Today we continue to talk about an interesting project, Frax, which currently has $400 million and ranks around 90th. Frax is the first fractional algorithm stablecoin protocol.

We know that the last awesome algorithmic stablecoin, Luna, has collapsed, and its highest market value reached 66 billion US dollars. If Frax can become the next Luna, then it is possible to become a 100-fold coin in the next bull market.

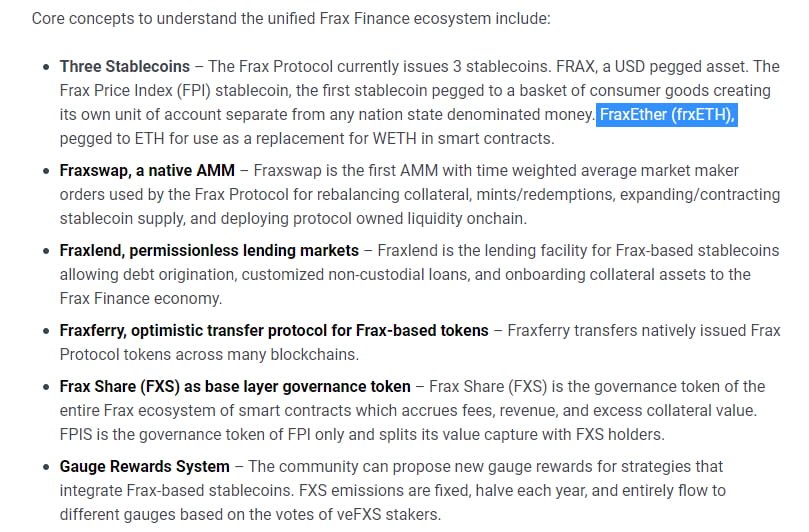

Frax Finance (Frax for short), formerly known as Decentral Bank, is a fractional algorithmic stablecoin protocol. Frax is an open source, permissionless, fully on-chain protocol that currently runs on Ethereum (cross-chain operation may be possible in the future). The ultimate goal of the Frax protocol is to provide a highly scalable, decentralized algorithmic currency to replace fixed-supply digital assets such as BTC. FRAX is a stablecoin with a target of around $1 per coin. Frax Shares (FXS) is a governance token that can accumulate fees, withheld income, and excess collateral value. It currently has three stablecoins, one is FRAX mentioned above, the other is FPI (Frax Price Index), and FraxEther (frxETH) is anchored to ETH.

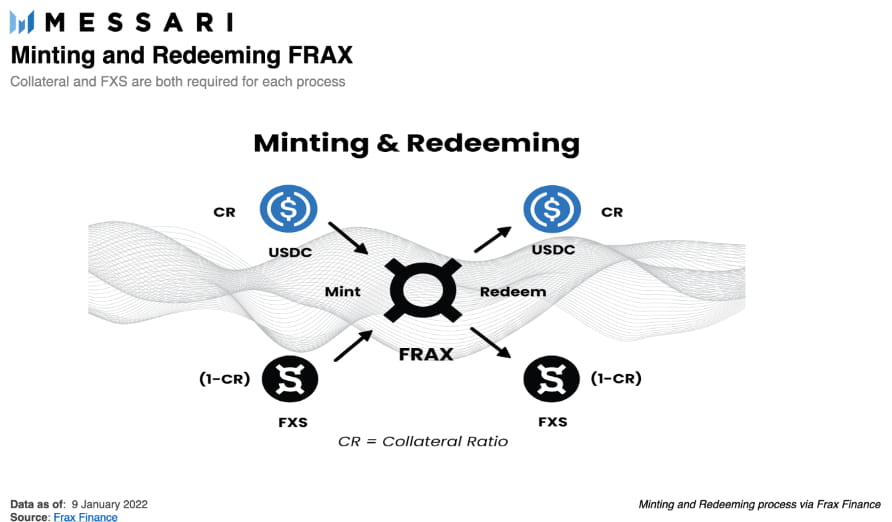

The Frax protocol implements a dual token system: the stablecoin FRAX and the protocol governance token FXS. The dual token system allows FRAX to be supported by both collateral and the algorithm (which manages the destruction and redemption of FXS). When collateral and FXS are deposited into the FRAX protocol contract, FRAX will be minted, and the amount of collateral required to mint 1 FRAX is determined by the collateral ratio. The collateral ratio of the Frax protocol determines the ratio between the collateral and the algorithm that supports 1 USD of FRAX.

FRAX is a system that can maintain tokens pegged to "1 US dollar" through "minting" and "redemption".

This allows arbitrageurs to balance the supply and demand of FRAX on the open market. If the market price of FRAX is above the target price of $1, an arbitrage opportunity exists by putting $1 of value into the system per FRAX and selling the minted FRAX tokens on the open market for more than $1. In order to create new FRAX, a user must place $1 worth of value in the system.

The difference is the proportion of collateral and FXS to the value of 1 USD.

When FRAX is at 100% collateralization, 100% of the value invested in the system to mint FRAX is collateral.

When the protocol enters the fractional phase, part of the value that enters the system during the minting process becomes FXS (and is then burned from circulation). For example, at a 98% collateralization ratio, each FRAX issuance requires $0.98 in collateral and $0.02 in FXS. At a 97% collateralization ratio, each FRAX issuance requires $0.97 in collateral and $0.03 in FXS, and so on.

When Frax is lower than $1, it means that the $1 behind Frax is valuable, and the Frax on the market will redeem the collateral. The liquidity of Frax on the market is less, and the value of Frax will rise. This principle is actually the same as the previous Luna.

The FRAX/FXS/collateral price is calculated by calculating the time-weighted average of the relevant token pairs on Uniswap and the ETH/USD price from the Chainlink oracle. Chainlink oracles allow the protocol to obtain the true price of the US dollar against various tokens, rather than just the average price of the stablecoin asset pool on Uniswap. This allows FRAX to remain stable against the US dollar itself, providing greater flexibility, rather than just anchoring to the weighted average price of other stablecoins.

Pegging stability is key to all stablecoins. FRAX maintains a 1:1 exchange rate with the US dollar through deep liquidity pools. The largest liquidity pool is the FRAX3CRV pool on Curve. As of now, the FRAX3CRV pool contains approximately 1.3 billion FRAX. This deep liquidity enables FRAX to be swapped with other stablecoins with low or no slippage. As part of the Frax v2 protocol, Curve AMO further improves the stability of the FRAX token by automatically providing excess collateral and FRAX to the FRAX3CRV pool to ensure sufficient depth of the FRAX3CRV pool (see the AMO section below for more details).

Token usage function

Frax Share (FXS) is FRAX’s non-stable ERC-20 governance token and has the following use cases:

Governance: Grants token holders governance rights to add/adjust collateral asset pools, set minting/redemption fees, and change the collateralization rate update rate.

Staking: Staking in various pools to earn rebates at a preferred annualized rate of return.

Minting and Redemption: FXS will be destroyed when FRAX is minted, and FXS will be minted when FRAX is redeemed.

Rewards: Users who deposit Uniswap LP tokens into an incentive pool can receive FXS rewards.

In the initial stage, FRAX is collateralized at a ratio of 100%, which means that minting FRAX only requires putting the collateral into the minting contract. In the partial collateralization stage, minting FRAX requires providing the appropriate ratio of collateral and destroying FXS.

The following is a picture of all its products:

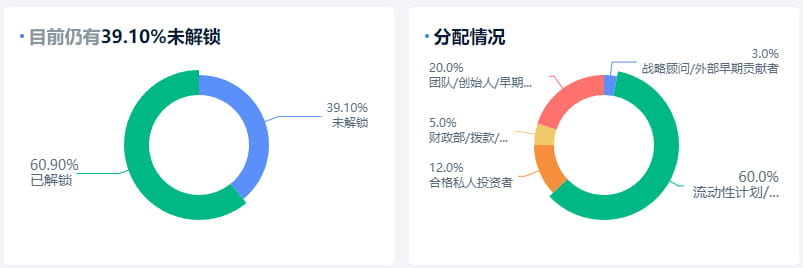

Token Distribution

The total supply of FXS tokens is initially set at 100 million. As more FRAX is used in the DeFi ecosystem, the value of the asset for FXS holders will continue to increase, because minting FRAX requires burning FXS (therefore reducing the FXS supply and increasing the value of the asset for FXS holders). As the value of FXS rises, the price stability of FRAX also increases, creating a positive feedback loop for all those who lend or borrow FRAX for DeFi transactions.

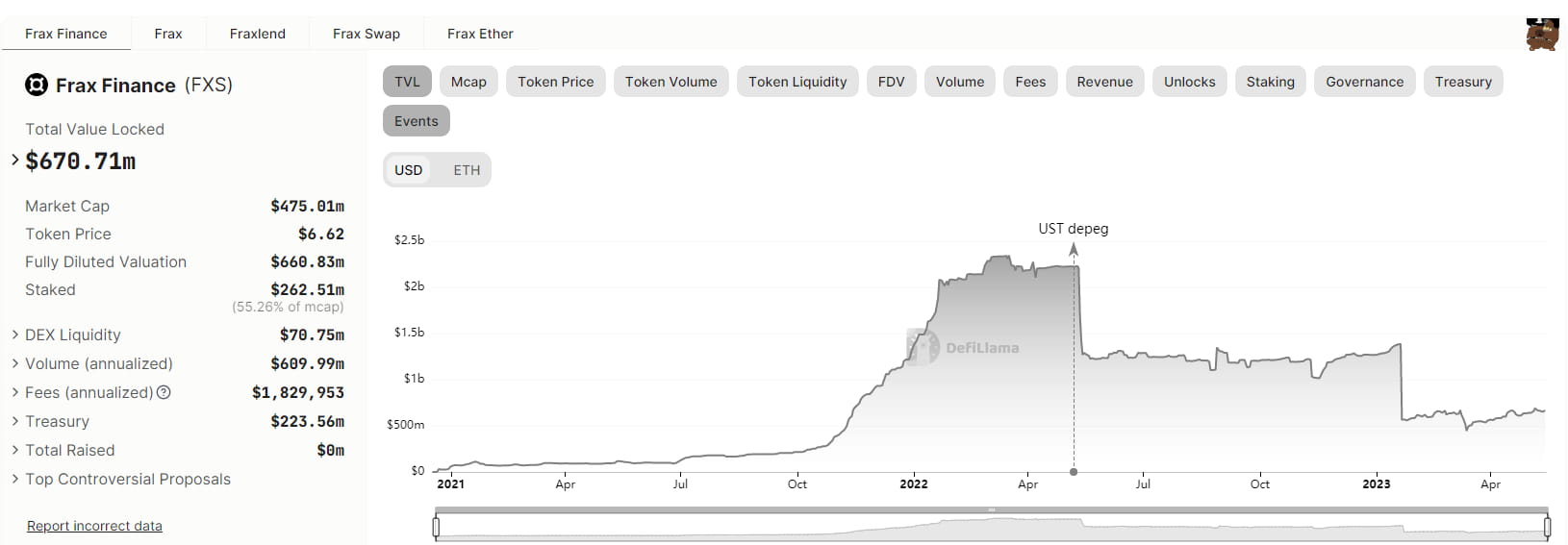

Looking at other data, the on-chain TVL is 670M.

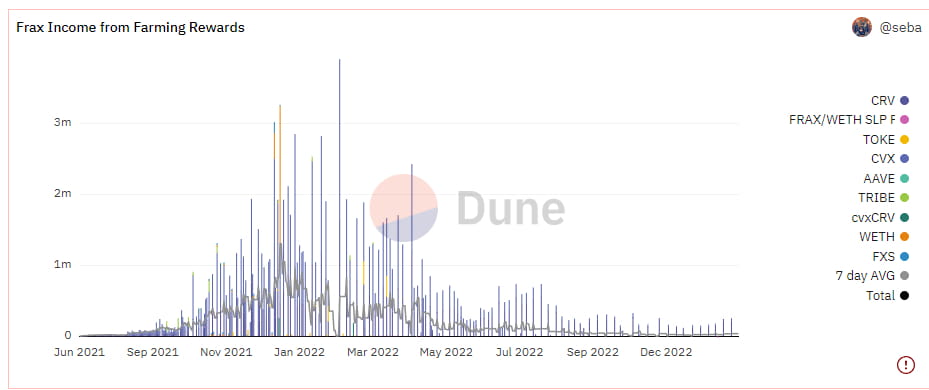

The following figure shows the protocol revenue data, with an average daily revenue of 700,000 US dollars, which is 200 million US dollars a year. Its current market value is only 470 million US dollars, so it is seriously undervalued. And there is a lot of room for imagination. If the bull market can be long-term luna, then it will be a hundred times the coin.

Finally, to sum up, algorithmic stablecoins are still a market with great room for imagination, because there are no star players in this track, and Luna, who was popular on the show, is dead. Of course, many algorithmic stablecoins have failed before, so there should still be some loopholes in this area, but you have to know that this market cake is too big, and there will definitely be adventurers to break in and grab this piece of cake. Think about how much money Tether makes just by issuing USDT. It has not done anything and has no collateral, but it has received 86 billion US dollars. If it is put in the bank for a year to earn interest, it can still earn 4 billion US dollars. It is simply lying down. Then there is the maker in the collateral stablecoin track, and the centralized one needs to resist censorship. You can see that BUSD has withered as soon as it was censored. Only algorithmic stablecoins have the characteristics of not needing collateral and being very transparent, so it is a battleground for strategists.