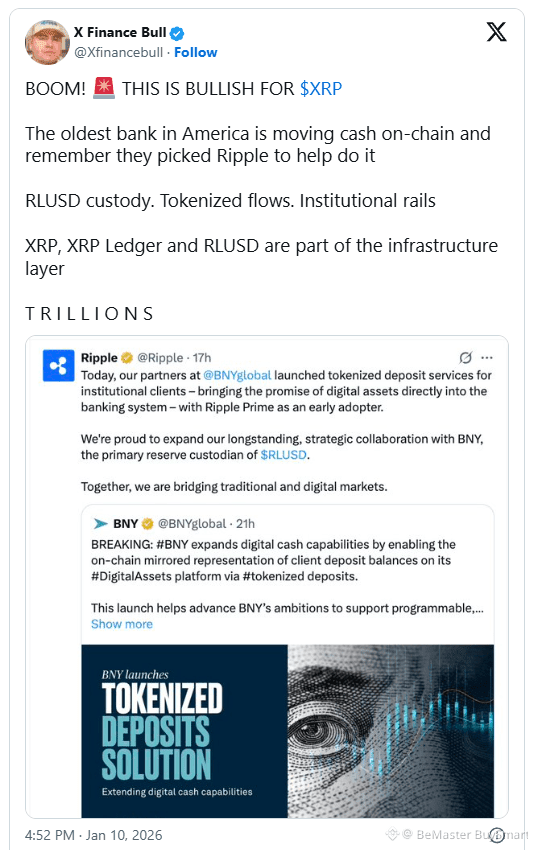

$XRP Crypto commentator X Finance Bull (@Xfinancebull) published a bullish post on XRP following a new announcement from Ripple and BNY Mellon. The post focused on institutional adoption, on-chain cash movement, and Ripple’s expanding role inside regulated financial systems.

X Finance Bull presented the development as a structural shift. He linked the announcement directly to XRP, the XRP Ledger, and RLUSD as core infrastructure components. Large institutions are now moving cash on-chain, and XRP is part of the process.

👉BNY Mellon Pushes Deposits On-Chain

Ripple confirmed that its partner BNY Mellon launched tokenized deposit services for institutional clients. Ripple added that the service brings “the promise of digital assets directly into the banking system,” with Ripple Prime acting as an early adopter.

BNY Mellon described the product as an on-chain mirrored representation of client deposit balances on its Digital Assets platform. The bank positioned the launch as an expansion of its digital cash capabilities. The announcement focused on programmability and institutional use cases.

Ripple also confirmed that BNY Mellon serves as the primary reserve custodian of RLUSD. That detail tied custody, compliance, and on-chain settlement into the same system. Ripple described the collaboration as an effort to bridge traditional and digital markets.

👉Ripple’s Role in Institutional Rails

X Finance Bull connected the announcement directly to the XRP infrastructure. The post stated, “The oldest bank in America is moving cash on-chain, and remember, they picked Ripple to help do it.” He emphasized custody, tokenized flows, and institutional rails as the key takeaway.

He noted that XRP, the XRP Ledger, and RLUSD are part of the infrastructure layer, placing the asset and its system within usable payment and settlement plumbing rather than another speculative system. It aligned with Ripple’s long-term strategy of targeting banks, asset managers, and large financial institutions.

Ripple Prime’s role as an early adopter added another layer. The service targets institutional execution and custody. Its involvement placed Ripple’s enterprise stack inside the tokenized deposit rollout from day one.

👉Why XRP Holders Are Paying Attention

X Finance Bull closed the post with a single word. “TRILLIONS.” The emphasis reflected the scale of bank deposits and institutional cash flows. Tokenized deposits differ from stablecoins. They represent bank liabilities on-chain.

For XRP holders, the significance lies in the access it provides. Ripple already operates within regulated banking environments, XRP already supports tokenization, and RLUSD already integrates with enterprise custody. The announcement showcased those components operating alongside one of the largest custodial banks in the world, bringing trillions into the crypto ecosystem.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.