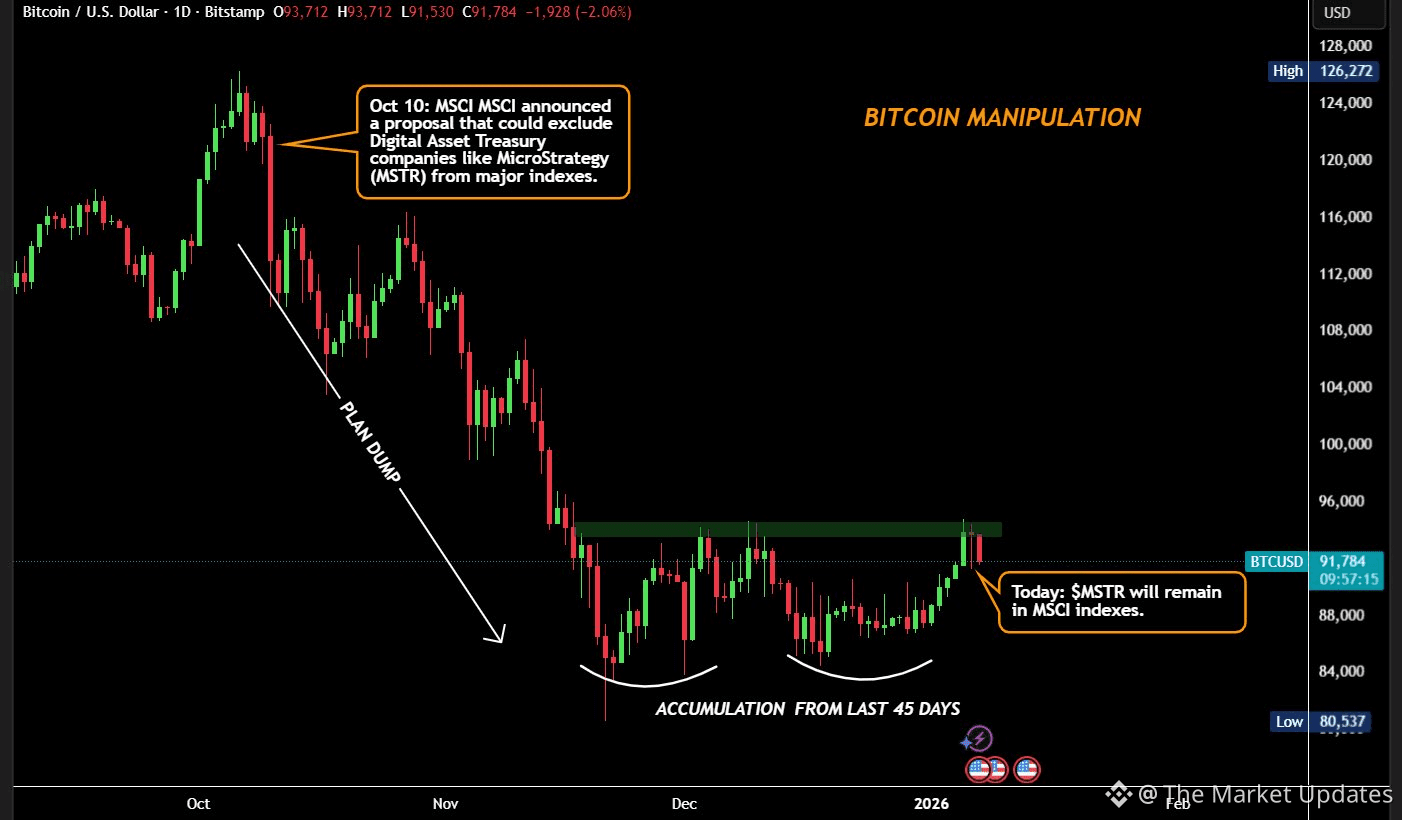

The sequence of Bitcoin’s October crash and January recovery looks like a planned setup, and the data supports it.

Let’s go through it 👇

1) OCTOBER 10: THE TRIGGER

On October 10, MSCI, originally a Morgan Stanley division, announced a proposal to remove Digital Asset Treasury Companies from its global indexes.

That included firms like MicroStrategy and Metaplanet, whose balance sheets hold billions worth of Bitcoin. This wasn’t a small change because MSCI indexes guide trillions of dollars in passive flows.

If those firms were removed:

• Pension funds and ETFs would be forced to sell

• Institutional exposure to Bitcoin would shrink

• Liquidity would tighten sharply

Minutes after the announcement, Bitcoin dropped nearly -$18,000, erasing more than $900 billion from crypto’s total market cap.

2) THEN THE 3-MONTH PRESSURE WINDOW.

The consultation stayed open until December 31, meaning three full months of uncertainty.

That overhang froze demand:

• Passive investors avoided exposure

• Index-linked funds risked forced selling

• Prices stayed weak

• Sentiment collapsed

During this period, Bitcoin dropped about 31%, altcoins even more.

It was the worst quarter for crypto since 2018.

3) JANUARY 1st: SUDDEN PUMP STARS

From Jan 1st, Bitcoin starts pumping without any bullish news, and in the first 5 days of 2026, Bitcoin jumped 8%, that’s a $7300 pump from $87,500 to $94,800.

No one knew why, but somehow the relentless selling stopped, and Bitcoin was printing back-to-back green candles.

These were probably insiders who knew what was coming in the next few days.

4) JANUARY 5th-6th: THE REVERSAL

Then, somehow, in 24 hours, everything flipped.

First, Morgan Stanley filed for its own spot Bitcoin, ETH, and Solana ETFs.

Then, in a few hours, MSCI announced that it would not remove the crypto-heavy companies after all.

The exact rule that caused three months of selling pressure was suddenly withdrawn the same day Morgan Stanley launched a product that benefits from a recovering market.

That’s not a coincidence.

Here’s the full sequence in order:

1. MSCI threatens index removals (October 10)

2. Crypto crashes, uncertainty lasts 3 months

3. Prices stay suppressed while institutions wait

4. Morgan Stanley files its ETF (January 5)

5. MSCI cancels the removal threat (January 6)

It’s a clear pattern:

Create pressure

accumulate at low prices

launch product

remove pressure

Make money

MSCI controls index inclusion.

Morgan Stanley controls capital distribution.

Together, they can influence how and when institutional money reaches Bitcoin.

The October crash wasn’t just market panic. It was a structural play.

Now that the overhang is gone, liquidity is returning, and the same players who engineered the pressure are positioned to profit from the rebound.

There is no official confirmation that this was coordinated, but the sequence, the timing, and who benefited raise real questions.