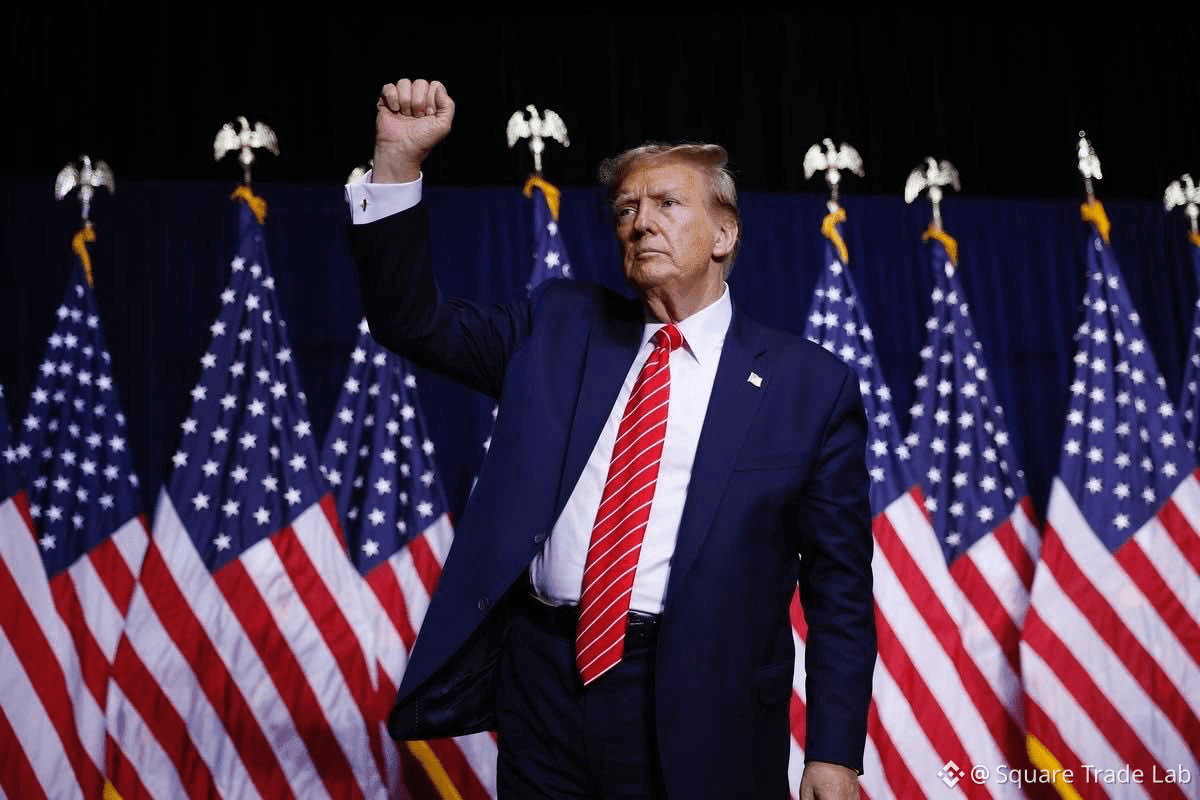

💥BREAKING: President Trump Orders Historic Credit Card Interest Rate Cap at 10%

🇺🇸 President Donald Trump has officially declared that all U.S. credit card companies must lower interest rates to 10% by January 20th.

“If credit card companies do not lower interest rates to 10% by January 20th, then they are in violation of the law, very severe things. They really abuse the public, I am not going to let it happen.”

This announcement represents one of the most significant consumer finance interventions in modern U.S. history, and its implications stretch across financial markets, consumer behavior, the crypto ecosystem, and even global economic dynamics.

⚡ Consumer Impact

Immediate relief for millions of Americans holding high-interest credit card debt. Average credit card interest rates range from 18%–30%, so a cap at 10% could save consumers thousands per year.

Disposable income increases—households may have more money to spend on retail, services, or savings, stimulating the economy.

Likely to reduce defaults and delinquency rates, as monthly payments decrease.

Could encourage responsible borrowing while simultaneously boosting consumer confidence.

🏦 Banking and Financial Market Impact

U.S. credit card issuers like Visa, Mastercard, and American Express will face margin compression.

Financial analysts anticipate revaluations of banking stocks, especially institutions heavily reliant on high-interest card revenue.

Possible increase in compliance and operational costs as banks adjust systems to enforce the cap.

Lending models may shift—banks could explore new fee structures, balance transfer promotions, or higher upfront fees to maintain profitability.

Risk of legal challenges from banks if enforcement is aggressive, potentially creating short-term volatility in the sector.

🪙 Crypto Market Implications

A U.S. credit card interest cap introduces systemic stress into fiat lending markets, potentially driving adoption of decentralized finance (DeFi) and crypto solutions.

Bitcoin (#BTC) may see an uptick in demand as investors hedge against perceived banking system manipulation or consumer restriction.

Ethereum (#ETH) and staking platforms could benefit as users look for yield-generating alternatives.

Altcoins like XRP (#XRP), Solana (#SOL), and Cardano (#ADA) may attract speculative inflows amid fiat market uncertainty.

Historically, policy-driven stress in traditional finance often correlates with increased retail crypto participation and long-term adoption.

📊 Market Analysis

Short-term: expect volatility in bank equities, fintech, and consumer credit sectors.

Medium-term: retail spending increases could boost consumer-driven indices such as S&P 500 and Nasdaq.

Long-term: policy sets a precedent for direct government intervention in consumer finance, which could shift the financial landscape permanently.

Traders should monitor liquidity flows, whale positions, and crypto exchange activity for emerging trends.

🌎 Global and Geopolitical Implications

A U.S. intervention of this scale could influence international financial institutions and inspire similar consumer protection measures abroad.

Global investors may reassess U.S. banking stability, potentially driving inflows into alternative assets like gold, BTC, and ETH.

Countries heavily invested in U.S. debt or dollar-denominated assets may recalculate risk exposure.

Could trigger debates on central bank authority vs. presidential influence, attracting global economic scrutiny.

⚡ Key Takeaways

Trump’s policy is unprecedented in modern consumer finance history.

Millions of Americans stand to benefit immediately, increasing disposable income and economic activity.

Banks and credit card companies face pressure to comply or risk enforcement action.

Crypto markets are likely to experience inflows as fiat stress encourages alternative asset adoption.

Market watchers should pay attention to liquidity, volatility, and regulatory response over the coming weeks.

🔥 Investor Alert

High-impact move for risk assets, retail adoption, and financial innovation.

Bitcoin, Ethereum, XRP, Solana, Cardano may see price action influenced by consumer cash flow shifts.

Policy-driven fiat stress historically drives speculative crypto interest, HODLing, and market participation.