Key Highlights

HYPE is down nearly 12% weekly, with price struggling to regain bullish momentum amid sustained selling pressure.

Major whale linked to Tornado Cash continues unloading HYPE, with ~$8.2M sold in the latest round alone.

Around 1.3 million HYPE tokens are currently unstaking, adding near-term supply risk.

Price is testing a critical support zone near $23.40, which aligns with the lower boundary of the descending channel.

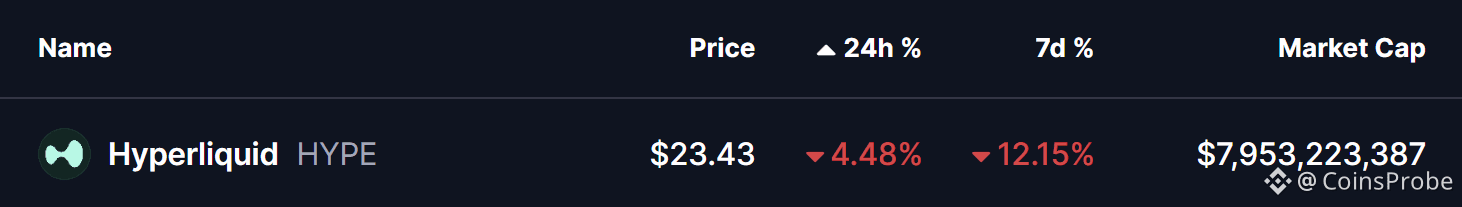

Hyperliquid’s native token, $HYPE , remains under sustained selling pressure as bearish momentum continues to dominate short-term price action. As of January 12, HYPE is trading lower by 4.48% on the day, extending its weekly decline to over 14%. Price is currently stabilizing around the $23.40 zone, an area that has now become technically critical.

The ongoing weakness is being driven by a combination of aggressive on-chain selling from a large holder and a fragile technical structure, raising questions about whether current support can withstand further supply pressure.

Source: Coinmarketcap

Source: Coinmarketcap

Persistent Unloading From a Major Holder

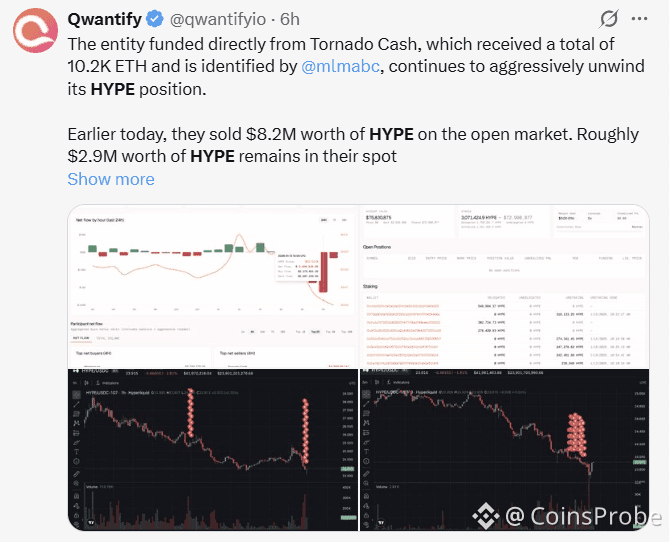

At the center of HYPE’s recent decline is continued distribution from a large entity linked to Tornado Cash-funded wallets. On-chain investigator @mlmabc highlighted that this cluster—originally seeded with 10.2K ETH—has been steadily liquidating its HYPE position.

The entity accumulated HYPE shortly after the token generation event in late 2024 at an estimated average cost of $8.80, placing it deep in profit. However, its ongoing market sells have created significant overhead pressure.

In the latest round of activity, approximately $8.2 million worth of HYPE was sold on the open market, pushing spot liquidity to its limits and triggering a peak taker delta of -$3.4 million on Hyperliquid’s spot market.

Source: @qwantifyio (X)

Source: @qwantifyio (X)

Key transactions included:

0x9abe…e0b0 selling ~$5.36M HYPE at an average price of $24.23

0x1f68…8053 selling ~$2.91M HYPE at an average price of $23.97

Despite these sales, the entity still controls roughly 3 million HYPE, valued near $73 million at current prices.

Unlock Schedule Adds Risk

Compounding concerns is the fact that 1.3 million HYPE is currently unstaking, with multiple unlock tranches scheduled between January 13 and January 19. Based on previous behavior, these unlocked tokens are likely to be sold into the market.

If the remaining exposure continues to unwind over the coming weeks, supply-side pressure could intensify, particularly if broader market sentiment fails to improve.

Source: @frontrunnersx (X)

Source: @frontrunnersx (X)

Can Hyperliquid (HYPE) Hold Key Support?

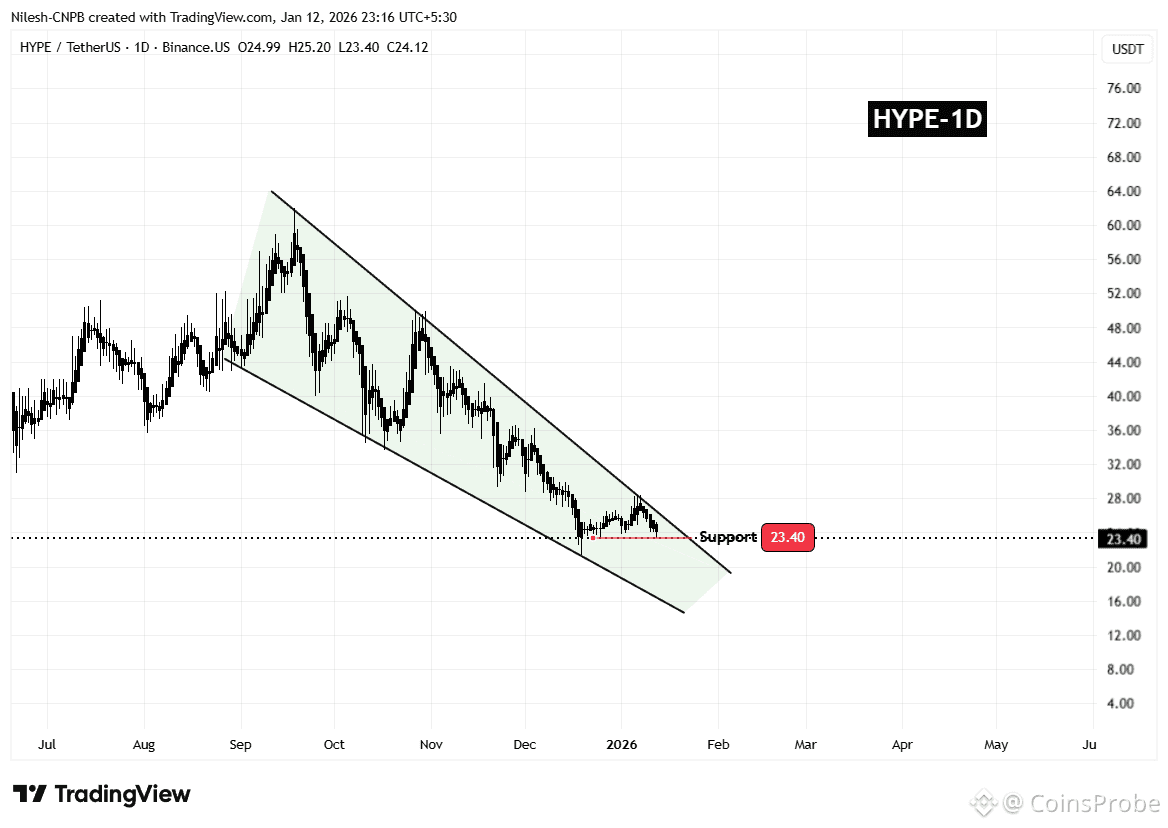

From a technical perspective, HYPE is trading within a falling wedge, reflecting a well-established downtrend since late 2025. Price is now testing a key horizontal support zone near $23.40.

While falling structures can sometimes resolve into bullish reversals, the current context remains fragile. Continued whale distribution and weak momentum reduce the probability of an immediate rebound.

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

Hyperliquid (HYPE) Daily Chart/Coinsprobe (Source: Tradingview)

A decisive daily close below $23.40 would weaken the structure further and could expose HYPE to the next downside area near $21.38, a level that aligns with prior demand zones and historical reactions.

Conversely, holding this support and stabilizing volume could allow price to consolidate before any meaningful recovery attempt—but confirmation is still lacking.

Bottom Line

Hyperliquid (HYPE) is at a decisive technical and structural crossroads. While price is attempting to stabilize near the $23.40 support zone, continued whale unloading and upcoming token unlocks keep the market under pressure. If buyers fail to defend this level, further downside toward the low-$21 region becomes increasingly likely. A sustained recovery will require both absorption of supply and a clear shift in momentum — neither of which has yet been confirmed.

Frequently Asked Questions (FAQ)

What is causing the recent drop in Hyperliquid (HYPE) price?

The decline is mainly driven by continued selling from a large whale wallet linked to Tornado Cash, combined with broader market weakness and rising token supply from upcoming unlocks.

What is the key support level for HYPE right now?

The most important support is around $23.40. A confirmed breakdown below this level could trigger further downside.

What happens if HYPE loses $23.40 support?

A clean break below $23.40 may open the door toward the next major support near $21.38, increasing downside risk in the short term.

Disclaimer: The views and analysis presented in this article are for informational purposes only and reflect the author’s perspective, not financial advice. Technical patterns and indicators discussed are subject to market volatility and may or may not yield anticipated results. Traders should perform independent research and make decisions aligned with their personal risk tolerance.