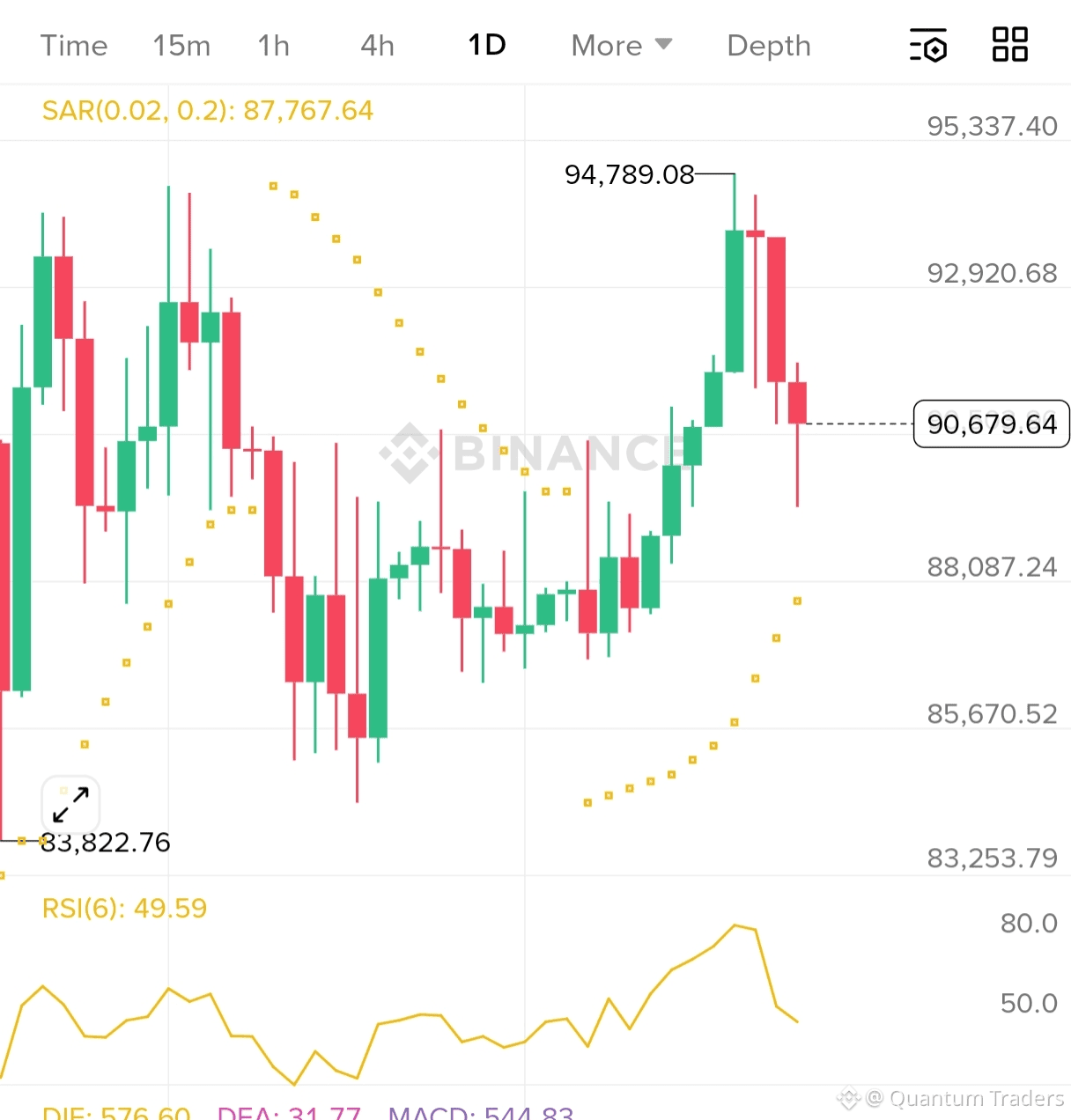

1️⃣ Daily (1D) – Short-term correction, not trend reversal

SAR: Below price → Daily trend still bullish

Price: Pullback from ~94.8k to ~90.6k = healthy correction

RSI (~49): Neutral (cooling from overbought)

MACD: Positive but flattening → momentum slowing, not bearish yet

✅ Conclusion (Daily):

> Higher-timeframe bias is still bullish, but market is in a cool-off phase.

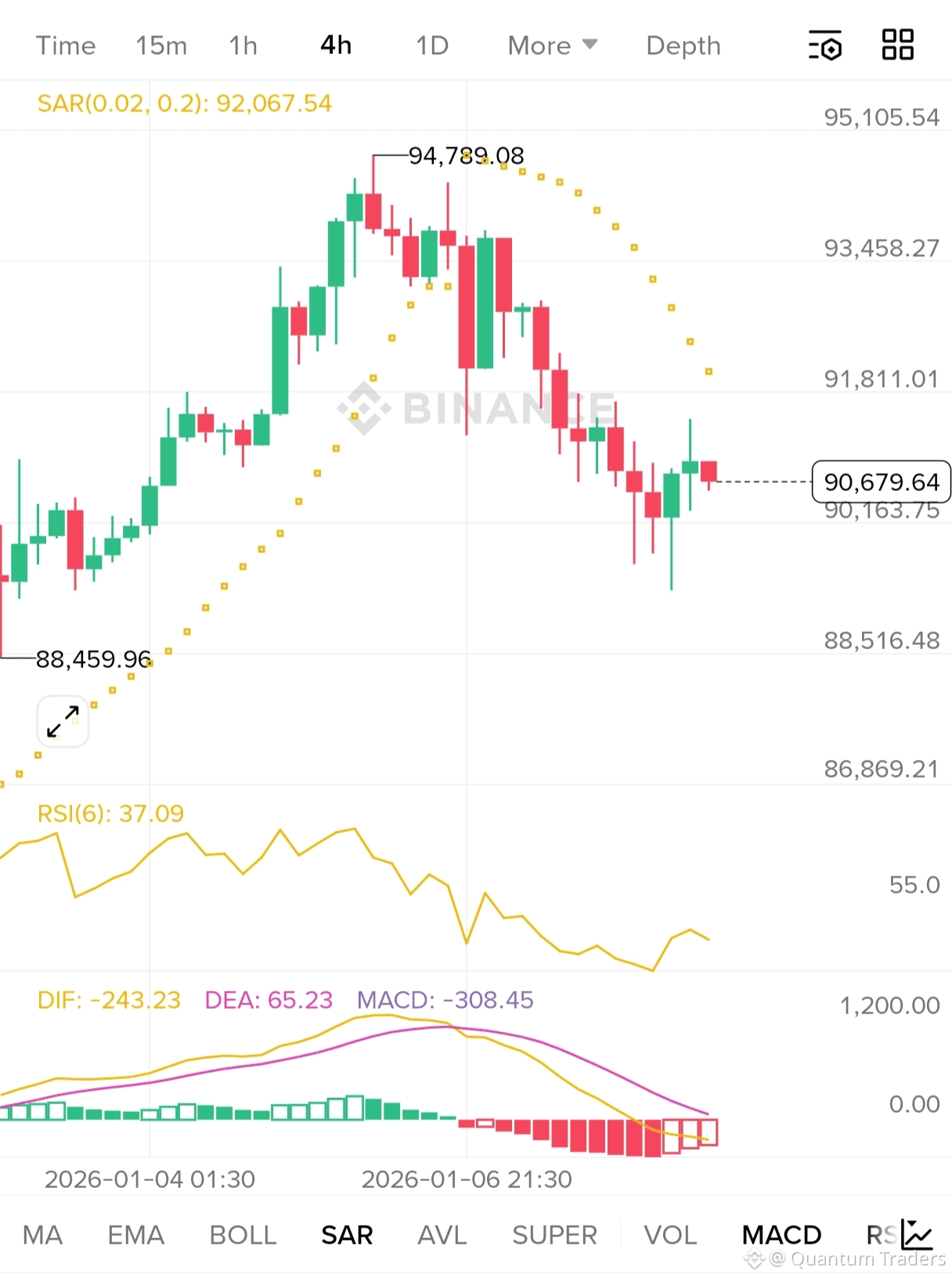

2️⃣ 4H – Bearish correction inside bullish structure

SAR: Above price → 4H trend is bearish

Structure: Lower highs from 94.7k

RSI (~37): Near oversold

MACD: Deep red but histogram shrinking → selling pressure weakening

⚠️ Conclusion (4H):

> BTC is correcting. This is the key timeframe to watch for reversal, not for aggressive buying yet.

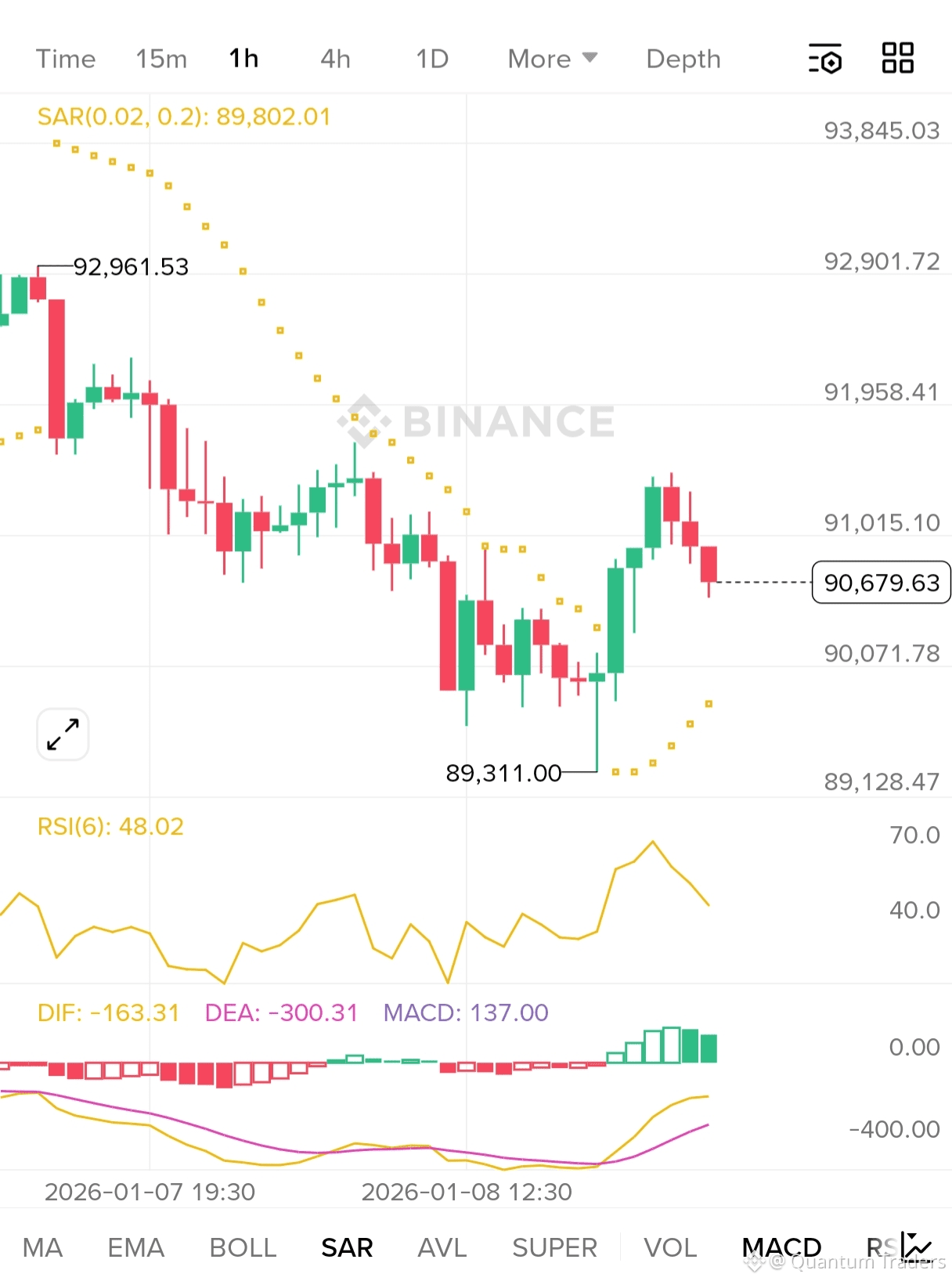

3️⃣ 1H – Early stabilization

SAR: Below price (recent flip) → early bullish attempt

RSI (~48): Neutral

MACD: Bullish crossover already happened

🟡 Conclusion (1H):

> Indicates relief bounce / consolidation, but not confirmed trend reversal unless sustained.

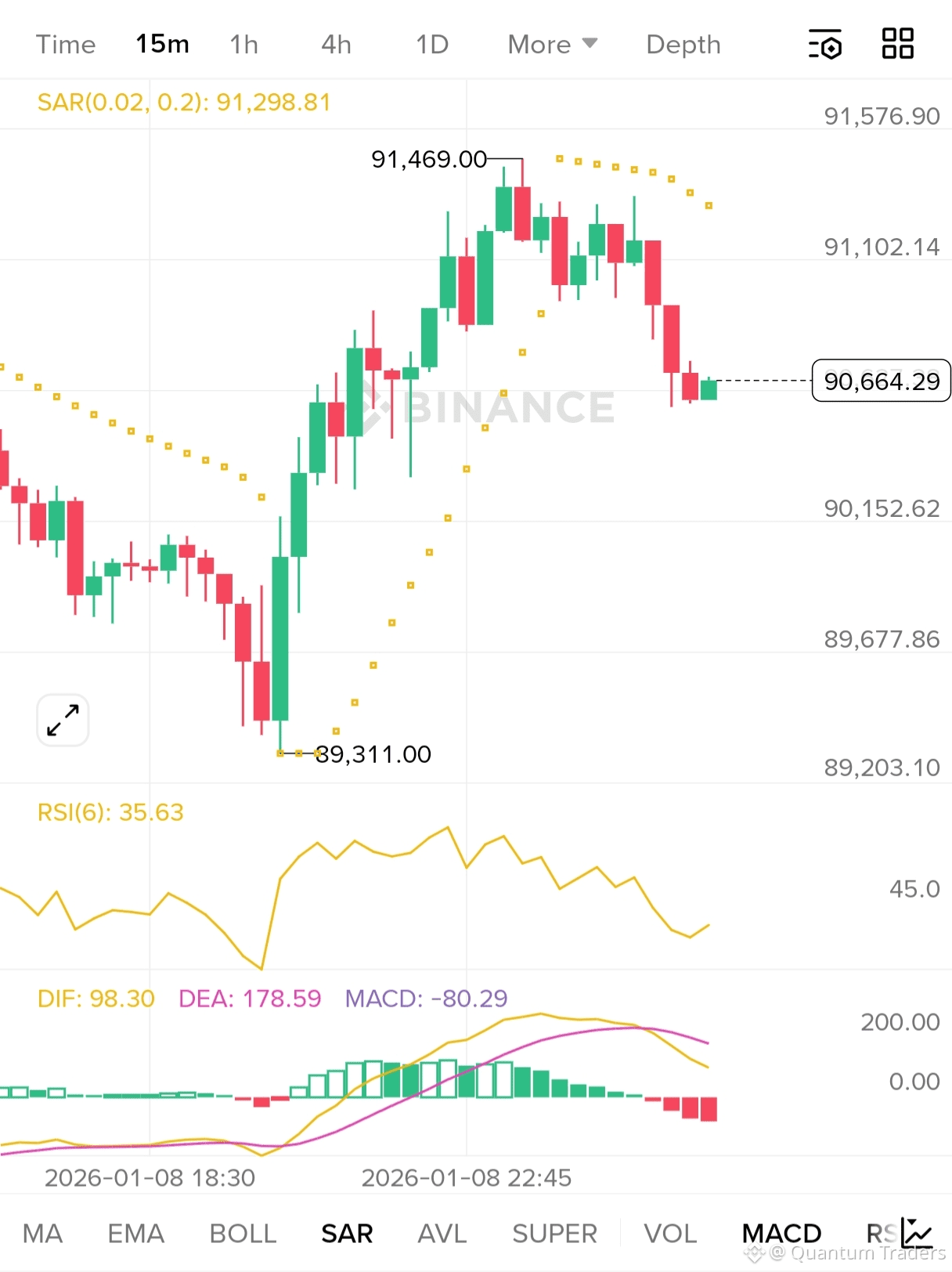

4️⃣ 15M – Weak bounce, still fragile

SAR: Above price → short-term pressure still there

RSI (~35): Slightly oversold

MACD: Turning negative again

⚠️ Conclusion (15M):

> Intraday momentum is weak → price may range or retest lows.

📌 Key Levels to Watch

Strong Support Zone

89,300 – 89,500 (major demand, multiple TF reaction)

If this breaks → next is 87.7k – 88k

Immediate Resistance 91,200 – 91,500

Major resistance: 92,900 – 93,500

🎯 Trading Bias

✅ Best Strategy Right Now

No FOMO buys

Wait for confirmation

📈 Safer Spot Entry Plan

Entry zone: 89,500 – 90,000

Only if:1H SAR stays below price

4H MACD histogram keeps shrinking

SL (spot mental): Below 88,800

Targets:

92.5k, 94k

❌ What NOT to do

Don’t buy aggressively above 91.5k

Don’t short near support (risk of sharp bounce)

🧠 Final Verdict

> BTC is in a corrective phase inside a bullish daily trend.

Smart money waits for 4H confirmation or buys near strong support, not mid-range.