DUSK doesn’t just have “stakers”—it has a system with rules, timing, and fairness mechanisms. That’s because DUSK is built for a serious target: privacy + compliance-ready finance, where the network must be stable, resistant to manipulation, and predictable.

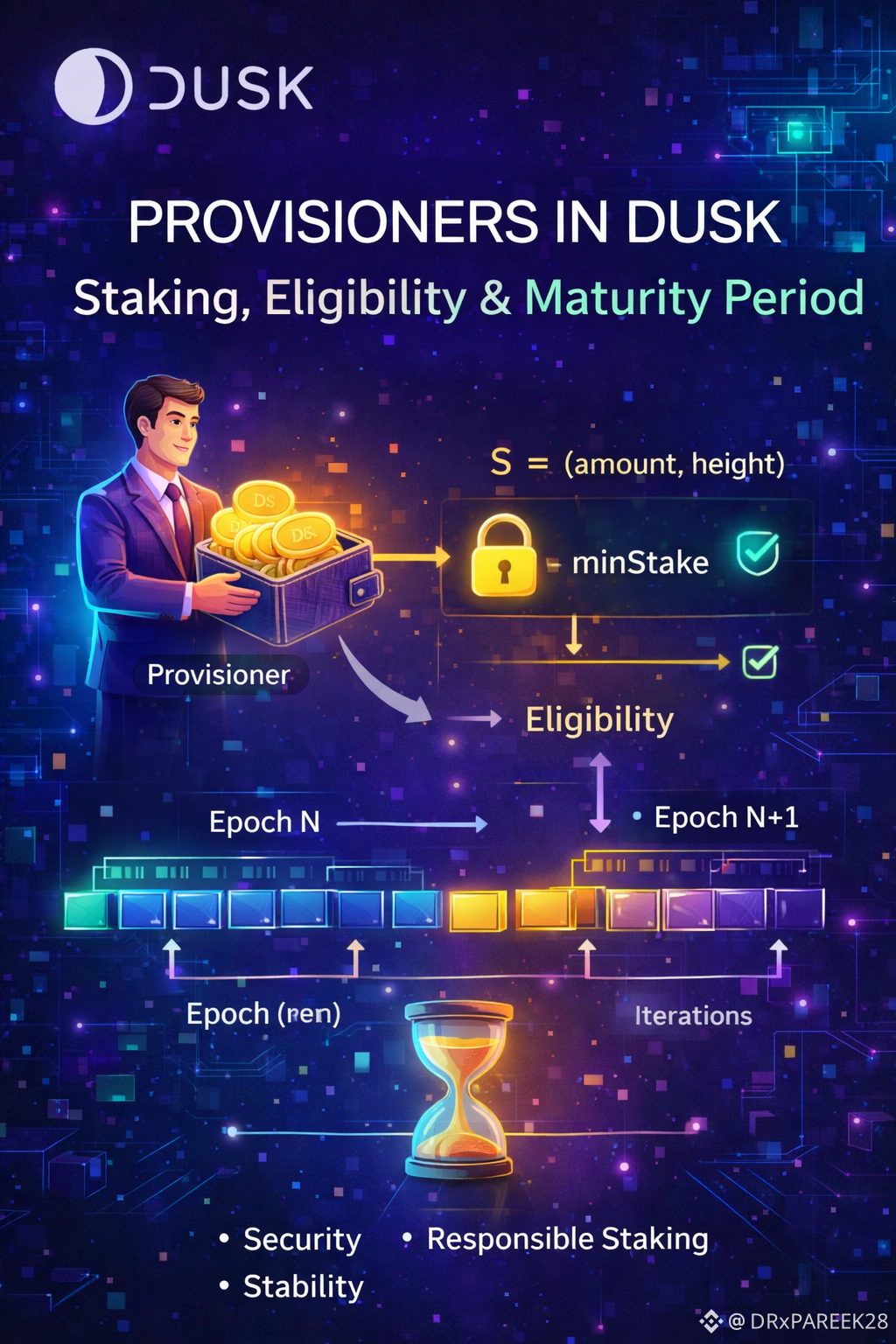

A Provisioner is any user who locks DUSK tokens as stake by broadcasting a staking transaction. Technically, a stake is represented as S = (amount, height):

amount = how much DUSK you stake

height = the block height when staking happened

There’s also a minimum stake parameter (example: minStake), meaning DUSK doesn’t allow extremely tiny stakes to flood committee selection.

Now here’s where DUSK becomes truly smart:

Just because you stake today doesn’t mean you instantly join consensus. That would be dangerous. A whale could move stake rapidly to manipulate selection.

So DUSK introduces a concept called Eligibility with a Maturity Period (M).

This maturity is connected to epochs (a fixed number of blocks). In DUSK:

an epoch is a network time window

stake becomes eligible only after maturity passes

This is like saying:

✅ “Welcome to consensus — but only after you prove you’re serious and stable.”

In practical terms, this makes DUSK more secure. It reduces:

sudden stake attacks

stake flipping

manipulation of committee selection timing

And the best part is, eligibility is deterministic and tied to blockchain logic, not human discretion. That keeps it permissionless and fair.

So Provisioners aren’t just investors—they are responsible participants, slowly entering and stabilizing the network. That’s why DUSK staking is not just reward farming. It’s a network security model designed like real finance: stable, measurable, and accountable.