The current price of Dusk (DUSK) is around $0.0579, with a modest 2% gain in the last 24 hours. The digital asset finds itself at a pivotal junction. The coming days and months present a complex mix of near-term technical uncertainty and the potential for profound, long-term transformation.

The Technical Picture: Conflicting Signals

The current technical analysis for DUSK presents a puzzle with no single answer.

· Current Signals: Multiple oscillators and short-term moving averages are flashing sell signals, suggesting recent weakness and downward pressure. However, key longer-term indicators like the 50 and 200-day moving averages still point to an underlying buy trend. The overall technical summary is a neutral consensus, reflecting this indecision.

· Key Price Levels: Analysts are watching the **$0.075 resistance level** closely. A decisive break above this point could validate a bullish trend, while a rejection could extend the current consolidation phase. Immediate support sits around the $0.0565 level from the recent trading range.

Short-Term Price Forecast: A Volatile Path

The immediate future for DUSK price action is likely to be volatile and heavily influenced by the broader crypto market.

Over the Next Week and 30 Days: Analysts diverge. Some predict a potential rise of up to +13% in the next month based on positive catalysts, while others warn of a neutral-to-negative correction of -2.6% to -27% in the next three months if bearish pressures win out. This wide range underscores the market's uncertainty.

Drivers of Short-Term Volatility:

· Sector Correlation: DUSK's price is currently tied to the broader Real-World Asset (RWA) token sector, which has recently underperformed.

· Algorithmic Trading: The token has seen significant activity from short-term traders targeting quick 14%+ profit zones, which can amplify both upward and downward price swings.

· Broader Market Sentiment: The overall crypto market sentiment, as measured by the Fear & Greed Index, remains in "Fear" territory.

The Bull Case: Catalysts for a 2026 Breakout

The optimistic outlook for DUSK rests on the successful execution of major project milestones. The single most important event is the imminent launch of the DuskEVM mainnet in Q1 2026. This upgrade makes Dusk compatible with the popular Ethereum Virtual Machine, allowing developers to build privacy-focused, compliant applications using Solidity. A smooth, on-schedule launch is considered critical to building investor confidence and ecosystem growth.

The second major catalyst is the real-world adoption of Dusk's technology. The partnership with NPEX, a licensed Dutch stock exchange, aims to bring over €200 million (or $300 million) in tokenized securities onto the Dusk blockchain throughout 2026. This could generate real transaction volume and fees, moving DUSK beyond speculative value to utility-based demand.

The Bear Case: Risks and Challenges

Despite a promising roadmap, significant obstacles remain.

· Execution Risk: The crypto space is littered with projects that failed to deliver promised upgrades on time. Delays or technical issues with the DuskEVM launch or the NPEX integration could severely damage market sentiment.

· Regulatory Uncertainty: While Dusk's compliance with EU regulations (MiCA) is an advantage, policy shifts could still pose risks. The project's success is partly tied to stable and favorable regulations in Europe.

· Fierce Competition: Dusk is not the only player targeting the RWA and institutional finance space. It must compete with both other blockchain protocols and traditional financial giants that are exploring tokenization.

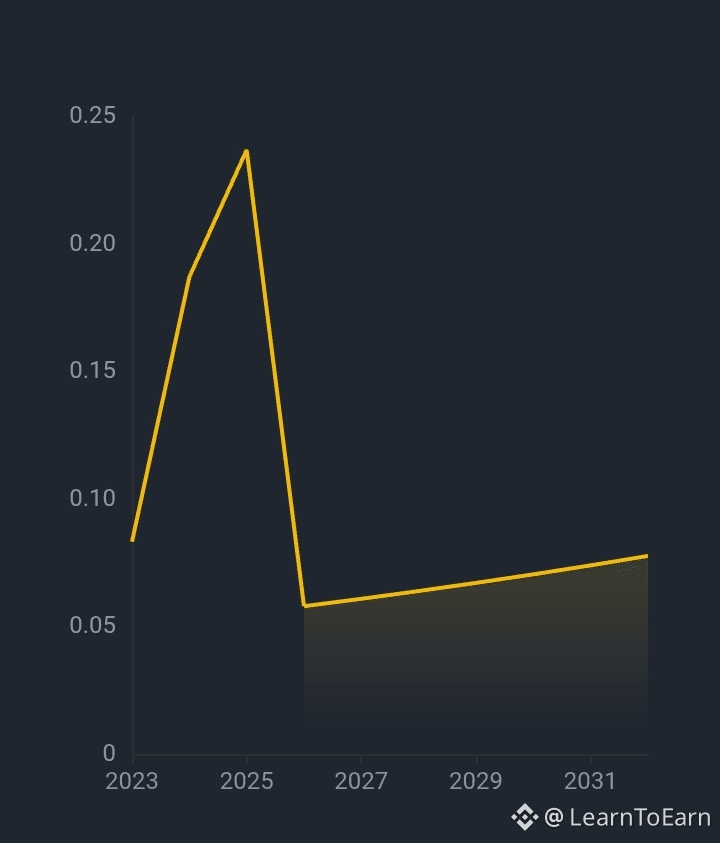

Long-Term Price Outlook (2026-2030)

Long-term forecasts are speculative and vary wildly, highlighting the high-risk, high-reward nature of the asset.

Neutral Scenario: Under steady but not explosive adoption, analysts project a price of €0.0466 to €0.0512 by the end of 2026. By 2030, this could grow to around €0.124 if trends continue.

Bullish Scenario: If Dusk successfully becomes a key hub for European RWA, some models suggest a potential climb to €0.0687 by the end of 2027 and €0.2877 by 2035.

Bearish Scenario: If adoption stalls or the market turns, bearish predictions warn of a potential decline to €0.0109 in 2026.

Key Takeaways for Investors

For those monitoring DUSK, the focus should be on tangible developments rather than daily price noise. The token is a high-conviction bet on the future of compliant, privacy-focused institutional finance on the blockchain. Its trajectory will be defined by real-world execution over the coming months.#Dusk @Dusk $DUSK