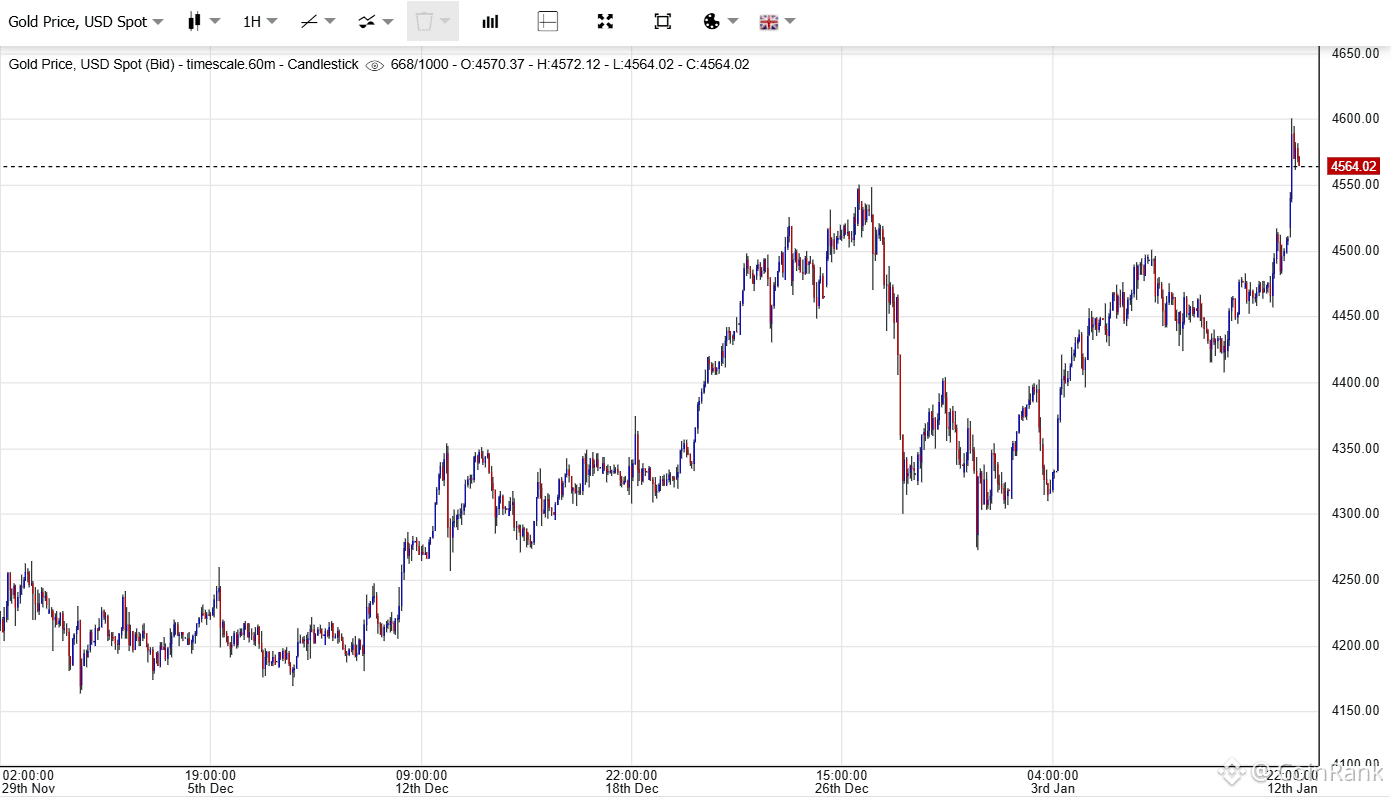

Spot gold reached a record high above $4,600 per ounce, benefiting first from heightened geopolitical and policy uncertainty, while Bitcoin rebounded but underperformed due to ETF and derivatives-driven market structure.

Bitcoin’s price action remains constrained by options hedging and liquidity conditions, even as its long-term store-of-value narrative continues to strengthen alongside gold.

The durability of the “dual bull” scenario depends less on headlines and more on whether policy risk persists, hedging pressure eases, and broader liquidity conditions begin to improve.

Gold’s record breakout above $4,600 and Bitcoin’s lagging rebound reflect a two-speed “store-of-value” rally driven by rising policy risk, geopolitical tension, and shifting market microstructure.

WHAT JUST HAPPENED: GOLD BROKE ABOVE $4,600 AS BITCOIN RECOVERED TOWARD $92K

Gold pushed into uncharted territory on Jan. 12, 2026, with Reuters reporting spot gold briefly hitting a record high of $4,600.33/oz during the session, a move framed around heightened geopolitical/economic uncertainty and rising expectations of U.S. rate cuts.

At roughly the same time, Bitcoin traded back toward the low-$90,000s, with BTC changing hands around $91,645 (intraday range roughly $90,225–$92,369).

The headline takeaway is not merely “both are up,” but that the market is increasingly treating gold as the immediate safe-haven bid while Bitcoin trades as a “high-beta store-of-value” that needs liquidity conditions and derivatives positioning to cooperate before it can keep pace.

WHY GOLD IS LEADING: SAFE-HAVEN + POLICY UNCERTAINTAINTY ARE HITTING AT ONCE

Gold’s breakout is being reinforced by a rare combination of risk drivers that tend to amplify demand for non-sovereign stores of value: geopolitical uncertainty, macro policy volatility, and concerns about the stability of the policy framework itself. Reuters reported that Fed Chair Jerome Powell said the administration had threatened him with a criminal indictment, a development that fueled market unease around central-bank independence.

Separately, ABC News reported that federal prosecutors had launched a criminal investigation into Powell, which he confirmed in a statement, underscoring why “policy risk” has entered the price of safe havens.

When this kind of institutional uncertainty rises, gold typically benefits first because it is a deeply liquid, globally recognized hedge that can absorb large “risk-off” flows immediately—often before higher-volatility alternatives (including BTC) fully reprice.

WHY BITCOIN IS LAGGING: IT’S STILL TRADING THROUGH MARKET MICROSTRUCTURE

Bitcoin’s rebound matters, but the reason it can underperform gold in “risk-off” bursts is structural: BTC is increasingly mediated by ETF flows and derivatives hedging, and those mechanics can pin or dampen price movement even when the macro narrative is bullish.

A clear example is the “gamma” dynamics around major options strikes. CoinDesk described how dealer hedging tied to large options positioning can keep BTC constrained in tight ranges, effectively turning price action into a mechanical tug-of-war until positioning decays or is rolled.

That does not mean BTC lacks demand; it means demand often needs a catalyst that overwhelms hedging flow (or a positioning reset) before sustained trend expansion becomes easier.

THE LINK BETWEEN GOLD AND BTC IS REAL—BUT IT’S NOT A 1:1 TRADE

The “dual bull” story works best when both assets are responding to the same underlying driver—most commonly declining confidence in fiat purchasing power or a loosening liquidity regime. In those regimes, gold tends to move first, while Bitcoin often follows with a lag once the market shifts from pure safety to a broader “alternative monetary asset” basket.

However, short windows can diverge sharply: gold can rally on immediate fear, while BTC may need either (a) stabilizing risk sentiment, (b) ETF inflows resuming, or (c) derivatives positioning flipping from suppressing volatility to amplifying it.

HOW FAR CAN IT GO: THREE CONDITIONS THAT DETERMINE DURATION, NOT HEADLINES

Rather than forecasting a price target, the cleaner way to assess endurance is to watch three conditions that historically decide whether “dual bull” becomes a multi-week trend or a short squeeze-and-fade:

POLICY RISK STAYS ELEVATED

If central-bank credibility and policy predictability remain questioned, gold’s bid can persist. Reuters’ reporting around the Powell indictment threat is precisely the kind of catalyst that can keep this channel active beyond a single session.

BITCOIN VOLATILITY IS RELEASED FROM HEDGING BANDS

When dealer hedging dominates, BTC can look “stuck” even as macro tailwinds build. CoinDesk’s options framing is a practical roadmap here: the moment positioning resets, BTC’s response can be abrupt.

LIQUIDITY CONDITIONS STOP GETTING TIGHTER

Gold can rally in tightening conditions; BTC is more sensitive to the marginal buyer’s cost of capital. If the market begins pricing easier conditions (or simply less uncertainty), BTC tends to regain relative strength.

THE PRACTICAL INSIGHT: THIS IS A TWO-SPEED “STORE-OF-VALUE” RALLY

The most useful way to read this episode is as a two-speed store-of-value rally:

Gold is acting as the immediate hedge against policy and geopolitical uncertainty (fast response, lower volatility).

Bitcoin is participating, but its path is shaped by ETF/derivatives plumbing—meaning it can rebound strongly, yet still lag gold unless positioning and liquidity line up.

If those conditions align, the “dual bull” can evolve from a headline coincidence into a durable macro trade; if they do not, the most likely outcome is gold holding strength while BTC chops in a mechanically constrained band.

Read More:

Why Gold Is Surging: Central Banks, Sanctions, and Trust-1

Gold Front-Runs QE as Bitcoin Waits for Liquidity-2

〈Gold Hits a Record High as Bitcoin Rebounds: How Long Can the “Dual Bull” Last?〉這篇文章最早發佈於《CoinRank》。