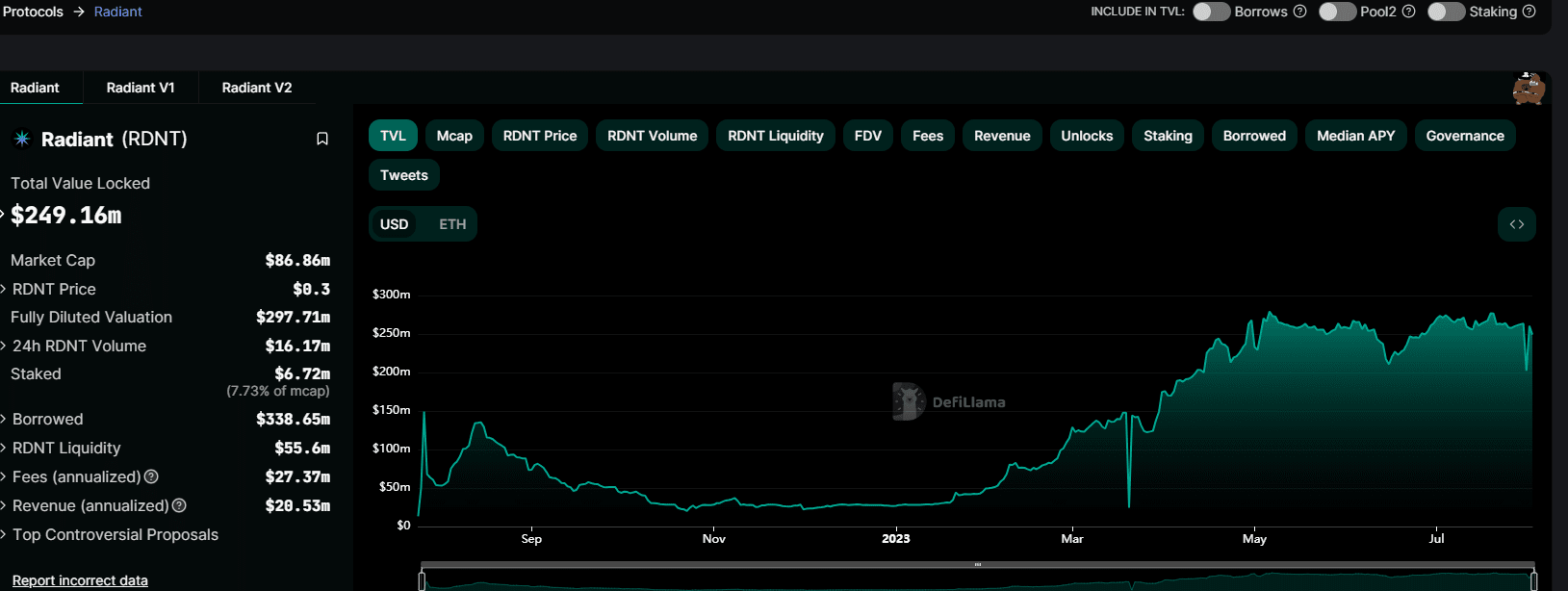

Today we are talking about a new project, Radiant Capital, a lending protocol similar to Aave or Compound. As TVL continues to increase, Radiant Capital has now become one of the largest protocols on Arbitrum, surpassing the leading lending platform AAVE. Radiant Capital’s current TVL on ARB is as high as $400 million. And his current market value is only US$80 million, ranking 200+, so is he an undervalued potential project? Let’s take a look today.

Project Description

Radiant Capital is a cross-chain DeFi lending protocol. The team positions itself as an omnichain lending protocol, aiming to achieve leveraged lending and composability between different chains. Cross-chain interoperability will be built on LayerZero, leveraging Stargate’s routing interface to allow collateral agents to withdraw funds on various chains.

The highlights of the Radiant Capital project are:

1) As the first cross-chain lending protocol launched in the LayerZero ecosystem, Radiant has completed the cold start of early projects and captured a certain size of market share and user groups, giving it a first-mover advantage in this track.

2) The improvements to the Radiant V2 version have extended the life cycle of the project and alleviated the inflation problem of the $RDNT token. The design of dLP is also expected to bring more liquidity to the protocol, but its impact is long-term. The process remains to be further observed.

3) Radiant based on LayerZero, at the cross-chain lending level, shares a token standard (OFT), so it can achieve liquidity sharing on all LayerZero-supported chains without relying on additional trust assumptions of external third-party cross-chain bridges. . If Radiant can make good security assumptions between oracles and relays in its V3 and V4 versions in the future, and achieve trustlessness at the contract level, then in terms of cross-chain security assumptions for assets, it will be better than the current mainstream on the market with the help of third-party technology. The three-party cross-chain bridge may be more advantageous in realizing cross-chain assets.

Run process

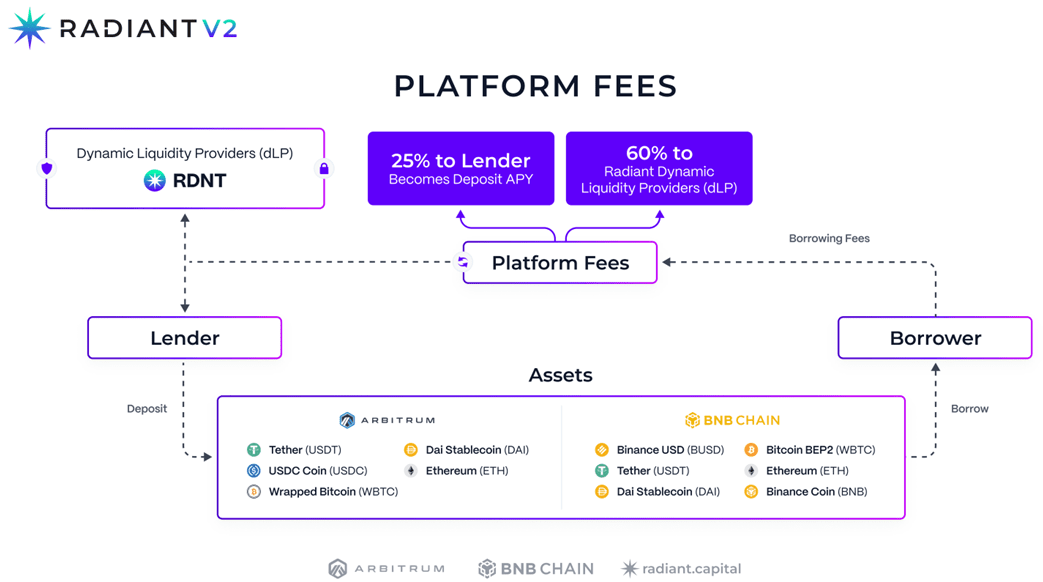

The operating mechanism of Radiant Capital can be seen in the figure above. It is essentially similar to the lending protocols currently on the market (such as Aave, Compound, etc.). The difference is that Radiant is going to be a full-chain lending protocol, that is, users can deposit money on the A chain. Deposit collateral and then lend or borrow on the B chain.

Radiant's overall operating mechanism is relatively simple: when users need to use Radiant's cross-chain lending service, they need to first deposit certain assets on the chains supported by the platform (currently the platform only supports Arbitrum and BNB Chain), which becomes a dynamic flow. Provider (dLP) before lending the assets required by the target chain. The fees earned by the Radiant V2 protocol are distributed: 60% to dynamic liquidity providers (dLP), 25% to depositors (Lenders), and 15% to designated DAO-controlled operating wallets.

In addition, Radiant also provides a one-click cycle function, which allows users to increase the value of their collateral through multiple automatic deposit and borrow cycles (achieving up to 5x leverage).

For example, users can deposit ETH, WBTC or other corresponding assets as collateral on Arbitrum through Radiant, and then lend BNB on BSC, thereby amplifying their own leverage. During this lending process, users do not need to perform cross-chain operations of assets (for example, in this example, there is no need to cross-chain their ETH on Arbitrum to BSC in advance). In other words, from the user's perspective, cross-chain lending operations can be completed on different chains or L2 without having to cross-chain assets to other chains.

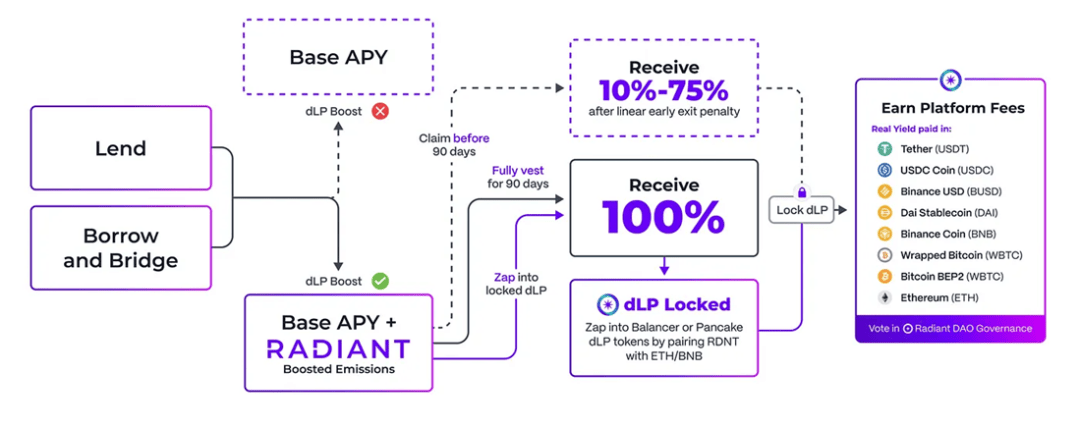

The picture above shows the V2 version released by Radiant Capital on January 16, 2023. Compared with V1, the changes mainly focus on two aspects:

1) Economic model

Radiant has introduced the concept of Dynamic Liquidity Provisioning (dLP) in order to solve the inflation problem of $RDNT. In the V2 version, users who simply deposit can only obtain the basic interest rate and no longer receive token rewards of $RDNT. . If you want to receive $RDNT token rewards, you need to lock dLP tokens that are at least 5% of the total deposit value (because the value of LP changes dynamically, it is called dynamic liquidity supply). This means that for a user’s $100 equivalent USD deposit, the user needs to hold at least $5 equivalent in dLP tokens to earn $RDNT token incentives.

A simple understanding is that in the V2 version, users not only need to provide LP, but also need to Stake a certain ratio of RDNT/ETH or RDNT/BNB dLP to obtain $RDNT token rewards.

2) Cross-chain mechanism

One of the first tasks of Radiant V2 is to convert the RDNT token standard from ERC-20 to LayerZero OFT (Omnichain Fungible Token) format. In Radiant V1, its cross-chain function mainly relied on Stargate's cross-chain routing. In V2, Radiant first replaced the Stargate routing interface of its native token $RDNT with LayerZero's OFT cross-chain standard. This can help $RDNT deploy to new chains faster and control the ownership of cross-chain contracts.

OFT (Omnichain Fungible Tokens)

OFT is a wrapper token that allows free movement between LayerZero supported chains. OFT is a shared token standard on all LayerZero-supported chains that can be seamlessly transferred on these chains without adding additional costs (such as cross-chain fees for assets). When OFT is transmitted between chains, it will be destroyed directly on the source chain through the token contract, and the corresponding token will be minted on the target chain (destruction and minting mechanism).

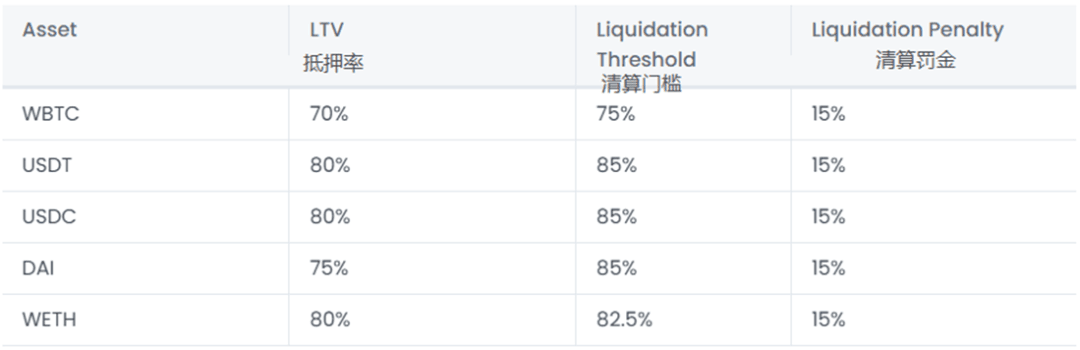

liquidation mechanism

Of course, Rdnt also has its own liquidation mechanism, similar to AAVE. Once liquidation is triggered, the liquidator can take over the borrower's debt and collateral, help repay the debt and receive discounted collateral in return (also known as liquidation reward).

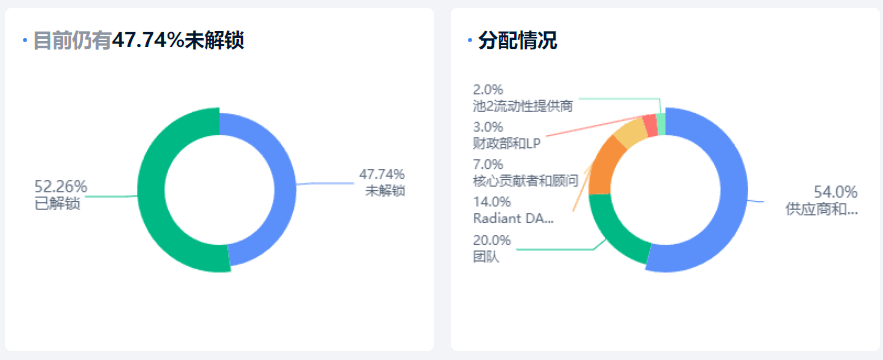

Token distribution

The maximum supply is 1,000,000,000 RDNT, and the circulation rate is 19.82%. The current currency price is around 0.3 US dollars. The team still gets a relatively large amount, 20%+14%+3%=37%, which is a little bit more. TVL also mentioned at the beginning of the article that it has 500 million US dollars and is gradually rising with strong momentum.

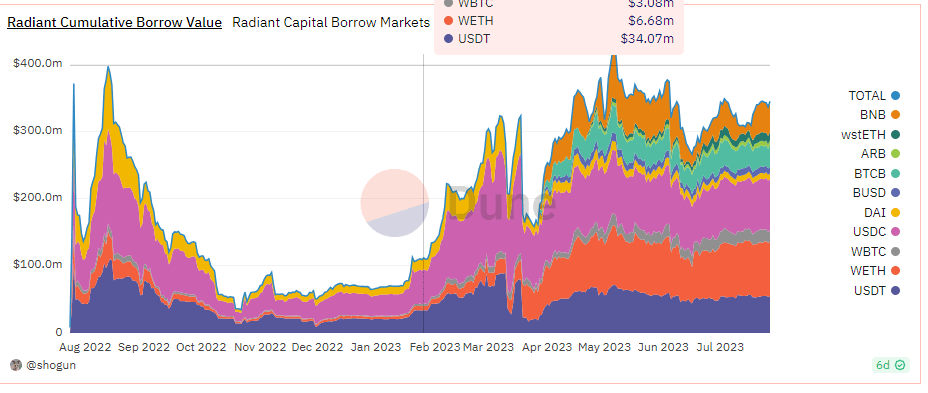

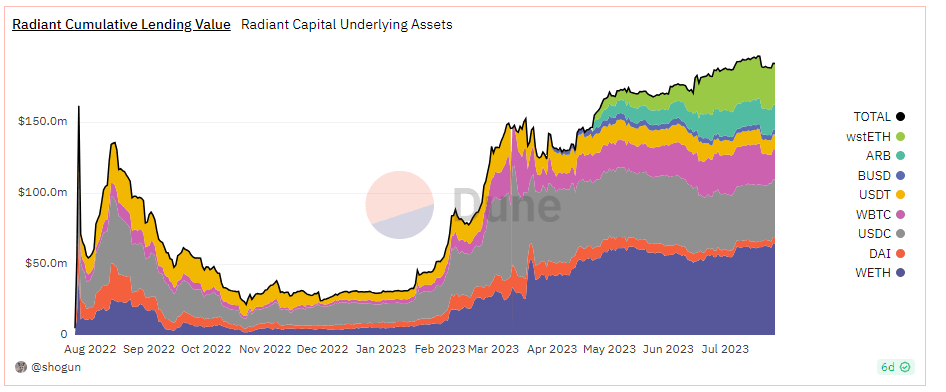

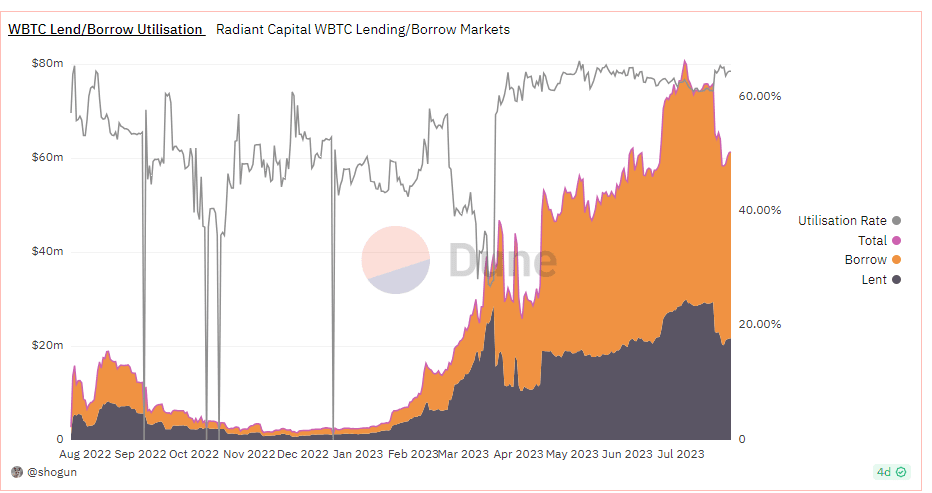

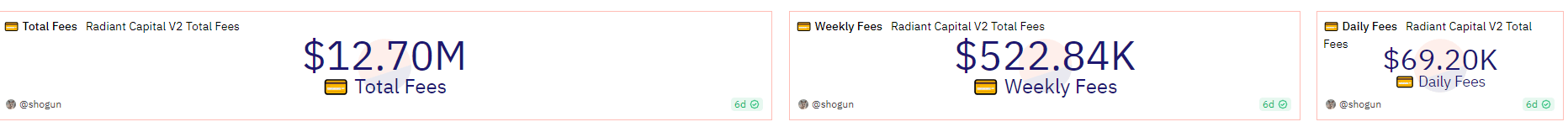

It can be seen from the data that the total borrowed assets are currently US$350 million, and the assets lent are US$200 million. The loan rate is almost 60%. The weekly fee income is 500,000, which is almost 26 million US dollars a year.

Finally, we conclude that this project is the leading lending project on L2 King ARB. The project is innovative and cross-chain lending is very thoughtful. The market has also given feedback and the data on the chain is very good. , but there is a problem now that the proportion held by the team is a bit high, and the current level of unlocking is not enough. It is a better time to wait until at least 60% is unlocked. The fundamentals of the project are fine, and the token model has passed V2 The model has been repaired a bit and is pretty good.