Plasma begins with a feeling most people in crypto have experienced but rarely talk about.

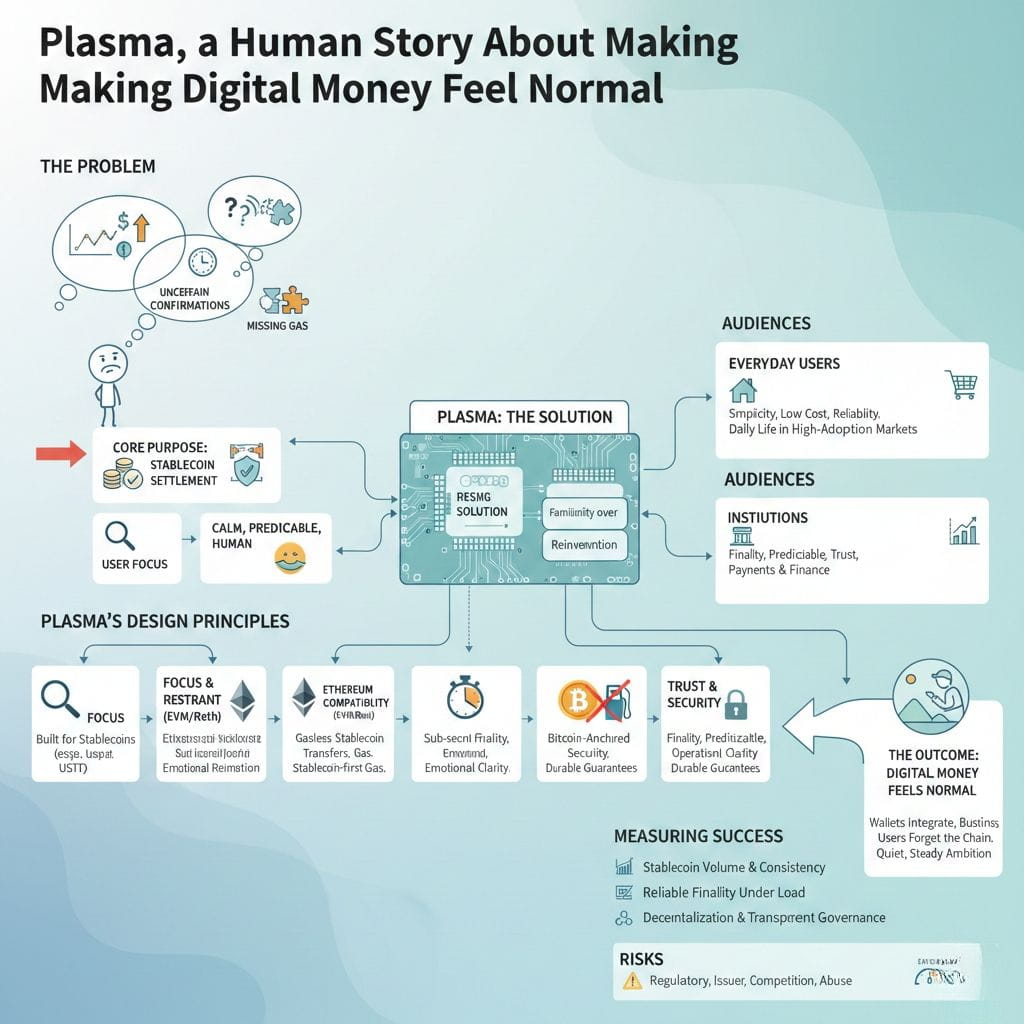

You have the money you want to send, usually a stablecoin, and yet the system puts barriers in your way. Fees jump, confirmations feel uncertain, or the transaction fails because you don’t hold a separate gas token.

To a normal person, that feels broken. Plasma exists because its builders looked at this frustration and decided that if stablecoins are already how people actually use crypto, then the entire blockchain should be designed around that reality.

It is a Layer 1 network built specifically for stablecoin settlement, not as a side feature but as its core purpose. The goal is simple on the surface but difficult in execution: make digital dollars move in a way that feels calm, predictable, and human.

At a deeper level, Plasma is about focus. Many blockchains try to be everything at once, supporting every possible application and narrative. Plasma chooses restraint instead.

It concentrates on stablecoins, especially USDT, because that is where real demand already lives. In many parts of the world, stablecoins are not speculative tools. They’re how people protect savings, send money across borders, and pay for real services.

Plasma is designed for those moments, when reliability matters more than novelty. I’m describing it this way because understanding Plasma is less about understanding code and more about understanding behavior.

To make this work, Plasma keeps full compatibility with Ethereum through an EVM-based execution layer built with Reth. For most people, the technical details don’t matter, but the intention does.

Developers already know how to build on Ethereum. Wallets already know how to interact with it. By staying compatible, Plasma avoids forcing the ecosystem to start over.

They’re choosing familiarity over reinvention, which increases the chance that useful tools actually appear and stay. This choice reflects a broader mindset inside the project: don’t add complexity unless it genuinely improves the experience.

Speed and certainty are another key part of Plasma’s design, but not in a flashy way. Plasma uses its own consensus system, PlasmaBFT, to reach finality in under a second.

Finality means that once a transaction is confirmed, it is truly finished. There is no waiting and no wondering if it might be reversed.

For payments and settlement, this emotional clarity is just as important as technical speed. When money is involved, people want closure. Plasma is built to provide that sense of completion quickly and consistently.

The most human part of Plasma’s design shows up in its approach to fees. Anyone who has helped a newcomer to crypto has seen the same confusion play out.

They have stablecoins in their wallet, but they can’t send them because they don’t own the chain’s gas token. From a normal perspective, that makes no sense.

Plasma addresses this directly by enabling gasless stablecoin transfers, especially for USDT. The network handles the complexity behind the scenes through controlled mechanisms so the user can simply send money.

This isn’t about showing off clever engineering. It’s about respecting the user and removing a moment that makes people feel lost or embarrassed.

Even when fees are required, Plasma aims to keep users anchored in stable value by supporting stablecoin-first gas. Instead of forcing people to think in volatile tokens, fees can be handled in stablecoins. Psychologically, this matters a lot. People think in dollars.

They plan in dollars. When costs are predictable, anxiety drops. When anxiety drops, trust grows. We’re seeing more projects experiment with this idea, but Plasma makes it foundational rather than optional.

Trust is also addressed through Plasma’s approach to security and neutrality. The network introduces Bitcoin-anchored security by periodically tying parts of its state to Bitcoin. In simple terms, this means Plasma records checkpoints in a system that is extremely hard to rewrite or censor.

This does not make Plasma perfect, but it strengthens long-term credibility. It signals that the project is thinking beyond short-term performance and toward durable settlement guarantees. For institutions and serious financial use cases, that signal is meaningful.

Plasma is designed to serve two very different audiences at once. On one side are everyday users in high-adoption markets who rely on stablecoins for daily life. They want simplicity, low cost, and reliability.

On the other side are institutions in payments and finance that care about finality, predictability, and operational clarity. Plasma tries to meet both by keeping the surface experience simple while building strong infrastructure underneath. Balancing these needs is difficult, but it is also where real impact tends to happen.

When judging Plasma’s health, it’s important to look past noise. Token price movements are loud, but they don’t tell the full story. What matters more is whether stablecoins are actually moving across the network every day, consistently and at scale.

Reliable finality under load, deep liquidity, and steady usage are signs of real adoption. Another important signal is whether the network continues to open up over time, with a credible path toward decentralization and transparent governance. If that path holds, confidence can grow naturally.

Plasma also has risks, and ignoring them would be dishonest. Its close relationship with stablecoins means it shares their regulatory and issuer-related risks.

Gasless systems must be carefully managed so they remain fair and resistant to abuse. Competition is intense, as many blockchains want to own payments and settlement. Plasma will not succeed by talking louder than others. It will succeed only if it executes better, year after year.

Exchanges like Binance may help people discover Plasma and provide liquidity, but visibility alone does not create lasting value. Real success looks quieter. It looks like wallets integrating Plasma because it reduces user friction.

It looks like businesses trusting it because settlement is clear. It looks like users forgetting which chain they’re on because everything just works.

I’m not claiming Plasma is guaranteed to win. Crypto doesn’t offer certainty. But there is something grounding about a project that starts with how people actually use money instead of how impressive a design sounds. They’re not chasing chaos or hype.

They’re trying to make digital money feel normal. If it becomes that kind of infrastructure, even quietly, it can matter more than many louder projects. We’re seeing crypto slowly grow up, moving from experimentation toward usefulness. Plasma sits in that transition. It doesn’t promise perfection. It promises effort, focus, and patience. And in a space that often moves too fast, that kind of steady ambition offers a calm and hopeful path forward.