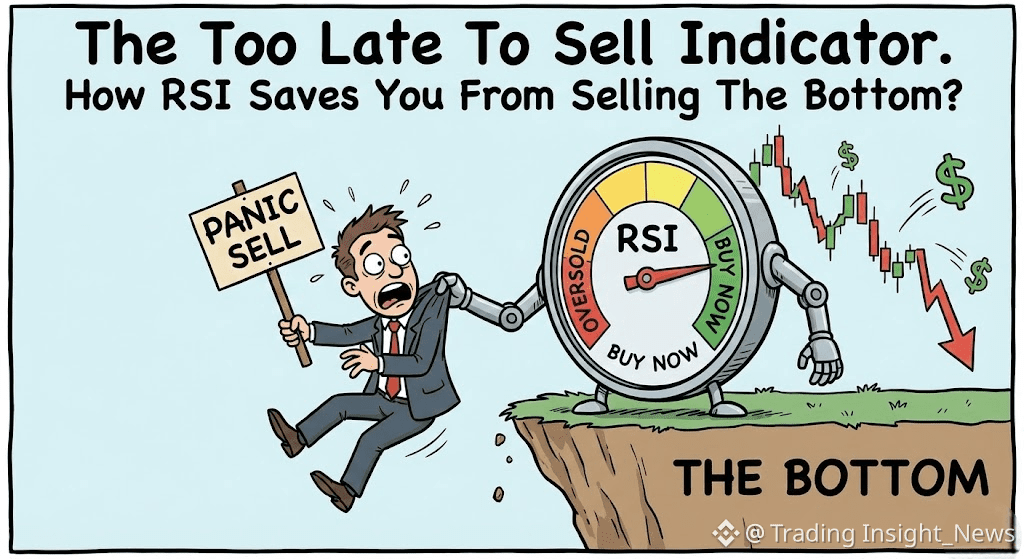

Panic implies emotion. Indicators imply data.When the market is crashing, your brain screams Sell everything before it goes to zero! But experienced traders know that when the pain is at its highest, the reversal is usually just around the corner. Before you hit that sell button, you must check the RSI.

🔸 The Rule of 30 and The Elastic Band Theory

The RSI measures the speed and change of price movements on a scale of 0 to 100.

The Rule is when RSI drops below 30 on the 4 Hr or D timeframe, the asset is mathematically Oversold.

Think of price like an elastic band. If you stretch it down too far, too fast, it must snap back eventually. Selling when RSI is at 20 or 25 is statistically the worst decision you can make. You are selling when the elastic band is stretched to its limit.

🔸 Waiting for a Reversal Tactic

Even if the market is entering a bear trend, nothing goes down in a straight line forever.

When RSI is oversold, short sellers start taking profits, and aggressive scalpers step in to buy the dip. This creates a Relief Rally.

If you absolutely must sell to protect your mental health, wait for the bounce.

Selling at RSI 20 = Maximum Loss.

Waiting for price to bounce and RSI to reset to 40-50 = Saving 5-10% of your capital.

👉 Next time you feel the panic rising, open the chart and look at the 4H RSI.

Is it below 30?

If YES Take your hand off the mouse. You missed the exit. Selling now is financial suicide. Wait for the green candle.

How many times have you sold at a loss just as the RSI hit rock bottom (below 30), only to regret it when the price recovered shortly afterward?

News is for reference, not investment advice. Please read carefully before making a decision.