The crypto market is showing early signs of capital rotation after a volatile start to the year. While most assets remain range-bound, several altcoins are consolidating just below key resistance levels, suggesting potential upside if momentum continues.

Coinphoton has identified three altcoins that stand out due to strong price structure, clear bullish signals, and well-defined invalidation levels.

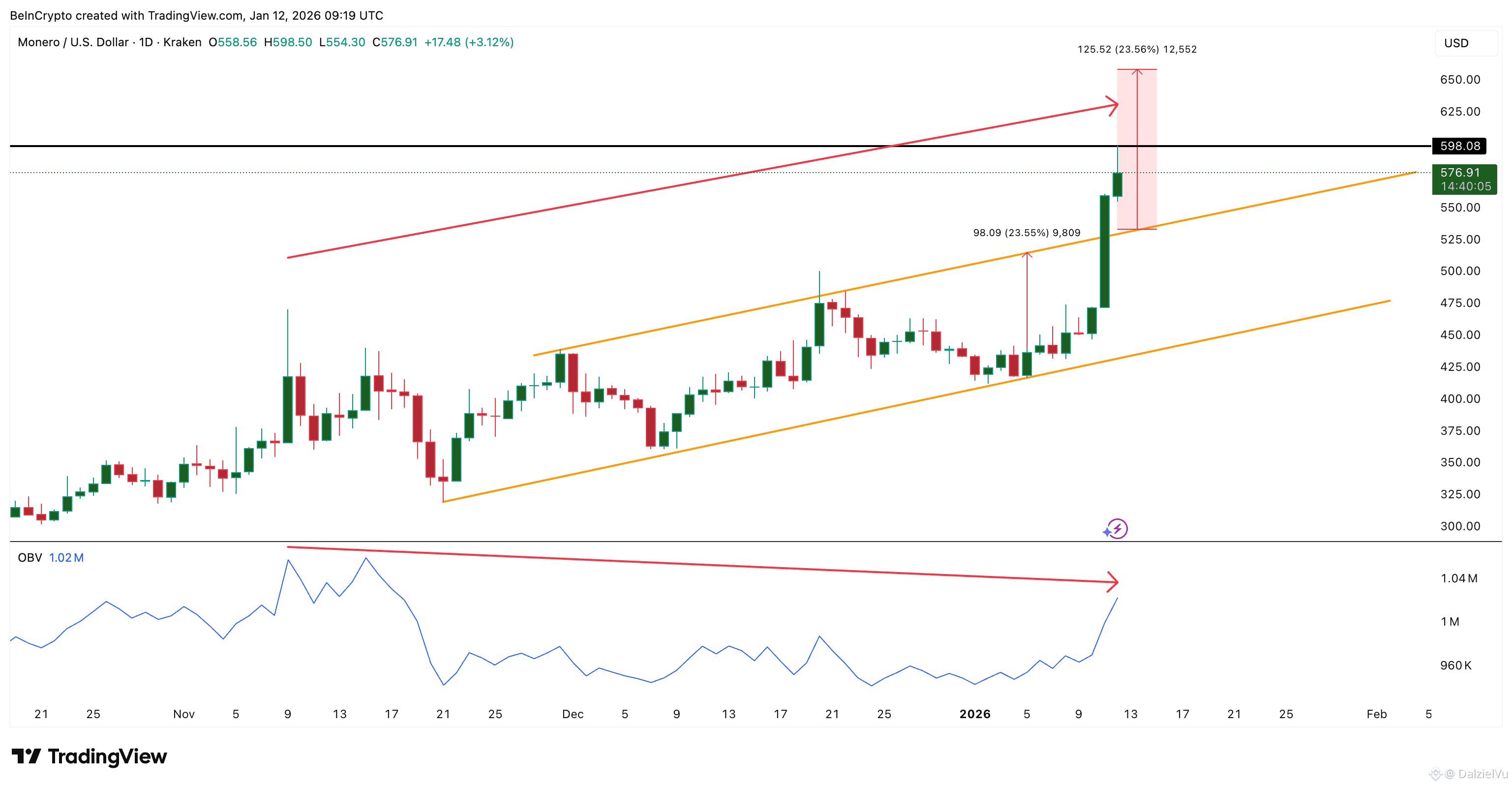

Monero ($XMR ) Privacy Narrative Leader 🛡️

Monero is emerging as a strong ATH candidate, driven by renewed interest in privacy-focused assets and capital rotation within the sector. Over the past week, $XMR has gained significant momentum and has already pushed into its previous all-time-high zone around $598.

Technical outlook

Breakout from an ascending channel on Jan 11

Bullish structure remains intact despite selling pressure near ATH

⚠️ Risk signal:

OBV shows bearish divergence, indicating that volume support is weaker and confirmation is still needed.

Key levels

Upside targets: $658 → $704

Invalidation: Below $523 (Fib 0.618)

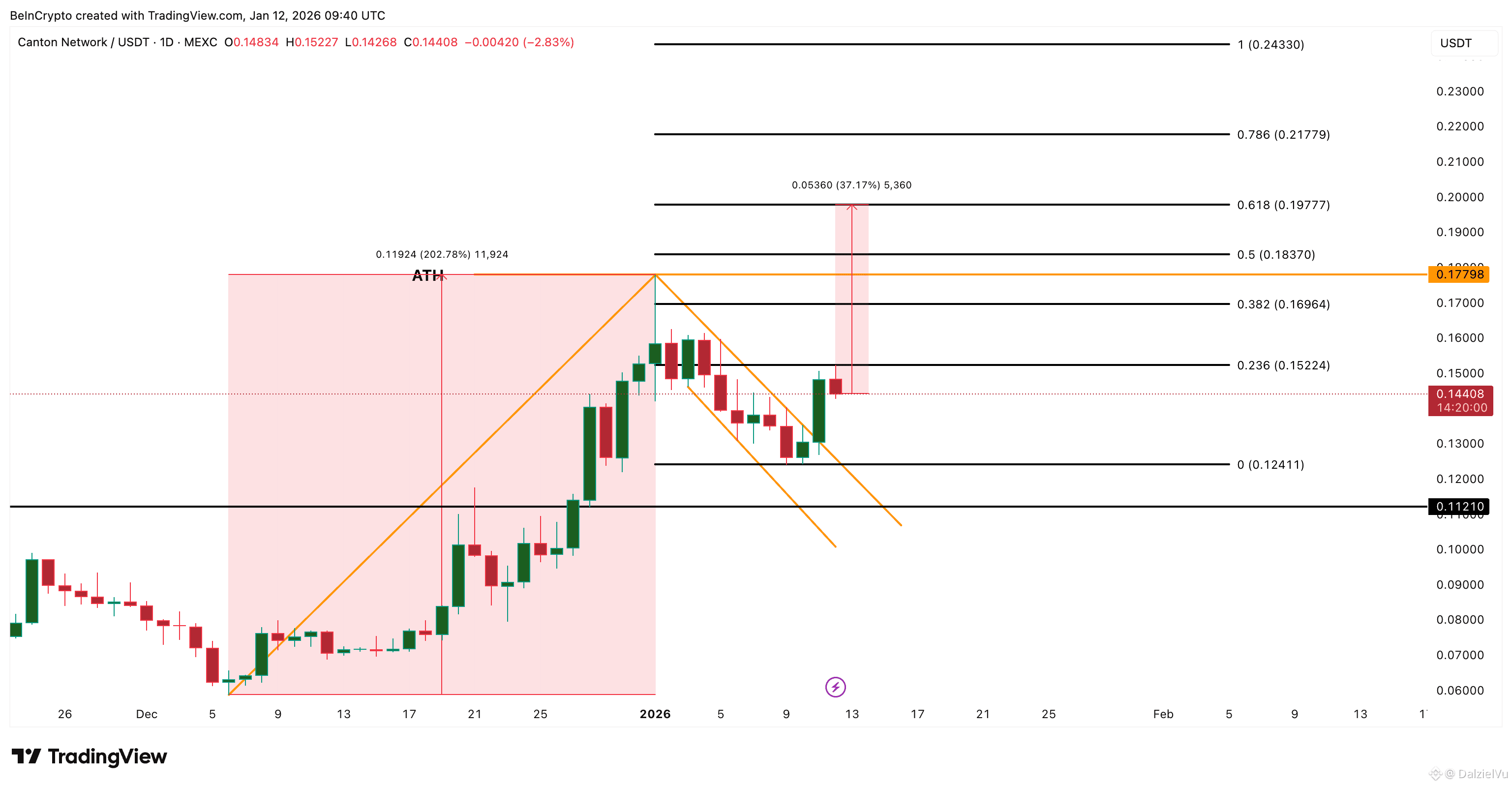

Canton (CC) Clean Bull Flag Breakout 🚩

Canton continues to show one of the clearest bullish structures among mid-cap altcoins. After a nearly 200% rally, price entered a healthy consolidation phase and formed a classic bull flag.

The breakout above the flag on Jan 11 suggests trend continuation rather than late-cycle exhaustion.

Key levels

Resistance: $0.177 (previous ATH)

If confirmed above this level, $CC enters price discovery

Targets

$0.197 → $0.243

⚠️ Invalidation:

Loss of $0.124 weakens the bullish setup, with $0.112 as critical support.

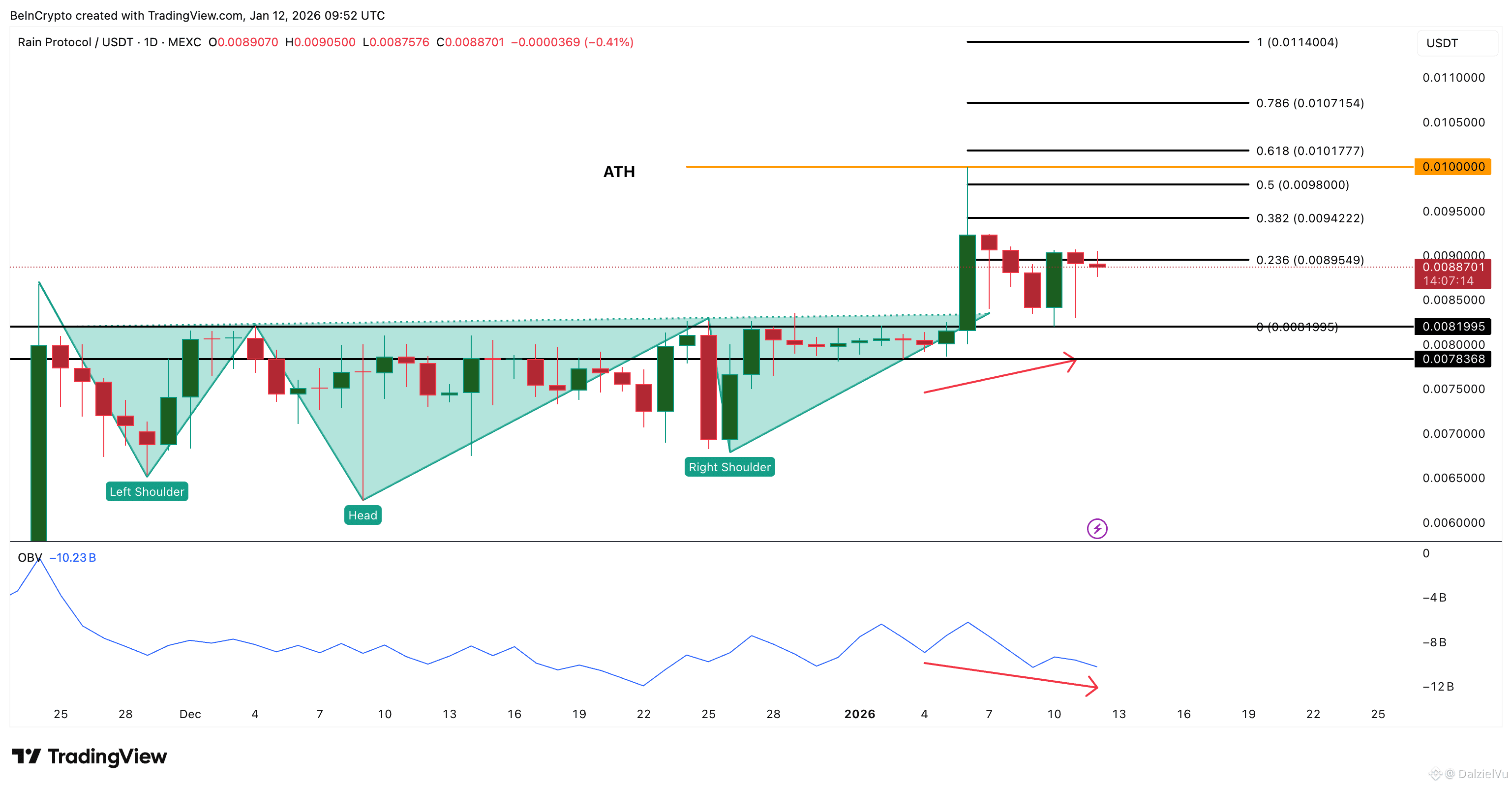

Rain ($RAIN) Consolidation Before Expansion

Rain is trading just below its all-time high and appears to be resetting after an impulsive move earlier this month. The breakout from an inverse head-and-shoulders pattern on Jan 6 remains structurally valid.

Price recently pulled back to $0.0081 and rebounded, showing that buyers are still defending higher lows.

Key levels

Resistance: $0.0089

ATH zone: $0.010

⚠️ Volume watch:

OBV divergence suggests participation has cooled and volume expansion is required for a sustained breakout.

Invalidation

Below $0.0081, risk shifts toward deeper consolidation near $0.0078