🚀

🔹 Introduction

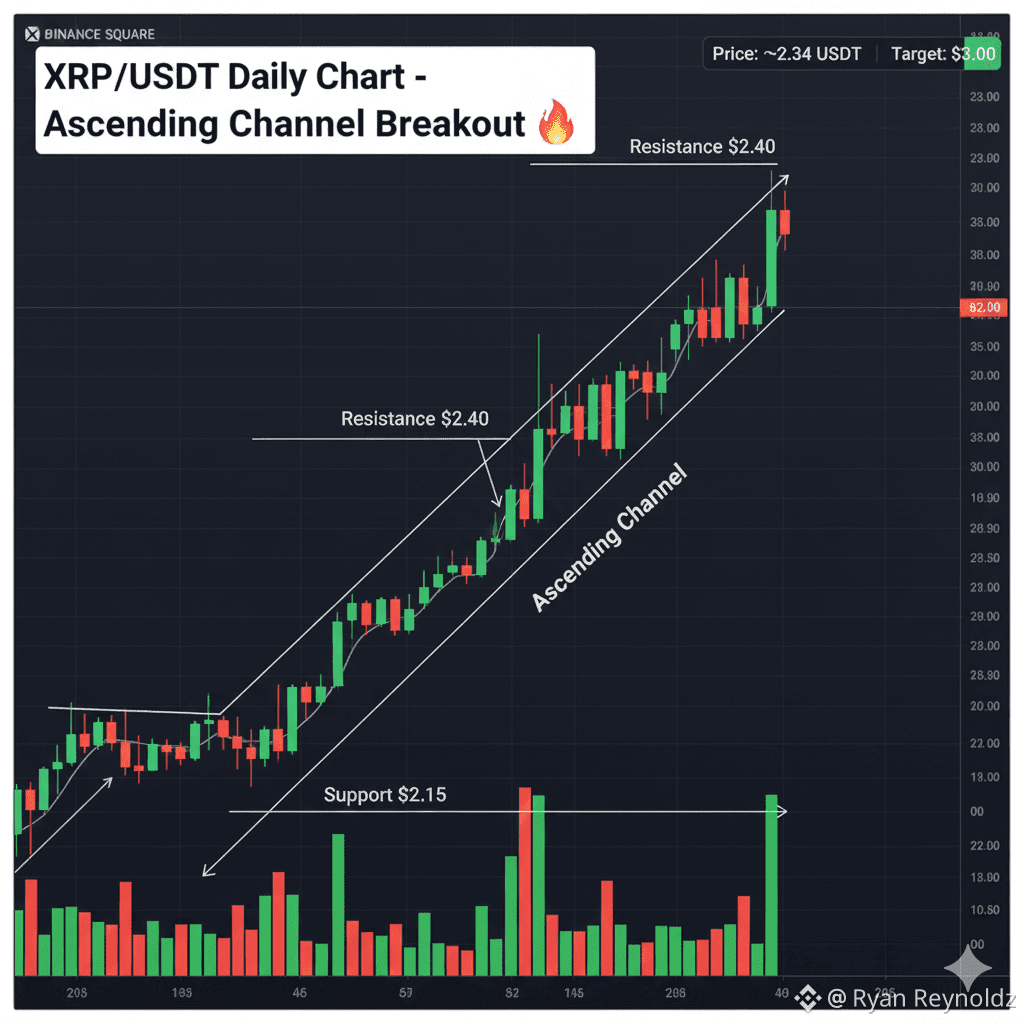

As we kick off the first week of 2026, $XRP has stolen the spotlight on Binance Square. With a massive surge in trading volume and a "Neutral" flip in market sentiment, XRP is leading the charge for major altcoins. The shrinking exchange supply is fueling a high-conviction move that has traders eyes locked on the next major breakout.

📊 Market Snapshot (as of Jan 6, 2026)

Price: ~$2.34 USDT

24h Change: +9.43% 📈

24h Volume: ~$4.07B

Market Cap: ~$130.2B

(Data from Binance Live Markets)

🔍 Why XRP is Trending

Supply Shock: Exchange reserves for XRP are at multi-year lows. When supply dries up while demand spikes, the resulting "Supply Shock" often leads to parabolic price action.

Institutional Tailwinds: Following the massive $471M Bitcoin ETF inflows last Friday, liquidity is rotating into high-cap liquid assets like XRP.

Breakout Momentum: XRP has decisively cleared the $2.12 psychological barrier, turning a year-long resistance into a launchpad for the next leg up.

📈 Technical & Price Outlook

Short-Term: Currently testing resistance at $2.40. If bulls maintain the current momentum, we expect a quick test of $2.55.

Medium-Term: The weekly chart shows a "Rounding Bottom" completion. With the RSI still below the overbought zone (65), there is significant "fuel" left in the tank for a move toward $3.00 by February.

Pattern: Ascending Channel. XRP is respecting a steep upward corridor, making higher highs and higher lows with perfect symmetry.

⚠️ Risk Note

While the momentum is exceptionally strong, XRP is known for sharp "wick" liquidations. Ensure you use trailing stop-losses around the $2.15 support zone to lock in gains if a sudden market-wide correction occurs.

📌 Conclusion:

XRP isn't just "trending"—it's dominating the top gainer's list. With institutional interest and a tightening supply, the road to $3.00 looks clearer than ever.

📊 XRP/USDT Technical Analysis Chart as follows