Fogo is very clearly building for institutional‑grade traders first (market makers, HFT desks, perp venues), then smoothing the UX so retail can ride on top of that infrastructure without feeling the complexity.

Primary target: institutional and HFT desks

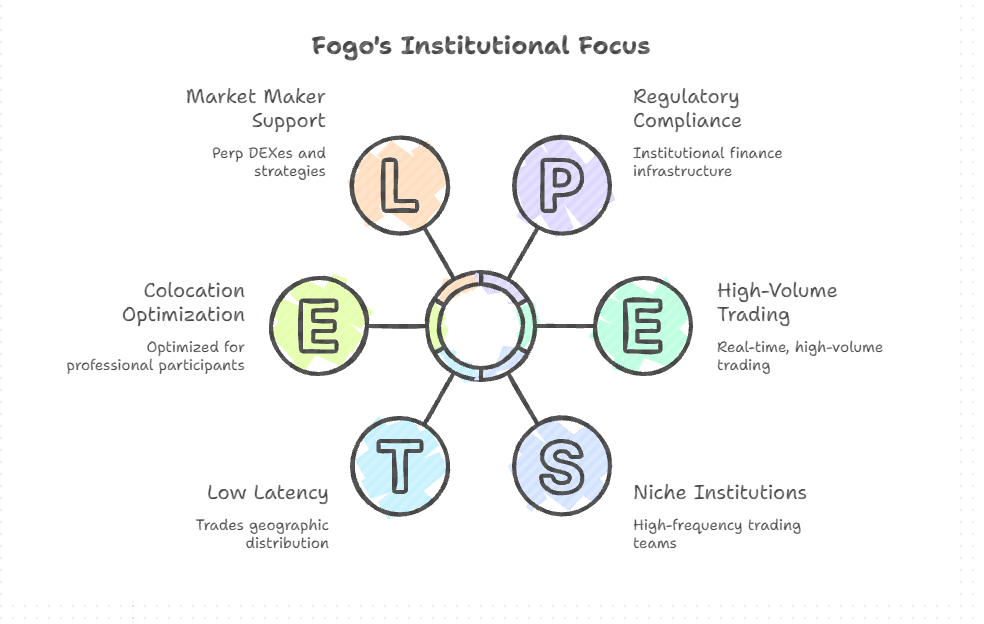

Fogo’s own docs and academy material say it’s “built by traders, for traders and institutions who live and breathe finance,” explicitly naming market makers, perp DEXes, and high‑frequency strategies as the core audience.

Multiple analyses frame Fogo as Wall Street‑grade / institutional finance infrastructure, aimed at real‑time, high‑volume trading and RWA flows that current chains can’t serve reliably.

Official positioning: Fogo “trades geographic distribution for lower latency, targeting institutional traders rather than consumer applications.”

Binance Square summaries put it bluntly: “Solana serves the masses, while FOGO serves niche institutions… high‑frequency trading teams and quantitative firms.”

So at the base layer, validator design, Firedancer client, colocation, Fogo is optimized for professional market participants, not casual degen retail.

But the UX layer is very retail‑friendly

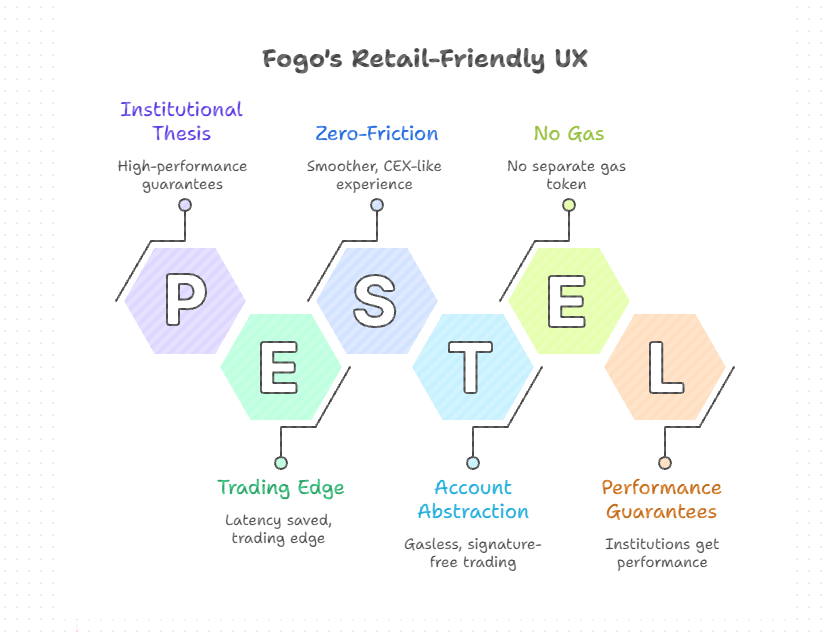

At the same time, Fogo invests heavily in UX so that retail can plug into that institutional‑grade rail:

Fogo Sessions (account abstraction + paymaster) let users connect any SVM wallet, sign once, and then trade gasless and almost signature‑free; every saved popup is marketed as “latency saved” and “trading edge,” but retail benefits from the zero‑friction feel.

“No gas, no hassle” messaging is plainly aimed at users who don’t want to hold a separate gas token or think about fee management just to trade.

Educational content (Fogo Academy, public guides) explains concepts in approachable terms while still highlighting the institutional thesis.

In practice, that means institutions get the performance guarantees; retail gets a smoother, CEX‑like experience piggybacking on the same infra.

How to think about it in one line

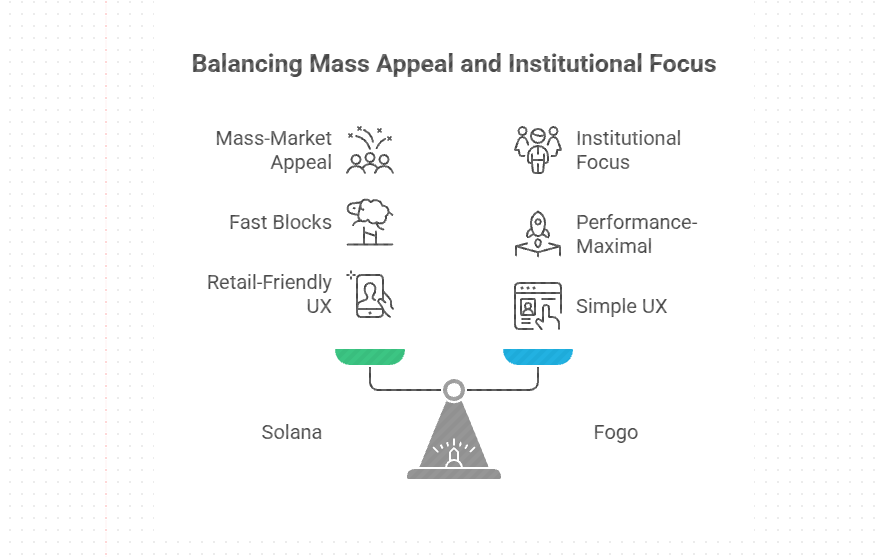

Solana: broad, mass‑market smart‑contract platform with fast blocks, serving everyone from NFT mints to memecoins.

Fogo: niche, performance‑maximal SVM chain tuned for institutional/HFT and RWA‑style flows, with gasless sessions and simple UX so retail can still use it without knowing what “Firedancer” or “colocation” even mean.

So if you’re a retail trader: Fogo is usable and even friendly to you, but the design target is institutional desks and serious market makers first, not memecoin culture or broad consumer apps.