XRP to $1,000,000?

Sounds ridiculous?

Only if you’re pricing XRP in today’s dying dollars.

But when you zoom out — past the ETFs, the lawsuits, and the memes — and model a world where real-world assets (RWAs) are fully tokenized…

$XRP doesn’t just go up.

It gets repriced. MASSIVELY.

Let’s break it down. Here’s the Case They Don’t Want You to See 👇🧵⚔️

2/🧵

Real World Assets are the key to the new global financial operating system.

• $300T+ in real estate

• $100T+ in government bonds

• $20T+ in corporate debt

• Commodities, carbon credits, payroll, treasuries…

All being tokenized.

All needing compliant rails.

All needing bridging liquidity across jurisdictions and chains.

That bridge?

XRP.

Because XRP isn’t a coin.

It’s a cross-asset, cross-border, FX-agnostic liquidity layer — programmable and neutral.

3/🧵

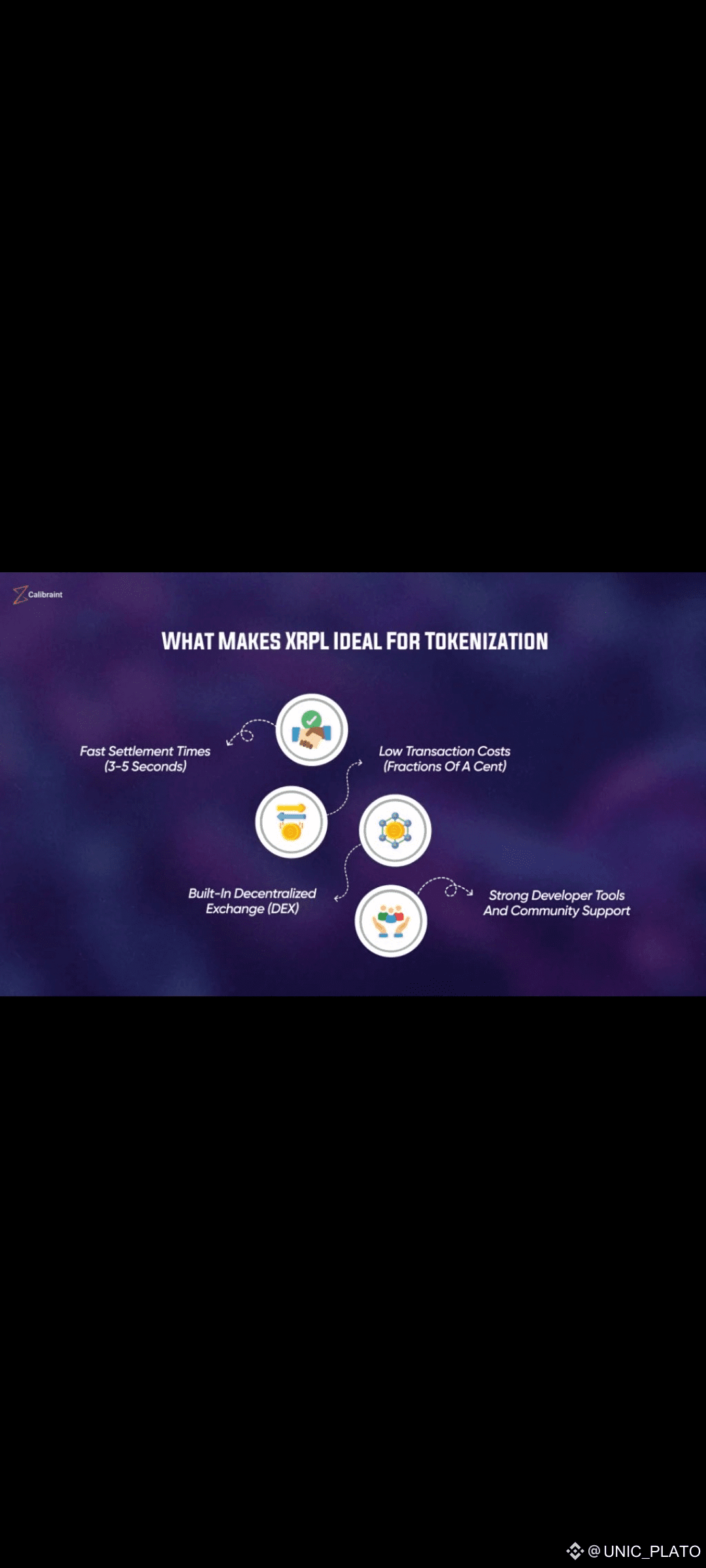

Tokenization unlocks trillions — but settlement must be instant and final.

You can’t tokenize $40M in real estate and settle it with 10-minute block confirmations.

Banks, hedge funds, and sovereign wealth won’t tolerate failed trades, slippage, or downtime.

They want:

• Finality

• Liquidity

• Neutrality

• Compliance

That eliminates Bitcoin.

That bypasses ETH congestion.

It leaves XRPL — with XRP as the toll asset.

Every bond. Every title. Every tokenized instrument.

Paid, swapped, or bridged through

4/🧵

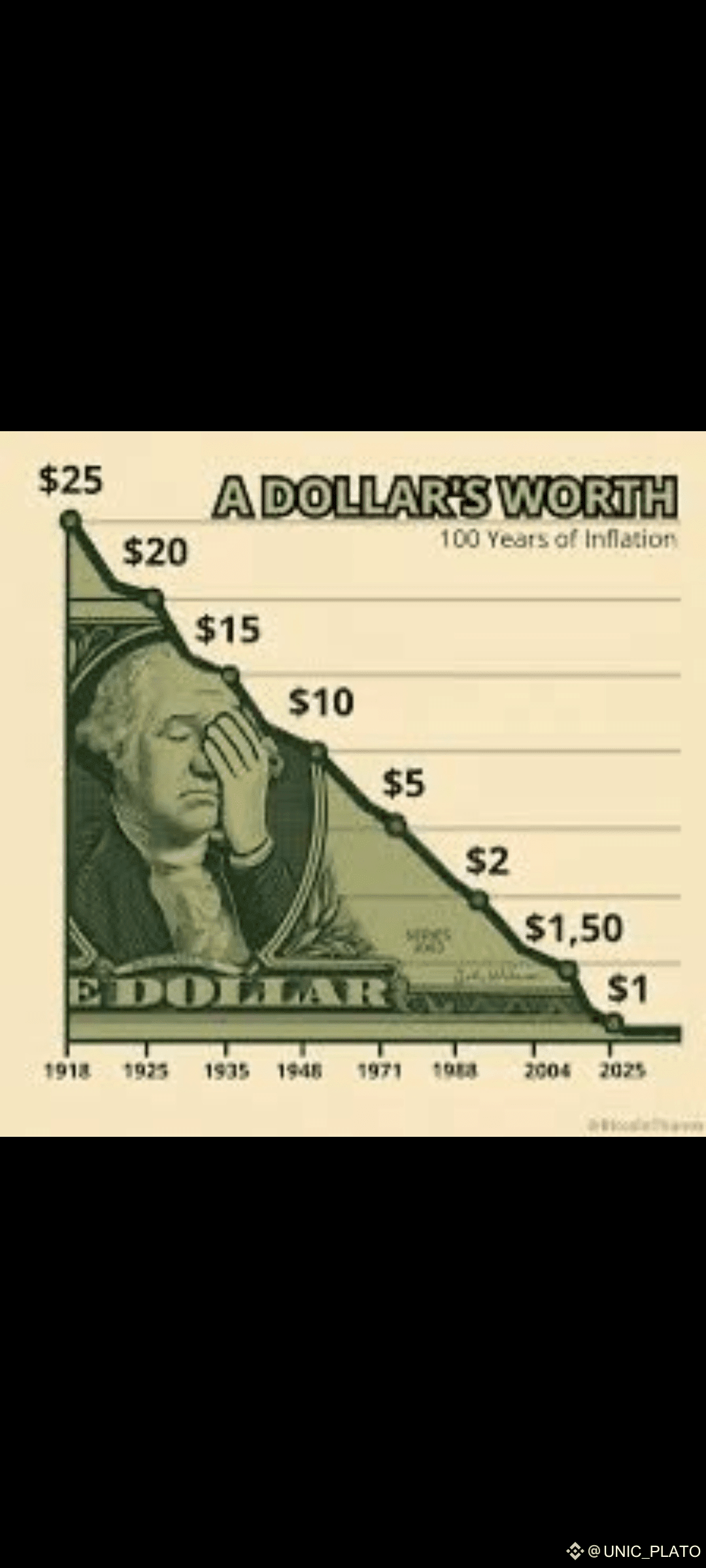

Now factor in inflation and dollar decay.

Since 1971, the dollar has lost 98% of its value.

We are entering a period of accelerated monetary debasement, sovereign defaults, and synthetic liquidity.

As $RLUSD, EURØP, and other regulated stablecoins rise — they’ll still be anchored to decaying fiat.

But XRP?

It will be the neutral bridge between assets, not fiat.

And when institutions are transacting in real value, not fake paper…

XRP will be measured in relation to tokenized assets, not collapsing currencies.

5/🧵

Let’s do the math:

Say $500T in real-world assets are tokenized over the next decade.

Even if XRP captured just 0.5% of global settlement volume through its rails…

That’s $2.5T in daily volume potential.

To settle that at scale with low volatility, XRP would need to carry massive per-token value to avoid moving markets.

Low supply.

High throughput.

Global bridge demand.

That’s not a $5 coin.

That’s a $1M asset with mandatory utility.

6/🧵

This isn’t a price prediction. It’s a reset projection.

When value flows out of fiat and into tokenized reality…

There will be a scramble for neutral collateral and frictionless liquidity rails.

XRP isn’t competing with coins.

It’s bidding to become the heartbeat of global digital settlement.

And in that future, $1M per token isn’t hype.

It’s simply function meeting velocity at planetary scale.

7/🧵

Final thought: They’re not trying to pump XRP.

They’re trying to bury it until the reset is done.

Because if you saw what it’s really built for —

You’d never sell.

📡 Want to decode the financial endgame before they flip the switch?