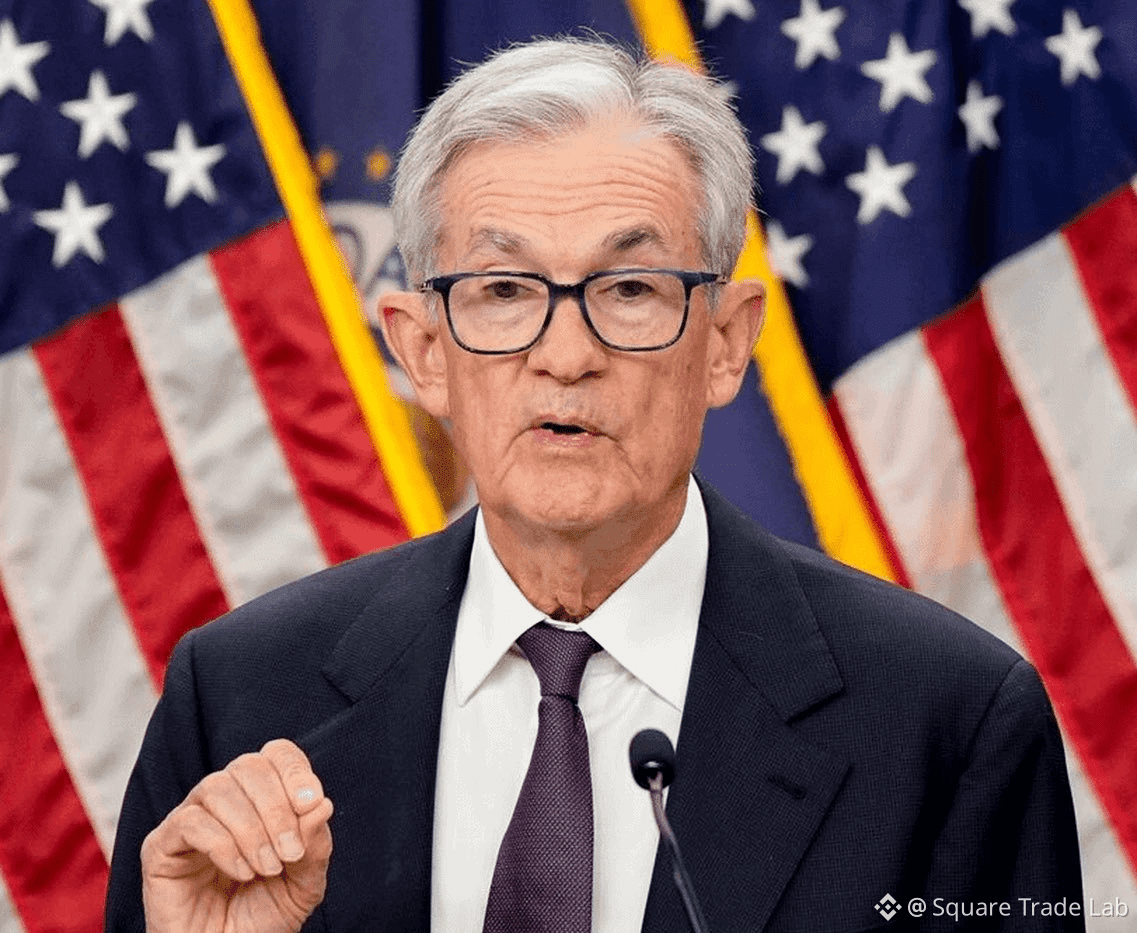

🚨 BREAKING: Federal Prosecutors Open Criminal Investigation Into Fed Chair Jerome Powell

New York Times Reports a Historic and Unprecedented Development

🇺🇸 According to a report by The New York Times, U.S. federal prosecutors have opened a criminal investigation into Federal Reserve Chair Jerome Powell, an extraordinary event that could reshape confidence in the U.S. financial system.

If confirmed, this would represent one of the most serious institutional crises in modern Federal Reserve history.

No charges have been announced at this stage. However, the very existence of a criminal probe into a sitting Fed Chair is enough to send shockwaves through global markets.

WHY THIS IS A BIG DEAL

The Federal Reserve is the backbone of: • U.S. monetary policy

• Global dollar liquidity

• Bond market stability

• Banking system confidence

• Crisis management during recessions

Jerome Powell is not a symbolic figure.

He directly influences: • Interest rate decisions

• Quantitative tightening or easing

• Liquidity facilities for banks

• Emergency interventions during market stress

A criminal investigation — even without charges — introduces institutional uncertainty into the heart of the global financial system.

Markets price risk faster than facts.

WHAT WE KNOW SO FAR

Based on NYT reporting and sources familiar with the situation: • Federal prosecutors have opened a criminal investigation

• The specific allegations have not been publicly disclosed

• No indictment or formal charges have been filed

• Jerome Powell has not made a public statement yet

• The Department of Justice has not issued official confirmation

This appears to be an early-stage investigation, but the implications are already enormous.

WHY THIS IS UNPRECEDENTED

The Federal Reserve was intentionally designed to be: • Independent from political power

• Shielded from legal and partisan pressure

• Trusted by markets as a neutral institution

A criminal probe into its Chair risks: • Undermining perceived Fed independence

• Politicizing monetary policy decisions

• Creating doubts around rate guidance

• Weakening long-term institutional credibility

Even if no wrongdoing is ultimately found, the damage to confidence can already be done.

MARKET IMPACT ANALYSIS

Bonds and the U.S. Dollar

• Treasury yields could become more volatile

• Investors may demand higher risk premiums

• Foreign holders of U.S. debt may reassess exposure

• Dollar dominance narratives could weaken

Equity Markets

• Financial stocks face heightened uncertainty

• Broader market volatility may increase

• Rate-sensitive sectors could react sharply

• Forward guidance credibility comes into question

Crypto and Alternative Assets

• Bitcoin historically reacts to institutional trust shocks

• Decentralization narratives strengthen during central bank crises

• Crypto often prices in uncertainty before traditional markets

• Capital may rotate into non-sovereign assets

This is exactly the type of macro event where crypto reacts first, not last.

GLOBAL RAMIFICATIONS

The Federal Reserve does not operate in isolation.

It anchors: • Global liquidity cycles

• Emerging market capital flows

• Central bank reserve strategies

• International trade financing

Other nations will closely monitor: • Whether Powell remains in office

• How aggressively U.S. institutions respond

• Whether political pressure escalates

• How markets digest Fed credibility risk

Any escalation could trigger global repricing of risk.

WHAT TO WATCH NEXT

Critical developments to monitor: • Official DOJ statements

• Response from the Federal Reserve

• White House reaction

• Treasury and bond market behavior

• Emergency Fed communications

• Volatility across BTC and ETH markets

This is not just a headline.

This is a system-level event.

BOTTOM LINE

This investigation — confirmed or denied — marks a turning point in market psychology.

Trust in institutions is fragile.

Once shaken, capital looks for alternatives.

And historically, Bitcoin thrives in moments like this.

Coin Hashtags 👇