The models of Walrus operator profitability have shown returns on hardware greater than three-year breakeven requirements based on the conservative pricing assumptions. The cost-benefit analysis shows that NVMe storage arrays demonstrate 25% of capital returns on an annual basis when operational in moderate capacity utilization. This economic sustainability is appealing to infrastructure providers who are willing to construct profitable businesses that are not reliant on hypothetical token appreciation.

Hardware amortization schedules are consistent with components replacement schedules that allow recycling of capital constantly. Walrus operators update infrastructure after every 4 years keeping it technologically current without any overhead cost of full replacement. The management of depreciation enhances economics better than the traditional operations of data center that have to have a special accounting treatment.

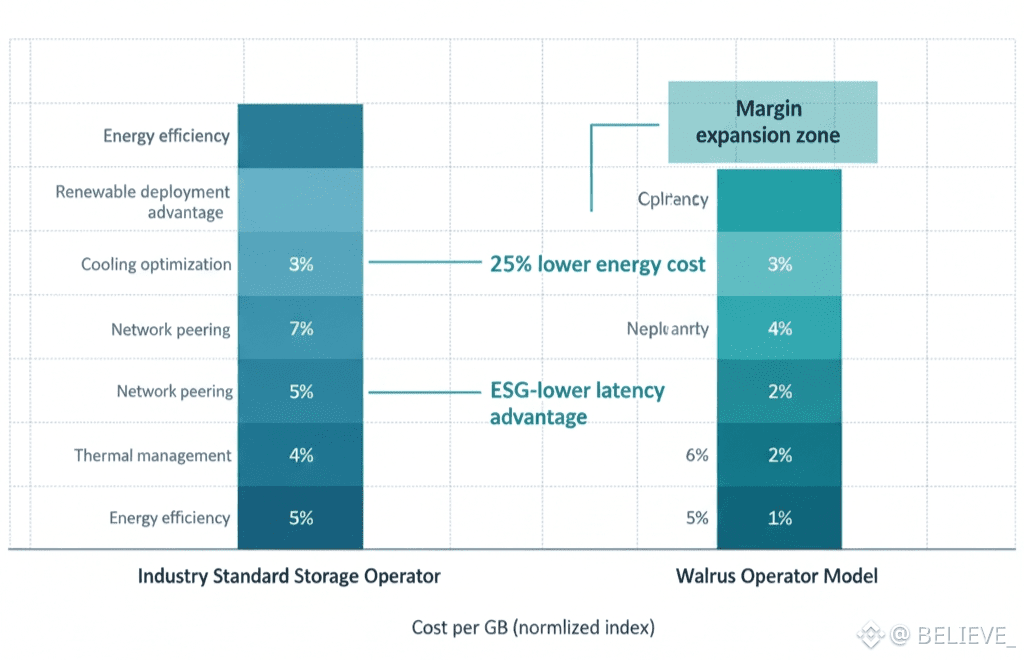

When the operators of energy costs gain competitive penalties by expanding the margins, power consumption optimization attains strategic differentiator. Walrus promotes deployments that are based on renewable powers with preferential treatment of stake weights on environments friendly capital. Competitors who operate on a sustainable basis appeal to ESG-driven delegators with premium valuation multiples.

Efforts to cool down cost increase over deployment periods. Per-gigabyte energy costs are a quarter less than industry standards used by walrus operators who use sophisticated thermal management. Operational excellence is directly transformed into competitive pricing that makes it expand its market share by offering better economics.

The optimization of network connectivity is transformed into material cost factor making operators competitive. Walrus operators who have preferential peering arrangements with providers of tier-1 backbone attain 30 percent lower latency than commodity transit. The effects of decisions of geographic positioning are significant in throughput economics which affect profitability in a material manner.

Facility consolidation strategies facilitate operators that are consolidating several small deployments in central facilities. Walrus saves administrative overhead by consolidating operations that enhance pay-off of management effort much better. Specialization of infrastructure is achieved by having operators specializing in storage which would be capital efficient.

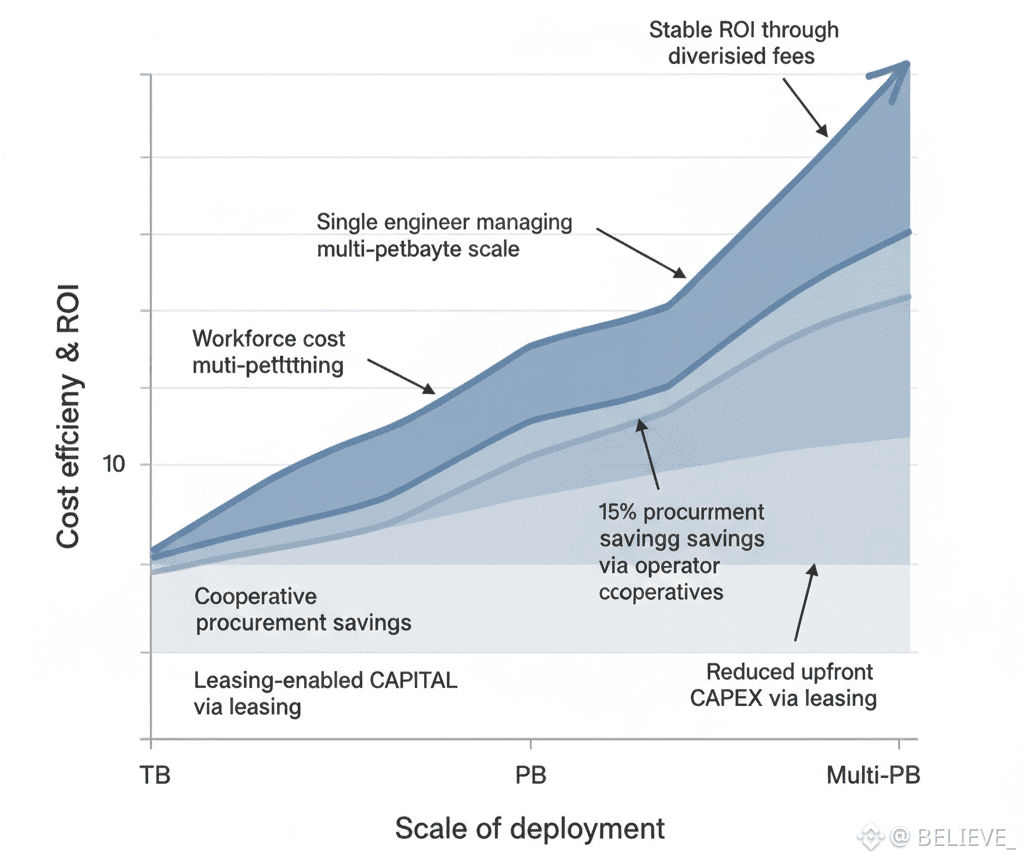

The size of workforce in the operators has not been significantly reduced yet in infrastructure being automated to carry out the regular functioning. Single engineers dealing with multi-petabyte deployments that would decrease the cost of personnel significantly are supported by Walrus. There are opportunities of labor arbitrage where the global operators in geographies which are low cost compete in terms of total cost.

The capital equipment leasing options lower reimbursement expenses on starting deployments and allow quicker scaling. Ownership leasing equipment Walrus operators incur very low up front capital needs by using equipment financing as opposed to ownership. Financial flexibility enhances operator capacities to scale to speedy responding to demand indicators in real-time.

Hardware buying at wholesale aggregates lower the costs of components due to the effect of volume discounts. Walrus operator cooperatives that buy in large groups realize 15% cost savings that are in comparison to small scale procurement. The collective bargaining power increases competitiveness in proportion to the scale of participants.

There are geographic arbitrages which are opportunities of exploiting better electricity prices in different parts of the world. By establishing themselves in places of renewable abundance, Walrus operators enjoy cost advantages over energy that can be offered at aggressive prices. The formation of regional specialization One way operators can maximise local factor conditions systematically.

Vertical integration strategies. The cost of components that Walrus operators of custom storage appliances are making is comparable to those of hyperscalers. Custom hardware has hardware designs that help in optimizing erasure coding and erase codes consume less computation.

The expert capacity planning field stops excessive wasteful overprovisioning. Walrus operators who operate on the basis of demand forecasting align infrastructure development with that of revenue growth. Conservative scaling eliminates stranded capital in excess capacity which has not materialized into demand.

Maintenance scheduling also maximizes the utilization of equipment so that when equipment is being replaced it is not overutilised. Walrus provides rolling maintenance without service interruption by use of a redundancy architecture. Maintenance engineering disciplines yield operational efficiency.

Infrastructure sunk costs are safeguarded by disaster recovery investment to avoid complete devastation by disasters. Walrus operators that spread their operations across geographic lines opportunities spread the risk of concentrating capital requirements in a single-facility ratio. Risk-adjusted returns through resilience engineering are better.

Commission creates diversity in earnings to operators, which lowers concentration of revenue to operators. Walrus makes operators receive retrieval fees, verification rewards and repair bonuses at the same time. Various sources of revenues enhance financial stability in operators through market cycles.

The risk of customer concentration is controlled so that the revenues are not hung on one-to-one relationships with tenants. Walrus promotes extensive customer bases that allow operators who would not lose their businesses in case of tenant exit. The diversity of customer portfolio enhances stability to facilitate sure long term planning.

Investing in supply chain resiliency precludes lock-in by the vendor that limits operational adaptability. The risk of single-vendor dependence is removed by having multiple hardware vendors, which, in turn, is supported by the operations of Walrus operators. Procurement flexibility enhances bargaining power that is cost competitive.

Optimization of insurance portfolio helps cushion the asset base against insurable risks. Walrus allows operators to secure commercial coverage of hardware failures, liability coverage and business interruption. Risk management enhances financial security that would allow it to operate with confidence.

The treasury management discipline levels out the cash flows of the operators through seasonal fluctuations in revenue. Walrus allows operators who carry reserves that would not cause working capitals deficits in times of declining market. Economic stability between financial periods makes operators more resilient.

Optimization of compensation structure makes the employees more incentive effort in line with profitability of the operator. Walrus allows operators to provide a bonus on performance in the form of operational excellence reward. Motivation amongst the staff is even further crossed when team success directly translates into individual monetary gain.

Innovation and consistency of operation are balanced in technology investment roadmaps. Competitive positioning by Walrus operators increasing research budgets on efficiency will enhance it. Cost leadership also persists due to continued optimization through changes in the capabilities of competitors.

Dynamics of operator consolidation arise as the scale benefits increase with time. Walrus empowers bigger operators with economies that are larger than cost structures of smaller operators. Consolidation in the markets increases faster with better services levels as it has achieved maturity in its operations.

The optionality of exit strategy allows operators who wish to sell businesses that are successful to strategic buyers. Walrus offers good exit liquidity which is appealing to infrastructure operators who are entrepreneurially-minded. The availability of liquidity is a lure to the entrepreneurial talent in developing world-class infrastructure businesses in a systematic manner.

Walrus operator economics show that rational capital is enticed to legitimate profit making by decentralized storage. Hardware ROI proves financial input that is secure in infrastructural investment. Price expansion competitive is made possible through operational optimization. The concept of Specialization provides lucrative niches that allow the existence of various business concepts. Margin on the disorder basis guarantees sustainability throughout the market cycles. Leveraged capital use builds competitive advantages. Rational economics appeals to serious infrastructure operators who are residential entrepreneurs that establish permanent businesses and not a toy trade that turns storage layer into institutional grade backbone infrastructure.