Everyone has heard about DCA

Simply understood as Average Price

Many people mistakenly think that when DCA, the price is averaged but losses remain the same.

The amount you lost has been recorded. The money for the next order will be calculated later, but the displayed price is the average price.

DCA mistakes

- Continuous DCA close together leads to insufficient capital to hold and burn out.

- WRONG CAPITAL RATIO FROM THE START

This DCA formula of Linh is something Linh self-assessed and feels it suits Linh's capital.

When to DCA

When the order is negative at least -500% for x25, 1000% for x50 and x75 then DCA.

You can choose -500% then DCA once.

The first order is always an exploratory order. If you go in the right direction, you will profit.

If you gain +50%, then take a little profit first and set a stop-loss point into the order then HOLD.

If you go the wrong way to -500%, then the first DCA order equals the initial order or equals your loss if you have capital.

ABSOLUTELY DO NOT DCA CONTINUOUSLY AND MANY TIMES CLOSE TO EACH OTHER

Usually only DCA up to the second time to return to the shore and make a profit. Once you return to the shore, set the stop-loss point close to the order. If it goes up, then just break even to recover losses.

If you go according to the plan and profit, then take a little and hold.

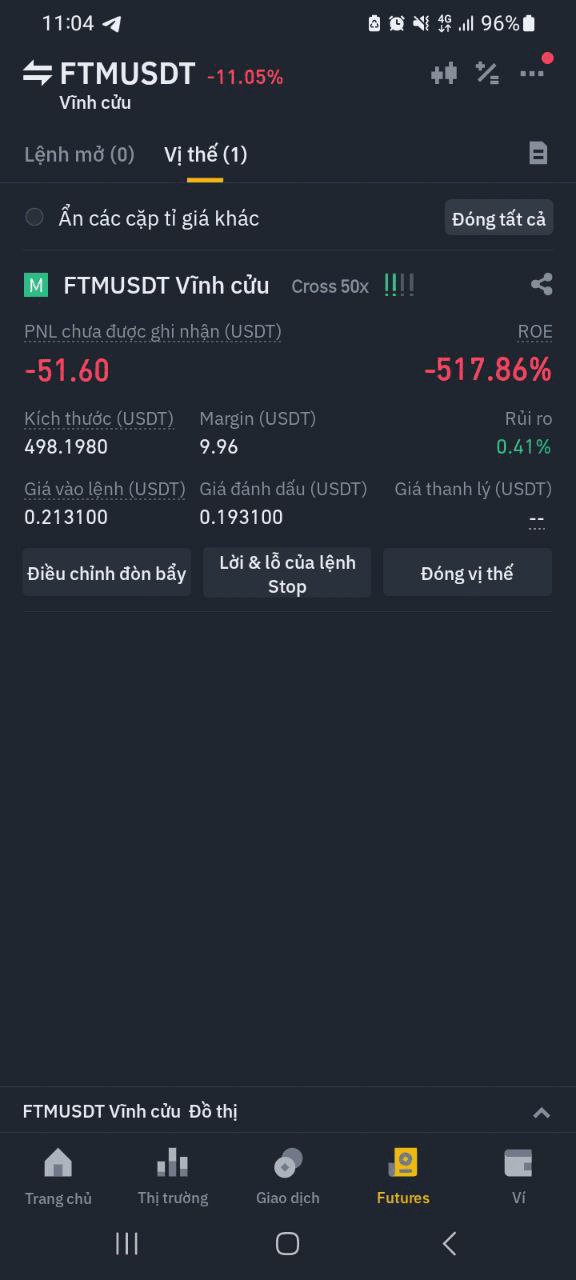

The example below is the signal from the previous day -500% for FTM AND the first DCA ratio of 1:1 equal to the capital.

And today has recovered losses and made a profit.

Stay calm and do not be resentful to win!

Wishing everyone successful Coin Trading!

If you love #KLINK, please FOLLOW AND LIKE LINK'S POST.

CW FUTURES SIGNAL CHANNEL FREE EXPERIENCE SHARING!