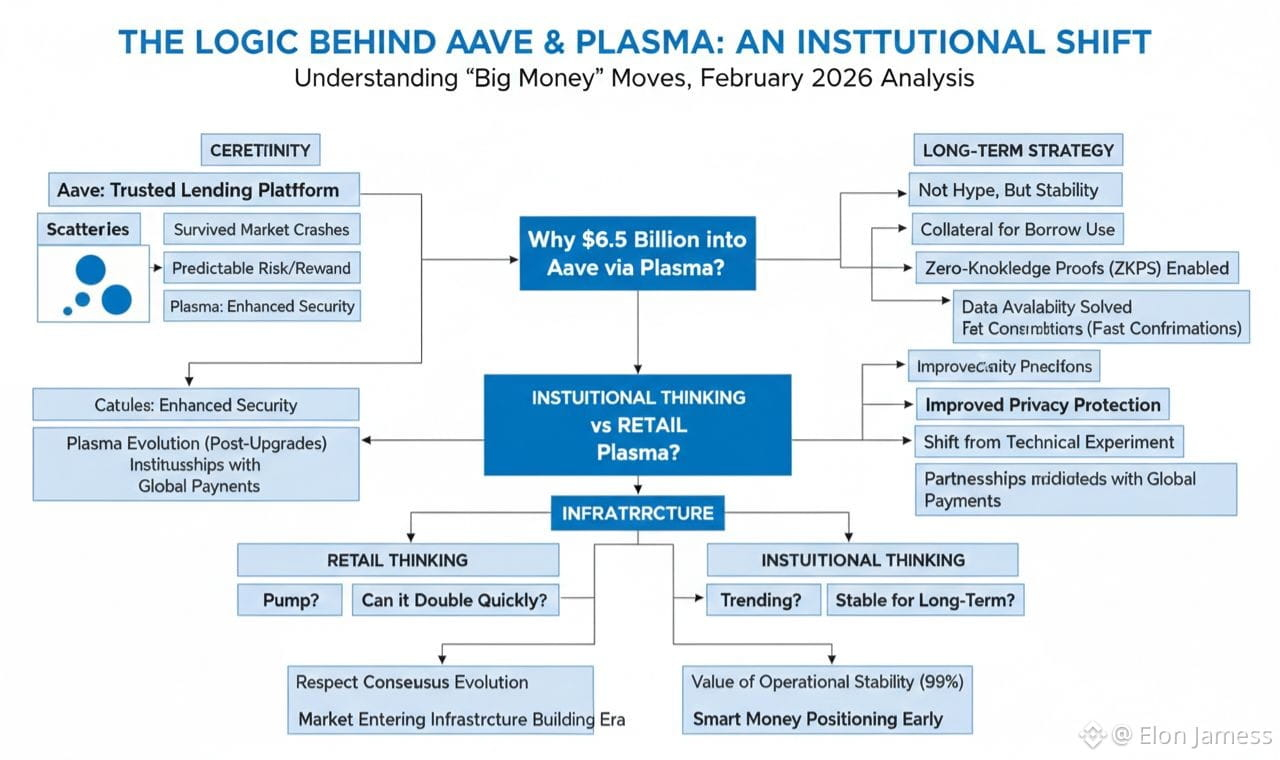

Most people in crypto saw the news about six point five billion dollars flowing into Aave through Plasma and reacted the same way they always do

they thought maybe it is just another arbitrage game or maybe some whales are playing short term tricks

others even said Plasma is old technology and nothing special

but this way of thinking shows how far retail investors are from the real shift happening in web3 right now

what looks strange on the surface is actually a very logical move by institutions that think completely different from normal traders

this story is not about hype or price pumps

it is about certainty infrastructure and long term strategy

first we need to understand something important

six point five billion dollars does not appear by accident

in decentralized finance money is the most honest signal

big funds do not move based on twitter trends or excitement

they move only when risk and reward are calculated very carefully

Aave is known as one of the safest and most tested lending platforms in crypto

it survived market crashes hacks and extreme volatility

so when institutions decide to park huge capital there it means they trust the system

the key reason behind this massive deposit is the combination of deep liquidity and stronger security that Plasma now offers

Plasma started years ago as a scaling idea but today it is very different

after many upgrades it has turned into something closer to an institutional settlement layer

privacy protection is better

transaction verification is faster

and the whole structure is more suitable for large financial players

for institutions this is not about buying a token and hoping it goes up

it is about using Plasma assets as collateral on Aave to earn steady returns

at the same time they can borrow stablecoins against those assets and use the money for hedging or other business activities

retail traders look at this and think it is risky

but professional investors with teams of analysts see it as a controlled interest rate strategy with predictable outcomes

another big change is that Plasma is slowly moving from being just a technical experiment to becoming a real compliance friendly channel

recent developments show that the Plasma team is working closely with major global payment companies

this means Plasma is no longer only a side solution for Ethereum

it is becoming a main road for real world money to enter blockchain systems

when a protocol starts to look like future financial infrastructure six point five billion suddenly looks small instead of big

many people still remember the old problems Plasma had

long exit periods slow user experience and technical limitations

those issues created a bad image in the past

but new updates introduced modern zero knowledge proof compatibility

this solved the biggest weakness of Plasma which was data availability

what used to take many days for confirmation can now be done in minutes

in simple words Plasma changed from a slow bureaucratic system into a fast automated production line

this is exactly the kind of transformation large organizations wait for before committing capital

the difference between retail thinking and institutional thinking becomes very clear here

retail investors usually ask

has the coin pumped

is it trending

can it double quickly

institutions ask completely different questions

how much real business runs on this protocol

can it handle payments better than traditional systems like SWIFT

is the technology stable enough for long term operations

inside the Plasma ecosystem many projects focused on real world assets have started to appear

almost all of them choose Plasma as their settlement layer

when physical assets begin moving on chain the level of certainty becomes much higher than any meme coin story

so what lessons can ordinary investors learn from this huge deposit

first we must respect how consensus evolves

Plasma coming back to life is not a step backward

it is a comeback after years of improvement and learning

while other Ethereum layer two networks fought for attention Plasma quietly found its own path in high frequency trading and compliance focused use cases

second we need to understand the value of certainty

in crypto the biggest cost is not fees

it is uncertainty

institutions are not betting on a ten times price jump

they are betting on ninety nine percent operational stability

that is why they feel comfortable putting billions into this system

this movement of money also shows that the market is entering a new phase

the early wild west stage of crypto is slowly turning into an infrastructure building era

Plasma recent actions from technical upgrades to partnerships with capital players are sending one clear message

serious money has already arrived

in this industry knowledge always beats luck

people who follow real capital flows will do better than those chasing random pumps

instead of laughing at big players for being too cautious we should try to understand why they are so confident

the six point five billion on Aave is not just a number

it is proof that the game is changing

and the smart money is positioning itself early

those who learn from this shift will be ready for the next stage of crypto growth

those who ignore it will keep wondering why institutions see opportunity where retail only sees doubt