Current Price

$ 907.63

Price Prediction

$ 914.47

(1.30%)

Fear & Greed Index

29 (Fear)

Sentiment

Bullish

Volatility

2.57% (Medium)

Green Days

16/30 (53%)

50-Day SMA

$ 873.10

200-Day SMA

$ 892.84

14-Day RSI

58.50 (Neutral)

According to our latest Binance Coin price prediction, BNB is forecasted to rise by 1.30% and reach $ 914.47 by February 10, 2026. Per our technical indicators, the current sentiment is Bullish while the Fear & Greed Index is showing 29 (Fear). Binance Coin recorded 16/30 (53%) green days with 2.57% price volatility

Current Price$ 907.63Price Prediction $ 914.47 (1.30%)Fear & Greed Index 29 (Fear)Sentiment BullishVolatility 2.57% (Medium)Green Days 16/30 (53%)50-Day SMA $ 873.10200-Day SMA $ 892.8414-Day RSI 58.50 (Neutral)

According to our latest Binance Coin price prediction, BNB is forecasted to rise by 1.30% and reach $ 914.47 by February 10, 2026. Per our technical indicators, the current sentiment is Bullish while the Fear & Greed Index is showing 29 (Fear). Binance Coin recorded 16/30 (53%) green days with 2.57% price volatility

In 2026, Binance Coin (BNB) is anticipated to change hands in a trading channel between $ 855.28 and $ 1,425.16, leading to an average annualized price of $ 1,123.30. This could result in a potential return on investment of 57.16% compared to the current rates

Binance Coin Technical Analysis

Neutral

Bullish 70%

Bearish

30%

Based on data from January 12, 2026 at 03:50, the general Binance Coin price prediction sentiment is neutral with 23 technical analysis indicators signaling bullish signals, and 10 signaling bearish signals.

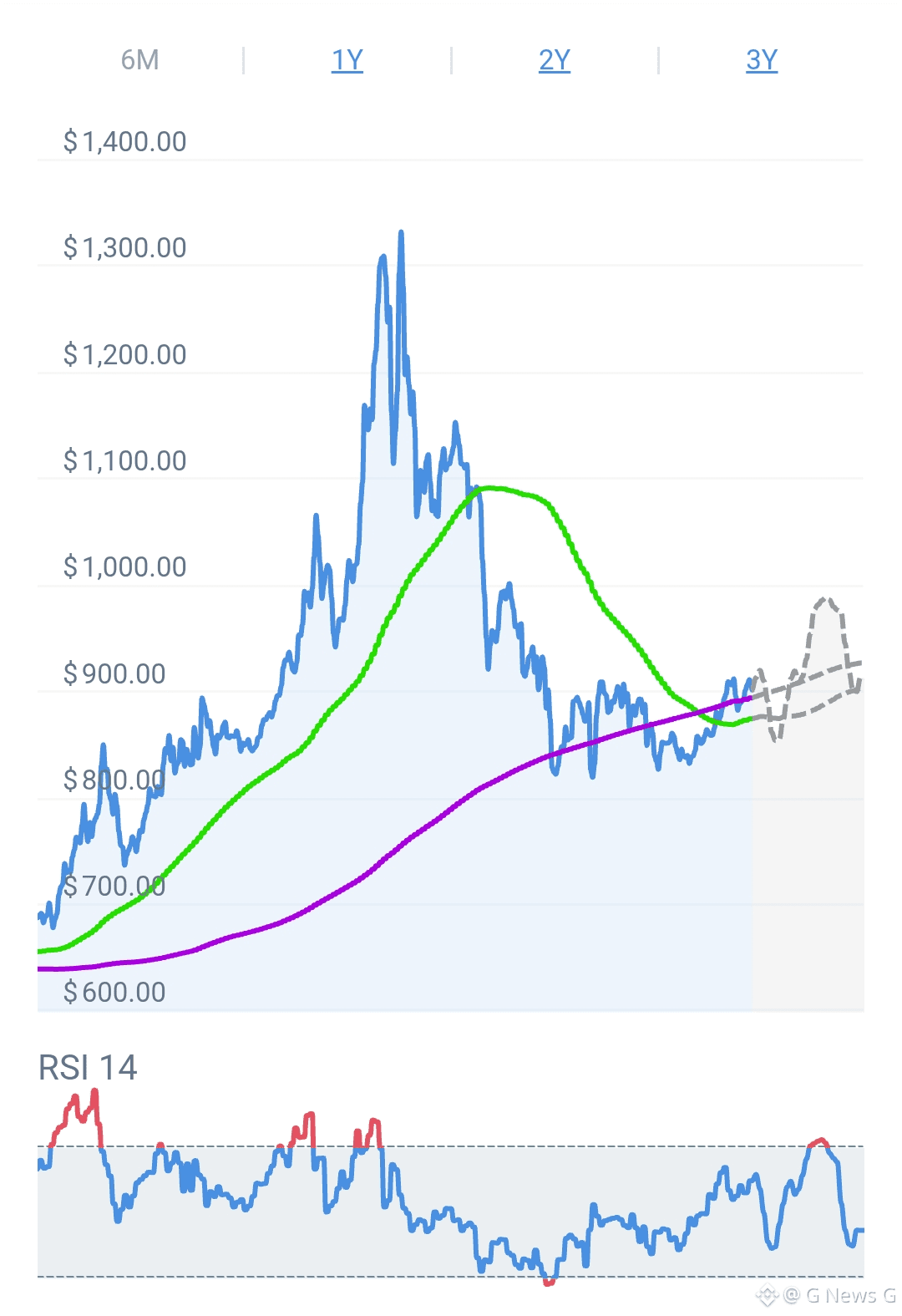

Binance Coin's 50-Day SMA, 200-Day SMA, and 14-Day RSI

Based on our technical indicators, Binance Coin's 200-day SMA will rise in the next month and will hit $ 928.42 by Feb 10, 2026. Binance Coin's short-term 50-Day SMA is estimated to hit $ 904.54 by Feb 10, 2026.

The Relative Strength Index (RSI) momentum oscillator is a popular indicator that signals whether a cryptocurrency is oversold (below 30) or overbought (above 70). Currently, the RSI value is at 58.50, which indicates that the BNB market is in a neutral position.

Binance Coin Key Price Levels

Based on today's classical pivot point (P1) with the value of $ 905.84, Binance Coin has support levels of $ 897.52, $ 888.12, and the strongest at $ 879.80. Similarly, Binance Coin resistance levels are at $ 915.25, $ 923.57, and $ 932.97.

CoinCodex - Crypto Prices, Charts, and Cryptocurrency Market CapGet App

Search for coins, ICOs, exchanges...

BNB

Binance Coin

$ 906.66

-0.27% Last 24H

Alternative

Overview

Price Prediction

Exchanges

News

Guides

Historical Data

Binance Coin (BNB) Price Prediction 2026, 2027-2030

5-Day Prediction

$ 892.62

1-Month Prediction

$ 914.47

3-Month Prediction

$ 1,250.10

6-Month Prediction

Unlock

1-Year Prediction

Unlock

2030 Prediction

Unlock

2040 Prediction

Unlock

2050 Prediction

Unlock

• Live

Be the first to vote!

Vote to see results

What will BNB's price be at the end of Q1?

Current Price

$ 907.63

Price Prediction

$ 914.47

(1.30%)

Fear & Greed Index

29 (Fear)

Sentiment

Neutral

Volatility

2.57% (Medium)

Green Days

16/30 (53%)

50-Day SMA

$ 873.10

200-Day SMA

$ 892.84

14-Day RSI

58.50 (Neutral)

According to our latest Binance Coin price prediction, BNB is forecasted to rise by 1.30% and reach $ 914.47 by February 10, 2026. Per our technical indicators, the current sentiment is Neutral while the Fear & Greed Index is showing 29 (Fear). Binance Coin recorded 16/30 (53%) green days with 2.57% price volatility over the last 30 days. Last update: Jan 12, 2026

Investment Calculator

If you invest $ 1,000.00 in Binance Coin today and hold until Sep 22, 2026, our prediction suggests you could see a potential profit of $ 571.88, reflecting a 57.19% ROI over the next 252 days.

Investment

1,000.00

HODL Until

22/09/2026

Estimated Profit

≈ $ 571.88

(57.19% ROI)

Disclaimer

Disclaimer: This is not investment advice. The information provided is for general information purposes only. No information, materials, services, or other content provided on this page constitutes a solicitation, recommendation, endorsement, or any financial, investment, or other advice. Seek independent professional consultation in the form of legal, financial, and fiscal advice before making any investment decision.

Short-Term Binance Coin Price Targets

Date Prediction Change

Jan 12, 2026 $ 902.77

-0.43%

Jan 13, 2026 $ 914.66

0.88%

Jan 14, 2026 $ 921.48

1.63%

Jan 15, 2026 $ 911.50

0.53%

Jan 16, 2026 $ 892.62

-1.55%

Over the next five days, Binance Coin will reach the highest price of $ 921.48 on Jan 14, 2026, which would represent 1.63% growth compared to the current price. This follows a 0.64% price change over the last 7 days.

Long-Term Binance Coin Prediction (2026-2050)

2026

2027

2028

2029

2030

2040

2050

Month Min Price Avg. Price Max. Price Change

Jan 2026 $ 855.28 $ 925.95 $ 989.82

9.17%

Feb 2026 $ 909.26 $ 974.60 $ 1,057.92

16.68%

Mar 2026 $ 1,022.50 $ 1,120.57 $ 1,250.10

37.88%

Apr 2026 $ 1,167.20 $ 1,275.46 $ 1,328.97

46.58%

May 2026 $ 1,109.08 $ 1,158.17 $ 1,217.80

34.32%

Jun 2026 $ 1,090.53 $ 1,141.90 $ 1,201.99

32.57%

Jul 2026 $ 1,113.17 $ 1,153.99 $ 1,199.33

32.28%

Aug 2026 $ 1,104.93 $ 1,141.78 $ 1,257.94

38.74%

Sep 2026 $ 1,130.88 $ 1,270.23 $ 1,425.16

57.19%

Oct 2026 $ 1,069.47 $ 1,176.22 $ 1,274.21

40.54%

Nov 2026 $ 985.82 $ 1,120.38 $ 1,198.33

32.17%

Dec 2026 $ 1,013.44 $ 1,020.30 $ 1,032.47

13.88%

In 2026, Binance Coin (BNB) is anticipated to change hands in a trading channel between $ 855.28 and $ 1,425.16, leading to an average annualized price of $ 1,123.30. This could result in a potential return on investment of 57.19% compared to the current rates.

Binance Coin Technical Analysis

Neutral

Bullish 70%

Bearish 30%

Based on data from January 12, 2026 at 03:50, the general Binance Coin price prediction sentiment is neutral with 23 technical analysis indicators signaling bullish signals, and 10 signaling bearish signals.

The analysis was last updated on January 12, 2026

Binance Coin's 50-Day SMA, 200-Day SMA, and 14-Day RSI

6M

1Y

2Y

3Y

Based on our technical indicators, Binance Coin's 200-day SMA will rise in the next month and will hit $ 928.42 by Feb 10, 2026. Binance Coin's short-term 50-Day SMA is estimated to hit $ 904.54 by Feb 10, 2026.

The Relative Strength Index (RSI) momentum oscillator is a popular indicator that signals whether a cryptocurrency is oversold (below 30) or overbought (above 70). Currently, the RSI value is at 58.50, which indicates that the BNB market is in a neutral position.

Binance Coin Key Price Levels

Based on today's classical pivot point (P1) with the value of $ 905.84, Binance Coin has support levels of $ 897.52, $ 888.12, and the strongest at $ 879.80. Similarly, Binance Coin resistance levels are at $ 915.25, $ 923.57, and $ 932.97.

Support Levels

#Price Strength

S1 $ 897.52

S2 $ 888.12

S3 $ 879.80

Resistance Levels

#Price Strength

R1 $ 915.25

R2 $ 923.57

R3 $ 932.97

Popular BNB Moving Averages and Oscillators for Mon, Jan 12, 2026 #gnewsg

Moving averages (MA) are a popular indicator in all financial markets, designed to smooth price action over a certain amount of time. They are a lagging indicator, which means they are influenced by historical price activity. In the table below, you can find two types of moving averages, simple moving average (SMA) and exponential moving average (EMA).

Daily Simple Moving Average (SMA)

Period Value Action

SMA 3 $ 906.91 BUY

SMA 5 $ 893.41 BUY

SMA 10 $ 886.44 BUY

SMA 21 $ 866.21 BUY

SMA 50 $ 873.10 BUY

SMA 100 $ 972.70 SELL

SMA 200 $ 892.84 BUY

Daily Exponential Moving Average (EMA)

Period Value Action

EMA 3 $ 902.51 BUY

EMA 5 $ 896.91 BUY

EMA 10 $ 884.88 BUY

EMA 21 $ 875.36 BUY

EMA 50 $ 890.45 BUY

EMA 100 $ 909.32 SELL

EMA 200 $ 878.06 BUY

Weekly Simple Moving Average (SMA)

Period Value Action

SMA 21 $ 973.56 BUY

SMA 50 $ 778.78 BUY

SMA 100 $ 677.51 SELL

SMA 200 $ 437.81 BUY

Weekly Exponential Moving Average (EMA)

Period Value Action

EMA 21 $ 898.99 BUY

EMA 50 $ 811.84 BUY

EMA 100 $ 692.28 SELL

EMA 200 $ 537.82 BUY

Binance Coin Oscillators

An oscillator is a technical analysis tool that constructs high and low bands between two extreme values, and then builds a trend indicator that fluctuates within these bounds. Traders use the trend indicator to discover short-term overbought or oversold conditions.

Period Value Action

RSI (14) 58.50 SELL

Stoch RSI (14) 83.91 SELL

Stochastic Fast (14) 81.52 SELL

Commodity Channel Index (20) 66.67 NEUTRAL

Average Directional Index (14) 29.05 BUY

Awesome Oscillator (5, 34) 28.95 NEUTRAL

Momentum (10) 43.74 NEUTRAL

MACD (12, 26) 5.42 NEUTRAL

Williams Percent Range (14) -18.48 SELL

Ultimate Oscillator (7, 14, 28) 60.76 NEUTRAL

VWMA (10) 894.19 BUY

Hull Moving Average (9) 909.88 SELL

Ichimoku Cloud B/L (9, 26, 52, 26) 871.13 NEUTRAL

Correlation

Over the past 7 days, Binance Coin price was most positively correlated with the price of Pump.fun (PUMP), Optimism (OP), PancakeSwap (CAKE), Stacks (STX), and Kaspa (KAS) and most negatively correlated with the price of JUST (JST), KuCoin Token (KCS), World Liberty Financial (WLFI), UNUS SED LEO (LEO), and TRON (TRX).