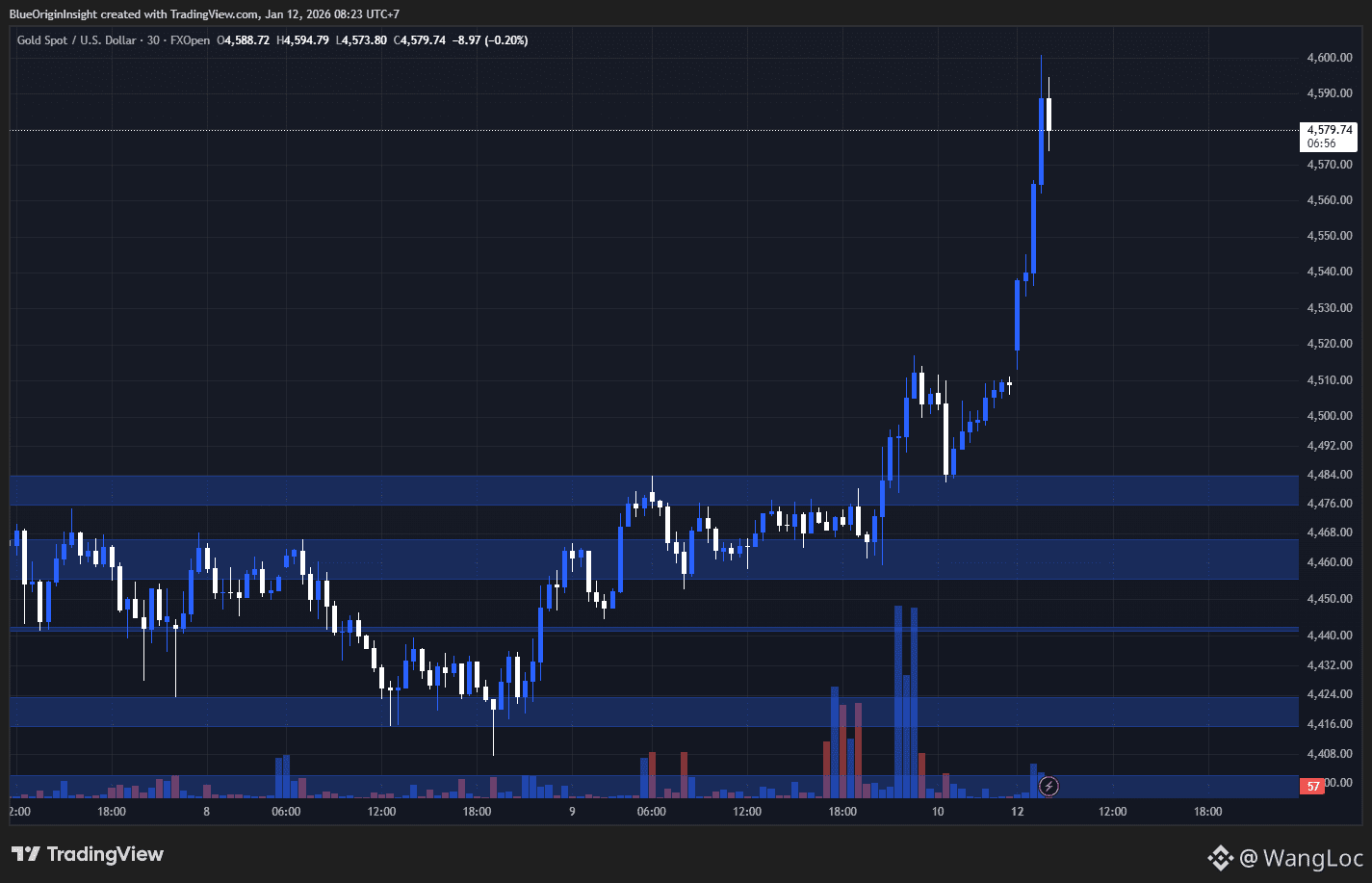

Gold has just delivered a clean breakout from the prolonged consolidation zone around 4460–4480, backed by a strong bullish candle and clear momentum. This is no longer technical noise it’s a confirmation that defensive capital is rotating back in.

Key M30 observations:

• Price broke above the prior supply zone without rejection wicks

• Structure remains clearly Higher High – Higher Low

• The latest push is an impulse leg, showing buyers firmly in control

Key levels to monitor:

• 4475–4485 (New demand): If price pulls back and holds → bullish continuation favored

• 4550–4580: Short-term resistance where profit-taking or volatility may appear

• 4420: Loss of this level would invalidate the breakout (low probability for now)

Strategic view:

No FOMO chasing

Prefer buy-the-dip setups into demand

Selling against the trend is low-probability

When gold moves like this, it’s not just about charts it reflects macro risk, capital protection, and shifting sentiment.

NFA | Risk management comes first

#GOLD #BTCVSGOLD #TrendingTopic