Have you ever wondered why we look at "Price" when "Market Cap" is the real scoreboard?

A fascinating valuation scenario is circulating in the community today, comparing $XRP XRP directly to Ethereum ($ETH ETH). If we remove the noise of short-term charts and look strictly at the math, the results are eye-opening.

The Math of a "Flip":

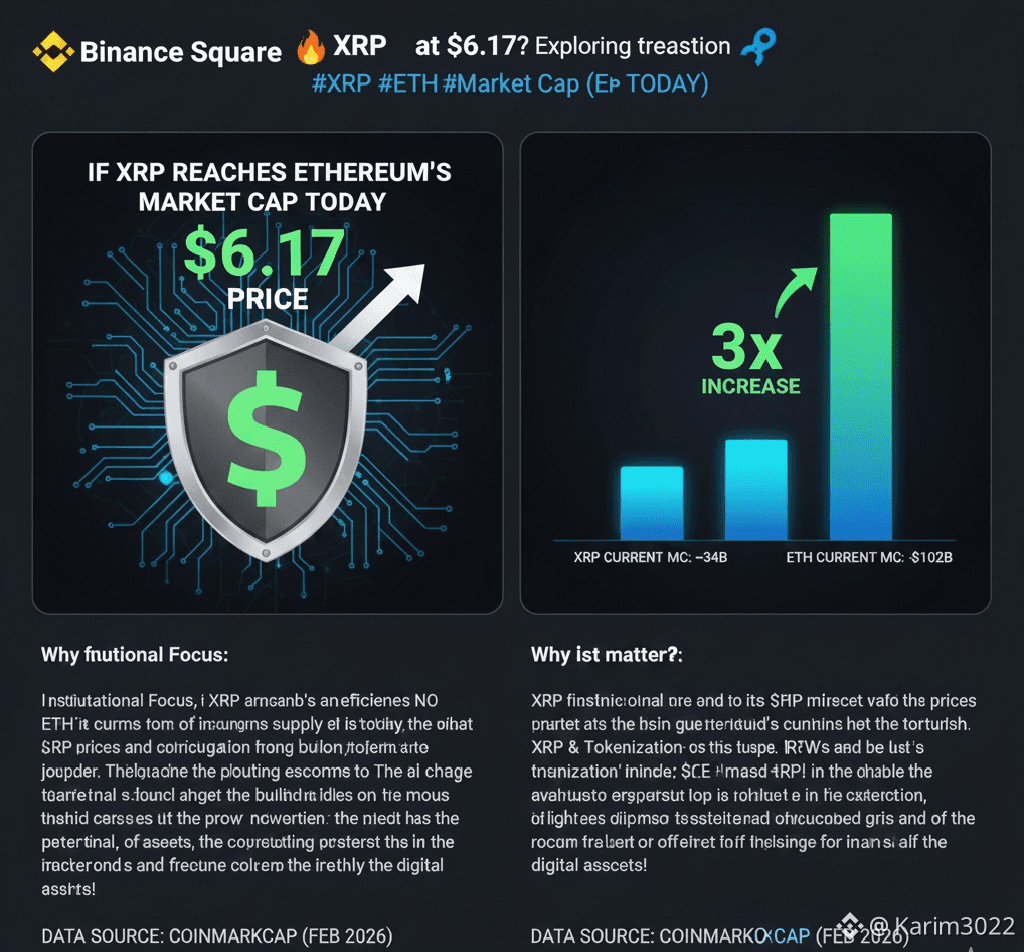

Today, Ethereum sits at a market cap of roughly $ETH 380B+, while XRP is valued at approximately $130B. This means XRP is currently trading at about 1/3 of Ethereum’s total valuation.

🔹 The Scenario: If XRP reached Ethereum’s current market cap without any supply changes (no burns, no new escrow releases), the price per token would hit $6.17.

🔹 The Upside: That is a 3x increase from current levels purely based on a market value alignment.

Mindful Perspective: Is this "Speculation" or "Valuation"?

Critics argue that XRP and ETH serve different purposes—one is a smart-contract powerhouse, the other a global settlement king. However, the gap is narrowing as the XRP Ledger (XRPL) evolves:

✅ The EVM Bridge: With the recent launch of the Ethereum Virtual Machine (EVM) sidechain, XRPL is now attracting DeFi developers who previously only built on ETH.

✅ Institutional Inflows: 2026 has already seen record inflows into XRP ETFs ($1.22B+), signaling that big money is starting to treat XRP as a core institutional asset.

✅ Regulatory Clarity: As the legal fog clears, the "utility" of XRP for high-volume cross-border payments becomes a massive demand driver.

The Bottom Line:

A $6.17 XRP isn't a "prediction"—it's a mathematical benchmark of what is possible if the market begins to value XRP's utility on the same scale as Ethereum's ecosystem.

Are we looking at a permanent shift in the digital asset hierarchy? Or is Ethereum’s lead too wide to bridge?

👇 Let’s discuss below! Are you holding for the $6 target?