💥BREAKING NEWS 🇺🇸

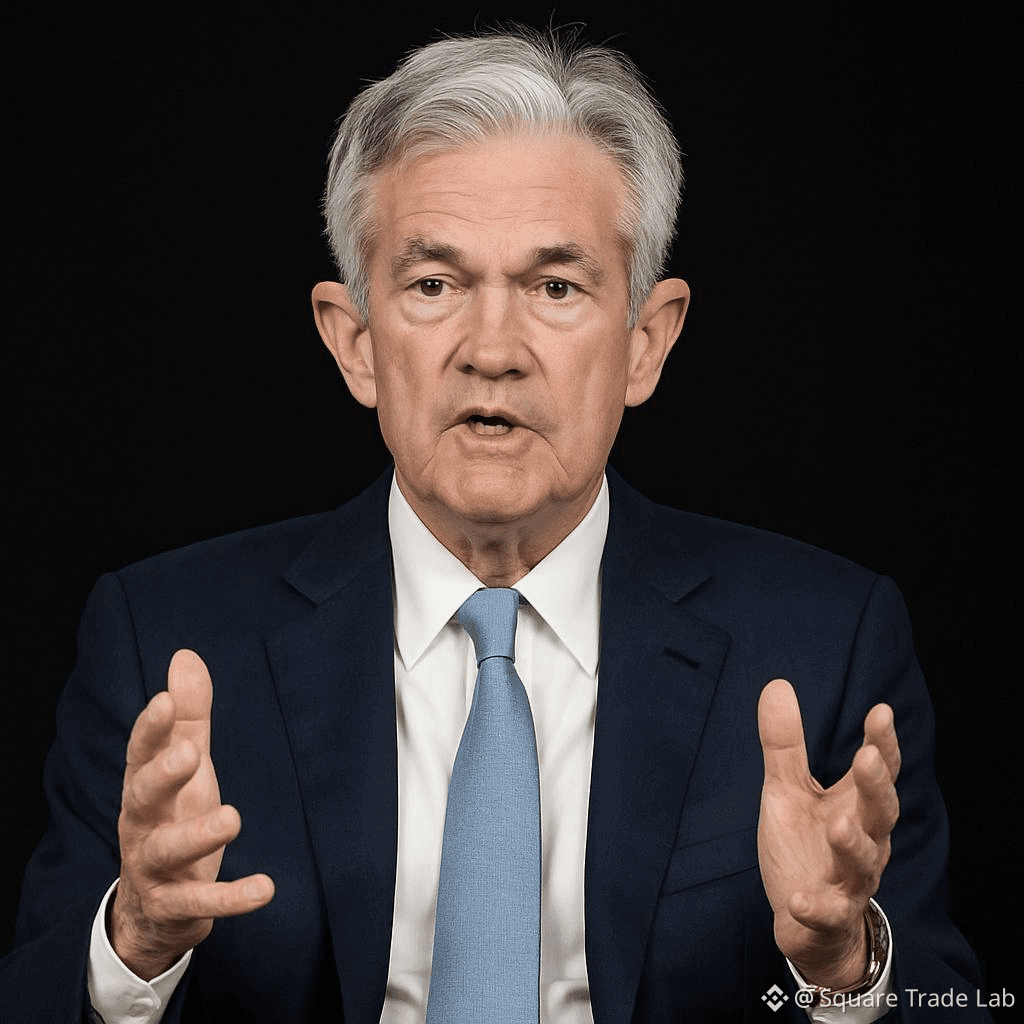

US Federal Prosecutors Open Criminal Probe Into Fed Chair Jerome Powell

In a move sending shockwaves across the financial world and political landscape, U.S. federal prosecutors have officially launched a criminal investigation into Federal Reserve Chair Jerome Powell, according to The New York Times. The probe concerns allegations of financial mismanagement, improper allocation of funds, and irregularities in the renovation of the Federal Reserve headquarters.

This historic investigation marks the first time in U.S. history that a sitting Federal Reserve Chair faces criminal scrutiny, sparking debates about central bank independence, governance, and political influence.

⚖️ Investigation Details

Allegations focus on overruns, unauthorized expenditures, and potential conflicts of interest in Fed HQ renovation contracts.

DOJ investigators are reviewing bidding processes, contractor selection, and compliance with federal financial regulations.

The Fed maintains that all projects were executed according to internal guidelines and legal requirements.

Legal experts warn that this investigation could set a precedent for accountability at the highest levels of the U.S. financial system.

🌍 Global Market Implications

Equities:

Expect immediate volatility across major stock indices including S&P 500, Nasdaq, and Dow Jones.

Investors may shift capital to safer assets, including precious metals and Bitcoin, in response to political uncertainty.

Bonds:

Treasury yields could fluctuate sharply as traders react to potential Fed disruption.

Corporate borrowing costs may rise, affecting real estate, tech, and consumer credit markets.

Commodities:

Safe-haven commodities like gold, silver, and platinum could see increased demand.

Oil and industrial metals may experience short-term price swings due to global risk-off sentiment.

Crypto:

Bitcoin (#BTC) may surge as investors seek a hedge against fiat and systemic risk.

Ethereum (#ETH) benefits from its role as a DeFi and smart contract platform, attracting institutional interest.

Altcoins like XRP, Cardano (#ADA), Solana (#SOL), and Polkadot (#DOT) could experience volatile spikes driven by market sentiment.

🏦 Political & Central Bank Impact

Raises serious questions about Fed independence versus political oversight.

Could trigger enhanced congressional monitoring and new financial governance protocols.

International central banks are closely watching, as the U.S. case may influence global monetary policies.

Potential geopolitical ripple effects, influencing trade negotiations, foreign policy, and economic alliances.

📊 Economic & Consumer Implications

Potential fluctuations in mortgage rates, credit card rates, and personal loans.

Corporations may postpone investments or adjust their capital strategies due to uncertainty.

Retail investors might shift funds into digital assets or safer investments, driving crypto adoption.

Increased liquidity flows into crypto could signal a new wave of institutional Bitcoin and Ethereum accumulation.

🔥 Crypto Market Takeaways

Bitcoin (#BTC): Digital gold continues to serve as a hedge against political and financial instability.

Ethereum (#ETH): Gains further credibility as the backbone of DeFi, NFTs, and staking rewards.

XRP, Cardano (#ADA), Solana (#SOL), and other altcoins: Could see speculative rallies and short-term volatility.

Market participants should watch exchange inflows, whale activity, and institutional positions closely.

⚡ Key Takeaways

This is unprecedented: a sitting Fed Chair under criminal investigation.

High volatility likely in stocks, bonds, commodities, and cryptocurrencies.

Crypto emerges as a safe-haven alternative for capital preservation.

Institutional investors are expected to reassess exposure across multiple asset classes.

The world is watching as U.S. political, financial, and economic systems collide, creating historic market conditions.

🪙 Coin Hashtags

#Bitcoin #BTC #Ethereum #ETH #xrp