A recent post by crypto enthusiast Bird offers a different way to look at XRP’s valuation—by comparing it directly to $ETH based purely on market capitalization, not short-term price action or speculation.

Instead of asking “How high can $XRP go?”, the analysis asks a simpler question:

What would XRP be worth if it had Ethereum’s current market cap?

👉 $XRP at Ethereum’s Market Capitalization

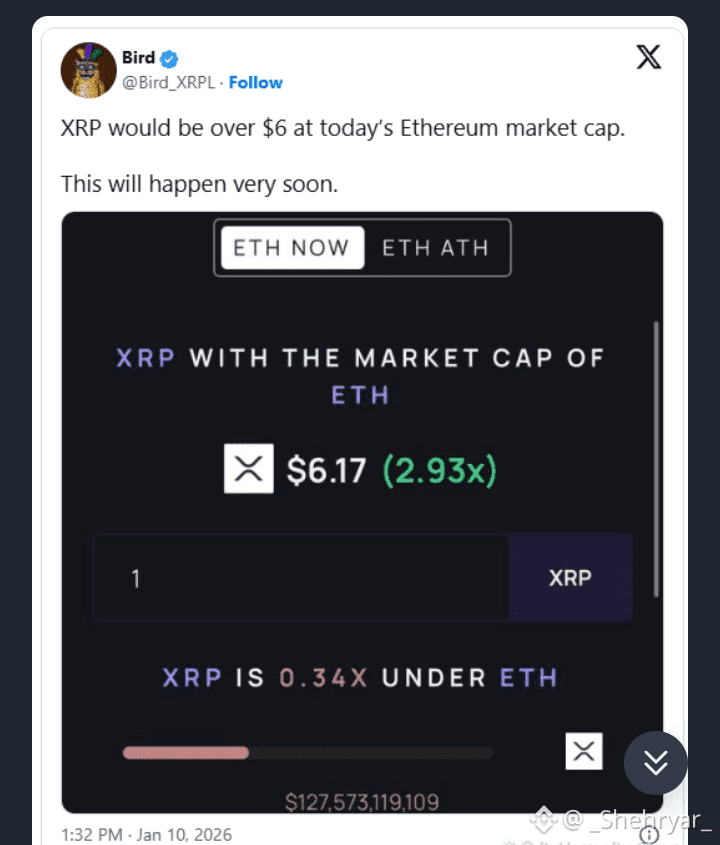

According to the figures shared, if XRP were valued at the same market capitalization as Ethereum today, its price would be around $6.17 per token.

That would represent roughly a 3× increase from XRP’s price at the time of the post. The visuals also highlight that XRP’s current market cap sits at about one-third of Ethereum’s, showing a significant valuation gap between the two assets.

Importantly, this is a purely mathematical comparison:

No changes to XRP’s circulating supply

No token burns or structural assumptions

Based solely on aligning XRP’s total market value with Ethereum’s

👉 Community Reactions: Optimism vs. Skepticism

The post sparked mixed responses within the crypto community.

Some argued that if XRP were ever to surpass Ethereum in market cap, it could force a broader re-evaluation of long-standing assumptions about crypto market hierarchy—even raising questions around dominance beyond just ETH.

Others pushed back, calling market-cap comparisons misleading and expressing doubt that XRP could ever reach such valuations. These opposing views reflect the ongoing debate over whether relative valuation is a meaningful indicator or simply a theoretical exercise.

👉 Factors Often Cited in a Bullish XRP Case

Supporters of XRP point to several fundamentals that could support higher valuation over time:

XRP’s focus on fast, low-cost value transfer and settlement

Ongoing development of the XRP Ledger, including tokenization and institutional tools

Potential impact of regulatory clarity, which could open doors for broader institutional use

Growing demand for blockchain-based payment and liquidity solutions

👉 A Valuation Illustration, Not a Prediction

The $6+ figure is not presented as a guarant eed target, but as a valuation reference point. It simply shows how differences in market capitalization translate into price when supply remains constant.

eed target, but as a valuation reference point. It simply shows how differences in market capitalization translate into price when supply remains constant.

Whether XRP ever closes that gap with Ethereum will depend on adoption, regulation, and broader market conditions. Still, the comparison provides a clear snapshot of where XRP stands today—and how much room exists if relative valuation were ever to shift.