In trading, price rarely moves randomly. It follows patterns, directions, and momentum. One of the simplest yet most powerful tools to identify that direction is the trendline.

A trendline is not a prediction tool. It is a structure tool. Traders who misuse it get confused. Traders who understand it gain clarity.

What Is a Trendline?

What Is a Trendline?

A trendline is a straight line drawn on a price chart to connect key price points and highlight the overall direction of the market.

There are two primary types:

Uptrend Line: Drawn by connecting higher lows

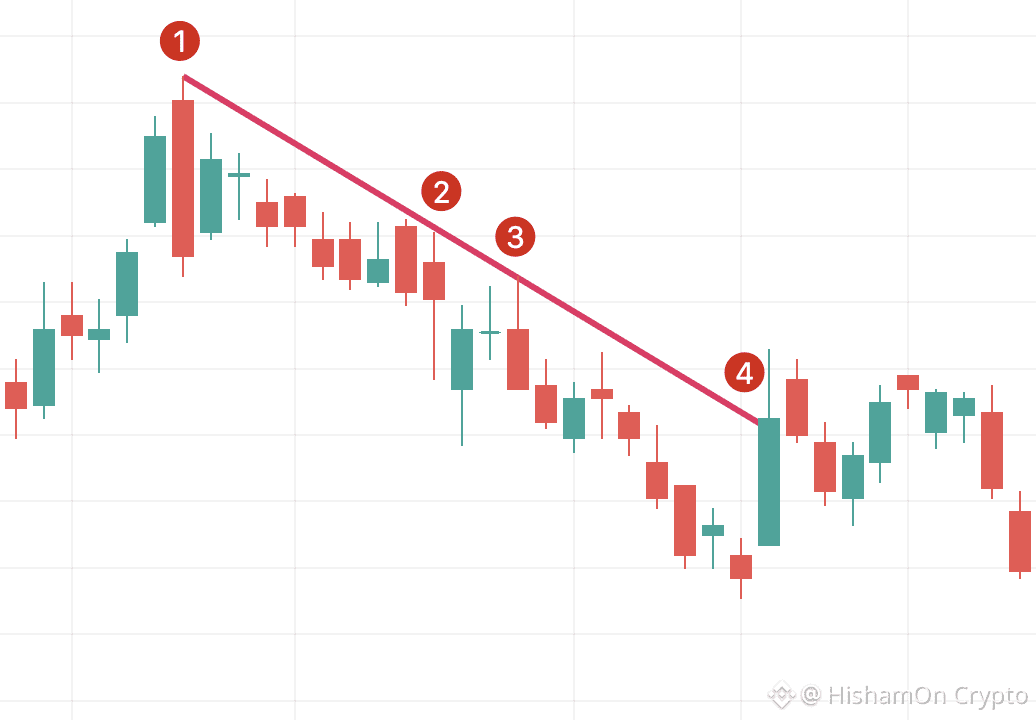

Downtrend Line: Drawn by connecting lower highs

If price respects the line repeatedly, the trend is valid. If it breaks, the trend is weakening or ending.

Simple concept. Powerful impact.

Why Trendlines Matter

Trendlines do three critical things:

Define Market Direction

They answer one question clearly:

Is the market going up, down, or sideways?

Act as Dynamic Support and Resistance

Unlike horizontal levels, trendlines move with price.

Price often reacts, bounces, or rejects from them.

Improve Trade Timing

Entries near trendline support or resistance offer better risk-to-reward setups.

Ignoring trendlines means trading without structure. That’s gambling.

How to Draw a Correct Trendline

Most traders draw trendlines incorrectly. Don’t be one of them.

Follow these rules:

Use at least two clear touchpoints (three is stronger)

Connect wicks, not random candles

Do not force the line to fit your bias

Adjust the line as new price data forms

A trendline must be respected by price, not by your imagination.

Common Uses of Trendlines in Trading

1. Trend Identification

If price stays above an uptrend line → bullish bias

If price stays below a downtrend line → bearish bias

Trade with the trend, not against it.

2. Entry and Exit Zones

Buy near uptrend support in bullish markets

Sell near downtrend resistance in bearish markets

Chasing breakouts without confirmation is a rookie mistake.

3. Breakout and Breakdown Signals

A confirmed break of a strong trendline often signals:

Trend reversal

Momentum shift

Volatility expansion

But one candle is not confirmation. Wait for structure.

4. Risk Management

Trendline breaks help define:

Stop-loss placement

Trade invalidation points

If the structure breaks, your idea is wrong. Accept it and move on.

Trendlines on Binance Charts

On Binance, traders can draw trendlines using the TradingView chart tools available on both desktop and mobile.

Combine trendlines with:

EMA or Moving Averages

Volume analysis

Market structure (higher highs, lower lows)

Trendlines alone are useful. Trendlines with confluence are deadly accurate.

Final Thoughts

Trendlines are not magic. They don’t guarantee profits. They don’t predict the future.

What they do is remove noise, define structure, and force discipline.

If you can’t draw a clean trendline, you shouldn’t be placing trades.

Master the basics — because in trading, simplicity beats complexity every time.

.