$XRP Few digital assets have endured as much skepticism and persistence as XRP. For years, critics questioned its relevance while supporters focused on its long-term role within global financial infrastructure.

As blockchain technology shifts from speculative trading toward real-world utility, this divide has become more pronounced. Recent commentary suggests that sentiment around XRP may be approaching a defining moment.

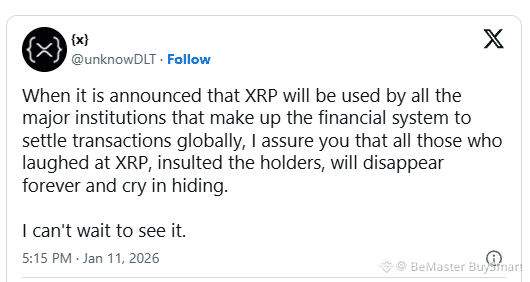

In a post on X, crypto commentator {x} (@unknowDLT) expressed confidence that XRP’s perception will change once its role in institutional settlement becomes widely recognized. His statement reflects a broader view within the XRP community that real adoption, rather than market narratives, will ultimately determine the asset’s legacy.

👉XRP Was Built for Global Settlement

XRP’s core design targets one of finance’s biggest challenges: efficient cross-border settlement. The XRP Ledger processes transactions within seconds, charges minimal fees, and operates with low energy consumption. These features directly address the inefficiencies of traditional correspondent banking systems, which often rely on slow, costly, and capital-intensive processes.

Unlike networks designed primarily for decentralized applications, XRP focuses on value transfer at scale. This specialization positions it as a bridge asset that can facilitate liquidity between different fiat currencies without requiring pre-funded accounts.

👉Institutional Engagement Continues to Expand

Ripple, the company most closely associated with XRP, has spent years developing enterprise-grade payment solutions for financial institutions. Through products such as On-Demand Liquidity, Ripple enables payment providers and banks to use XRP to source liquidity in real time. This approach reduces reliance on nostro accounts and improves capital efficiency.

While no official announcement confirms universal adoption by all major institutions, Ripple has documented partnerships and live corridors across multiple regions. Financial institutions continue to test blockchain-based settlement tools, and central banks increasingly explore tokenized payment systems. Supporters like {x} (@unknowDLT) view these developments as steady progress toward broader integration.

👉Why Critics May Be Left Behind

Much of the criticism directed at XRP has focused on price action and regulatory uncertainty rather than functionality. During periods of slow market performance, narratives often overshadow underlying development. History shows that infrastructure technologies frequently gain validation only after adoption reaches scale.

{x} (@unknowDLT) argues that once institutional usage becomes visible and measurable, dismissive voices may fade. When utility drives demand, market perception tends to adjust rapidly.

👉From Speculation to Utility-Driven Value

The conversation around XRP increasingly centers on use rather than ideology. As financial systems modernize, assets that solve real operational problems stand to gain relevance. XRP’s focus on settlement efficiency aligns with this shift.

Timelines remain uncertain, and no single announcement will transform the system overnight. However, the broader movement toward blockchain-based settlement continues to accelerate. For XRP supporters, confidence rests on function, not hype. In that context, {x} (@unknowDLT)’s assertion reflects a belief that long-term utility will outlast criticism and redefine how XRP is viewed within global finance.

🚀🚀🚀 FOLLOW BE_MASTER BUY_SMART 💰💰💰

Appreciate the work. 😍 Thank You. 👍 FOLLOW BeMaster BuySmart 🚀 TO FIND OUT MORE $$$$$ 🤩 BE MASTER BUY SMART 💰🤩

🚀🚀🚀 PLEASE CLICK FOLLOW BE MASTER BUY SMART - Thank You.