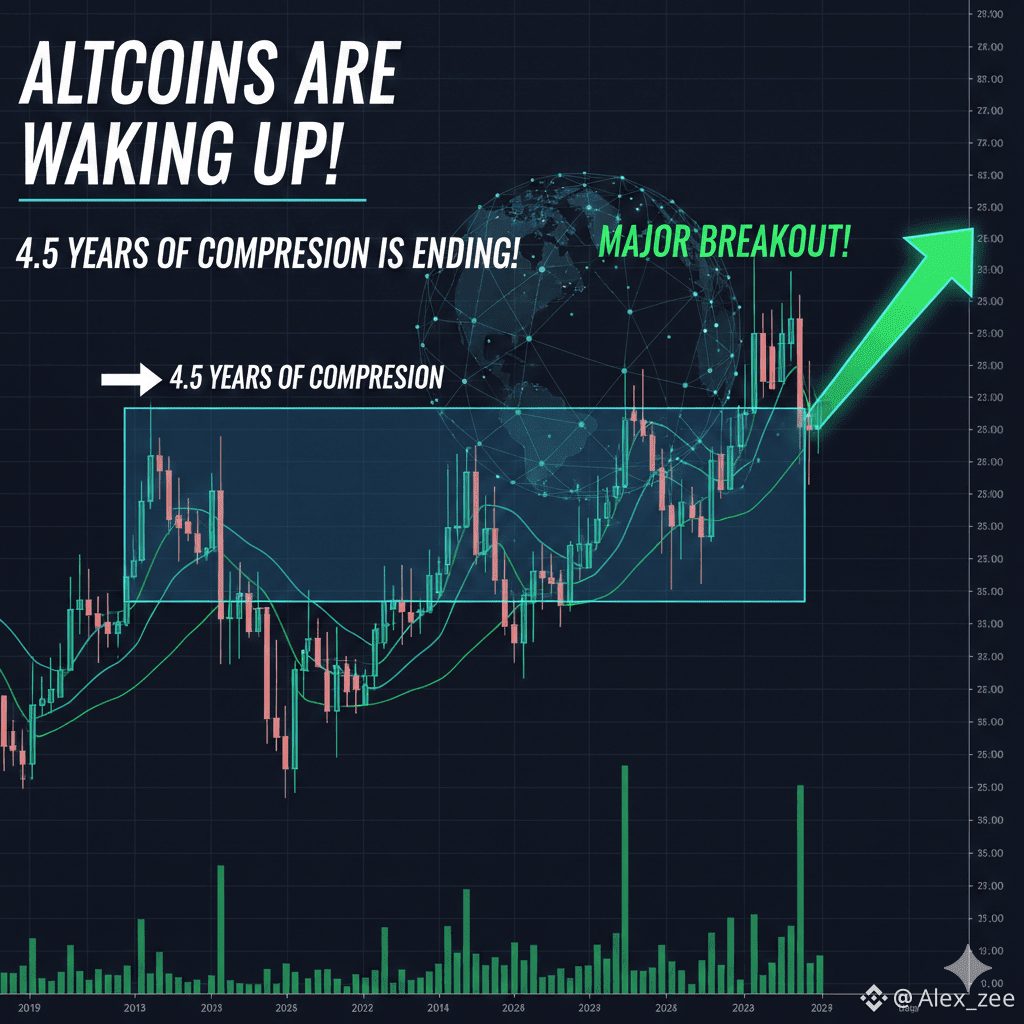

The cryptocurrency market is abuzz with excitement as a significant shift appears to be underway in the altcoin space. After an extended period of consolidation and "compression" spanning approximately 4.5 years, many analysts are pointing towards a potential major breakout for altcoins. This could signal the end of a long accumulation phase and the beginning of a new, dynamic cycle.

The Long Compression Phase: A Closer Look

For the past four and a half years, many altcoins have experienced what can best be described as a period of "compression." This refers to a sustained period where prices trade within a relatively narrow range, often characterized by lower volatility and a lack of clear directional momentum. From a technical analysis perspective, this can be seen as an extended accumulation phase where "smart money" gradually enters positions without causing significant price spikes.

Historically, such prolonged compression phases in financial markets often precede substantial price movements. The longer the compression, the more explosive the potential breakout. During this time, underlying projects continue to build, develop, and gain adoption, laying the groundwork for future growth, even if their market valuations don't immediately reflect it.

Signs of a Potential Breakout

Several indicators are now suggesting that this long compression is nearing its end:

Increased Volume: We're beginning to observe an uptick in trading volume across various altcoin pairs. This increase in liquidity often accompanies significant price movements, indicating growing interest from both retail and institutional investors.

Breakout from Long-Term Resistance: On weekly charts, many altcoins are challenging, and in some cases, breaking above long-standing resistance levels that have capped their price action for years. A decisive break above these levels, especially on high volume, is a strong bullish signal.

Bitcoin Dominance Shifting: While Bitcoin often leads the crypto market, a sustained altcoin rally typically sees Bitcoin dominance (the percentage of the total crypto market cap held by Bitcoin) begin to decline. If this trend continues, it suggests capital is flowing from Bitcoin into altcoins.

Positive Fundamental Developments: Beyond technicals, many altcoin projects have matured significantly over the past few years, delivering on roadmaps, expanding ecosystems, and securing partnerships. These fundamental strengths provide a solid foundation for price appreciation.

What This Could Mean for Investors

For investors, the potential end of this compression phase presents both opportunities and risks:

Opportunity for Growth: If a major breakout materializes, altcoins could see substantial price appreciation, potentially outpacing Bitcoin in percentage gains during a bullish cycle.

Increased Volatility: Breakouts are often accompanied by increased volatility. While this can lead to higher returns, it also means greater risk and the potential for larger drawdowns.

Careful Selection is Key: Not all altcoins will perform equally. It's crucial for investors to conduct thorough research, focusing on projects with strong fundamentals, active development, clear use cases, and robust communities.

Looking Ahead

The coming weeks and months will be critical for confirming whether this perceived awakening truly leads to a sustained altcoin bull run. Traders and investors should closely monitor key technical levels, volume trends, and overall market sentiment. While the excitement is palpable, a disciplined approach, risk management, and continuous research remain paramount in navigating the dynamic world of altcoins.

The stage appears set for an exciting period in the altcoin market. The question now is, will the 4.5 years of compression unleash the explosive growth many are anticipating? Only time will tell, but the signs are certainly intriguing.