#BNB_Market_Update  BNB, the native token of the BNB Chain, has experienced recent price fluctuations, with its value currently trading around $922.66 as of mid-November 2025. Despite short-term volatility, a combination of significant institutional integration and positive technical indicators is painting a bullish picture for the asset's future.

BNB, the native token of the BNB Chain, has experienced recent price fluctuations, with its value currently trading around $922.66 as of mid-November 2025. Despite short-term volatility, a combination of significant institutional integration and positive technical indicators is painting a bullish picture for the asset's future.

Key Developments Driving BNB Optimism

Several factors are contributing to a positive outlook for BNB, balancing out concerns over immediate price movements.

1. Major Institutional Integration

A landmark development is the integration of BlackRock's BUIDL fund, a tokenized U.S. Treasury fund, onto the BNB Chain. This move is significant for two key reasons:

Institutional Adoption: It signals growing acceptance and use of the BNB Chain by major financial institutions.

RWA Utility: The fund's acceptance as off-exchange collateral enhances institutional access and brings Real World Assets (RWA) into the BNB ecosystem, expanding its liquidity and overall utility.

2. Bullish Technical Signals

From a technical analysis perspective, two key indicators are suggesting positive short-term momentum:

Bullish EMA Crossover: The 7-period Exponential Moving Average (EMA7) has recently crossed above the 25-period Exponential MovingAverage (EMA25). This is often interpreted by traders as a signal of a potential shift towards an upward price trend.

Bullish MACD Crossover: The Moving Average Convergence Divergence (MACD) line has crossed above its signal line, supported by a positive MACD histogram. This suggests that bullish momentum is currently increasing.

Risks and Community Outlook

While the long-term indicators are positive, it's important to consider the complete picture.

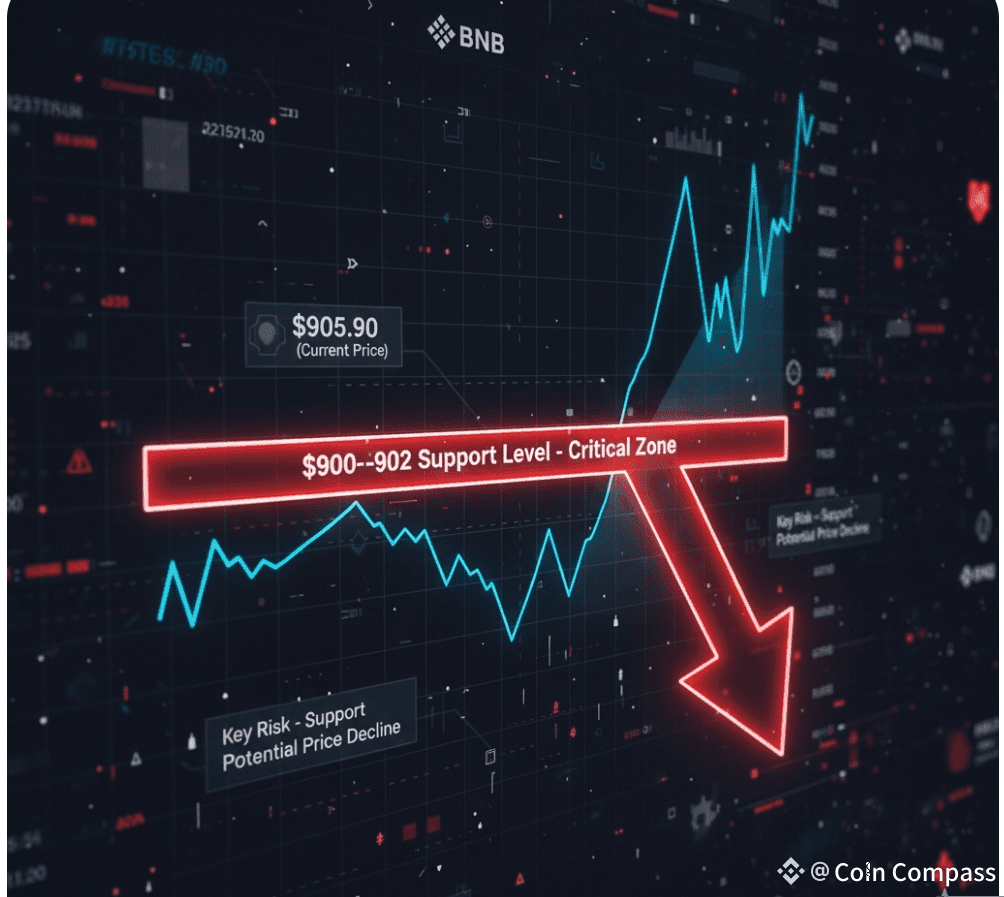

Key Risk: Support Level

Analysts are closely watching a critical support level for BNB's price, identified in the $900-$902 range. The price recently touched $905.90, highlighting the importance of this zone. A sustained break below this support level could potentially lead to further price declines in the short term.

Community Sentiment

The BNB community sentiment appears to be mixed but leans heavily optimistic for the long term. While some express valid concerns about short-term price volatility and potential dips, the general feeling is that the foundational ecosystem developments, especially the recent institutional integrations, are paving the way for significant long-term growth.