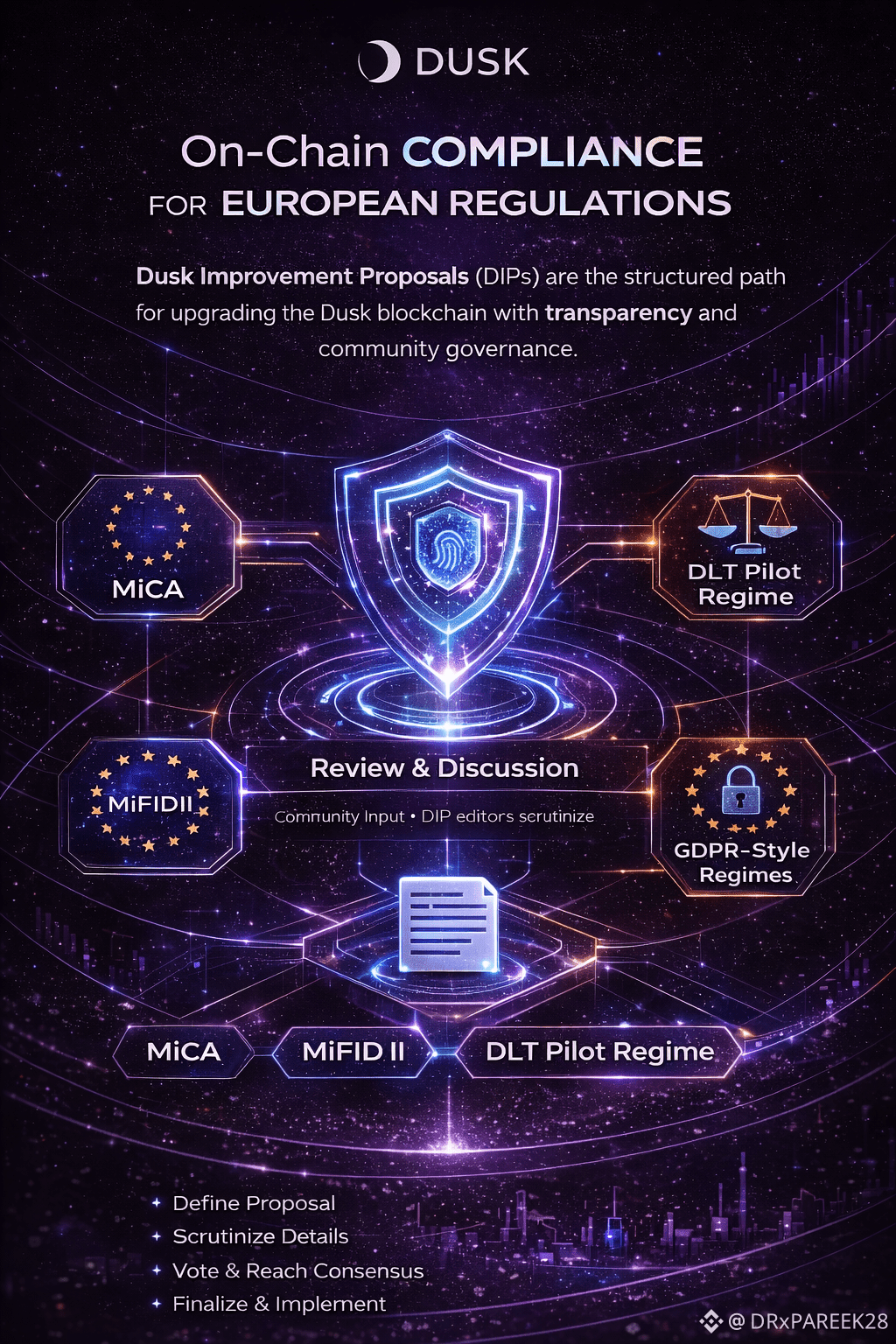

For years, blockchain promised to reinvent finance, but the truth is simple: real finance doesn’t move at the speed of hype. It moves at the speed of regulation. That’s why the most serious shift happening in Web3 today isn’t just tokenization or RWAs—it’s on-chain compliance. And if we’re talking about Europe, that conversation automatically includes frameworks like MiCA, MiFID II, the DLT Pilot Regime, and privacy rules that look very similar to GDPR-style compliance expectations. This is exactly the environment where Dusk Network starts to feel less like a normal blockchain project and more like a long-term financial infrastructure play.

Dusk is built for institutions that need something most public chains struggle to deliver: confidentiality without losing compliance. In traditional markets, compliance is not optional. Financial instruments must meet strict requirements for issuance, trading, disclosure, reporting, identity checks, and investor protection. In most DeFi ecosystems, everything is transparent and permissionless, which can be useful for open markets but becomes a major barrier when you bring in regulated assets. Dusk tackles this gap by combining privacy technology with a compliance-first design, meaning financial entities can run regulated workflows on-chain while still meeting the legal standards regulators expect.

If we start with MiCA (Markets in Crypto-Assets regulation), it is a framework designed to bring structure, accountability, and consumer protection into the crypto economy within the EU. MiCA introduces licensing rules for crypto service providers, stricter governance, stablecoin regulations, and transparency obligations for issuers. For blockchains and tokenization platforms, the big message is clear: if you want institutional adoption, your infrastructure must support verifiable and compliant activity. Dusk’s direction aligns well with this reality because it is focused on enabling financial-grade asset issuance that doesn’t look like a wild experiment, but like a controlled and traceable market environment.

Then there’s MiFID II, the backbone regulation for investment services and financial markets in Europe. MiFID II is not about crypto specifically—it covers everything from securities trading to market transparency, investor protection, and reporting. This matters because once equities, bonds, and regulated securities are brought on-chain, they don’t stop being regulated just because they’re tokenized. If anything, the demand for proof becomes even stronger. A Dusk-style blockchain environment—where privacy is possible but compliance remains built into the system—becomes extremely relevant here. Institutions need to protect sensitive trading data, but regulators still need assurance that rules are being followed. That balance is the heart of the Dusk narrative.

The DLT Pilot Regime takes the conversation one step further. It is basically Europe testing how regulated trading and settlement could work using distributed ledger technology under supervised conditions. Think of it as a “sandbox” but for serious market infrastructure like trading venues and settlement systems. This is where Dusk can shine because its architecture isn’t designed for casual DeFi use—it’s designed for compliant financial instruments that require controlled access, regulated settlement, and privacy-preserving execution. When regulators test tokenized market infrastructure, they don’t want a system that leaks confidential data or lacks governance structure. They want something that behaves like financial infrastructure while still offering blockchain efficiency. Dusk is positioned directly at that intersection.

Finally, there’s the privacy side, where GDPR-style regimes shape the rules of data protection. This part is critical and often ignored. Many blockchain systems struggle with GDPR-type requirements because blockchains are immutable—data written cannot be removed. That creates issues when personal data is involved. Dusk’s privacy-preserving approach using cryptographic proofs helps reduce exposure by allowing verification without public disclosure. Instead of broadcasting sensitive details across the network, privacy layers can enable “proof of compliance” while keeping identity and transactional information protected. That’s not just a technical advantage—it’s a regulatory advantage.

When you combine these realities, you start to see why Dusk focuses so heavily on regulated finance. It’s not chasing the easiest users—it’s targeting the hardest part of the market: institutions that must obey law, reporting, and privacy standards. And if on-chain finance is going to become mainstream in Europe, it will only happen through ecosystems that respect frameworks like MiCA, MiFID II, DLT Pilot, and GDPR-level privacy expectations. Dusk isn’t simply trying to bring assets on-chain. It’s trying to bring trust, compliance, confidentiality, and regulation onto the blockchain—because that’s what will ultimately unlock real financial adoption, not hype.