliance risks arise from the interaction between blockchain systems and evolving legal frameworks across different jurisdictions.

2.1 Regulatory Actions

XPL tokens and the Plasma network may be subject to regulatory inquiries or actions by authorities. Such actions could restrict further development, implementation, or usage of the network or token, depending on the nature and outcome of regulatory review.

Even when a project aims to comply with existing regulations, interpretations can vary, and enforcement priorities may change over time.

2.2 Evolving Laws

Laws related to financial securities, consumer protection, data privacy, and cybersecurity continue to evolve globally. New or amended regulations may introduce additional requirements or limitations that affect how the Plasma network operates.

Compliance adjustments may require changes to operational processes, disclosures, or technical design, potentially increasing complexity or costs.

Part 2: Market Adoption, Ecosystem, and Network‑Level Risks

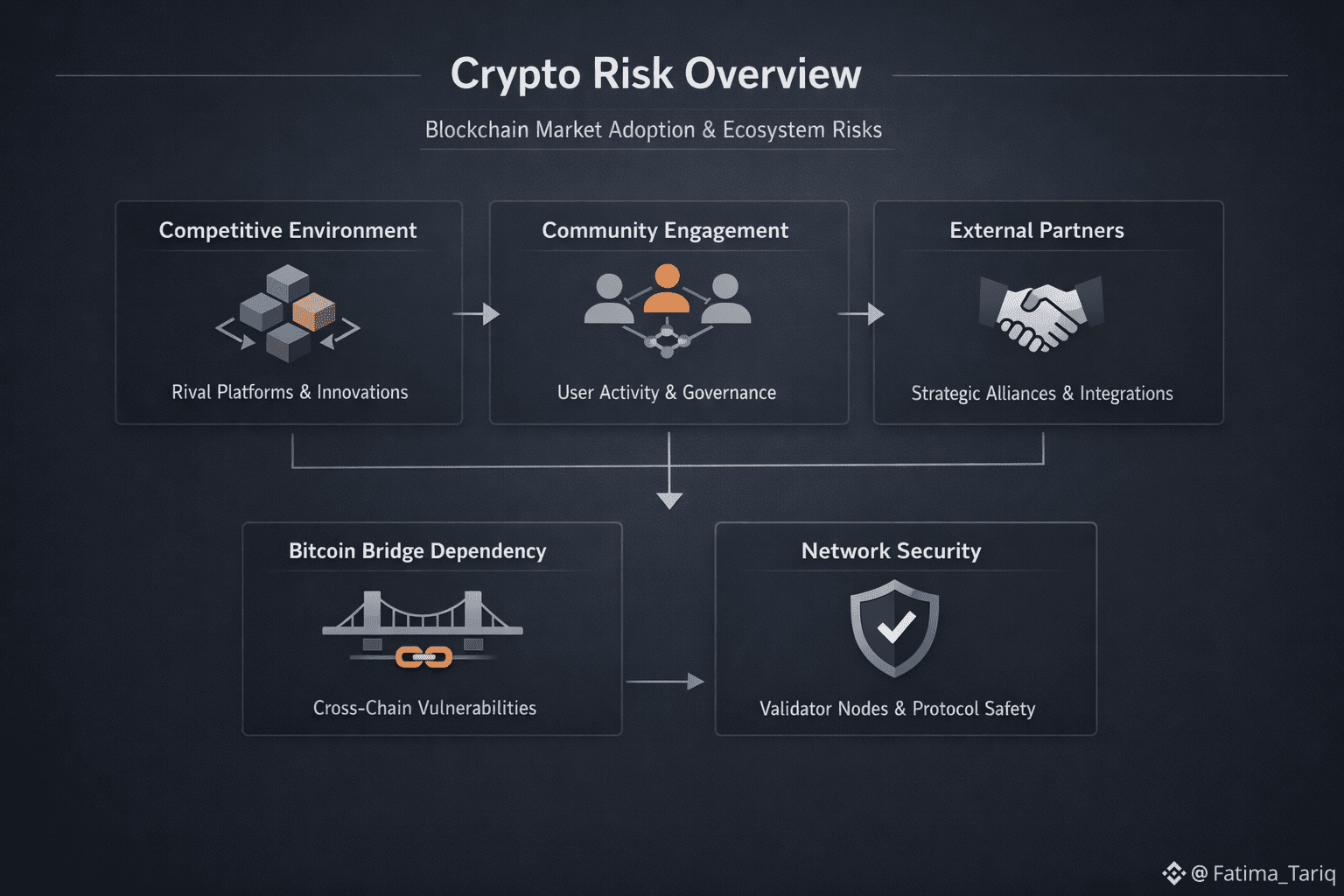

Section 3: Market Adoption Risks

Market adoption risks relate to whether the Plasma blockchain and XPL token achieve meaningful, sustained usage over time. Even well‑designed technology can face challenges if it does not gain sufficient traction within a competitive environment.

3.1 Competitive Environment

The blockchain ecosystem is highly competitive, with many networks offering settlement, scalability, and infrastructure solutions. Plasma operates in an environment where established and emerging blockchains compete for attention from stablecoin issuers, developers, validators, and users.

There is a risk that Plasma may not capture sufficient interest or adoption relative to alternative platforms. If stablecoin issuers or users choose other networks, overall activity on the Plasma blockchain may remain limited. Reduced adoption could affect network utility, validator participation, and long‑term sustainability.

Competition does not only occur at the technical level. Factors such as ecosystem maturity, tooling availability, integration timelines, and external partnerships also influence adoption outcomes.

3.2 Community Engagement Risks

The success of decentralized networks depends heavily on active participation from their communities. For Plasma, this includes validators, developers, infrastructure providers, and users.

If the network fails to attract or sustain an engaged community, growth may slow. Low validator participation could impact network security and liveness, while limited developer activity could reduce innovation and ecosystem expansion.

Community trust is built gradually through consistent performance, transparent communication, and predictable governance. Any breakdown in these areas may weaken engagement over time.

Section 4: Ecosystem Risks

Ecosystem risks arise from the Plasma network’s reliance on external participants and interconnected systems.

4.1 Dependence on External Partners

The project depends on partnerships with stablecoin issuers, infrastructure providers, exchanges, and other third‑party service providers. These external entities play a role in token distribution, network access, liquidity, and broader ecosystem functionality.

Delays, failures, or changes in direction by any of these partners could disrupt implementation plans or slow adoption. Because these entities operate independently, their priorities or operational challenges may not always align with the project’s timeline.

This reliance introduces coordination risk that cannot be fully controlled by the core development team.

4.2 Bitcoin Bridge Dependencies

The Plasma network incorporates a trust‑minimized Bitcoin bridge designed to support cross‑chain functionality and state anchoring. While this bridge adds important capabilities, it also introduces additional technical and operational dependencies.

Any failure, vulnerability, or operational issue within the bridge infrastructure could affect cross‑chain asset transfers or network state verification. Cross‑chain systems are inherently complex, and even well‑designed bridges may present new attack surfaces or failure modes.

Section 5: Technology‑Related Risks

Technology‑related risks focus on the underlying blockchain infrastructure, smart contracts, consensus mechanisms, and supporting systems.

5.1 Blockchain Dependency Risks

XPL tokens rely entirely on the Plasma blockchain network. If the network experiences downtime, congestion, or performance degradation, token transfers, trading, and other on‑chain activities may be disrupted.

As transaction volume grows, the network may also face scalability challenges. Increased usage could lead to slower processing times or higher operational complexity if scaling solutions do not perform as expected.

Under exceptional circumstances, such as network forks or consensus failures, there remains a theoretical risk that transaction finality could be affected. While such events are rare, they are important considerations for any blockchain‑based system.

5.2 Smart Contract Risks

Smart contracts introduce both efficiency and risk. Undiscovered vulnerabilities or exploits may impact token security, staking mechanisms, or governance functions.

In addition, some smart contracts are immutable once deployed. If errors or design flaws are identified after deployment, correcting them may be difficult or impossible without significant changes to system architecture. This immutability increases the importance of thorough testing but does not eliminate residual risk.

Section 6: Network Security Risks

6.1 Consensus‑Level Threats

The Plasma blockchain may face risks related to consensus attacks, including validator collusion, censorship attempts, network partitioning, or Byzantine failures. Such events could impact transaction ordering, network integrity, or system availability.

Consensus security depends on sufficient validator participation and aligned economic incentives. Any imbalance in these areas could weaken network resilience.

6.2 Cybercrime and Infrastructure Attacks

Beyond individual wallet risks, the broader network infrastructure may be exposed to cyberattacks such as distributed denial‑of‑service (DDoS) attacks. These attacks could disrupt network operations, delay transactions, or temporarily limit access.

Infrastructure‑level risks highlight the importance of operational security alongside protocol‑level design.

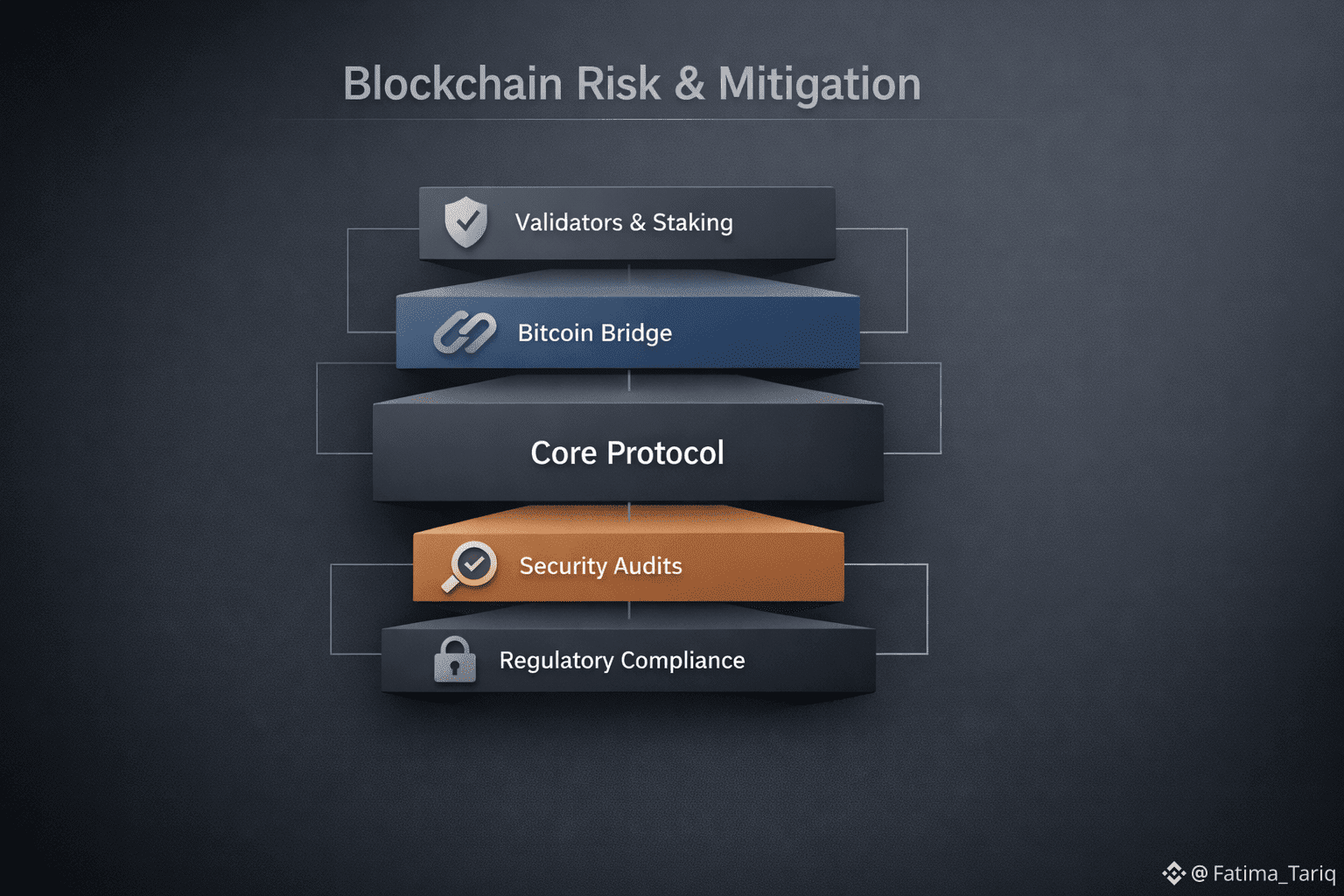

Part 3: Validator, Bridge, Software, and Infrastructure Risks — and Mitigation Measures

Section 7: Validator and Staking Risks

Validator participation and staking mechanisms are critical to the security and stability of the Plasma blockchain. These elements introduce specific risks that may affect network performance and trust

7.1 Validator Participation Risk

PlasmaBFT consensus depends on sufficient and active validator participation. If the number of validators is too low, or if participation declines over time, network security and liveness may be weakened.

Insufficient validator diversity can increase the risk of centralization, making the network more vulnerable to operational disruptions or coordinated behavior.

7.2 Slashing Risks

Validators may face slashing penalties if they engage in misbehavior, violate protocol rules, or fail to meet performance requirements. Slashing can result in the partial or total loss of staked XPL tokens.

While slashing is designed to protect network integrity, it introduces financial risk for validators and may discourage participation if perceived as unpredictable or overly punitive.

7.3 Economic Attack Vectors

Economic attack vectors may arise if a single entity or coordinated group acquires a large concentration of XPL tokens. Such concentration could potentially influence validator behavior or compromise consensus dynamics.

Although economic incentives are designed to align participant behavior, these risks cannot be fully eliminated in open blockchain systems.

Section 8: Bitcoin Bridge Risks

8.1 Cross‑Chain Security Risks

The trust‑minimized Bitcoin bridge introduces additional security considerations. Cross‑chain systems inherently increase complexity, creating new potential attack surfaces.

Any vulnerability in bridge logic, verification mechanisms, or operational processes could affect cross‑chain asset transfers or state anchoring.

8.2 Bridge Dependency Risk

Plasma relies on the proper functioning of the Bitcoin bridge for certain cross‑chain operations. Failures, delays, or disruptions in bridge infrastructure could impact network functionality or user experience.

Because bridge components may evolve independently, maintaining long‑term reliability requires ongoing monitoring and maintenance.

Section 9: Software and Infrastructure Risk

9.1 Core Code Vulnerabilities

Despite extensive testing, undiscovered bugs in the Plasma blockchain’s core protocol may exist. Such bugs could lead to network instability, security vulnerabilities, or unexpected behavior.

Early‑stage blockchain software carries inherent technical uncertainty, particularly during periods of rapid development.

9.2 Technological Disruption Risks

Emerging technologies, including advances in computing or cryptography, could potentially weaken existing blockchain security assumptions. For example, future developments in quantum computing may challenge current encryption standards.

While these risks are speculative, they form part of the long‑term risk landscape.

9.3 Dependency on Underlying Technology

The Plasma network depends on internet connectivity, computing hardware, and cryptographic algorithms. Failures or disruptions in any of these foundational components could affect network availability and performance.

Section 10: Mitigation Measures

10.1 Technical and Security Mitigation

Planned mitigation measures include comprehensive security audits by Spearbit and Zellic to identify and address vulnerabilities before mainnet launch.

The project builds on proven components such as the Reth execution engine and consensus principles inspired by Fast HotStuff. A phased rollout approach, beginning with Mainnet Beta, allows for testing and refinement before full feature deployment.

10.2 Regulatory and Compliance Mitigation

A proactive compliance approach is reflected in alignment with the MiCA framework through detailed white paper disclosures and regulatory notification processes.

The offering process includes safeguarding of crypto‑assets through BitGo Europe GmbH as an authorized CASP. The legal structure is established under British Virgin Islands law, with defined jursdiction for dispute resolution.

10.3 Operational and Governance Mitigation

Mitigation efforts include an experienced development team with backgrounds in technology and finance, institutional backing from Framework Ventures, Bitfinex/USDT0, and Founders Fund, and strategic partnerships within the stablecoin ecosystem.

10.4 Market and Adoption Mitigation

Plasma’s purpose‑built design focuses on stablecoin use cases, addressing a specific market need. Industry relationships and multi‑jurisdictional distribution aim to reduce concentration risk and support broader adoption.

Section 11: Limitations of Mitigation

No mitigation strategy can fully eliminate risks inherent in early‑stage blockchain technology. Market volatility, regulatory evolution, and adoption uncertainty remain largely outside issuer control.

Network success ultimately depends on real‑world usage, validator participation, and sustained ecosystem engagement.

Perfect — here is the Final Part (Part 4), written clearly, fully aligned with your provided material, Binance‑safe, neutral in tone, and easy to understand. This completes the full structure.

Part 4: Information About the Offeror and Final Conclusion

Section 12: Information About the Offeror

The Plasma project is developed and supported by an early‑stage issuing entity structured to support the long‑term development, operation, and governance of the Plasma blockchain network and the XPL token. While the entity is well‑funded and institutionally backed, it does not yet have long‑term audited financial records due to its recent establishment.

The project operates under a defined legal framework, with incorporation under British Virgin Islands law. This structure provides jurisdictional clarity for governance, contractual relationships, and dispute resolution. The offering process incorporates safeguards aligned with applicable regulatory standards, including the use of BitGo Europe GmbH as an authorized Crypto‑Asset Service Provider (CASP) for safeguarding crypto‑assets.

The development team brings experience from technology, blockchain, and financial sectors. Institutional backing from Framework Ventures, Bitfinex/USDT0, and Founders Fund provides strategic support, industry access, and operational resources. These relationships contribute to ecosystem credibility but do not eliminate operational or market risks.

The Plasma blockchain is positioned as a Layer 1 network purpose‑built for stablecoin settlement. Its design combines full EVM compatibility, sub‑second finality through PlasmaBFT, and stablecoin‑centric features such as gasless USDT transfers and stablecoin‑first gas models. Bitcoin‑anchored security is designed to enhance neutrality and censorship resistance.

Section 13: Balanced Risk Perspective

The risks outlined across technical development, regulatory compliance, market adoption, ecosystem dependencies, and infrastructure security are inherent to early‑stage blockchain networks. Plasma is no exception. While mitigation measures reduce exposure, they do not fully remove uncertainty.

Key risks remain tied to technology maturity, validator participation, regulatory evolution, competitive pressures, and adoption dynamics. External factors such as market volatility, legal changes, and broader macroeconomic conditions may influence outcomes beyond the issuer’s control.

At the same time, the project’s focus on a specific and clearly defined use case — stablecoin settlement — reflects an attempt to address real infrastructure needs rather than broad, undefined ambitions. Purpose‑built design can reduce complexity, but execution and adoption ultimately determine success.

Section 14: Mitigation Limitations and Reality Check

Mitigation strategies, including audits, phased rollouts, regulatory alignment, and institutional partnerships, provide meaningful safeguards. However, no framework can guarantee network performance, security, or adoption.

Early‑stage blockchain systems evolve in live environments where unexpected challenges may arise. Market behavior, user demand, and regulatory interpretation continue to shape outcomes long after initial design decisions are made.

Participants should understand that XPL tokens do not represent guaranteed returns, future performance assurances, or risk‑free exposure. Network participation involves technological, economic, and regulatory considerations that require informed decision‑making.

Final Conclusion

Plasma represents a focused attempt to build stablecoin‑first blockchain infrastructure with an emphasis on settlement efficiency, neutrality, and institutional readiness. Its architecture reflects lessons learned from earlier blockchain systems, while its risks reflect the realities of innovation in an evolving regulatory and technological landscape.

Success will depend on execution, transparency, validator participation, and real‑world adoption rather than promises or speculation. For participants, understanding both the opportunities and the risks is essential.

Measured progress, clear communication, and responsible governance will play a defining role in shaping trust and long‑term sustainability.