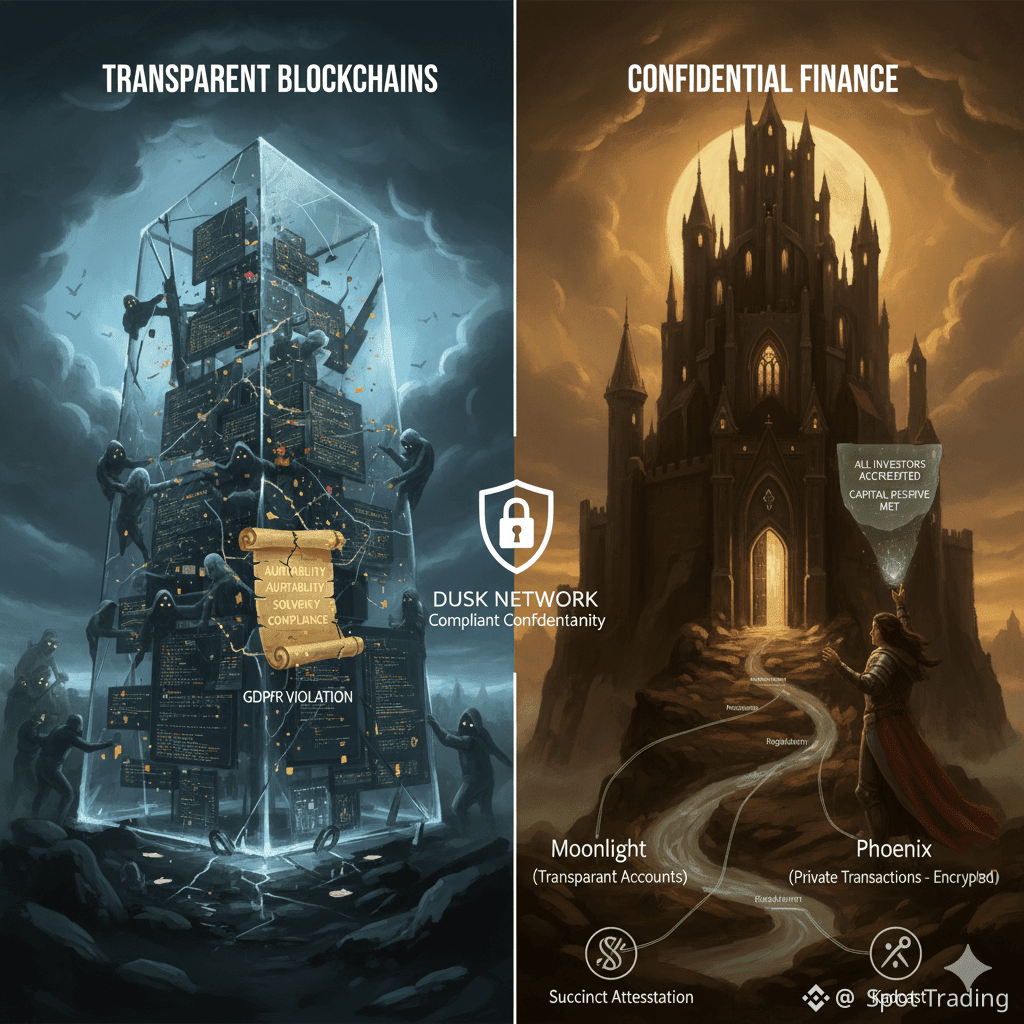

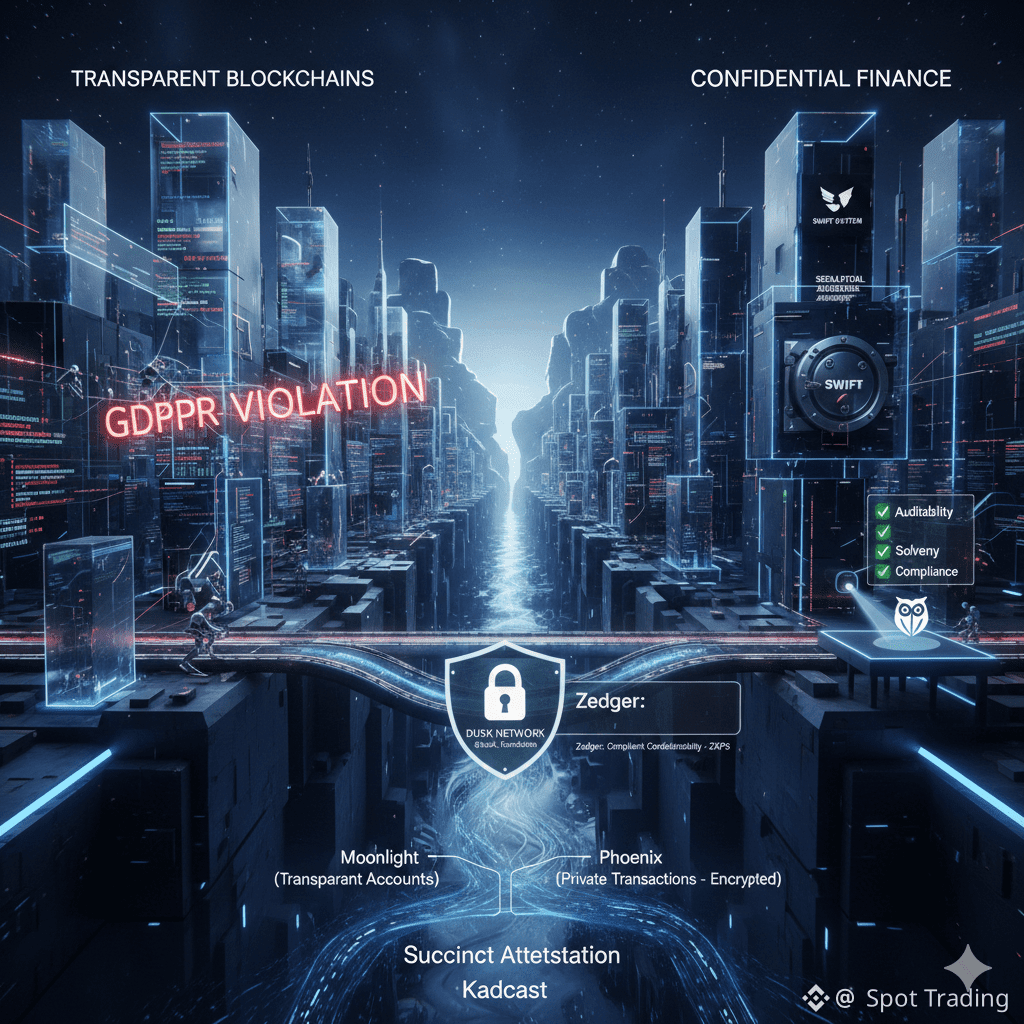

The original promise of blockchain was transparency—to make a public, immutable record for all to view. For many use cases, this has been a huge breakthrough. However, in the multi-trillion-dollar traditional and institutional world of finance, this transparency is, in fact, the biggest impediment to adoption. The truth is that in finance, confidentiality is not a nicety, but a necessity.

The Fundamental Mismatch: Transparency vs. Operation

Public blockchains such as Ethereum or Solana function according to the principle of indiscriminate disclosure. Each transaction amount and each address of the wallets as well as all contract interactions are public. Although the blockchains are transparent in this way and ensure a high degree of accountability within the networks, this is absolutely incompatible with finance as the transaction amounts and addresses are publicly.

Strategic Front Running:

A portfolio rebalancing by a fund and a large trade by a bank's OTC desk would be transparent in a real-time environment, and this practice of front running by rivals and bots would chip away at its value.

Breach of Confidentiality of Clients:

This is yet another duty of financial institutions. They are expected to handle client information, specifically financial data, in a confidential way. By having an open ledger, their entire financial dealings will be revealed, violating GDPR, among other laws.

Intellectual Properties within Smart Contracts:

The business logic contained within a complex financial smart contract—a novel derivatives pricing algorithm or a credit scoring system—must have its code base entirely open source, enabling it to be immediately cloned and undermining any potential advantage.

Market Stability Risks:

The publicly observable nature of large distressed trades might result in risky predatory actions despite the requirements of a stable financial system.

Finance works on the model of “need to know” transparency as opposed to broadcasting. This is why the sector makes use of private databases, secure messaging systems (like the SWIFT system), and secret bilateral agreements.

The Compliance Paradox “But regulators require transparency!” is often the tart reply to this. This is a deeply misconstrued point. What regulators require is auditability and access to supervision, not transparency. What they want is the ability to investigate, to prove solvency, and to verify compliance. Even if there is complete transparency of public blockchains, they do not gain any advantage over any other civilian; they merely lose their right to perform targeted and undercover inquiry in order to prevent any panic in the markets.

"The real need is for a principle of selective revelation. A system requires a way to cryptographically verify that it conforms with regulatory requirements without making underlying sensitive information available to the public at large. That is a chasm that cannot be spanned by the base layer of a transparent blockchain."

"Enter Dusk: A Native Solution, Not a Patch" This is where @Dusk radically differs. Rather than constructing a system in which privacy is an afterthought to be retrofitted in with tenuous “layer-2” solutions, or accomplishing it in no way and leaving it to others to figure out how to add it on later as an afterthought after realizing that non-private systems will have no security to preserve anyway, Dusk Foundation’s design of its blockchain, as described in its whitepaper, includes privacy.

The Dual-Transaction Engine: Dusk derives two engines:

Moonlight and Phoenix, each serving a distinct purpose, one with a focus on transparent and account-based transactions and the other, an UTXO-based private transaction engine called Phoenix. In the case of Phoenix, the transactions are made confidential through the utilization of Zero-Knowledge Proofs (ZKPs). These transactions are checked for their authenticity, validating the lack of a double spend and adherence to rules on the network, without knowing the transaction details, including the parties and amount, involved in the transaction.

Zedger:

The Protocol for Compliant Confidentiality: This is the genius part. Zedger refers to a smart contracts framework used specifically for financial instruments, namely securities and RWAs. This allows all contractual language, ownership, as well as all transactions, to stay under lockdown. More critically, it incorporates oracle functions regarding regulatory compliance. The certified auditor or regulator may be provided the capability to create a zero-knowledge proof related, say, "all investors are accredited" or "capital reserve requirement satisfied" without having access to the actual underlying data, which directly honors the desired requirement of the regulators.

The infrastructure is backstopped by Succinct Attestation, a proof-of-stake consensus that provides transaction finality in seconds, and Kadcast, an efficient peer-to-peer network that reduces bandwidth usage and stale blocks. It's not just about privacy; it's building out a stack that will meet the performance and predictability requirements of global markets.