Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

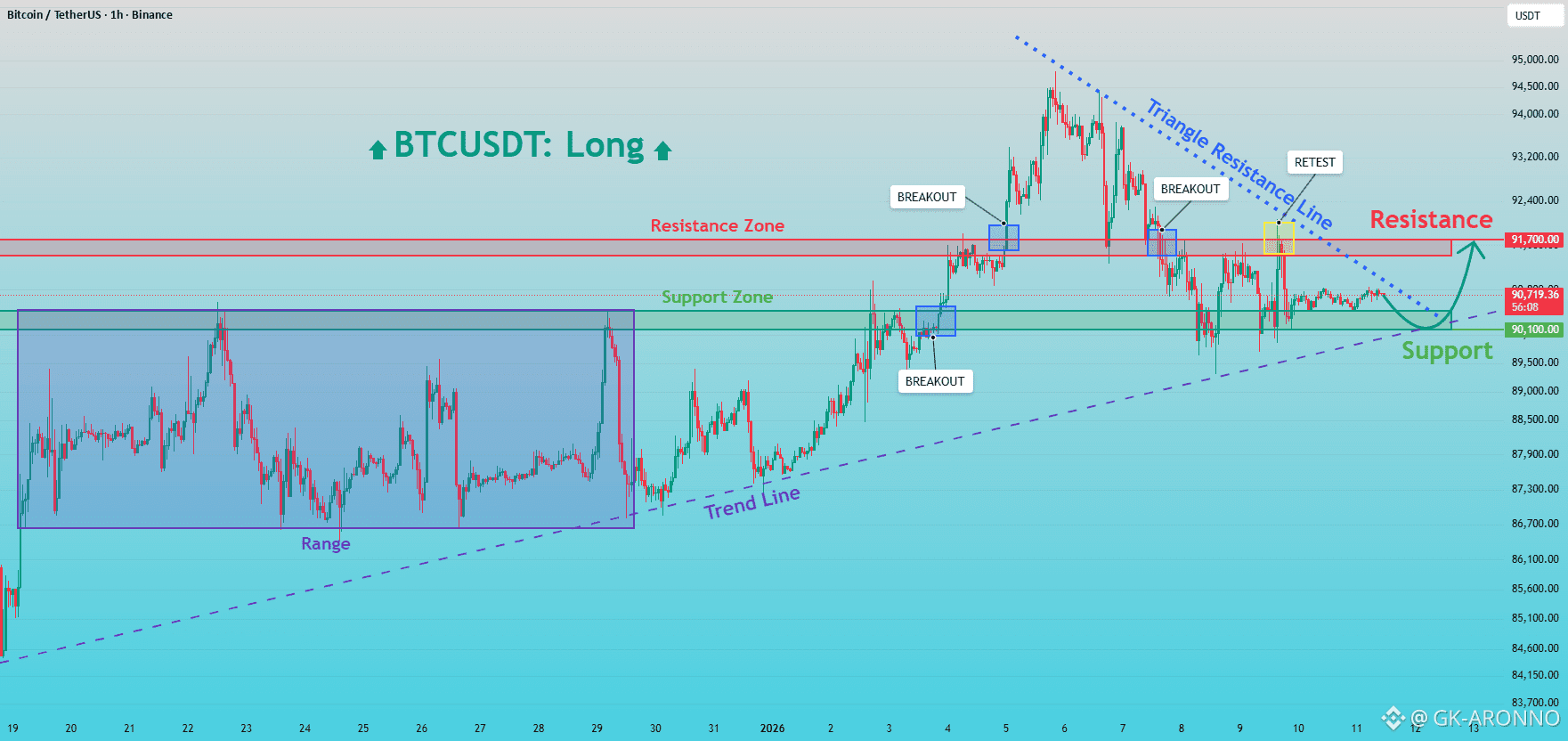

BTCUSDT previously traded inside a well-defined range, where price moved sideways for an extended period, indicating balance and accumulation between buyers and sellers. This consolidation phase ended with a clean breakout to the upside, confirming a shift in market control toward buyers. Following the breakout, price respected a rising trend line, forming higher highs and higher lows, which validated a bullish market structure. As BTC continued higher, it reached a key Resistance Zone around 91,700, where selling pressure appeared. Price reacted from this area and pulled back, but the move remained corrective rather than impulsive. During the pullback, BTC found support at the Support Zone near 90,100, which aligns with previous breakout structure and the rising trend line. At the same time, price is trading below a descending triangle resistance line, suggesting compression and preparation for a directional move.

Currently, BTC is holding above the support zone and the ascending trend line, while consolidating below resistance. This structure suggests buyers are still defending the market, and the overall bullish bias remains intact as long as support holds.

My Scenario & Strategy

My primary scenario: as long as BTCUSDT remains above the 90,100 Support Zone and continues to respect the rising trend line, the bullish bias remains valid. I expect buyers to defend this area and attempt a breakout above the 91,700 Resistance Zone, which would open the door for continuation toward higher levels.

However, a decisive breakdown below support and the trend line would weaken the bullish structure and increase the probability of a deeper corrective move. Until that happens, price action favors consolidation followed by potential upside continuation.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

✅ Trade here on $BTC