The promise of real world assets on blockchain has always felt tantalizingly close like a vault door cracked open just enough to glimpse stacks of treasuries real estate deeds and corporate bonds waiting to be digitized.

Yet years into the hype most RWA projects still feel like pilots trapped in permissioned sandboxes where tokenization meets the harsh light of regulators and privacy demands that public chains simply cannot handle.

Institutions nod politely at the demos but when it comes time to move real capital they hesitate concerned about exposing client data to every node operator or failing a single audit trail.

This is where Dusk enters the conversation not as another optimistic layer two chasing yield but as a privacy compliance stack that treats those very tensions as solvable engineering problems rather than roadblocks.

Dusk's core technology revolves around making privacy and compliance protocol native features specifically through its Confidential Security Contracts XSCs and the Citadel digital identity protocol.

XSCs allow for the issuance and management of tokenized assets where transaction details ownership structures and even smart contract inputs remain encrypted on chain yet verifiable through zero knowledge proofs and selective disclosure mechanisms.

This means a bond issuance or property token can prove adherence to KYC AML rules transfer restrictions or jurisdictional limits without broadcasting sensitive values to the public ledger.

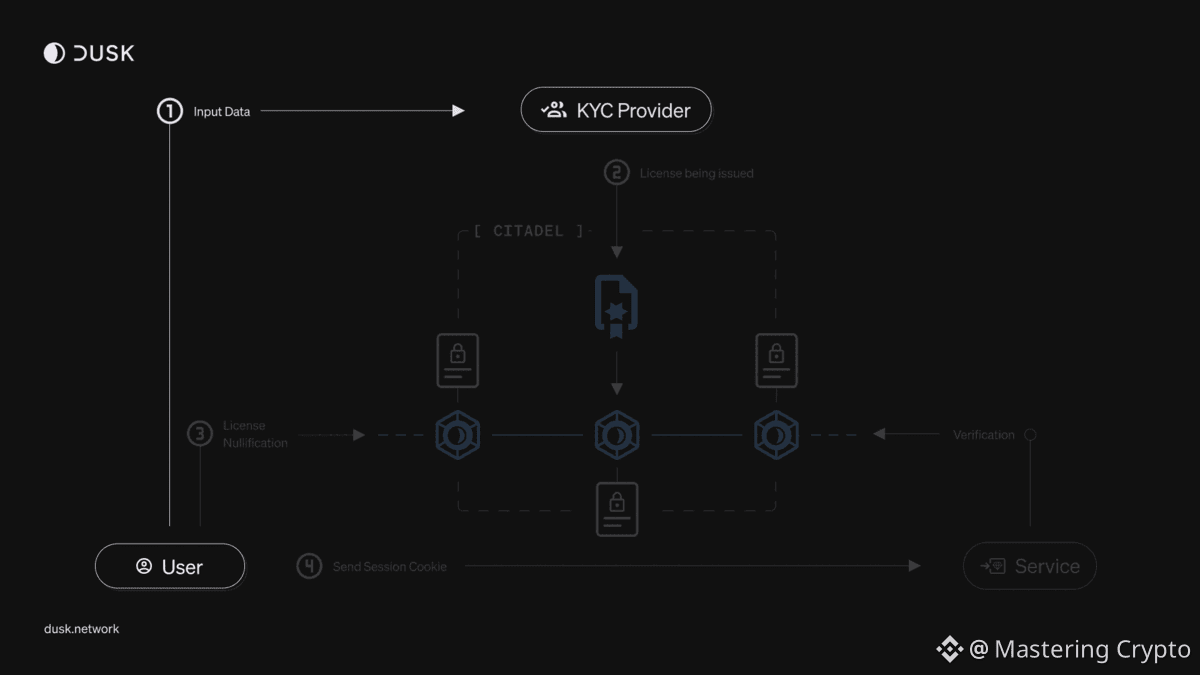

Citadel complements this by enabling self sovereign identities that bind legal personhood to on chain actions in a privacy preserving way so users retain control while regulators get the attestations they need.

In everyday terms imagine transferring a tokenized treasury bill.

The amount and your wallet stay hidden from casual observers but the network enforces that only verified EU compliant entities can receive it and auditors can request a cryptographic proof of the trade's validity without seeing the full picture.

DuskEVM brings Ethereum compatibility to this setup letting developers use familiar Solidity tools while layering in Hedger for homomorphic encryption and zero knowledge capabilities that keep computations private.

The result is lifecycle management for RWAs from minting legal rights to automated dividends and redemptions that feels seamless secure and legally sound without relying on off chain wrappers or trusted third parties.

This approach ties directly into the surging RWA market now projected to hit trillions in tokenized value as banks like BlackRock and JPMorgan experiment with on chain funds and credit instruments.

Broader trends show a clear pivot.

MiCA in Europe and similar rules elsewhere demand auditability for securities while institutions crave the efficiency of instant settlement and composability without the privacy pitfalls of fully transparent chains like Ethereum.

Permissioned networks solve compliance but kill decentralization.

Privacy coins like Monero offer hiding spots but no regulatory hooks.

Dusk carves a niche by aligning with licensed partners like NPEX a Dutch MTF to bring euros worth of securities on chain under real regulatory umbrellas blending DeFi's automation with traditional finance legal rigor.

From where I sit having tracked DeFi's evolution through yield farms to sophisticated protocols Dusk's stack resonates because it acknowledges a simple truth.

RWAs will not scale if they force institutions to choose between innovation and liability.

Most chains prioritize speculation over substance leading to flash crashes and rug pulls that scare off serious money.

Dusk flips that by embedding the boring but essential components compliance gates private execution and verifiable disclosures right into the base layer.

It is pragmatic almost understated which is refreshing in a space full of moonshots.

It might not pump like a meme coin but for builders eyeing tokenized private equity or real estate funds this is the kind of infrastructure that actually gets deals done without midnight compliance scrambles.

That said balance requires calling out the hurdles.

Selective disclosure sounds elegant but implementation demands flawless cryptography and one flaw could expose data or block legitimate trades.

Liquidity remains a bootstrap problem.

NPEX partnerships help but RWAs need deep order books and cross chain bridges to thrive.

While Dusk targets Europe first global fragmentation means adapting to SEC dynamics or Asian regulatory frameworks could stretch the model thin.

It is not a silver bullet for all RWAs just a compelling one for regulated privacy sensitive slices like securities and funds.

Still in a market where over ninety percent of tokenized assets languish in pilots Dusk's live integrations signal real momentum over vaporware.

What stands out in practice is how Dusk reimagines the user and issuer experience.

An asset manager can tokenize a money market fund embed transfer whitelists based on Citadel IDs and automate yield distributions privately all while generating audit ready proofs for quarterly filings.

Investors access these from self custodial wallets enjoying fractional ownership without the opacity of private equity funds.

Market makers operate without leaking strategies into public mempools and regulators monitor high level flows without micromanaging every transaction.

This stack lowers the friction that has kept RWAs niche potentially unlocking trillions in illiquid assets for on chain efficiency.

Tying back to trends Dusk arrives as oracles like Chainlink and interoperability standards mature enabling RWAs to compose with DeFi primitives safely.

Partnerships with venues like NPEX demonstrate viability with hundreds of millions in securities eyeing blockchain rails.

Yet success hinges on execution expanding EVM tooling proving scalability under load and attracting issuers beyond pilots.

The sentiment stays measured exciting potential but grounded in the grind of regulatory technology.

In my view shaped by years dissecting protocols from Aave to Arbitrum Dusk avoids the trap of overpromising universality.

It owns its lane compliant privacy for finance first RWAs.

This focus could make it indispensable as tokenization hits the mainstream much like how Chainlink became dominant by solving one problem deeply.

For developers the private contract playground invites novel designs like confidential AMMs or automated compliance oracles.

It feels like a quiet bet on where capital actually flows not hype driven decentralized exchanges but regulated markets digitized at last.

Looking forward Dusk's stack positions it to capture a slice of the RWA explosion as barriers fall.

With mainnet evolutions like DuskEVM live and more licensed issuances inbound it could bridge the institutional gap that has stymied public chains.

The paradigm shifts from blockchain despite regulation to blockchain with regulation enabling RWAs to scale without endless legal hacks.

If trends hold rising tokenization volumes stricter privacy laws and demand for efficient settlement platforms like Dusk will not just stand apart.

They will define the on chain future of real assets making the vault door swing wide open for good.