Altcoins Are Rallying Alongside Bitcoin — Here’s Why This Cycle Is Different:

For years, the cryptocurrency market followed a predictable, almost rhythmic cycle. Bitcoin would take the lead, surging to new heights and capturing the lion’s share of global liquidity. During this "Bitcoin dominance" phase, altcoins cryptocurrencies other than Bitcoin typically remained stagnant or even lost value as traders sold their holdings to chase Bitcoin’s gains. Only after Bitcoin settled into a sideways consolidation would capital "rotate" back into the broader market, igniting the legendary "Altcoin Season."

However, as we move through January 2026, this historical playbook has been discarded. We are currently witnessing a phenomenon that was once considered a market anomaly: Bitcoin and major altcoins are rallying in lockstep. On January 5, 2026, Bitcoin briefly surpassed $93,000, a nearly 7% gain since the start of the year. Simultaneously, Ethereum climbed past $3,200, while Solana, XRP, and AI-driven tokens like Bittensor () saw double-digit gains. This is not a sequence of events; it is a synchronized market expansion.

Here is a deep dive into why this cycle is structurally different and why the "wait-your-turn" era of crypto investing may be over.

1. The End of the Liquidity Bottleneck: In previous cycles (2017 and 2021), the crypto market suffered from what economists call a "liquidity bottleneck." There was a limited pool of capital mostly from retail "early adopters" that had to be moved around like a zero-sum game. To buy an altcoin, an investor almost always had to sell their Bitcoin first.

Institutional "Basket" Investing: In 2026, the bottleneck has been replaced by a "superhighway" of institutional capital. The approval and massive success of Spot ETFs for both Bitcoin and Ethereum have fundamentally changed how money enters the system. The Multi-Asset Entry: Large wealth managers, such as Morgan Stanley and Fidelity, are no longer just offering "Bitcoin." They are filing for and managing diversified digital asset ETFs. Parallel Inflows: When a pension fund or a sovereign wealth fund allocates $500 million to crypto today, they aren't waiting for “rotation." They are buying weighted baskets that includes, and often or simultaneously. This fresh, external capital allows both Bitcoin and altcoins to rise together because the buying pressure is no longer coming from the same finite pool of retail "degens."

2. Market Maturity and the "Blue-Chip" Classification: One of the primary reasons altcoins used to lag was a lack of investor confidence. Historically, altcoins were viewed as high-risk speculative bets that only made sense once the "safe" play (Bitcoin) had already been delivered. Proven Utility and Lindy Effect: By 2026, the market has undergone a "survival of the fittest" regime. Major altcoins are no longer seen as experimental. Ethereum has cemented itself as the world’s settlement layer for tokenized real-world assets (RWAs). Solana has proven its resilience as the primary hub for high-speed retail decentralized finance (DeFi) and DePIN (Decentralized Physical Infrastructure) projects. Chainlink has become the indispensable "oracle" infrastructure for global finance. Because these assets now have established ecosystems and real-world revenue models, they have earned a "blue-chip" status. Investors now hold them with “long-term" conviction like how they hold Bitcoin. This reduces the panic-driven correl

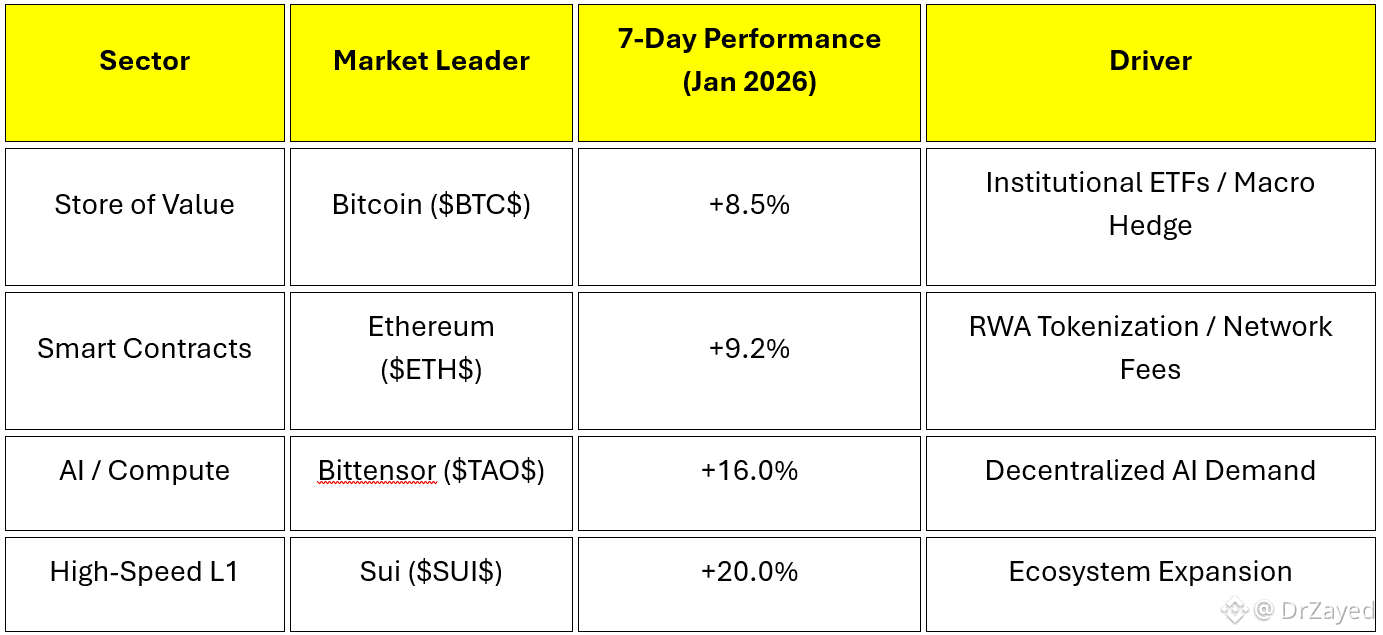

3. The Rise of "Dispersion" Over "Euphoria": In past cycles, a broad altcoin rally was often a sign of a "blow-off top" the final, frantic stage of a bubble where everything (including "worthless" coins) went up. In January 2026, the rally is much more selective, a phenomenon analysts call Market Dispersion. Quality Over Quantity: While Bitcoin is rallying, we aren't seeing every token on the market go up. Instead, the gains are concentrated on utility-driven protocols:

This simultaneous movement suggests broad-based participation rather than a speculative frenzy. Capital is flowing into these assets because of their specific fundamentals, not just because Bitcoin is moving.

4. Regulatory Clarity as a Catalyst: For years, the "Sword of Damocles" hanging over altcoins was regulatory uncertainty in the United States. Many tokens were labeled "unregistered securities," causing institutional investors to avoid them. A New Era of Legitimacy: By early 2026, the landscape has shifted significantly. Following the Genius Act and broader bipartisan market structure legislation, the rules of the road for digital assets are clearer than ever. Regulatory De-risking: With the SEC adopting a more innovative-friendly stance and clear guidelines for stablecoins, the "existential risk" for large-cap altcoins has vanished. Bank Integration: Major banks like JPMorgan and Goldman Sachs are now using on-chain deposit tokens and tokenization platforms. When the legal risk is removed, altcoins stop trading like "shady experiments" and start trading like "technology stocks." This allows them to participate in "risk-on" market environments alongside Bitcoin and the S&P 500.

5. The Role of Stablecoins and 24/7 Liquidity: Stablecoins have evolved into the "connective tissue" of the 2026 crypto market. With a total market cap approaching $1.2 trillion by some forecasts, stablecoins like and provide instant, 24/7 liquidity across all asset classes. In the past, moving money from a Bitcoin trade into an altcoin could take days due to banking delays or illiquid exchange pairs. Today, the "on-chain" economy moves at the speed of light. If an institution sees a value opportunity in an altcoin while Bitcoin is rallying, they can execute that trade instantly using stablecoin reserves. This creates a much more efficient market where price discoveries happen in parallel rather than in sequence.

What This Means for Modern Portfolio Construction: The death of the "sequential cycle" means that the traditional "wait-for-altseason" strategy is officially obsolete. Investors who stay on the sidelines of the altcoin market are waiting for Bitcoin to "finish" its run risk missing out on the primary growth phase of the cycle. The New Strategy for 2026: Embrace Simultaneity: Build a diversified portfolio that includes Bitcoin (as a macro hedge) and high-utility altcoins (as a technology play) at the same time. Focus on Dispersion: Don't buy "the market"; buy the leaders. The 2026 cycle rewards protocols with real users, revenue, and regulatory compliance. Monitor the ETH/BTC Ratio: While they are moving together, the ETH/BTC ratio is currently forming a "long-term base," suggesting that Ethereum may soon begin to outperform Bitcoin on a relative basis even as both continue to rise.

Conclusion: Healthier, More Mature Market: The fact that altcoins are rallying alongside Bitcoin is the ultimate sign that the cryptocurrency market has "grown up." We are no longer in a world where a single asset dictates the fate of thousands of others. Instead, we have entered an era of Market Breadth, where different sectors from decentralized AI to tokenized finance can thrive based on their own merits. As Bitcoin approaches the $100,000 milestone, it is no longer traveling alone; it is leading a sophisticated, multi-trillion-dollar digital economy that is finally ready for the global stage.