Markets are always moving, but they don’t move in a straight line. Prices rise, fall, and then rise again. Yet, many traders fail not because they pick the wrong asset, but because they use the wrong strategy for the market they’re in.

Understanding whether you’re in a bull market or bear market, and knowing how to act accordingly, is one of the most important skills a trader or investor can develop.

This guide will teach you how to recognize market conditions, adjust your strategies, and protect your capital while maximizing opportunities.

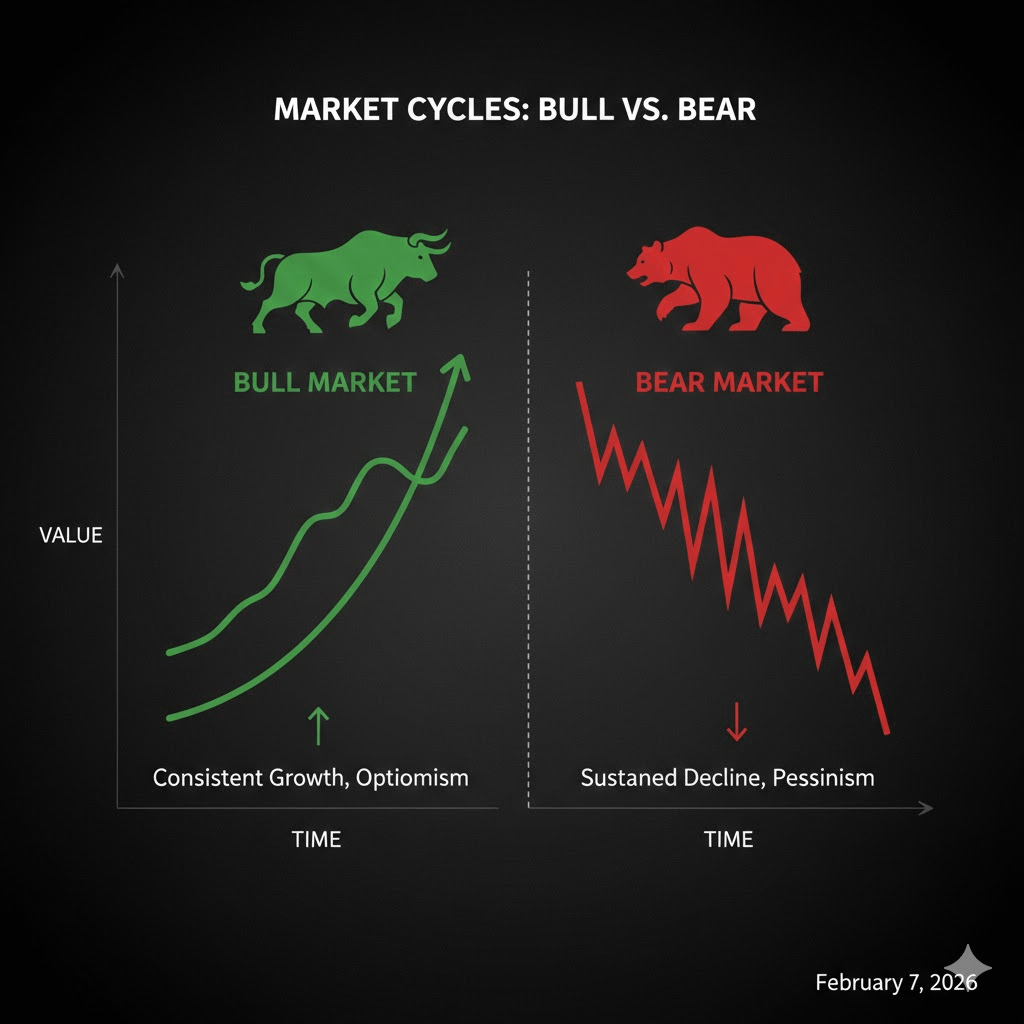

Understanding Market Cycles

Before jumping into strategies, it’s essential to understand the environment you’re trading in.

Bull Market

Prices are trending upward over time.

Confidence is high, optimism grows, and buying outweighs selling.

Examples: periods when Bitcoin consistently hits new highs or when stock indices are climbing steadily.

Bear Market

Prices are trending downward over time.

Fear dominates, selling pressure outweighs buying, and traders often panic.

Examples: during crypto crashes or stock market downturns.

Key insight: A strategy that works in a bull market can fail completely in a bear market. Adapting your approach is crucial.

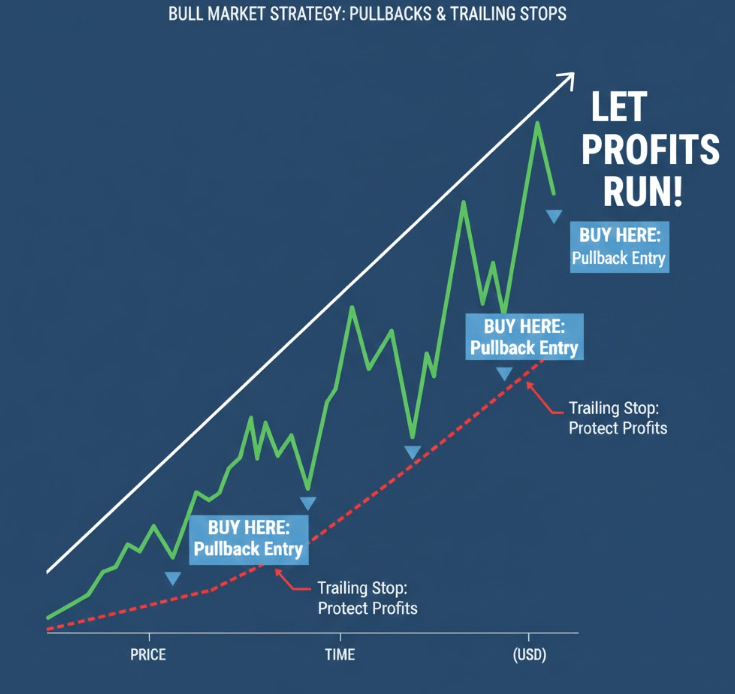

Strategies for Bull Markets

Bull markets are about momentum and opportunity. The price trend is your friend the goal is to ride it while managing risk.

Follow the Trend

Buy assets that are going up; avoid shorting strong momentum.

Don’t try to predict tops trends often last longer than expected.

Buy on Pullbacks

Avoid chasing prices after big jumps; entry after small retracements is safer.

Use support levels, moving averages, or prior consolidation zones as entry points.

Let Profits Run

Selling too early out of fear is a common mistake.

Use trailing stop losses to protect gains while staying in the trend.

Scale Into Positions

Avoid committing all capital at once.

Gradual entry improves average entry price and reduces emotional pressure.

Mindset tip: Bull markets reward patience, trend-following, and smart risk management.

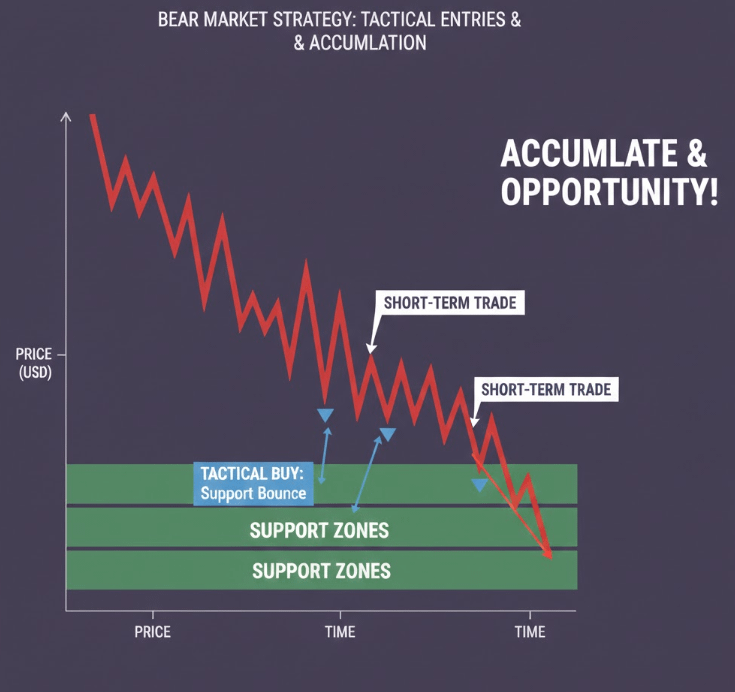

Strategies for Bear Markets

Bear markets are about preservation and patience. The goal is to protect your capital and look for high-probability opportunities.

Prioritize Risk Management

Reduce position sizes and use tighter stop losses.

Avoid overtrading — not every dip is a trade.

Cash Is a Position

Sometimes, staying in cash is smarter than forcing trades in unfavorable conditions.

Patience allows you to capitalize on better opportunities later.

Focus on Short-Term and Tactical Trades

Long-term buy-and-hold can be risky during declines.

Consider short-term trades, hedging, or range-bound strategies.

Accumulate Slowly

Use bear markets to gradually acquire high-quality assets at discounts.

Dollar-cost averaging helps reduce risk while positioning for future bull runs.

Mindset tip: Bear markets reward discipline, patience, and strategic thinking.

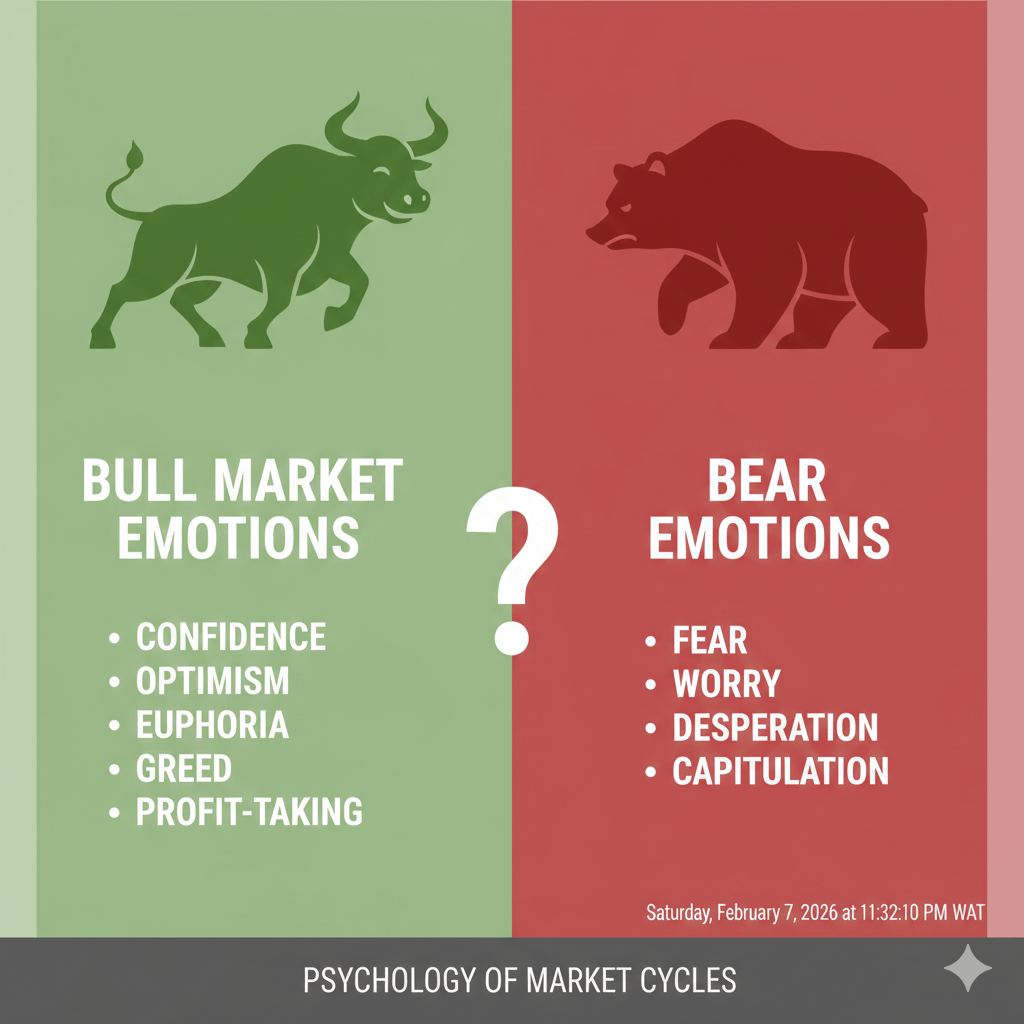

Psychology: Why Markets Test You

Markets are as much about human behavior as they are about charts.

Bull markets amplify confidence leading to overtrading and ignoring risk.

Bear markets amplify fear leading to panic selling and missed opportunities.

Traders who fail usually lose because their emotions don’t match the market, not because of poor analysis.

Common Mistakes to Avoid

Using the same strategy in every market.

Chasing trades out of fear of missing out (FOMO).

Ignoring stop losses or risk limits.

Confusing temporary rallies for trend reversals.

Avoiding these mistakes dramatically improves long-term results.

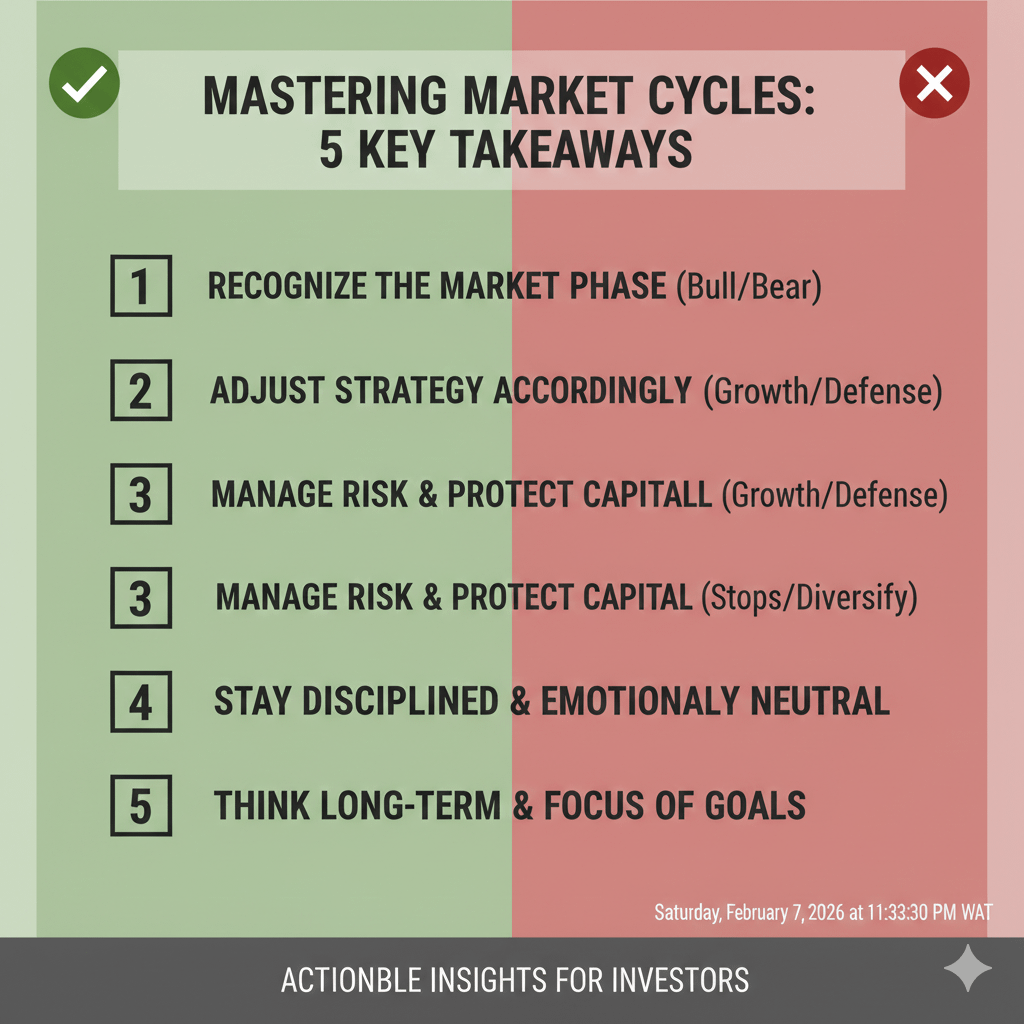

Practical Takeaways for Traders

Recognize the market: Identify whether you’re in a bull or bear phase.

Adjust your strategy: Momentum-based in bull markets; risk-focused in bear markets.

Manage risk: Protect capital first, profits second.

Stay disciplined: Emotions can destroy your account.

Think long-term: Every market phase has opportunities if approached strategically.

Final Thought

Bull markets reward confidence and patience.

Bear markets reward discipline and caution.

The traders who survive and thrive aren’t the ones who trade harder. They’re the ones who adapt faster, protect capital, and follow a plan that matches the market environment.

Master both bull and bear market strategies, and you stop reacting to the market you start working with it.